1. The Canadian Banking Structure

Unlike the United States that has 4,135 commercial banks, Canada has 77 financial institutions:

- 34 domestic banks

- 15 subsidiaries of foreign banks that are permitted to offer the full range of wholesale and retail banking services1

- 28 foreign banks like PNC have established branches in Canada

Canada is a dual-currency country with clearing systems and payment services in both Canadian (CAD) and U.S. dollars (USD). Both Canadian- and U.S.-dollar banking services are available for Wire, AFT (ACH) and Cheque. The USD clearing systems are separate and unique to those in the U.S., such as the Fed, the Clearing House and U.S. banks.2

The Bank of Canada oversees three payment systems as regulated by the Payments Clearing and Settlement Act:

- Lynx: real-time system for large-value, time-critical payments (“Wires”). Lynx replaced the Large Value Transfer System (LVTS) in 2021 as part of Canada’s payment modernization efforts

- Automated Clearing Settlement System (ACSS): payments clearing system for cheques and electronic items (AFT or “Canadian ACH”), such as pre-authorized debits and direct deposits

- Interac: electronic payment processor for P2P, P2B and B2B online transactions (Interac operates the primary debit card system and the e-Transfer system (similar to Zelle in the U.S.).

Both Lynx and ACSS are operated by Payments Canada (formerly the Canadian Payments Association). Payments Canada is currently working on a new Real Time Rail (RTR).

2. Payments Canada Modernization Initiative3

Payments Canada underpins the Canadian financial system and economy by owning and operating Canada’s payment clearing and settlement infrastructure, including associated systems, by-laws, rules and standards. The value of payments cleared by Payments Canada’s systems in 2022 was approximately $119 trillion or $476 billion every business day.

Payments Canada began the journey in 2016 to modernize the Canadian payments ecosystem to address key areas that consumers and businesses were anxious to improve:

- Faster payment options

- Date-rich payments

- Transaction transparency

- Easier payments

- Cross-border convenience

- Activity-based oversight

- Open and risk based access

- Platform for innovation

This multi-year initiative aligned Canada with many countries around the world looking to improve their payments landscape and help consumers and businesses with their various transactions. This Canadian investment into the payment rails will also increase the similarities to U.S. payment systems and technology, offering cross-border synergies for these very important trading partners.

Payments Canada also manages the Canadian ISO 20022 usage guidelines and message specifications, with a goal to ensure all payments systems support this international payment messaging standard. In March 2023, Lynx was upgraded and now is compliant with ISO 20022 messaging. Lynx along with high-value payments systems across the globe are all working to meet the Swift mandate for banks and market infrastructures to move to the ISO20022 messaging standard away from the MT message for cross border payments by 20254.

3. Automated Funds Transfer (AFT/ACH Payments)

Automated Funds Transfer (AFT), Canada’s version of ACH, is available in both CAD (base currency) and USD.

AFTs experienced significant improvements due to Payments Modernization. The most critical enhancement was the introduction of a third clearing window at 9 p.m. ET, which added tremendous value for transactions occurring in the western part of the country. Previously, the latest clearing time was 5 p.m. ET.

AFT payments can be sent individually, as a bulk payment file with several AFT instructions, or as part of other payment items in a Mixed/Integrated Payables File. Canada has seen a movement from manual file uploads to direct connectivity between Enterprise Resource Planning (ERP) platforms and bank systems for sending payment instructions. They are a low-cost alternative to cheque and a pathway for companies to convert to electronic payments.

4. Cheque Payments

Check in Canada is spelled with “que” at the end. Cheques are available in both CAD (base currency) and USD. The use of cheques has been in decline in Canada in favor of electronic payment instruments.

There is no clearing float in Canada. Cheques clear overnight in a batch process (through the same system that Canadian AFT (ACH) clears, ACSS); but what’s different is that they are backdated to the prior day’s date of deposit.

Many financial institutions can print and mail cheques on behalf of companies. These types of cheque payments are often combined with transmitted payment files as a means to outsource cheque payments. These payment files can also include other types of payments, which we highlighted in item #6.

After a series of amendments to Payments Canada rules, banks can create and use image of cheques as part of the clearing process. This process is similar to the image-based cheque clearing processes used in the U.S. These images can also be made available to clients for investigation and tracing purposes.5

Notes:

- Controlled disbursement is not available in Canada and is only available in the USA

- Canadian cheque specifications are different than U.S. check specifications

- As a best practice, companies issuing cheques should always enable some form of fraud protection.

5. Lockbox Services

When conducting business in Canada, having accounts in-market and being able to initiate and receive local currency payments not only improves the clearing of funds but also reduces the foreign exchange risk that comes with cross-currency transactions. Lockbox services are available for both CAD and USD cheques.6

Establishing a lockbox for processing cheques and remittances may benefit your organization from a quantitative (mail processing times and interest earnings opportunity) as well as a qualitative perspective (improved information reporting with remittance information and time saved from a resource perspective).

Having a Canadian mailing address for payments has several advantages for U.S. companies. In instances where organizations don’t have resources available to process incoming cheques, it could be beneficial to outsource this work to an in-market Canadian lockbox, so you can direct your energies to core operations rather than to reconciliation.

A unique aspect to Canada, although uncommon, lockboxes may receive post-dated cheques, requiring them to be processed at a later time depending on issuance date.

Alternatively, a Remote Deposit Capture (RDC) device can be advantageous if you receive a limited number of cheques and prefer to leverage an in-house scanning device rather than establishing lockbox services.

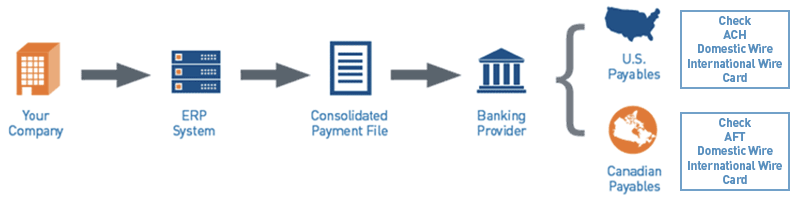

6. Integrated Payables

An Integrated Payables file optimizes a corporation’s payment protocol by automating the disbursement function with a single transmission of one consolidated payment file. Within this single, consolidated file, a company can send all of their payables in one place: cheques, AFT/ACH, wire and card payments.

By establishing connectivity from a company’s ERP system directly into the bank’s operating platform, companies can optimize efficiency, enhance data integration, tighten process control and capitalize on a reduction in processing costs.

This type of payables setup is popular in the U.S. and is commonly used by corporate companies automating payables across various payment types in the Canadian market. Certain bank providers are even able to accept files for both countries across the same payments channel, eliminating the need to set up and maintain multiple host-to-host connections. It is important to talk to your banking provider about their ability to accept an Integrated Payables file as your company strives to optimize the accounts payables process.

Figure 1: Integrated Payables Example Diagram

View accessible version of this chart.

7. Real Time Payments

Canada’s newest payment rail in nearly 40 years will be Real-Time Rail (RTR), that will facilitate the delivery of low-value payments in a matter of seconds. RTR will provide a faster alternative to less efficient payment options, support last-minute payments and provide certainty of receipt.

RTR is an extremely exciting payment introduction for B2B payments. Companies will have the benefits of 24/7/365 payment processing capabilities, prioritizing access of payments as well as finality. Additionally, enhanced data will be able to be transmitted with the payment unlike in previous payment options. An increased focus on faster real-time payments is taking place in Canada, which is aligned with other countries such as the United States (RTP and FedNow), England and Australia.[7]

There is no exact ‘go-live’ date, but Payments Canada is planning to launch its own RTR in the near future.

8. Commercial Card Payments

Commercial Card technology and product enhancements have seen tremendous development within North America over the last decade. Card and virtual card payments have a direct benefit to corporations’ working capital metrics, as well as internal controls. As the industry continues to evolve, virtual payments hold an increasingly important position within submitting and receiving payments. Establishing a single-card provider, in conjunction with other treasury services, can provide opportunities to review and upgrade supplier agreements and qualify for revenue sharing in the form of a rebate. As companies work towards optimizing their payables process, consider converting low-dollar invoices — historically paid by cheque — to now be paid by card.

Visa, MasterCard and American Express are the main credit card associations in Canada. Interac is the main debit card system operating in Canada. Debit cards supporting both Visa and Interac networks are also available. Domestic transactions made via these cards are processed through the Interac system, with online and international transactions processed via the Visa network.

Consolidating to a single card provider for both US and Canadian programs will offer companies the ability to leverage the same technology regardless of jurisdiction.

9. Know your Customer and Due Diligence in Canada

As corporations look to open accounts in Canada, they are required to perform Know Your Customer (KYC) and Due Diligence tasks. Setting up banking services in foreign jurisdictions often require additional information compared to the USA. For instance, in Canada companies are required to identify any individual who owns (directly or indirectly) 25% or more of the legal entity. Having an established relationship with a banking provider with a Schedule II (foreign bank subsidiary) or III (foreign bank branch) banking license in Canada can reduce the time required to create an account in Canada. Given most of the information required to open an account in-market is likely captured, only additional items of validation may need to be requested. Partnering with a North American financial institution always helps when expanding outside the United States.

Although companies may have U.S. accounts open with their U.S. bank provider, Canadian accounts will still require their own in-market regulatory and compliance approval. Even when working with the same bank in both countries, a review of Canadian-specific regulations and sanctions is required. Every country has its own unique regulatory and compliance procedures that must be fulfilled.

10. Digitization and Innovation

The global pandemic emphasized the uncertain financial market, thus contributing to firms increasing their attention on cash flow position to better prepare for the future. Faster payments adoption has been a focus for years in Canada, and the nature of remote work has accelerated the need for such services with virtual payments and businesses. The implementation of new technology such as the Lynx in Canada in 2021 and the push to improve and enhance payments with the business-to-business systems has become increasingly pertinent.

Payments Canada has rolled out a multiyear modernization initiative, striving to achieve worldwide conformity. With the support of the Canadian banking industry and companies within country, Payments Canada is not only improving payment infrastructure but also the technology to remain globally competitive.

Payments Canada is working to build their own 24/7/365 system named the Real-Time Rail (RTR), which will leverage the ISO 20022 standards. (For more details, refer to tip 7 above). Mobile banking and APIs are also contributing to the innovation initiative. By providing the ability to pull data from relationship banking and technology providers automatically, companies can have information at their fingertips. As companies expand internationally, managing data can become a full-time responsibility. With the use of automated API’s, organizations can and will benefit from the seamless data integration that becomes available across business units and financial data. Payments Canada offers a Developer Portal which allows companies to build their own API connections, accessible here: https://developer.payments.ca.7

Another key innovation that can help your company thrive in a digital world is a virtual commercial card program, which allows for initiation and control of payments on behalf of an organization. PNC offers this program through ActivePay®. Leveraging leading-edge technology that can be integrated within an ERP system, your company can pay suppliers while providing invoice information that can include important detail as well as the invoice itself. Combining the ability to automate bulk transactions or individual virtual card payments with the added security maximizes the advantages of these payments.

Banking in Canada

It’s important to take a fresh look at how you are operating in Canada. As Canada improves payments systems and introduces leading global technology, collaborating with a bank or strategic supplier who understands your business model and can work alongside your company as it grows will become vital.

In the face of a constantly changing economic landscape with interest rate and currency fluctuations, ensuring your treasury management provider and account structure are flexible and optimized for your needs is more important than ever. We recommend keeping up to date on developments that will affect your business and potentially influence the structure of your banking relationships and services in North America.

About PNC Bank Canada Branch

Established in Canada in 1998 and a Canadian commercial lending foreign bank branch since 2001, PNC Bank Canada Branch (“PNC Canada”) offers specialized knowledge and experience to help you succeed in this vital cross-border marketplace. PNC is uniquely structured and positioned to serve the needs of companies that operate in both Canada and the U.S., offering an integrated approach for treasury management and payments through PINACLE®, PNC’s top-rated corporate online and mobile banking platform.

Ready to Help

If you are a U.S. company with actual or projected operations in Canada, or a Canadian company, PNC Canada can assist you with credit, depository, and treasury management products and services. If you are interested in exploring how PNC Canada might be able to assist with your Canadian operations, we encourage you to contact your Relationship Manager or visit pnc.com/canada.

Sources

- FDIC - Historical Bank Data (fdic.gov)

- The uniqueness of USD clearing in Canada tends to impact USD checks drawn on banks in the US. These are treated as cross-border items.

- payments.ca

- Worth noting, both FedWire and CHIPS will be moving to the ISO20022 standard over the next two years

- payments.ca

- Some limitations may occur with USD checks drawn on a bank in the United States, as these are considered cross-border items

- payments.ca

Accessible Version of Chart

Figure 1: Integrated Payables Example Diagram

Automatic disbursement of payments via the consolidated payments file, made possible by your company’s ERP system connection to your banking provider. In the United States, your consolidated payment file would include check, ACH, Domestic Wire, International Wire and Card. In Canada, your consolidated payment file would include cheque, AFT, Domestic Wire, International Wire and Card.