PINACLE® Foreign Exchange Netting

Net Intercompany Payments Worldwide

Utilize a web-based platform to potentially manage cross-border settlements amongst affiliates, potentially increase productivity, and generate cost savings.

A Technology-Savvy Solution for Streamlining Intercompany Payments

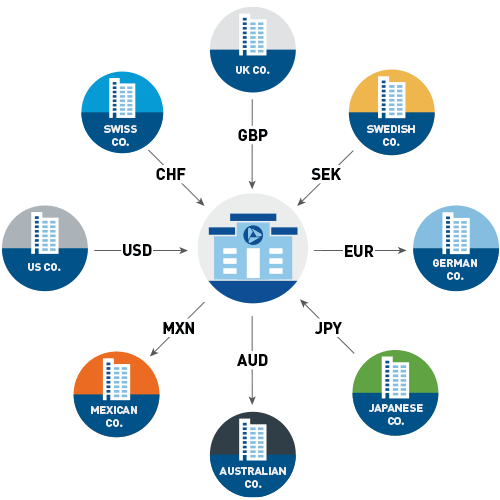

Transition from numerous uncoordinated bilateral payments to an organized multilateral net settlement.

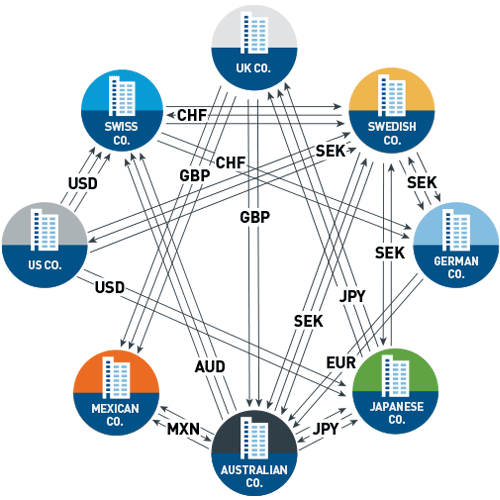

Without Netting

Bilateral Netting

PNC FX Multilateral Netting

Improve Control of Your Intercompany AP/AR Process

Explore the path toward using PNC’s comprehensive and customizable solution for managing your intercompany AP/AR.

PNC can help take your multilateral netting to the next level through:

- Customized Calculations – Configure the system netting methodology to the settlement requirement of each subsidiary. Choose from Full Netting, Gross Netting, Currency Netting, or Hybrid settlement options.

- Expanded Use – Enable the incorporation of additional cash flows to optimize the benefits of multi-lateral netting. Include items beyond AP/AR such as risk management hedges, royalties, foreign earnings repatriations, and intercompany loan payments.

- Enhanced Communication – Utilize the system's discussion and dispute module to enhance communication amongst participants for more efficient resolution of AP/AR mismatches.

- Transaction Verification – Reduce discrepancies by using the system's matching module to automate validation of AP/AR data files prior to settlement.

- Data Integration – Utilize system architecture to easily upload transaction activity and to download data files for automated reconcilement and reporting.

Video: PNC Foreign Exchange Netting

Bring Efficiency and Automation to your Intercompany Settlement Process

Paso 1: Organize

Setting up entities and a netting schedule allows you to create a companywide program. This also helps when acquiring new entities.

Paso 2: Compile Data

Decentralized or centralized data entry/file uploads allow process flexibility within the corporation as well as the ability to utilize shared services groups.

![]()

Paso 3: Pagos netos

After all data is entered and reviewed, the system will efficiently net funds between entities. Each entity will pay or receive one net amount in its functional currency.

Paso 4: Reconcile

After the final netting step has been completed, upload data into your ERP system to clear account ledgers and automate reconcilement of each period.

Overall Satisfaction with PNC PINACLE FX Netting Platform

Overall Performance

96% of PINACLE FX Netting clients surveyed are satisfied with the platform.

Already have recommended it to numerous people. We really appreciate the customer service efficiency when adding participants or contacts or making changes. This is our third netting platform and it highly outperforms the other two systems we used.

Facilidad de implementación

91% of PINACLE FX Netting client surveyed find the platform easy to set up and use.

Not just the ease of the product, but also the customer service we receive from the team.

Increased Efficiency

96% of PINACLE FX Netting clients surveyed agreed that the platform increased their firm’s efficiency for processing intercompany transactions.

Efficiency gain, cost savings, PNC platform is easy to use...great product!

*25 of 44 survey requests were completed. n = 25 for all data

PINACLE FX Netting Capabilities

- Enable the netting of cash flows between subsidiaries and/or parent via the platform.

- Establish the dates and frequency of the netting schedule.

- Run the netting program as A/P driven, A/R driven or both A/P and A/R matched.

- Facilitate communication using dispute module and automated email notifications.

- View all reports and statements online or via multiple file formats.

- Configure currency netting calculations: full, currency, gross and home currency.

- Import and export to ERP systems such as SAP, Oracle, or other providers.

- Implement role-based system access for each user with dual approval authorization.

- Include vendor payments with your intercompany activity.

PINACLE FX Netting Benefits

- Potentially reduce the number of international payments.

- Can increase cash availability through float reductions.

- Reduce FX notional required for conversion.

- Gain relationship pricing on all FX transactions.

- Realize potential cost savings on international transactions.

- Reduce time spent on internal payment process.

- Efficiency gained though automated reconciliation.

- Leverage netting center to reduce foreign account requirements.

- Validate program effectiveness via system reporting.

Listos para ayudar

En PNC, combinamos una amplia gama de recursos financieros con una comprensión profunda de tu empresa para ayudarte a lograr tus metas.

Learn more about PNC Foreign Exchange »

Divulgaciones legales importantes e Información

PNC does not provide legal, tax or accounting advice unless, with respect to tax advice, PNC Bank has entered into a written tax services agreement. PNC does not provide investment advice to PNC Retirement Solutions and Vested Interest plan sponsors or participants. You should consult your own legal, tax, accounting and financial advisors.

Lea un resumen de los derechos de privacidad para residentes de California, el cual describe los tipos de información que recabamos, así como la manera en que utilizamos dicha información y el motivo por el cual la utilizamos.