As we bid farewell to 2020 and welcome in 2021, it seems like a good time to reflect on the trends of the past year and offer some perspective to nonprofit organizations preparing for a new one.

By way of background, we serve as outsourced chief investment officers (OCIOs) for nonprofits, endowments, and foundations across the PNC Institutional Asset Management® national footprint. Additionally, we have served on the boards of both grant-makers and grant-seekers. It is from these perspectives that we offer our thoughts below.

Farewell, 2020

We promised ourselves we wouldn’t use the word “unprecedented” – but how else do you talk about 2020? In early 2020, we remember a story breaking in the news regarding asbestos levels in Philadelphia schools forcing a number of them to temporarily close and engage in remediation. At the time, the challenge felt insurmountable: What were we supposed to do with a city’s worth of kids who couldn’t go to school?

Fast forward a couple of months. With coronavirus cases dominating the headlines, the question became what do you do with an entire state, and then an entire country, full of kids who couldn’t go to school? How do you help the parents that, all of a sudden, had to provide childcare and keep their children engaged in remote learning? But the fallout wasn’t only contained to the education system. To name a few:

- Wealth disparities were exacerbated – Not every job was able to go remote when the world went into lockdown: some were lost to the crisis (e.g., restaurants and travel), while others became potentially more dangerous (e.g., grocery store workers). Unfortunately, many of the jobs able to go remote were on the higher end of the income scale, whereas many lost to the crisis were on the lower end.

- Learning disparities – At the start of the crisis, not every household had equal access to the internet and technology (e.g., computers and tablets) necessary for children to learn remotely. Despite public, private, and nonprofit efforts, this still remains a challenge into 2021.

- Gender disparities within the workforce – There is ample research suggesting that women tend to bear the lion’s share of “unexpected childcare.” With the nation’s children shifting to home-based learning and childcare effectively shutting down across the country, the data point to large numbers of women being forced to leave the workforce or otherwise put their careers on hold. According to a report by the Federal Reserve Bank of Kansas City[1], women accounted for 60% of jobs lost in March 2020 despite holding less than half of all jobs in February.

Through it all, nonprofit organizations were a pillar of our nationwide response: They helped provide food and shelter to those who fell on hard times, they brought religious services to our homes through live streaming when we could no longer attend in person, and so much more. It was truly remarkable to see the mobilization: They stepped up quickly and they stepped up well, in our view. We’d like to pause here to say thank you. Without you, we’re not sure that the country could have made it through the crisis intact.

With that said, we know the year was extremely difficult. While meeting the increased demand, three key challenges emerged: funding from investment portfolios, revenue beyond the investment portfolio, and difficulty maintaining operations.

Funding from Investment Portfolios

In 2020, the balance between shortfall risk and volatility risk was put to the test: A major market drawdown in March and April hit nonprofit investment programs at the same time they needed to make emergency distributions and/or meet funding requests. It was truly the proverbial one-two punch. The “bounce back” was also quick: The investors who liquidated their portfolios might have missed the bounce back; however, the investors who participated in the bounce back were not reassured. Instead, recognizing that the underlying problem – the global pandemic – had not gone away, they wondered if they should sell while the markets were mostly recovered.

This speaks to the tradeoff between shortfall risk and volatility risk: Without targeting higher-return investments, which come with higher risk, the investment program decreases the likelihood it will be able to fund its distribution while preserving purchasing power (shortfall risk); on the other hand, by increasing allocations to investments with higher risk profiles, the investment program is increasing its overall volatility risk.

More questions came out of this. What cash should be put aside for funding distributions or operations: 3, 6, 12 months’ worth, or more? There is no easy answer to this question. In BDO USA LLP’s (BDO) 2020 Nonprofit Standards Benchmarking Survey, 54% of organizations reported having 6 months or less of reserves.[2] With money market yields hovering near zero percent across the year, cash created the potential for significant drag on portfolio return. At PNC, we focused on working with each client. Not every nonprofit organization had the same goals, objectives, and financial situation, so customization of our guidance was important for weathering the storm without potentially permanently impairing long-term asset pools.

Revenue beyond the Investment Portfolio

Unfortunately, the pandemic hit at a time when we weren’t necessarily as prepared as we might have wanted to be for a crisis. Things like food banks, remote learning equipment, personal protection equipment for healthcare organizations, and other things of this nature weren’t really built to the levels needed to support the whole nation at once. This created an immediate need for funding; unfortunately, as the demand for help/grants skyrocketed, donors and grant-makers were stretched thin by an economic downturn and/or loss of revenue coupled with an entire country that suddenly needed their support. Similarly, the squeeze on tax revenue for the federal government and state/local municipalities created a negative downstream effect on grants and/or “fee for service” type revenue streams. To put it in perspective, in BDO’s Nonprofit Standards survey, government grants and fee for service accounted for an average of 20.2% and 37% of respondents’ funding, respectively. Other surveys of the nonprofit industry put the revenue for these two sources even higher. This would imply that major interruptions in these two sources could have profound consequences on budgets.

Meanwhile, fundraising as a funding source has largely followed the crisis: organizations that were relevant to mitigating the effects of the pandemic (e.g., food banks, health and human services, healthcare systems) reported fundraising success, while organizations less tangibly connected (e.g., higher education, museums, animal-related) reported struggling across the year. Further, using religious organizations as an example, the inability to meet in person created additional difficulties for fundraising. We would expect some of this to normalize moving into 2021, but the trajectory of a return to normal is largely dependent on the path of the pandemic recovery.

Shifting to the operational revenue, the landscape remains challenging: Things like foot traffic and ticket sales were down across 2020, and in some cases put entirely on hold (where pandemic-related policies placed restrictions on gatherings such as art performances, for example). Unfortunately, we don’t expect this to change in the near term.

Difficulty Maintaining Operations

The final point we will make for 2020 is that, despite an increased need from the causes they serve, nonprofits experienced significant difficulty in maintaining operations due to funding and logistical challenges.

Funding challenges materialized in organizations having to lay off workers in large part because of the pandemic lasting longer than expected and supplemental funding programs from the government running out. Additionally, with nonprofit wages typically less than those of for-profit businesses, our clients shared that logistical challenges were also amplified, including:

- Difficulty in hiring/retaining high-skill workers created problems in trying to ramp up operations and address all of the problems that the pandemic caused.

- Nonprofits often have to do things in person – homeless shelters, food pantries, working with children with disabilities, and so much more – making a transition to remote impossible for many nonprofit employees.

- Increased cost of operations – purchasing masks and hand sanitizer, in addition to increasing the frequency and intensity of cleaning regimens, all costs money.

Taken as a whole, 2020 was a year of challenges. Seldom have we been so ready to put a year in the rearview mirror. But with that said, we have every hope that 2021 will bring light at the end of the tunnel.

Welcome, 2021

The world is hoping for 2021 to bring a return to the stability and normal that we lost in 2020. With that in mind, we encourage our clients to pay attention to both the size and scope of fiscal stimulus and the path of the virus and the vaccine.

Size and Scope of Fiscal Stimulus

We are encouraging our clients to pay attention to help on the horizon. With that said, we are framing it as a case of “prepare for the worst (no stimulus) and hope for the best (an extensive stimulus package).” As we write this in December 2020, we would advise that whatever it turns out to be and whenever it is finalized, you should work with your legal and financial advisors to understand and to utilize it to the fullest. This support can help your organization to continue the purposeful work it does toward the constituents, communities, and causes that you support.

Path of the Virus and the Vaccine

The wild card for 2021, in our view, is the path of COVID-19, which will be governed by new case curves in various geographies, any vaccine-related production schedule and deployment updates, and the success or failure of restarting the global economy.

At the beginning of the crisis in 2020, a phrase we found ourselves using often was “when things return to normal, we’ll do…” and use that as a reason to hold off or wait on future plans relating to our business. From meeting with our clients in person to hosting educational events, it seemed like everything was on hold. Fast forward a month or two into the crisis, and as a company we made a collective decision to ban that phrase. While we look forward to the day that things return to normal, it is impossible to predict not only when things are physically capable of returning to normal (i.e., when enough people receive an effective vaccine), but also when things are psychologically capable of returning to normal (i.e., when enough people feel comfortable venturing out in public again). This will have a profound effect on the global recovery.

During a quarantine from the Bubonic Plague, Sir Isaac Newton discovered gravity. With that in mind, focus now on the tools that your organization can leverage during and after the crisis. For example, a number of our clients used the crisis to work on their digital capabilities such as virtual fundraising events and social media donor outreach strategies. Let the silver lining of the current quarantine be your organization building its digital muscles for the current and future philanthropic landscape.

Pay Attention to the Details

Perhaps not exclusive to investment programs, but as the old saying goes, it can be easy to fall into the mindset, “if it isn’t broke, why fix it?” To put it simply, we don’t agree that investment programs should remain static. While there is not a necessity to make changes frequently or even at all, we believe it is important to review all aspects of the investment program on a periodic basis and/or as changes in your organization, its objectives, or the capital market landscape occur.

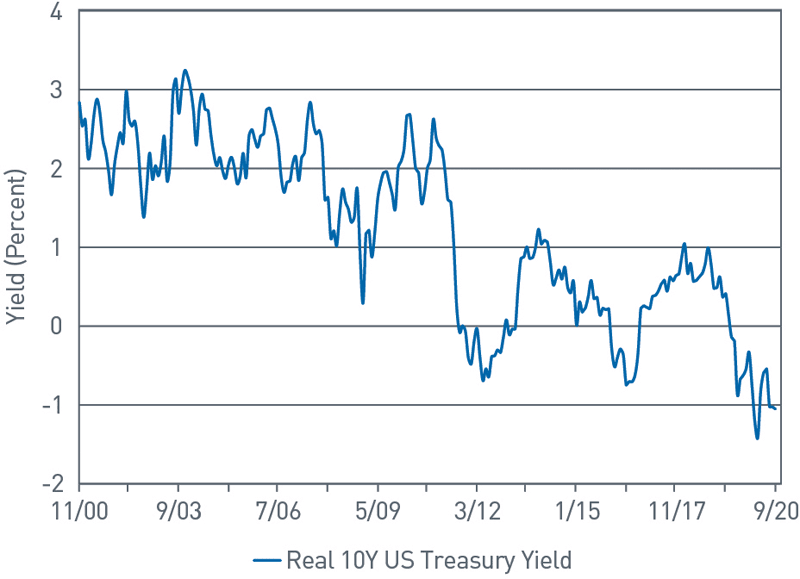

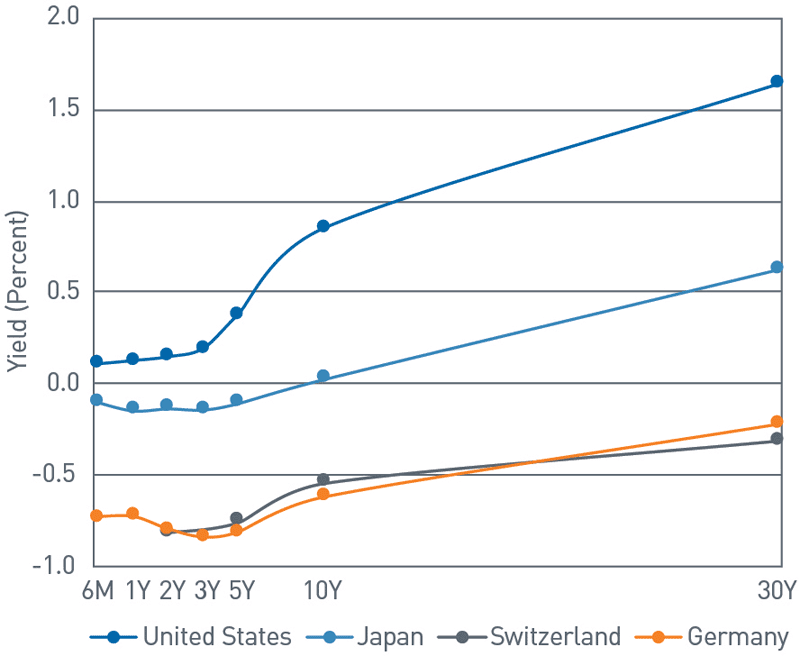

Looking specifically at fixed income yields for government-issued securities, as an example, there has been a steady march lower over the last decade (Chart 1). The result can be seen in Chart 2: The yield curve around the world has moved to a level that makes the return potential on fixed income (barring any incremental return from active management creating alpha) non-meaningful in reaching the return objectives of nonprofit investment programs (in our experience, the total return objective tends to be in the 5% to 8% range).

Chart 1 : Monetary Intervention Keeping Real Rates Low

As of 9/30/20

Source: FactSet® Research Systems Inc., PNC

View accessible version of this chart.

Chart 2: Nominal Rates Remain Under Pressure

As of 10/31/20

Source: FactSet Research Systems Inc., PNC

View accessible version of this chart.

We won’t belabor this point as it has been well discussed for years; however, we believe it is also worth noting that one of the other commonly cited benefits of investment grade fixed income, diversification, has become strained in recent years as well: We’ve seen the correlation of high-grade fixed income price movements to equity price movements moving closer to +1 during market downturns, at a time when investors expect/need the correlation to be closer to -1.

In reviewing this change to the landscape for fixed income as part of an investment portfolio, we are looking at it through the lens of a goals-based approach. In its simplest form, a goals-based approach is one that sets a goal or objective, often defined as a return target, and seeks to minimize the risk necessary to achieve it. Put another way, would you rather keep your distribution rate (and return target) high and accept more risk, or would you rather accept a lower distribution rate (and return target) to keep risk at a similarly lower level? Being honest in answering this question will help your organization to manage expectations.

Conclusion

While it might begin to feel like every year is “the most difficult time in nonprofit history,” it is easy to understand why consensus might agree that now, more than ever, is a time of challenge and change. For a nonprofit organization to succeed, it is important for its leaders to look to the lessons of the past, stay focused in the present, and always keep an eye on the future.

We continue to hope you and your families are safe and healthy. This past year will undoubtedly go down as one of the most challenging in many of our lifetimes. We want to thank you, our clients, for another year of working together. We treasure each and every relationship and hope to welcome in a brighter 2021 with each of you. Stay safe and be well.

Sincerely,

Abhijeet Bhutra, OCIO Investment Advisor and Suzana Vujasin, CFA, CAIA OCIO Investment Advisor

About The Endowment & Foundation National Practice Group

The Endowment & Foundation National Practice Group builds on PNC Bank’s long-standing commitment to philanthropy and is focused on endowments, private and public foundations, and nonprofit organizations. Our group is structured to help these organizations address their distinct investment, distribution and capital preservation challenges.

For more information, please contact Chris McGurn at christopher.mcgurn@pnc.com or Henri Cancio-Fitzgerald at henri.fitzgerald@pnc.com.

Accessible Version of Charts

| Date | Real 10Y US Treasury Yield (Percent) |

| 11/30/2000 | 2.85 |

| 9/28/2001 | 1.97 |

| 9/30/2002 | 1.39 |

| 9/30/2003 | 2.71 |

| 9/30/2004 | 2.18 |

| 9/30/2005 | 2.42 |

| 9/29/2006 | 1.7 |

| 9/28/2007 | 2.49 |

| 9/30/2008 | 1.39 |

| 9/30/2009 | 1.83 |

| 9/30/2010 | 1.7 |

| 9/30/2011 | -0.07 |

| 9/28/2012 | -0.38 |

| 9/30/2013 | 0.86 |

| 9/30/2014 | 0.75 |

| 9/30/2015 | 0.14 |

| 9/30/2016 | -0.62 |

| 9/29/2017 | 0.63 |

| 9/28/2018 | 0.79 |

| 9/30/2019 | -0.67 |

| 9/30/2020 | -1.05 |

| Expiration | United States Yield Curve (Percent) | Germany | Japan | Switzerland |

| Yield Curve (Percent) | Yield Curve (Percent) | Yield Curve (Percent) | ||

| 6M | 0.11 | -0.727 | -0.096 | #N/A |

| 1Y | 0.128 | -0.726 | -0.141 | #N/A |

| 2Y | 0.149 | -0.795 | -0.13 | -0.806 |

| 3Y | 0.194 | -0.84 | -0.136 | #N/A |

| 5Y | 0.38 | -0.813 | -0.102 | -0.753 |

| 10Y | 0.854 | -0.617 | 0.032 | -0.542 |

| 30Y | 1.6401 | -0.214 | 0.6305 | -0.315 |