For decades, investors using a traditional 60/40 strategy — with 60% of a portfolio invested in equities and the other 40% in fixed income — generated strong returns. Recent market volatility and higher interest rates have made it more difficult to achieve desired outcomes through public equities and fixed income alone. Savvy investors are turning to alternative investments to build more durable portfolios — and unlock greater wealth potential.

Considering Alternative Investments

According to Andrew Schuler, investment managing director at PNC Private Bank, it’s crucial to look at the full picture of your current portfolio and long-term goals when evaluating potential alternative investments. “The right approach depends on how much capital your want to allocate, the composition of your existing assets and your overall risk profile,” he said. “Whether you are building wealth, growing it to leave a legacy for your family or managing the drawdown of wealth in retirement, alternatives can play a tailored, strategic role. They tend to work best when integrated thoughtfully into a broader financial plan.”

Investors may often use alternative investments to:

- Diversify portfolios: low or negative correlation to traditional assets, alternatives can reduce exposure and vulnerability to market volatility.

- Access private markets: Opportunities include venture capital for private startups and direct investment in more mature companies not available on public stock exchanges.

- Enhance risk-adjusted returns: Alternatives can improve returns while potentially limiting downside risks — outperforming traditional-only portfolios over time.

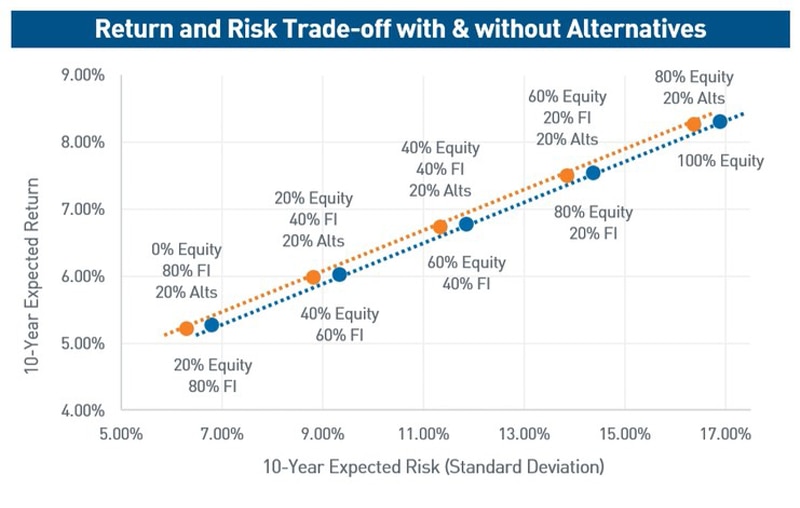

When added to a portfolio with traditional assets, alternative investments may lower portfolio volatility and enhance returns.

>

Source: PNC Capital Market Assumptions, Windham Portfolio Advisor, 2024.1

Ver la versión accesible de este gráfico.

What are Accredited Investors and Qualified Purchasers?

Both must meet criteria from the U.S. Securities and Exchange (SEC) Commission. Accredited investors are defined by annual income and net worth while qualified purchasers are defined based on how much money they have invested. In addition to other criteria, an individual accredited investor must have net worth over $1 million or a minimum income over $200,000. Qualified purchasers that are individuals must have $5 million invested. Most qualified purchasers are also accredited investors.

Common Types of Alternative Investments

Alternative investments span a broad range of asset classes and strategies outside of publicly traded equities and fixed income securities. They are generally available only to certain accredited investors and qualified purchasers and may require longer holding periods and higher risk tolerance —yet they open the door to differentiated, often higher-return opportunities.

| Capital privado | Private Credit | Fondos de cobertura | |

|---|---|---|---|

| Cómo funciona | Invest in companies not traded on public markets | Loan funds to private companies | Investment vehicles with securities and derivative positions to generate absolute returns |

| Ejemplos | Venture capital, capital growth equity, buyouts | Direct lending, mezzanine debt, distressed debt | Event-driven, relative value, macro, equity hedge |

| Beneficios | High return potential, exposure to growth companies | High yield potential, consistent income, diversification | High return potential, diversification, downside protection in volatile markets |

| Riesgos | Illiquidity, high fees, less transparency than public markets | Illiquidity, credit risk, potential borrower default | Complexity, high fees, limited transparency, high cost of entry |

| Ideal para | Those with large cash and liquid investments seeking long-term returns through direct company ownership | Those with large cash and liquid investments looking for income and diversification beyond public credit markets | Those with large cash and liquid investments seeking risk-managed, uncorrelated returns in volatile markets |

| Bienes raíces | Infraestructura | Criptomoneda | |

|---|---|---|---|

| Cómo funciona | Ownership interest in physical assets (equity) or earning interest from loans made to real estate owners (credit) | Provide capital to build, acquire, or upgrade physical assets that support utilities, communication, roads, etc. | Digital currency that enables transactions without banking intermediaries |

| Ejemplos | Direct property ownership, Real Estate Investment Trusts (REITs), real estate crowdfunding | Infrastructure Exchange Traded funds, Yield Companies, specialized REITs | Bitcoin ETFs, direct cryptocurrency holdings, blockchain-focused equity ETFs |

| Beneficios | Rental or interest income, capital appreciation, inflation hedging | Stable, long-term cash flows, capital growth potential, inflation protection | High return potential, diversification |

| Riesgos | Illiquidity, higher upfront costs, valuation challenges | Extended illiquidity, regulatory shifts, budget overruns | High price volatility, regulatory uncertainty, technology vulnerabilities |

| Ideal para | A variety of investors interested in gaining cash flow through rental income | Those with large cash and liquid investments seeking predictable return on investment | Those without many liquid assets but want to explore diversification and quick ROI |

Are Alternatives Right for You?

Alternative investments aren’t one-size-fits-all. They are best suited for individuals with the capacity — and willingness — to invest for the long term, tolerate less liquidity and evaluate opportunities through a sophisticated lens.

“The key with alternatives is thoughtful integration,” Schuler said. “It’s not about chasing yield or trends, but about identifying where these strategies can fill specific gaps like risk reduction, income generation or accessing nontraditional return streams.”

While alternatives can enhance a portfolio’s long-term return when part of an overall investment strategy, they may not be right for everyone. Investors should speak to an advisor to understand what investments are right for their goals and risk profile.

For more information on alternatives and other investment opportunities, talk to your PNC Private Bank Advisor.

VERSIÓN TEXTUAL DE LOS GRÁFICOS

Return and Risk Trade-off With and Without Alternatives. This scatter plot compares the expected 10-year return versus expected risk (measured as a standard deviation) for portfolios with and without alternative investments. The x-axis represents the 10-Year Expected Risk (Standard Deviation), ranging from 5.00% to 17.00%. The y-axis represents the 10-Year Expected Return, ranging from 4.00% to 9.00%. Each data point represents a different asset allocation scenario, grouped into two categories: portfolios without alternative investments, and those with 20% allocated to alternative investments. The chart shows that for a given level of risk, portfolios with 20% alternatives consistently offer higher expected returns compared to portfolios with traditional sets only. The line connecting each category of dots slopes upward from left to right, illustrating that higher risk levels are associated with higher expected returns in both cases. At lower risk levels, a traditional po