Getting married or moving in together can be a rewarding and fulfilling experience. Sharing finances, however, can be a little less romantic. In fact, money is often reported as the leading cause of stress in relationships.

If you and your partner haven’t had the “money talk” yet, or it’s been awhile, it’s time to make it a priority. Here are four strategies for having a conversation to ensure you’re on the same page.

1. Keep it simple.

Start by asking your partner how their family managed money when they were growing up. Were they spenders or savers? Did they talk openly, or argue, about money? Their responses can help you tee up a discussion about both of your current spending habits.

This is also a great opportunity to talk about your emotions and goals related to money. Did either of you grow up fearing money would “run out,” and are you finding that it impacts your spending habits today? Are you worried about day-to-day expenses, or focused on having enough for retirement?

2. Be honest.

Completely honest. Lay all your debts on the table, including what you owe on student loans, mortgages, auto loans and credit cards. And share what you’ve saved, too. The whole purpose of the money talk is to understand each other’s full financial picture. Then, discuss average monthly expenses and compare budgets. If you don’t have a budget, track your spending for the next few weeks. Share what you learn with your partner. Keeping secrets can only cause problems later.

3. Work as a team.

Now that you know where you both stand financially, think about how you want to share your money.

There are several options. Choose the ones that make you both comfortable. Whether you keep separate accounts, share a savings account but each keep your own spending accounts, or combine all of your money, remember that you still have shared expenses like housing, utilities and groceries to consider.

4. Make a plan.

Talk to each other about your financial goals. Do you want to retire early and travel the world? Or are you focused on saving a down payment for your first home? Understanding your individual and shared financial goals will help you create a budget you can stick to, and one that can serve as a baseline when you consider spending money. Meeting with a financial advisor can also open your eyes to another opinion about handling your assets, investments and insurance.

5. Talk about a new budget.

What are your fixed expenses? How much can you afford to spend on home and debt payments, food, gas and entertainment? Keeping your spending at a comfortable level will free up cash to save each month for an emergency fund, major purchase or retirement. Review your budget periodically with your financial goals in mind and make adjustments as needed.

You can also keep a sense of independence in your financial relationship without deviating from your shared plan. Designate a certain amount of “fun money” that each person can spend, no questions asked.

And no matter what, remember that it can be normal for this conversation to feel a bit uncomfortable. But it’s important to making your relationship strong for the long term.

More questions about combining finances? Visit your nearest PNC branch and talk to a PNC Banker.

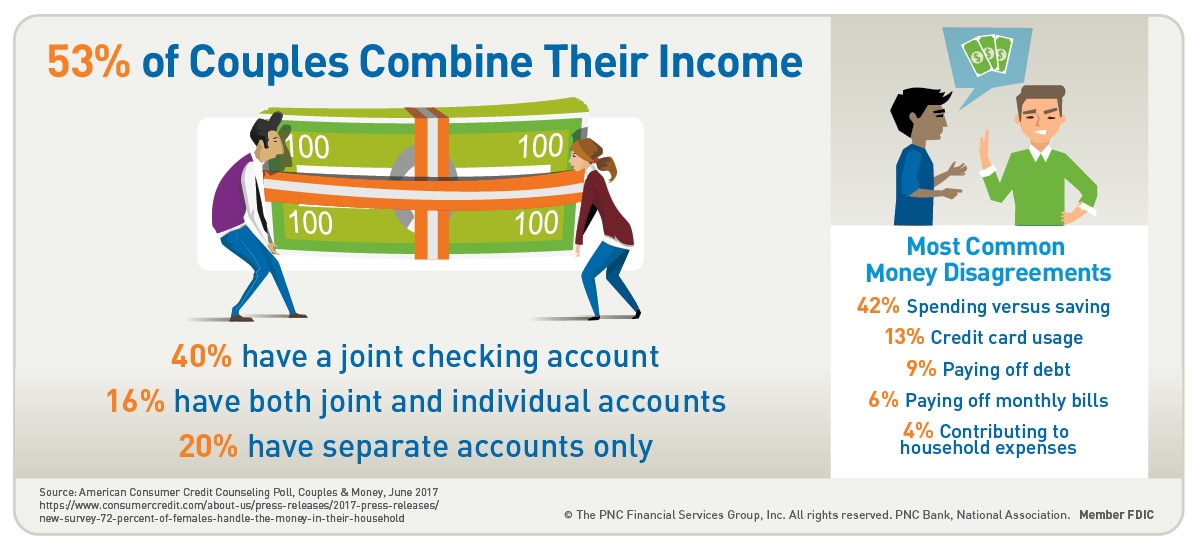

TEXT VERSION OF IMAGE

- 53% of couples combine their income

- 40% have a joint checking account

- 16% have both joint and individual accounts

- 20% have separate accounts only

Most common money disagreements

- 42% spending versus saving

- 13% credit card usage

- 9% paying off debt

- 6% paying off monthly bills

- 4% contributing to household expenses

Source: American Consumer Counseling Poll, Couples & Money, June 2017

https://www.consumercredit.com/about-us/press-releases/2017-press-releases/new-survey-72-percent-of-females-handle-the-money-in-their-household