Regular account or plan reviews can help you prioritize your goals and create an actionable plan to avoid potentially costly investment mistakes. With that in mind, here are five additional reasons you should review your financial situation annually.

1. You can create a personalized path to help achieve your goals

While many investors share similar goals – a comfortable retirement, providing for a child’s college education, etc. – each path to success is going to be highly personalized. An annual review provides you and your Financial Advisor the opportunity to take an in-depth look at your goals, and prioritize what matters most. Together, you can begin to estimate the cost of these goals, and determine whether you’re on track to achieving them or need to identify ways to catch-up. According to Rich Guerrini, President & CEO of PNC Wealth Management:

Annual reviews provide clients a snapshot of their current financial state and resources. This allows an investor to better personalize their approach, accounting for their available resources, estimated time horizon, tolerance for risk and more.

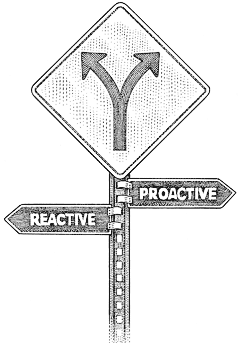

2. You're more likely to be proactive

Annual reviews can help you look at your portfolio through a new lens. It’s a chance to look at a particular security or position you might hold and ask, “Why do I own that? What role does this play in moving me toward my goals?” It can also help you understand how your assets align with what you’re looking to accomplish.

Guerrini is quick to stress this point. “In order to achieve any goal – whether it be financial or personal in nature – you need to take deliberate action that helps you progress toward it. Annual reviews help our clients to think more intentionally about their goals and be more deliberate about their financial futures. It’s about developing the mentality that the actions you take today – whether big or small – are what really matters.”

3. A lot can happen in a year

Taking the time to recognize changes in your life, shifts in your priorities and evolving family dynamics will help you to make minor adjustments to your financial plan. Going too long without a review could result in the need to take significant or drastic measures to get back on track; and tweaks are much easier to implement than a major overhaul. This also ties back to being proactive.

The alternative is an investor who behaves reactively, making impulse decisions based on changes in market conditions rather than on what it is they’re looking to accomplish long-term; thus, resulting in potentially costly mistakes.

4. You can turn information into knowledge

With the vast amounts of information and news constantly bombarding investors it can feel like information overload, and become all too easy for investors to tune everything out. An annual review provides you an opportunity to discuss and digest some of this content with the help of your Financial Advisor who can also provide you with guidance on what to do with this information. This becomes especially important when you consider that many investors make decisions regarding their money based on emotion. Guerrini is apt to point out:

Taking the time to understand the applicable insights – and apply those relevant to your personal situation – can balance emotional responses and help increase confidence when making decisions.

5. You'll build a solid client-advisor relationship

Regular reviews – at least once a year – provide an opportunity to open up a more continuous dialogue and strengthen your relationship with your Financial Advisor. There is great value to be had in working alongside a professional who understands the evolution of your personal situation, goals and family dynamics, and who can provide customized guidance designed to help improve your financial well-being. Guerrini sums this up, saying, "Clients want to work with advisors who truly know them. What better way is there to get to know someone than through regularly scheduled meetings?"

A PNC Wealth Managemernt Financial Advisor can assist you in navigating today’s economy to help you reach your retirement and other investment goals.

To speak with a Financial Advisor about your unique situation and schedule a financial review, stop by your local branch or call 855-762-4683, today.