A qualified charitable distribution (QCD) lets you send up to $100,000[1] each year directly from an IRA to a charity once you attain the age of 70 1/2.[2] A QCD is a relatively easy, tax-efficient way to support qualified charitable organizations that are important to you.

The amount of a QCD is not included in your adjusted gross income (AGI), which may provide other tax benefits as well.

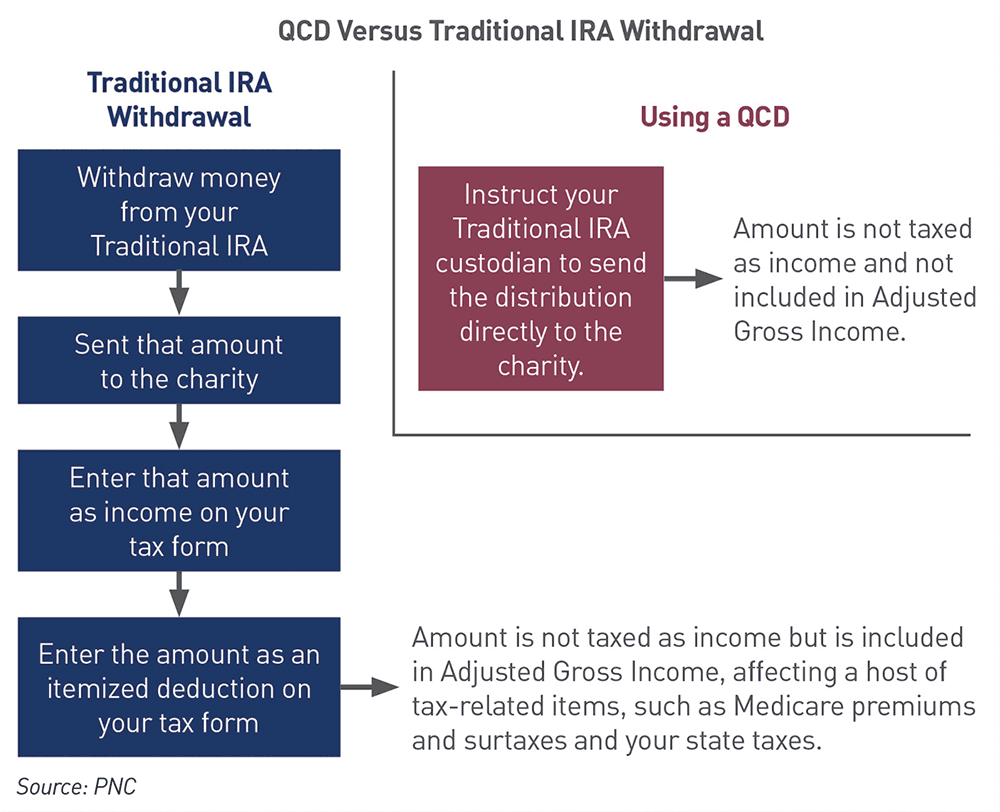

An individual’s charitable contribution (that is not a QCD) can be an itemized deduction, which reduces taxable income.[3] The money used to fund the contribution is, however, included in your AGI if it is derived from a taxable source, such as employment income or distributions from a qualified plan.

Your AGI is the starting point for calculating a number of tax-related items. For example, AGI is used in determining how much of your Social Security benefits are taxed, your eligibility to contribute to a Roth IRA, whether you are subject to the net investment income tax, your Medicare premium, in many states, your state income taxes, and whether your itemized deductions are phased out.

Once you reach age 73, you are required to take annual required minimum distributions (RMDs) from traditional IRAs and most of your other retirement accounts.[4] Any money you send from the IRA to a qualified charity as a QCD counts toward your traditional IRA’s RMD. If an RMD was taken and then given to a charitable organization, subject to certain limitations, the amount withdrawn and then contributed would be deducted for income tax purposes, but would be included in your AGI.

By not including the amount of a QCD in AGI, a QCD is particularly useful for charitably inclined people in higher tax brackets who are still working or have other significant pension income and do not need the RMD to fund living expenses.

For QCDs made in a tax year beginning after 2019, the $100,000 QCD limit for that year is reduced, but not below zero, by the excess of the aggregate amount of IRA contributions deducted for the taxable year, and any prior year that the taxpayer was age 70½ or older, over the amount of such IRA contributions that were used to reduce the amount of QCDs in all earlier years.

Qualified Charitable Distribution

To make a QCD, ask your traditional IRA custodian to send the money directly to the qualified charity (you cannot receive the money first and then send it to the charity yourself). Qualified charities include most 501(c)(3) organizations. You cannot make a QCD to donor-advised funds, private foundations, or supporting organizations. However, subject to certain restrictions and requirements, you can make a one-time election to treat up to $50,000 (indexed for inflation) transferred from an IRA to a split-interest entity (which includes a charitable remainder annuity trust, a charitable remainder unitrust, and charitable gift annuity) as a QCD.[5]

QCD Opportunities

QCDs offer several advantages:

- They benefit charities that you care about.

- QCDs are not included in AGI, which can provide a number of tax-related benefits.

- They may be used to satisfy some or all of an annual RMD without causing an income tax on the amount of the QCD.

- They may be used to make gifts to multiple charities, up to a total of $100,000 annually.

- Even if you do not itemize deductions, QCDs may provide a tax benefit.

QCD Considerations

QCDs must meet the following criteria:

- They can be made only from IRAs.

- You must be at least 70-1/2 years old.

- QCDs are limited to $100,000, subject to reduction by the excess of the aggregate amount of IRA contributions you deducted for the taxable year, and any prior year that you were age 70½ or older, over the amount of such IRA contributions that were used to reduce the excludable amount of QCDs in all earlier years.

- Contributions must be transferred directly from the IRA to the charity.

- You may make QCDs only to qualified charities. QCDs cannot be made to donor-advised funds, private foundations, or supporting organizations.

- You must obtain a letter from the charity substantiating the gift and stating that nothing was received in return.

For more information, please consult your PNC Advisor or contact PNC Private Bank.