According to the Census Bureau, in 2030, all members of the baby boomer generation will have reached age 65, the traditional retirement age.

Set Your Goals

Some common goals are listed here. Add other goals that may not be included on this list and then prioritize them by importance to you.

- Maintaining your current lifestyle throughout retirement

- Not outliving your resources

- Protecting a spouse’s financial security

- Providing for other family members

- Additional discretionary experiences and

- Philanthropy

Determine Your Spending

Consider the broad range of costs you'll need to plan for retirement. Many Americans are likely concerned about the high medical expenses they might face in retirement. Yet, housing is the top expense for retirees across all age groups, and transportation costs rival the amount spent on health care.[1]Your advisor can help you estimate costs and plan realistic future budgets, factoring in such things as inflation, expense spikes, and potential changes in your lifestyle and/or health, including:

- Essential expenses such as housing, transportation, and food

- Discretionary expenses such as travel, a second home, and leisure activities

- Health care costs including both the cost of Medicare coverage and costs not covered by Medicare

- Potential long-term care expenses

- Philanthropic donations and

- Assistance and/or gifts to family members

Know Where You Stand

Determine how much of your income will be derived from each of the following sources and whether these sources are guaranteed or subject to risk:

- Social Security retirement benefits and spousal benefits

- Defined benefit pension plans, including what your spouse may receive after your death

- Traditional retirement accounts, including 401(k)s, 403(b)s and Individual Retirement Accounts (IRAs)

- Roth retirement accounts, including 401(k)s, 403(b)s, and IRAs

- Health Savings Accounts (HSAs)

- Taxable accounts

- Real estate

- Life insurance policies

- Annuities

- Wages, if you plan to work in retirement

- Inheritances

- Trust income and

- Nonqualified deferred compensation, stock options, restricted stock

Create a Budget

Once determined how much you will need and compare it to how much you will save, it is a best practice to create a reasonable budget.

Create a Withdrawal Plan

How you withdraw money from various sources can greatly affect what you ultimately take home. Your advisor can model different scenarios to help you choose what is appropriate for your circumstances, weighing all the above and factoring in income taxes.

Make your Social Security Decision

There are three main considerations when choosing when to start taking Social Security:

- How much will you receieve? Claiming prior to full retirement age (FRA) can reduce the amount you receive by approximately 25%; waiting until age 70 can increase the amount by about 8% per year not compounded.[2]

- What is the impact of working after you start Social Security benefits? If you take Social Security prior to reaching FRA and earn more than a certain amount, part of your benefit will be withheld.[5]

- Will your spouse rely on your Social Security benefits during your lifetime or after your death?

Make Your Health Care/ Medicare Decisions

Options to obtain health care coverage if you leave the workforce before being eligible for Medicare, include:

- Continuing your current employer’s coverage, usually for 18 months, under COBRA[6]

- Employer-sponsored retiree health care coverage if offered and

- Private-pay policies.

When you do become eligible for Medicare, the decisions you make will affect your budget and include:

- Whether to choose traditional Medicare or a Medicare Advantage plan

- Which Part D Prescription Coverage plan to choose

- Whether to choose a Medigap policy and, if so, which one and

- How Medicare will coordinate with any employer-sponsored health care coverage you have

Examine Options for Long-Term Care Needs

According to the U.S. Department of Health and Human Services, "At some point in our lives, about 60 percent of us will need assistance with things like getting dressed, driving to appointments, or making meals."[7] Consider which of the following you might rely on:

- Family-provided care

- Self-pay

- Long-term care insurance and

- Medicaid

High medical expenses are Americans’ biggest financial worry about retirement. Yet, housing is the top expense for retirees across all age groups, and transportation costs rival the amount spent on health care.

View accessible version of this chart.

TEXT VERSION OF CHART

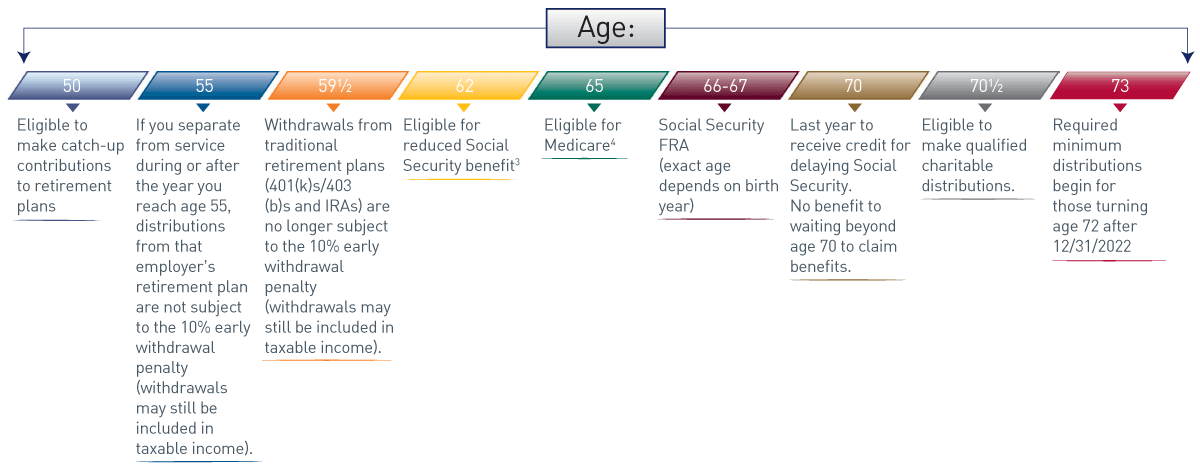

Chart 1: Timeline of Ages (view image)

The graph represents a timeline of ages, starting with age 50 and going through age 73, and the benefits a person becomes eligible when he or she reaches that ages.

Age 50: Eligible to make catch-up contributions to retirement plans.

Age 55: If you separate from service during or after the year you reach age 55, distributions from that employer’s retirement plan are not subject to the 10% early withdrawal penalty (withdrawals may still be included in gross income).

Age 59½: Withdrawals from traditional retirement plans (401(k)s/403(b)s and IRAs) are no longer subject to the 10% early withdrawal penalty (withdrawals may still be included in gross income).

Age 62: Eligible for reduced Social Security benefit (with some exceptions).

Age 65: Eligible for Medicare. (Generally, enrollment in Parts A and B is automatic if you are already receiving Social Security benefits three months before you turn age 65. If you are not, you should apply for Medicare three months before that month.)

Age 66-67: Social Security FRA (exact age depends on birth year).

Age 70: Last year to receive credit for delaying Social Security. No benefit to waiting beyond age 70 to claim benefits.

Age 70½: Eligible to make qualified charitable distributions.

Age 73: Required minimum distributions begin for those turning age 72 after December 31, 2022.

Source: PNC