It's been a long time coming, but the 5G era has officially arrived. After years of careful planning and research, we are beginning to see the next generation of mobile networking technology in action all across the United States. From semiconductor companies to software developers, 5G will have unique implications for each industry within the technology sector, creating opportunities for those who are ready to meet tomorrow's networking challenges.

This new technology promises to change the way we live and do business by bringing more data, more quickly, to a broad array of new devices. Enabled by 5G's evolutionary benefits, entirely new business models are projected to emerge in the coming years, giving rise to a new generation of businesses that may reshape the sector as we know it.

PNC's 5G Technology Series aims to uncover the many ways in which the next generation of wireless networks will likely impact our daily lives, while also exploring the opportunities it presents for the various industries that comprise the tech sector.

Key insights from this series:

- 5G networks offer significant enhancements over previous iterations thanks to the use of higher-frequency radio bandwidth.

- The new technologies underpinning 5G will reshape wireless infrastructure as we know it.

- Network rollouts will be gradual, requiring years of incremental improvements to reach peak performance.

- Each industry within the technology sector will be uniquely affected by the next generation in wireless technology, creating a world of new risks and opportunities.

5G Networks Explained

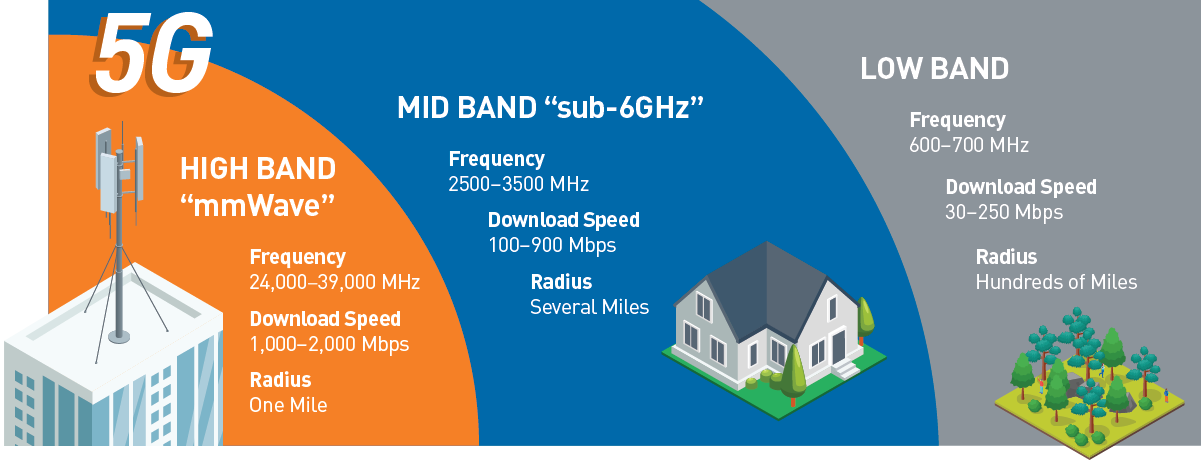

Much like previous advancements in wireless technology, 5G promises a breadth of benefits compared to its predecessors. Comprised of three frequency bands, each with its own strengths and weaknesses, 5G wireless networks consist of individual layers that work together to provide a seemingly ubiquitous service.

“Low band" 5G (600-700MHz) is the slowest of the three, with speeds ranging from 30-250 megabits per second (Mbps), but offers the greatest range with towers providing coverage for hundreds of miles.

Mid band (2.5-3.5GHz), also referred to as “sub-6GHz", boasts speeds up to 900 Mbps while covering a radius of several miles.

And finally there is high band (24-39GHz), also known as “mmWave." High band 5G offers the fastest theoretical download speeds at more than 2,000 Mbps but is limited to a one-mile radius and is particularly susceptible to interference, as we will discuss later.[1]

View accessible version of this chart.

View accessible version of this chart.

5G networks can be up to 20x faster than 4G. One of 5G's most anticipated advantages is the expected increase in download and upload speeds. The International Telecommunications Union (ITU) cites theoretical download rates of 20 gigabits per second (Gbps) for 5G, compared to 1 Gbps for 4G.[2] Though real-world experiences will vary, the gulf in actual download speeds between the two is expected to widen over time as network enhancements continue to roll out in the coming years.

Latency will diminish to as low as a single millisecond. Latency, estimated as the time it takes for a signal to travel to and from its destination, is expected to shrink significantly with 5G. In existing 4G networks, latency averages around 50 milliseconds (ms). In 5G networks, the ITU mandates a 4ms latency for general communications. This is reduced even further to a razor-thin 1ms for ultra-reliable low-latency communication (URLLC).[2]

5G will support at least one million devices per kilometer. 5G networks can support far more devices than their 4G predecessors. ITU standards mandate a minimum connection density of one million devices per square kilometer for 5G. That number supports the mass machine-to machine communication scenarios advanced by internet of things (IoT) advocates. In a world where everything from automobiles to mobile air quality monitors connect wirelessly via 5G, support for advanced network density will become paramount.

Network capacity will be up to 10x greater. The total volume of data capable of being transferred through 5G networks in a given moment is much greater compared to previous wireless networks. With total data usage per household in the U.S. continuing to climb, the increased capacity will play a pivotal role in the proliferation of IoT devices over the next 10 years as bandwidth demand surges.

Key types of 5G use cases:

- Enhanced mobile broadband (eMBB) aims to provide higher data bandwidth and more reliable connectivity, which greatly impacts user speeds and connectivity.

- URLLC minimizes signal response times and serves applications such as autonomous vehicles and telesurgery.

- Massive machine-type communication (MMTC) provides connections to a large number of devices and enables applications with many IoT devices, as found in industrial settings.

5G Architectural Differences

5G's enhanced capabilities stem from fundamental architectural differences that distinguish the way it operates compared to incumbent networks.

Networks will be defined in software. In conventional 4G networks, the equipment controlling the flow of data across the network is proprietary and typically situated at each individual cell tower, making the infrastructure costly to roll out and difficult to configure. With 5G, service providers will heavily rely on software to provide superior control over their networks.

Software-defined networking (SDN) allows 5G network operators to configure custom network rules that govern how data flows for specific applications. An industrial 5G network user might want to source and store its traffic at micro data centers located in its factories, close to where the traffic is produced, without sending data all the way back to the center of the 5G network. This can help to minimize latency. An SDN-based network would allow it to configure those data management rules itself.

Private networks will support corporate applications. SDN also opens up another possibility for 5G users: network function virtualization (NFV). This enables administrators to carve up a physical network, transforming it into multiple virtual networks that only serve specific applications and clients.

NFV enables “network slicing," a practice in which carriers create private networks tailored to specific client needs. A manufacturer using 5G to handle product quality control in its factories might have different technical requirements than a local government using the technology to manage traffic density sensors. Network slicing can support both.

Average cell sites are smaller. The antenna that relays the signal between the network and a device within a mobile network is also known as the base station, or cell. In 4G networks, these are known as macrocells. They're relatively large for wide-area coverage.

While 5G networks still utilize macrocells, they also leverage far more small cells, which need less power and are easier to install. You'll find them adorning streetlamps and even buried under street access hatches. 5G also supports femtocells, which are tiny cells the size of a paperback book, designed to support very small (typically indoor) spaces.

More antennae increase device density. These small cells must be smarter to deliver high bandwidth and low latency communications to more devices in 5G networks. One technique that is used to improve signal efficiency is massive multiple-input multiple-output (MIMO) antennae arrays. By adding more transmitters and receivers to carry radio signals, networks can deliver more than one data signal over the same stream, increasing the capacity of one connection without requiring more spectrum. 5G base station antennae can support up to 100 ports, which means that they can support more radio signals, and therefore more devices.[3]

Cell sites manage interference via beamforming. Crowding these massive MIMO arrays into a small area creates its own problems. More radio signals mean more interference, which can degrade signal quality and data performance. To combat this challenge, carriers have introduced another technology: beamforming.

Beamforming analyzes radio signals from devices in a given area to understand where they're coming from. It then tailors its outgoing signals, directing them towards specific devices rather than broadcasting them equally around the entire area. Think of it as a traffic signaling system for radio spectrum that keeps everything running efficiently by avoiding unnecessary collisions.

5G Has Two Key Challenges

While 5G promises a broad array of new possibilities, from UHD video streaming to robotics applications in manufacturing, there are technical drawbacks to the new technology that may impede our ability to leverage 5G's full potential.

Higher frequencies mean limited range. While 5G has an advantage in speed, the technology's biggest hurdle is its range. Carriers must use millimeter wave (mmWave) technology, which works at higher frequencies, to achieve the greatest speeds. However, these radio frequencies can only transmit over a short range and are more susceptible to severe weather and common physical obstructions such as walls or foliage. To overcome these technical limitations, service providers will need to invest heavily to meet infrastructure requirements, which leads to 5G's second-biggest challenge.

Greater cell density requires more capital investment. mmWave limitations are forcing service providers to think strategically about the way they roll out their 5G infrastructure. As a result, companies are mitigating this delay by also rolling out slower low- and mid-band services on a more widespread basis. For example, T-Mobile aimed to increase the coverage of its mid-band network from 30 to 100 million people in the fourth quarter of 2020.[4] However, this approach simply reallocates existing 4G spectrum and will not provide the same speed improvements as higher-spectrum networks.

High-band 5G’s minimal range and susceptibility to physical obstructions make it challenging to provide a ubiquitous user experience, restricting initial deployments to heavily populated areas. It also calls for the use of femtocells in buildings to extend 5G capabilities indoors.[5] All of these limitations will require a significant investment, delaying the rollout of 5G's most promising offerings.

5G Has Key Implications for the Semiconductor Industry

As previously mentioned, this series will focus on how 5G is expected to impact each industry within the technology sector, beginning with semiconductors. 5G networks rely on a new generation of hardware that will drive demand for a wide range of semiconductors. The high frequency spectrum, smaller cell sites, and edge computing technologies are only part of the broader tailwinds that are positioning the industry to be one of the greatest beneficiaries of 5G wireless networks.

Base station 5G components are beginning to see significant volumes. Given the significant investment in cell deployments required by the new wireless technologies, one of the largest opportunities lies with 5G infrastructure chip makers. Both increased content delivery and equipment complexity present growing tailwinds for the industry, with global 5G base station sales projected to reach over 600,000 units in 2020 before rising to over one million units in 2021. Annual deployments are then expected to ramp up annually, reaching nearly two million by 2025.[6]

Smartphones will be an early growth driver. 5G brings new opportunities in consumer broadband devices, particularly with the launch of Apple's iPhone 12 lineup in late 2020. The number of 5G smartphones is expected to jump from 187 million units in 2020 to 1.14 billion units by 2024.[7]

Designers of embedded radio frequency (RF) chips sold to smartphone makers and infrastructure companies are well positioned to take advantage of ongoing tailwinds. With the gradual shift to more advanced 5G networks, RF content per phone is expected to continue growing rapidly at a double-digit CAGR over the next few years.

5G will support an explosion of connected devices. Another major opportunity lies with chip makers that support the IoT ecosystem. The CAGR for other consumer 5G devices, including computing, is expected to increase by 72% between 2021 and 2023, with global revenues reaching $496 million. Industrial and automotive applications promise even more aggressive growth, with CAGRs of 221% and 285% respectively.[7]

5G offers rich opportunities for edge computing. Roughly 90% of data generated by enterprises is currently processed in centralized data centers, but the growing number of connected devices is fueling the need for data traffic to be processed and stored at the edge. Shifting centralized computing to the edge of the network will make tomorrow's cloud architecture more adaptable, decreasing the likelihood of potential bottlenecks as billions of new devices compete for limited bandwidth and processing power.

As industrial businesses convert legacy supervisory control and data acquisition (SCADA) networks to run over IP networks, that data becomes more useful for applications like real-time analytics and machine learning powered computer vision. In many cases, these applications need low latency to work well. URLLC and MMTC support these use cases, enabling companies to collect data via local femtocells and process it locally. Semiconductor companies stand to benefit from edge computing not just as a revenue-generating application, but as an internal manufacturing use case.

5G will encourage new business models. The semiconductor industry is expected to enjoy increased hardware volumes as it sells components to support 5G infrastructure and device usage, but it also stands to benefit from monetization opportunities as it builds more functionality into its products. Possibilities here include feature monetization after the point of sale, enabling semiconductors to unlock new capabilities in their products as customers increase processing volumes.[7]

Looking Forward

While 5G promises a new age in telecommunications, it will take years before we begin to see its more transformational capabilities reach their potential. The highest-speed, lowest-latency 5G networks will require time to fully deploy and end-user adoption will be a similarly gradual process. With so much change on the horizon, the greatest opportunities still await those who can deftly navigate the shifting landscape.

Ready To Help

Learn how PNC's Technology Industry team can help you leverage 5G, or contact us to find out more about the emerging opportunities that 5G promises.

Accessible Version of Chart

5G Graphic

| 5G |

Frequency |

Download Speed |

Radius |

|

| Low Band |

600 - 700 MHz | 30 - 250 Mbps | Hundreds of Miles |

|

| Mid Band "sub-6GHz" | 2,500 - 3,500 MHz | 100 - 900 Mbps | Several Miles | |

| High Band "mmWave" |

24,000 - 39,000 MHz | 1,000 - 2,000 Mbps | One Mile |