Mexico has long been a prime market and trading partner for many U.S.-based companies. This can be traced back to a number of factors, including geographic proximity, favorable trading policies (see “Impact of USMCA”) and the large size of the Mexican economy. Mexico has the world’s 10th largest population at more than 125 million people and the world’s 11th largest economy at approximately $2.5 trillion.[1] Companies doing business in Mexico need to stay on top of the constantly changing political, economic and regulatory landscape. Companies not doing business in Mexico might reconsider that stance.

1. Impact of USMCA

Since coming into effect in 1994, the North American Free Trade Agreement (NAFTA) fundamentally reshaped North American economic relations and has ushered in a period of free trade and increasing economic interdependence among the United States, Canada and Mexico. NAFTA eliminated most tariffs on products traded among the three countries, with a major focus on liberalizing trade in agriculture, textiles, and automobile manufacturing.[2] As a result, Mexico and the United States have become closely connected, with almost 80% of Mexican exports and 47% of Mexican imports tied to the U.S.[1]

In 2017, all three countries came back to the negotiating table and began the long process of updating NAFTA. After almost 3 years, the U.S., Mexico and Canada have reached an agreement to modernize the 25-year-old NAFTA. The result was the new United States–Mexico–Canada Agreement (USMCA), which went into effect on July 1, 2020.[3]

The USMCA builds on many of the existing free trade provisions of NAFTA. Some of the most affected industries include the automobile industry (increased North American content requirements) and the dairy industry (expanded ability of U.S. dairy producers to access the Canadian market). Other changes include greater provisions for worker rights in Mexico and expanded intellectual property protections.[4] For companies in certain heavily impacted areas, such as the automotive and dairy industries, it is important to review the implications of USMCA in greater detail.

Given all of the recent changes, it is a prudent time for companies to be reviewing their supply chains and banking arrangements to confirm that they are appropriately mitigating risks and operating efficiently around the world. The remainder of this article will go into further detail on additional considerations for companies doing business in Mexico.

2. Mexican Banking Structure

It can be extremely useful to understand the local banking structure when considering expansion into Mexico. Mexico’s banking sector consists of approximately 200 banks and financial institutions, inclusive of credit unions and representative offices of foreign banks. However, more than 80% of the market share in Mexico is controlled by the top seven banks. Following a period of recent consolidation, the majority of Mexico’s banking assets are in nondomestic ownership. Four of Mexico’s five largest banking groups and 68% of total banking assets are owned by foreign groups.[5]

Contrast that with the U.S., which has a much more fragmented banking sector as there are more than 10,000 banks and financial institutions, inclusive of commercial banks and credit unions. Although most U.S. banks do not operate directly in Mexico, many have established referral relationships with Mexican banks and some even offer MXN-denominated accounts domiciled in the U.S. If you are looking to get in touch with a bank in Mexico, consider working with your current banking provider in the U.S., who should be able to help make the appropriate connections.

Largest Mexican Banks

| Bank | Total Assets (USD million) November 30, 2019 |

| BBVA Bancomer (BBVA Group) | 109,245 |

| Banco Santander Mexico (BSCH Group) | 77,573 |

| Banamex (Citigroup) | 67,318 |

| Banco Mercantil del Norte (Banorte) | 59,336 |

| HSBC Bank Mexico | 39,891 |

| Scotiabank | 29,806 |

| Banco Inbursa | 19,844 |

Source: National Banking and Securities Commission and www.accuity.com

3. Mexican Payment Systems — SPEI (MXN) and SPID (USD)

The System for Electronic Interbank Payments, or SPEI, is the Mexican Central Bank’s platform for local currency payments (Mexican peso or MXN) within the country. Introduced in 2004 and substantially updated within the past 3 years, SPEI was originally designed to be a 24/7, near-real-time settlement system for high-value payments.[6] However, in practice it is used for nearly all domestic MXN electronic payments regardless of size, and most banks’ online banking platforms default to SPEI for all domestic MXN transfers.

The Mexican Central Bank uses a “good funds” model to settle SPEI payments, so no credit is ever extended. A transfer request with insufficient funds is held in queue until the account is funded and the transaction can be completed.

Critical to successful use of the SPEI system is the CLABE, which is the standardized banking code for all domestic accounts, whether denominated in MXN or USD. It is an 18-digit number, comprising the traditional 11-digit basic account number, three digits each to identify the bank and its location and one “control” digit.[7] This CLABE functions very much like the European IBAN account number. It is critical that the CLABE be used rather than the shorter 11-digit account number in order to minimize the chances of returned funds or payment delays.

There is a similar system for USD payments within Mexico — the System for Interbank Payments in Dollars, or SPID. Also run by Mexico’s Central Bank, this system only operates for a limited window each business day (i.e., 8:00–14:15 in Mexico). This allows for longer back-office processing periods so that banks have time to apply the more-stringent AML/CFT policies that are in place for USD transactions. In terms of payment clearing, the Central Bank does not provide liquidity to SPID’s participants, but rather, banks must send USD to Mexico’s Central Bank to settle transactions.[8] The SPID system is used much less frequently than the SPEI system for payments within Mexico, as transfers in USD are used mostly for external USD transfers and not for daily payment needs.

4. Mexican Payment Practices

The use of all payment instruments, excluding checks, grew by volume in the most recent study of Mexican payments.* The decrease in check transaction volume and value reflects a fundamental, long-term shift away from paper-based payments and collections in the Mexican market and around the world. This is caused by a combination of increasing technological advances as well as changing consumer and corporate behavior. However, it is worth noting that checks continue to be a relatively important part of the Mexican payments landscape and that cash plays a large part in the Mexican economy for low-value payments. High-value credit transfers account for, by far, the largest proportion of payments by value, while credit and debit cards are the dominant format by volume.

Statistics of Instrument Usage and Value*

| Transactions (Million) | % Change | Traffic (Value) (MXN Billion) |

% Change | |||

| 2017 | 2018 | 2018/2017 | 2017 | 2018 | 2018/2017 | |

| Checks (MXN Checks) | 66.4 | 59.1 | -11.0 | 2282.9 | 2201.4 | -3.6 |

| Credit Cards | 649.5 | 660.7 | 1.7 | 578.6 | 565.4 | -2.3 |

| Debit Cards | 1,474.7 | 1,663.7 | 12.8 | 736.8 | 863.0 | 17.1 |

| Credit Transfers | 763.4 | 967.5 | 26.7 | 347,906.3 | 353,287.9 | 1.6 |

| high-value | 480.0 | 601.4 | 25.3 | 270,484.9 | 266,854.1 | -1.3 |

| low-value | 283.4 | 366.1 | 29.2 | 77,421.4 | 86,433.8 | 11.6 |

| Direct Debits | 36.3 | 42.5 | 17.1 | 138.0 | 165.8 | 20.1 |

| TOTAL | 2,990.3 | 3,393.5 | 13.4 | 351,642.6 | 357,083.5 | 1.6 |

Source: Mexico AFP Country Profile Report

While most business transactions are conducted electronically (see “Electronic Invoicing”), it is important to understand all of the local payment practices in Mexico in order to be prepared when talking with vendors and customers alike. While initially lagging behind the rest of North America and Europe for many years in terms of card usage and acceptance, card payment volumes have grown substantially in Mexico since the turn of the century. The total number of debit card transactions grew from 235.1 million in 2005 to 1.6 billion in 2018, while credit card transactions rose from 134.7 million to 660.7 million. Visa (Electron) and Mastercard (Maestro) operate the main debit and credit card systems in Mexico.[5]

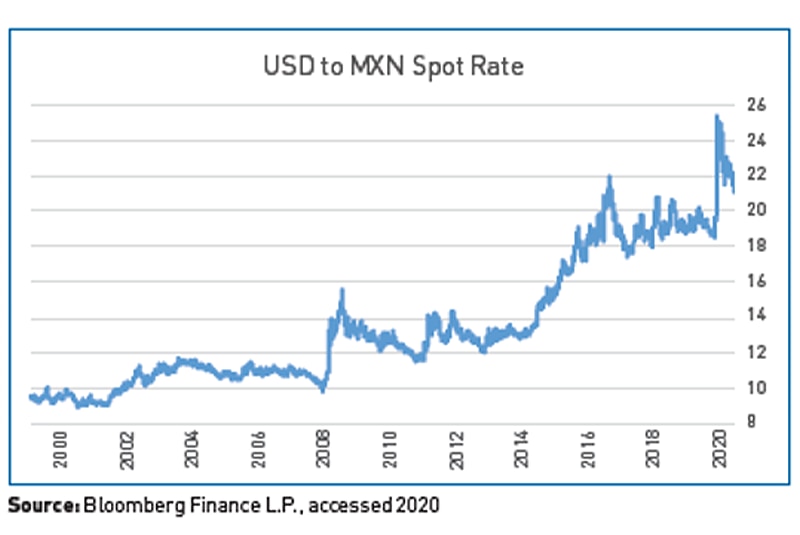

5. Understanding the Mexican Peso

Recent data indicates that MXN is currently the most-traded currency from Latin America and the 15th most-traded currency in the world. Its transaction share has remained largely unchanged over the past 10 years.[9] There are several factors affecting liquidity, activity and volatility in MXN:

- Market-Based Exchange Rate. MXN is a freely convertible currency. A wide range of hedging products, such as forwards and options, exist to allow importers and exporters to efficiently manage currency risk.

- U.S. Nexus. Mexico’s proximity to and strong trade links with the U.S. tie its economic health with that of its larger neighbor. Policy statements on immigration and trade can cause exchange-rate movements in addition to those caused by conventional economic and financial metrics.

- Oil. While less dependent than before on petroleum, Mexico still has vast crude oil reserves that are an important part of the economy. Historically, falling crude prices correlated with a falling MXN and vice versa.

- Interest Rates. Higher interest rates in Mexico compared to the U.S. can induce investors to buy MXN in favorable market conditions. These flows can reverse when investors reduce risk even due to events in other emerging markets.

These factors mean that exchange-rate movements can derive from economic or political developments locally or in the U.S., global oil market-related movements, and occurrences in other emerging market economies, particularly those in Latin America.

6. Opening Accounts in Mexico

Major U.S. banks offer MXN-denominated accounts outside of Mexico, the only option for companies with no presence in the country. And while these accounts do allow for the incoming and outgoing movement of MXN, they are often limited to wires in and out of the account and to electronic reporting of account activity.

Companies needing more robust capabilities for MXN account(s) will want an account at a full-service Mexican bank. To do that, they must have an established legal entity in Mexico, as Mexican banks will not open nonresident accounts, only accounts for Mexican companies. The Mexican entity does not necessarily need to have employees on the ground, but if not, there will be a need to engage an external party on the ground who can be listed as a signer of the account and given power of attorney. This is so that the Mexican bank can fulfill KYC (Know-Your-Customer) obligations and allow initial account documents to be signed, and for periodic documentation refreshes. Mexican accounting and/ or law firms provide this service for a fee, and your U.S. bank should be able to provide an introduction. Such an arrangement can also benefit companies with a local operations presence but with no finance employees in country who would traditionally have corporate signing authority to execute documents.

The online banking capabilities of Mexican banks are quite robust but typically in Spanish, and account opening documentation is in Spanish as well.

This is offset by online banking platform demonstrations in English and call centers staffed with English-speaking employees, as well as plans of some banks to produce a bilingual online platform.

Lastly, Mexican banks can open accounts in either MXN or USD, facilitating invoicing in either currency, as well as payment options via both the SPEI and SPID platforms. Most Mexican banks can report daily activity and balances to your U.S. bank via SWIFT MT940 to enable centralized reporting for all of your company’s international accounts.

7. Setting Up an Entity in Mexico

Companies, at some stage of their commercial dealings with Mexico, may examine the arguments for establishing an entity within the country itself. The reasons can vary from wanting to increase sales, to partially manufacturing and/or sourcing locally, to being able to invoice in local currency — among many other factors. In fact, to even be able to open a bank account within Mexico requires a legally established local entity, as nonresident accounts are no longer available due to KYC restrictions.

For many, consulting an accounting firm in Mexico is the recommended first step to setting up an entity in Mexico, as opposed to contacting a local law firm. Your bank can provide the appropriate introduction. The local accounting firm can advise on the steps and documentation needed, the time it should take, and the estimated costs of creating a local entity. They can also support the ongoing legal, accounting, tax and regulatory requirements, should you choose to outsource those functions. Your chosen local accounting firm will guide you through considerations of the expected immediate and future scope of the local company and what signing authority — if any — will be given to local staff and can recommend the appropriate type of company to establish. They will employ the services of a local law firm, called a bufete legal in Spanish, to handle the preparation, delivery and registration of necessary documentation. This will save you from having to independently find, vet and hire a local law firm.

The accounting firm can be given a power of attorney to not only handle these matters but also to facilitate signing of bank account opening documentation, meeting the requirements for a local signatory and taking receipt of bank key fobs for online banking, on your behalf. The power over the banking account can be revoked later and access to online banking limited to the U.S. staff, if desired.

8. Outsourcing of Operations

Mexico has benefitted from the global trend of outsourcing. For example, many U.S. companies have relocated workers with certain administrative functions to Mexico, as the country can provide trained workers at cheaper wages than a similar employee would cost in the U.S. Geographic proximity, time zone compatibility, and the availability of an energetic and young workforce with bilingual language capabilities helps to explain the volume of companies moving their treasury operations, shared service centers and other functions to Mexico.

One focal point for this outsourcing is located in Queretaro, Mexico. Located just a few hours’ drive from Mexico City, it is considered one of the safest cities in the country and has developed into a center for both domestic and international investment. This includes many corporations from the U.S., Canada, France, Germany and Japan, including some of the largest global companies, such as Hilton, Natura, Santander, DHL, AT&T and EY.

Queretaro’s proximity to Mexico City and relatively developed logistical infrastructure and central location make it ideal for logistical purposes. In fact, it was named as a winner on the most recent Financial Times report, “Latin American States of the Future.”[10]

Queretaro has more than 10 industrial parks, and more than 100 new companies established offices there between 2010 and 2018. This is highly concentrated by companies in the automotive, aeronautical, food and information technology segments, and each segment has developed its own mini-ecosystem. Queretaro remains an attractive location for investment, as there are announced plans for 90 more investment projects estimated at USD $1.5 billion planned for the coming years.[11 -13]

9. How to Manage Nonpayment Risk and the Need for Risk Mitigation

While an integral part of North America and the USMCA, Mexico is still considered an emerging market and as such may represent greater risk than Canada and the U.S. The availability and reliability of credit-related information on vendors and buyers alike, and thus the ability to evaluate credit criteria, may make decisions to extend unsecured credit — via open account trading terms — much more difficult and ultimately introduce more risk.

For these reasons, risk mitigation products, services and techniques should be considered. For any buyers you decide do not warrant open account terms, requiring letters of credit, whether commercial for specific transactional payments or standby letters of credit to support ongoing sales, should be evaluated as to feasibility, impact on sales and related costs.

Other risk mitigation possibilities include documentary collections, whether payable at sight or on terms, and/or credit insurance to back up open account sales. Although each of these products offers some degree of protection, the relative pros and cons should be evaluated together with your international banking associate as to which product suits each situation based on the level of protection offered, applicability and cost.

10. Electronic Invoicing

Electronic invoicing was first introduced in Mexico in 2004, made mandatory in 2014, and underwent a significant upgrade in 2017. It is called Comprobante Fiscal Digital por Internet, or CFDI by its Spanish acronym, and is now associated with almost all activity in the formal economy of the country, providing detailed, digitized information about purchases and sales to Mexico’s IRS, known as SAT.

An individual electronic invoice identifies the seller who issues the invoice, the buyer who receives it, details of the transactions (including amount, currency, payment terms and date) and a digital stamp of an entity authorized by SAT that validates the invoice. While these can be created at no cost using the SAT website, high-volume users typically work through an electronic invoice intermediary or generate them using their own ERP system.

Companies called proveedores autorizados de certificación (PAC) exist to provide technical assistance with interfacing customer billing and vendor payments from a company’s software solution with the Mexican government’s SAT system.[14]

As with establishing an entity and opening a bank account in Mexico, your bank can provide the necessary introduction(s).

Ready to Help

Considerations for doing business in Mexico have continued to evolve over the last few years, and we expect the trend to continue. PNC’s International Advisory Team can provide overall guidance and help you understand the complexities of conducting business in Mexico. For more information on how PNC might be able to assist with your Mexican operations, please contact your PNC Relationship Manager, or visit pnc.com/international.

Accessible Version of Charts

USD to MXN Spot Rate

| Date | MXN Currency - Last Price |

| 9/14/2020 | 21.1124 |

| 9/13/2019 | 19.4062 |

| 9/14/2018 | 18.8888 |

| 9/14/2017 | 17.6657 |

| 9/14/2016 | 19.2734 |

| 9/14/2015 | 16.7524 |

| 9/15/2014 | 13.2362 |

| 9/16/2013 | 12.9308 |

| 9/14/2012 | 12.7149 |

| 9/14/2011 | 12.9331 |

| 9/14/2010 | 12.8362 |

| 9/14/2009 | 13.3741 |

| 9/15/2008 | 10.7425 |

| 9/14/2007 | 11.1223 |

| 9/14/2006 | 10.976 |

| 9/14/2005 | 10.821 |

| 9/14/2004 | 11.5611 |

| 9/15/2003 | 10.9575 |

| 9/13/2002 | 9.963 |

| 9/14/2001 | 9.515 |

| 9/14/2000 | 9.305 |