Everyone has financial goals. Some goals are short term, like saving for a vacation or having sufficient funds to cover emergency expenses. Other goals are long term, like paying for a child’s education or wedding, or having enough income for a comfortable retirement. So many of life’s goals have a common element: to achieve them requires money (sometimes a lot of money). Accordingly, whatever your financial goals are, the key to achieving those goals is having a disciplined saving strategy.

“Saving is a key principle. People who make a habit of saving regularly, even saving small amounts, are well on their way to success. . . . Use your savings to plan for life events and to be ready for unplanned or emergency needs.”[1] One way to save is to “pay yourself first.” To do that, before spending any of your income, take a portion of it and deposit it into your bank account, investment account or retirement account. Benjamin Franklin wrote, “…a penny [saved] is a penny got…”[2] He also wrote in 1736 for Poor Richard’s Almanack the following advice in an article entitled “Necessary Hints to Those That Would Be Rich”:

"He that loses five shillings not only loses that sum, but all the advantage that might be made by turning it in dealing, which by the time that a young man becomes old will amount to a considerable sum of money."[3]

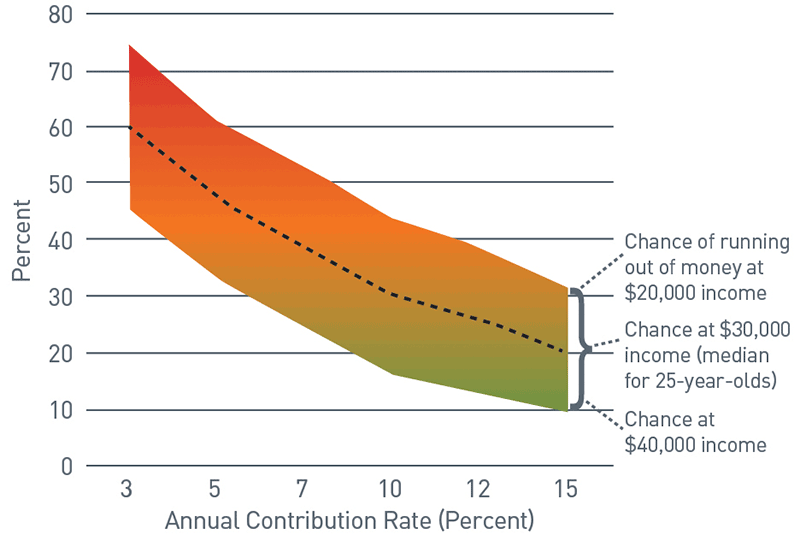

In today’s modern world, is Franklin’s advice from the 18th century still valid? Let’s consider an example. Assume that you visit your favorite coffee shop three times every day and pay $4 each visit for your favorite brew. Now, let’s assume that instead of visiting three times daily, you visit twice daily and save $4 every day. In a five-day work week, that amounts to $20 saved. In a 50-week work year, your total amount saved would be $1,000. That $1,000 could be a nice emergency savings account, allowing you to weather a routine emergency, like a car repair, without having to use a high interest rate credit card or withdrawing funds from a retirement account. Now, let’s take our example one step further. Consider what you could have if you saved the cost of that daily cup of coffee over a 40-year career. To illustrate that, let’s invest $1,000 at the end of each year in an investment account earning 4% net of fees and taxes for 40 years. (For ease of illustration, assume investment returns are also credited at the end of each year.) At the end of 40 years, you would have $95,026 (see Chart 1). Of course, your barista would not like this, but you and your financial advisors would.

Chart 1: Saving the Cost of a Cup of Coffee

Source: PNC

View accessible version of this chart.

It’s a fairly straightforward proposition: “With compound interest, you earn interest on the money you save and on the interest that money earns. Over time, even a small amount saved can add up to big money.”[4] Of course, the same principle applies to larger amounts over long terms.

Let’s look at saving for a very important long-term goal, retirement. As noted in a brochure published by the U.S. Department of Labor (DOL), “Financial security in retirement doesn’t just happen. It takes planning and commitment and, yes, money.”[5] First on the DOL’s list of things to do to prepare for retirement is: “Start saving, keep saving and stick to your goals [and t] he sooner you start saving, the more time your money has to grow…”[6]

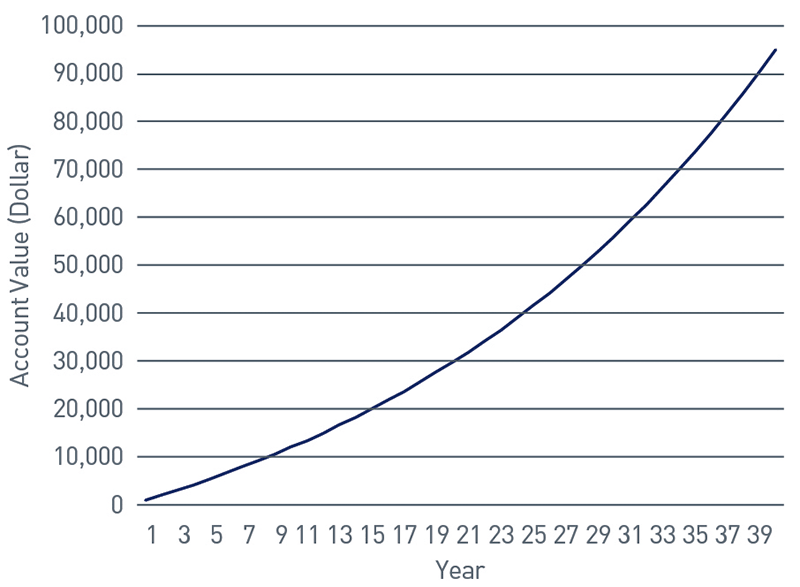

Now, imagine saving throughout a long career, and how much could be available for your retirement. Consider a 25-year-old who starts out earning $75,000 per year and receives a 2% raise each year until retirement at age 70. Assume that through employee contributions and employer matches, each year 10% of the employee’s salary is contributed to a qualified plan, and that the assets in the plan return 5% per year net of fees. At age 70 when the employee retires, the employee would have $1,736,912 (see Chart 2).

Chart 2: Account Value (Compound Return)

Source: PNC

View accessible version of this chart.

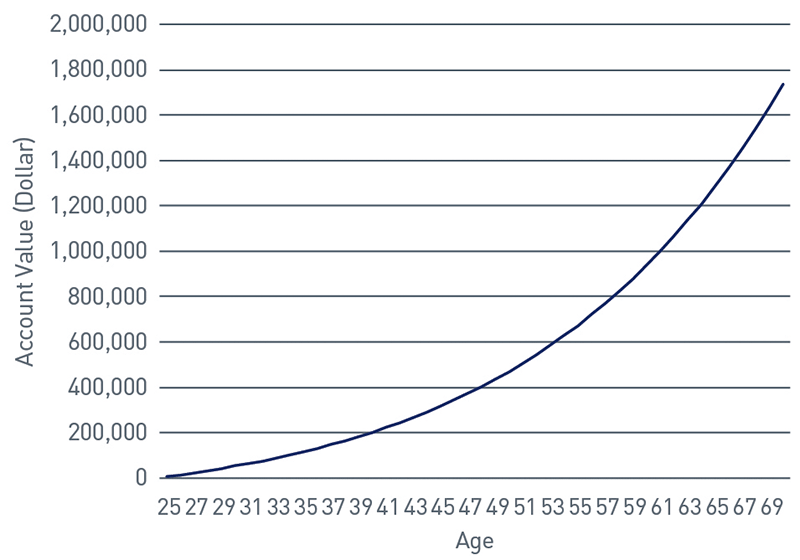

Chart 3: What’s the chance of running out of money in retirement?

Source: Source: EBRI; calculations by Joshua Gotbaum. https://www.brookings.edu/opinions/the-newmath- of-saving-for-retirement-may-boil-down-tothis- one-absurdly-simple-rule/

View accessible version of this chart.

Notwithstanding that your earnings may not stretch as far as you would like, planning for the future, including retirement, is essential.[7] Neglecting to plan for retirement in the early years of employment may negatively impact your lifestyle in retirement.[8] Research by the Employee Benefits Research Institute (EBRI) shows that millennial wage earners should be setting aside at least 10% of their paycheck though employer and employee contributions to a retirement plan. “If your employer contributes 3%, then your share is at least 7%. If the company kicks in 5%, then you [should] save at least 5%. If your employer does nothing, [you should] set aside at least 10% of each paycheck . . . . (If you are older and haven’t started retirement saving, then 10% will be too low: start thinking at least 15%-20%.)”[9] (But remember, your contribution of pre-tax earnings should not exceed the annual employee contribution limit for the qualified plan.) If your employer matches your contribution up to a certain percentage of compensation, you should contribute at least the amount necessary to be fully matched. Failing to do so is like voluntarily giving up compensation. “The EBRI simulation model suggests that, in the income ranges of most millennials, a contribution rate of 10% starting in a worker’s mid-20s cuts the risk of running out of money in retirement to about 30%, less than one chance in three. Contributing more than 10% when [possible]… will give you a better cushion.”[10]

So, what should you do?

Pay yourself first. Before spending, be sure to allocate some of every paycheck to a savings, investment or retirement account. Start early, even if it’s just a small amount. As described above, even a small amount invested in your early years can grow to something substantial.

Contribute as much as allowed to your employer’s qualified retirement plan(s). Plan features differ, so seek professional advice. If you cannot contribute the full amount permitted by law, contribute as much as you can. If your employer matches your contributions, be sure to contribute enough to receive the full match; failing to do so is like voluntarily foregoing compensation. If you are paying student loans and cannot afford to contribute to your employer’s plan, beginning in 2024, an employer’s plan may match certain student loan payments with contributions to your qualified plan account. If your employer’s plan has this feature, do what is necessary to qualify for that match. If your employer’s plan does not have this feature, ask for it to be added.

Take advantage of other benefits. If your employer offers financial benefits in addition to a qualified retirement plan, be sure to take advantage of them. For instance, your employer may provide financial assistance for additional education, which may help you increase your future salary, or your employer may offer an employee stock purchase plan that allows you to purchase company stock at a discount. Review your benefits package, and if you have questions, ask a professional, such as your financial advisor, accountant or attorney. Set aside funds for an emergency. Creating an emergency savings account can allow you to cover the cost of an emergency without tapping into retirement assets or using high interest rate credit cards.

Seek professional advice. Working with a professional investment advisor and financial planner can help keep you on track. Of course, it is possible to watch the value of your investments rise and fall in almost real time. Yet, daily market movements, especially if the market is declining, can be nerve wracking. Using a professional investment advisor can take the emotion out of investing and help prevent precipitous moves that could damage long-term results. Working with a professional investment advisor will also help you select investments that are appropriate for your short- and long-term goals. To that end, a financial planner can prepare illustrations that will assist you in setting your goals, including your anticipated retirement needs. Periodically, your financial planner will review your plan and illustrate your progress. This will help you determine if you are on track or if adjustments are necessary.

Disciplined saving is the foundation for a successful financial life. PNC Private Bank has investment professionals who can help you save and invest and Wealth Strategists who can prepare financial models that can help you set your financial goals, determine courses of action to achieve your goals and monitor them for adjustment as needed. For more information, contact any member of your PNC Private Bank team.

TEXT VERSION OF CHARTS

Chart 1: Saving the Cost of a Cup of Coffee (view image)

| Year | Account Value |

|---|---|

| 1 | $0 |

| 3 | $3,122 |

| 5 | $5,426 |

| 7 | $7,898 |

| 9 | $10,583 |

| 11 | $13,486 |

| 13 | $16,627 |

| 15 | $20,024 |

| 17 | $23,698 |

| 19 | $27,671 |

| 21 | $31,969 |

| 23 | $36,618 |

| 25 | $41,646 |

| 27 | $47,084 |

| 29 | $52,966 |

| 31 | $59,328 |

| 33 | $66,210 |

| 35 | $73,652 |

| 39 | $81,702 |

| 39 | $90,409 |

Chart 2: Account Value (Compound Return) (view image)

| Year | Account Value |

|---|---|

| 25 | 0 |

| 27 | 24,104 |

| 29 | 43,050 |

| 31 | 64,604 |

| 33 | 89,059 |

| 35 | 116,741 |

| 37 | 148,011 |

| 39 | 183,265 |

| 41 | 222,944 |

| 43 | 267,535 |

| 45 | 317,574 |

| 47 | 373,656 |

| 49 | 436,437 |

| 51 | 506,642 |

| 53 | 585,073 |

| 55 | 672,613 |

| 57 | 770,239 |

| 59 | 879,031 |

| 61 | 1,000,180 |

| 63 | 1,135,002 |

| 65 | 1,284,947 |

| 67 | 1,451,619 |

| 69 | 1,636,788 |

Chart 3: What’s the chance of running out of money in retirement? (view image)

The X axis of the chart displays the annual contribution rate as a percent of income, from 3% to 15%. The Y axis displays the percent chance of running out of money in retirement at that particular contribution rate. There is a dotted line denoting an income of $30,000, which is the median income of 25-year olds. The line runs down, starting at a 60% chance of running out of money at a 3% annual rate of contribution, and ending at a 20% chance of running out of money at a 15% annual rate of contribution. On either side of the dotted line is a shaded line denoting the chances of running out of money at other income levels. The shaded area above shows that the chances of running out of money goes up as high as 75% at a 3% annual rate of contribution for those with a $20,000 income and moving down to a 30% chance of running out of money at a 15% annual rate of contribution. Below the dotted line, the shaded area shows that those with an income of $40,000 have a 45% chance of running out of money when making a 3% annual contribution, which steadily decreases to 10% when making a 15% annual contribution.

Source: EBRI; calculations by Joshua Gotbaum. https://www.brookings.edu/opinions/the-new-math-of-saving-for-retirement-may-boil-down-to-this-one-absurdly-simple-rule//