People purchase life insurance for many reasons, such as providing cash to maintain the family’s lifestyle following the death of a breadwinner, replacing wealth lost to estate and income taxes, or providing liquidity to a business following an owner or key employee’s death. With all of the possible uses for life insurance, the question is often asked, “how much life insurance do I need”?

Of course, the answer to the question is: “it depends.” It depends on a number of factors, including your stage in life, your financial and other life circumstances, the purpose for which you are buying life insurance, and your budget. Further, the amount you need may not always be the same because as your life circumstances change, the amount of life insurance coverage that you need may also change.

One thing is certain, the answer to the question will be different for each person. Accordingly, it is not possible to provide an exact amount for how much life insurance coverage you, as an individual, need. Instead, this article highlights some of the reasons for purchasing life insurance and how you may determine the amount of coverage you need.

The Basics

It can be difficult to contemplate death, and yet everyone dies. When a person dies, things are never the same; there is someone forever missing. The person who has died is irreplaceable. The grief and sorrow following a person’s death must be faced when it arrives. However, when a person who has died has financial responsibilities, it is possible to plan in advance to allow for those responsibilities to be satisfied, even after death.

Consider the financial obligations that you have to your family. You work and are compensated. Those funds are used to provide food, shelter and other necessities of life. You may be saving funds to provide your children with an education. You may also plan to help your adult children to get a start in life. What would happen to your family were your compensation to cease as a result of your death?

Life insurance provides a cash payment upon death so that a family has the funds necessary to continue living the lifestyle to which they have become accustomed. How much life insurance coverage you need depends upon a number of factors, including your current lifestyle, the cost of living where you reside, whether you have debt (such as a mortgage), whether you need to set aside savings to fund children’s college or graduate school education, and whether your spouse will continue to work after you die, to name a few.

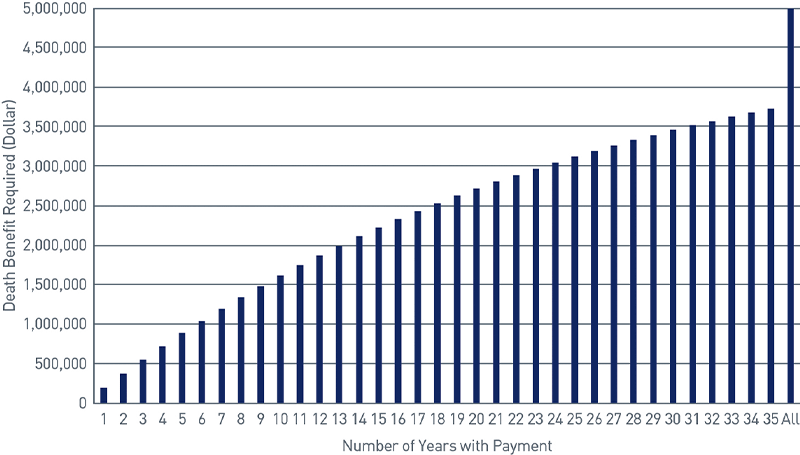

Another consideration that will determine how much life insurance you need is whether you intend the beneficiaries to receive only the income earned from investing the full death benefit or whether the death benefit itself (the principal) will also be used by the beneficiaries. If you expect both income and principal to be used by the beneficiaries, then you would need a smaller amount of death benefit. Chart 1 shows the amount of death benefit needed to provide a payment of $200,000 at the end of each year for different periods of time. Chart 1 assumes a 4% annual return on investment net of taxes and fees.

"If you expect both income and principal to be used by the beneficiaries, then you would need a smaller amount of death benefit."

Chart 1

Source: PNC

Scroll down for the accessible version of this chart.

Other Needs

There are other uses for insurance besides providing for your family. These uses, and the amount of life insurance protection needed, depend upon your specific circumstances. Nevertheless, financial obligations like these can be provided for, in whole or in part, by a life insurance death benefit.

"There are other uses for insurance besides providing for your family. These uses, and the amount of life insurance protection needed, depend upon your specific circumstances."

Business Owners

Business owners can often use life insurance. The amount and type of life insurance used depends on the need. The following are examples of some uses for life insurance in a business context:

- Key Person Life Insurance: Consider what would happen if an important employee or co-owner of your business (even yourself) died. Of course, the business would have to replace that person. However, the death could adversely impact the business for some time. The business could receive the death benefit from a policy of life insurance insuring the life of the key employee (or owner) to help replace lost revenue and provide for the cost of hiring a new employee.

- Buy-sell Life Insurance: Business owners often agree that should one of them die, the other owners (or the company) will purchase the deceased owner’s share of the business. A life insurance death benefit can help provide the funds to do so after an owner’s death. Buy-sell agreements may also require the remaining owners to purchase a retiring owner’s share of the business. The cash value in a life insurance policy that has accumulated over the retiring owner’s lifetime can be used to fund some or all of the purchase price.

- Compensation: A life insurance policy can be offered to important employees as a benefit. Additionally, life insurance policies can be used to help fund non-qualified deferred compensation plans.

- Estate Equalization: For a business owner who wishes to leave the business to one child while providing equal value to other children, a life insurance death benefit can provide some or all of necessary amounts to the children who do not receive the business.

"A life insurance policy can be offered to important employees as a benefit. Additionally, life insurance policies can be used to help fund non-qualified deferred compensation plans."

Illiquid Investments

Federal estate tax is due nine months following death. Many states also impose an estate or inheritance tax. If you are extensively invested in illiquid assets, such as real estate, hedge funds, private equity or similar investments, it may be difficult to raise sufficient funds to pay estate and inheritance taxes by the deadline without resorting to a sale at “fire-sale” prices. A life insurance policy death benefit can help pay some or all of these taxes.

Long-term Care

It can cost tens of thousands of dollars each year for health assistance if you are not able to fully care for yourself. Long-term care expenses are, generally, not covered by Medicare. Long-term care insurance was created to protect your assets by providing a benefit that pays for some or all of the expenses of providing care. However, over the years, traditional long-term care insurance has become more and more expensive. It is possible to help pay for these expenses through a long-term care rider to a life insurance policy. With such a policy, should you need long-term care, the death benefit can be accessed, in monthly payments, to provide for care during your life. Further, unlike a policy of long-term care insurance, if you don’t require lifetime care, upon your death, the policy will pay your beneficiaries a death benefit.

"Over the years, traditional long-term care insurance has become more and more expensive. It is possible to help pay for these expenses through a long-term care rider to a life insurance policy."

Don't Guess

How do you determine the right amount of life insurance? It can be hard to know where to start. PNC Private Bank® has the resources to help. Working together, a PNC Private Bank insurance strategist and wealth strategist can help you determine how much life insurance protection is appropriate for you and your family, and which types of policies should be purchased to provide that coverage. Also, they can create a financial plan that can help you determine how the cost of your insurance protection can fit into your budget.

For more information, please contact your PNC Private Bank advisor.

TEXT VERSION OF CHARTS

Chart 1: (view image)

| Number of Years with Payment | Death Benefit Required |

|---|---|

| 1 | $192,308 |

| 2 | $377,219 |

| 3 | $555,018 |

| 4 | $725,979 |

| 5 | $890,364 |

| 6 | $1,048,427 |

| 7 | $1,200,411 |

| 8 | $1,346,549 |

| 9 | $1,487,066 |

| 10 | $1,622,179 |

| 11 | $1,752,095 |

| 12 | $1,877,015 |

| 13 | $1,997,130 |

| 14 | $2,112,625 |

| 15 | $2,223,677 |

| 16 | $2,330,459 |

| 17 | $2,433,134 |

| 18 | $2,531,859 |

| 19 | $2,626,788 |

| 20 | $2,718,065 |

| 21 | $2,805,832 |

| 22 | $2,890,223 |

| 23 | $2,971,368 |

| 24 | $3,049,393 |

| 25 | $3,124,416 |

| 26 | $3,196,554 |

| 27 | $3,265,917 |

| 28 | $3,332,613 |

| 29 | $3,396,743 |

| 30 | $3,458,407 |

| 31 | $3,517,699 |

| 32 | $3,574,710 |

| 33 | $3,629,529 |

| 34 | $3,682,240 |

| 35 | $3,732,923 |

| All | $5,000,000 |