Qualified Charitable Distribution Continues to Gain Popularity

Individual retirement account (IRA) owners who have reached age 70½ and are motivated to give to charity can satisfy their required minimum distribution (RMD) through a qualified charitable distribution (QCD, also known as a charitable rollover), assuming the transfer is made directly from the IRA custodian to the qualified charity. Donors can give up to $100,000 annually and avoid the income tax that would ordinarily be due on a withdrawal.

When the desire for income is expressed, the donor should consider a lump sum cash distribution from the IRA (which can also satisfy the donor’s RMD). The lump sum distribution, in turn, can be used to create a charitable gift annuity (CGA). This arrangement can help offset the taxable event, which is the withdrawal of funds from the IRA, and establish a fixed payment stream of income with all the benefits of a standard CGA. If income is not required immediately, the donor may consider a deferred or flexible deferred CGA.

Survey Results and CGA Trends

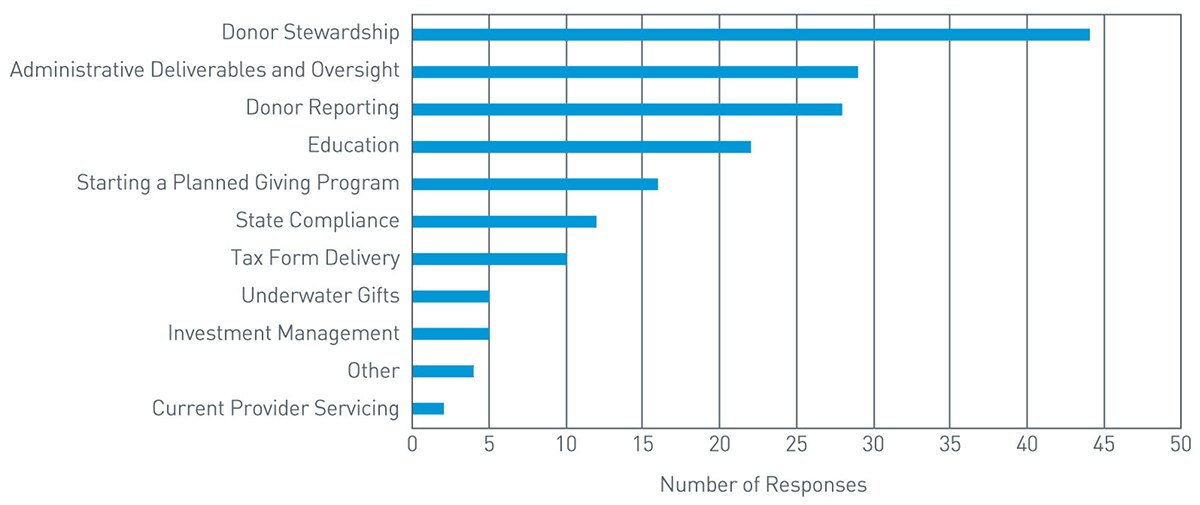

In the survey, we asked participants what they saw as the biggest challenge faced by their organizations. What was the top answer? Donor stewardship. From our perspective, the active planned gifts (CGA, charitable remainder trust, and pooled income fund) afford the charitable organization with the most natural of all stewardship opportunities.

One trend worth noting is while the number of new gifts for CGAs has decreased, the average dollar amount of gifts for CGAs has increased. This implies the size of the average new gift is continuing to rise.

What is the biggest challenge facing your organization?

View accessible version of this chart.

The Power of Repeat Donors Through Active Stewardship

In the ACGA 2017 Survey of Charitable Gift Annuities, charities were asked to report the percentage of gift annuities issued in the last year that were from donors who had previously contributed a gift annuity to their charity. In the 2017 results, the mean for “repeat donors” was 47%, up from 44% in the 2013 survey.

We believe the incredible potential for repeat CGA gifts is made possible largely through active stewardship.

Maintaining communication through telephone calls is beneficial on multiple levels. Your communication becomes personal and, in turn, the relationship becomes that much stronger.

Not only are you able to stay current with any changes in contact details for your CGA donors, but you can also continue to place a human touch to the connection they have with your organization. This could be an ideal opportunity to remind donors that CGA is a great tool for generating charitable deductions for use by those looking to itemize.

We welcome the opportunity to share more information. Please contact Chris McGurn at 410-237-5938 or christopher.mcgurn@pnc.com or Chip Giese at 410-237-5801 or chip.giese@pnc.com.

ACCESSIBLE VERSION OF CHART

What is the biggest challenge facing your organization?

| Challenge | Number of Responses |

| Administrative Deliverables and Oversight | 29 |

| Investment Management | 5 |

| Underwater Gifts | 5 |

| State Compliance | 12 |

| Donor Stewardship | 44 |

| Current Provider Servicing | 2 |

| Education | 22 |

| Tax Form Delivery | 10 |

| Donor Reporting | 28 |

| Starting a Planned Giving Program | 16 |

| Other | 4 |