Growing your family is exciting… and scary. It’s one of the biggest emotional and financial events you’ll ever face. Whether you’re coupled up or preparing for single parenthood, getting your financial house in order before bringing a baby home will make your life a little easier. Here are four ways to get ready.

- Have the money talk. If you haven’t already, it’s time to chat with your partner or level with yourself about your current and future finances. Consider the short-term expenses of a hospital stay, formula and baby supplies – and how that will impact your current budget. Also, do your best to estimate longer-term expenses like childcare and college savings, because caring for children tends to get more expensive as they age. If you don’t have a household budget, now is a great time to create one. And if money conversations are hard for you, consider talking to a trusted financial advisor for advice.

- Pay off debt. We know. You had to have that crib and matching changing table you saw online, and you put it on your credit card. Now you’re paying interest on it, and that’s money you could have saved for an emergency (think late-night ER visit for a sick child) or something as simple as diapers (according to Investopedia**, families can spend up to $550 on diapers in the first year alone). Start with credit cards and once those are paid off, eye other debts like auto and student loans.

- Budget for life insurance. You want to ensure that your child will be taken care of if the unexpected happens. If a family loses the income of a parent, life insurance provides a parachute that helps you or a guardian pay for living and education expenses, retain a home, and provide some level of normalcy during a difficult time.

- Keep saving (or start saving!) for retirement. It may be tempting to cut back on retirement savings. But think about the long-term financial stability of your family. As you age, weigh the benefits of spending on a certain lifestyle now versus not being a financial burden to your child later. Many financial professionals suggest saving 15 percent of your yearly income if you can.

More questions before baby arrives? Visit your nearest PNC branch and talk to a PNC Banker today.

TEXT VERSION OF IMAGE

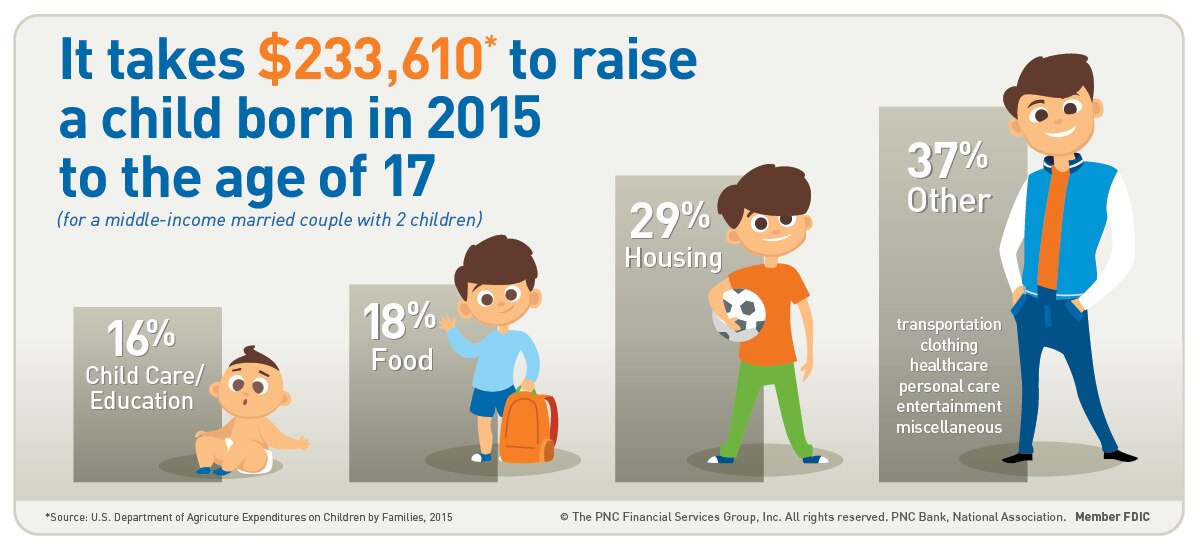

It takes $233,610* to raise a child born in 2015 to the age of 17 (for a middle-income married couple with 2 children)

- 16% Child Care/Education

- 18% Food

- 29% Housing

- 37% other - transportation, clothing, healthcare, personal care, entertainment, miscellaneous

*Source: U.S.. Department of Agriculture Expenditures on Children by Families, 2015