Economic conditions, securities markets, people and philosophies tend to be in a perpetual state of flux. Constant change can undermine commitment to a long-term investment plan; however, when an organization has a comprehensive Investment Policy Statement (IPS) that sets forth long-term strategic direction, investment guidelines, and accountability standards, the course is well established and, over time, goals are more likely to be achieved.

Having a well-drafted IPS gives organizations the discipline to face the uncertainties of challenging investment environments.

Removing emotion from the equation positively correlates with better results for the investment portfolio, leaving the organization better positioned to fulfill its mission.

Executive Summary

An IPS is an investment management document drafted by a client, often with the help of an investment advisor or consultant. The document serves as a strategic guide in the management of the client assets specified in the IPS and outlines the fiduciary responsibilities of those groups and individuals involved in the oversight of the assets.

Documentation of the client’s objectives and constraints are critical in determining the Strategic Asset Allocation (SAA) that may best help achieve the client’s long-term investment goals. Portfolio parameters may also be established which identify suitable investment styles and vehicles to employ in the portfolio, as well as tactical asset allocation ranges that managers may utilize in order to take advantage of market dislocations. Risk management control procedures, performance, and client service/reporting requirements may also be outlined.

The entire process of developing the IPS should be an educational experience for the client.

It entails a detailed discussion of how investment decisions are made, who is responsible for each aspect of this process, and clearly lays out expectations. The development process has value to the investment advisor as well, as it allows the adviser to get to know the client better, and ultimately, the IPS provides clarity around guidance for investment decision making.

We recommend that the IPS be reviewed at least annually and as a response to material changes in an organization’s circumstances or capital market assumptions. The IPS is meant to be a portable document that can be easily understood by anyone involved in the investment process. It is important that parties involved in the oversight of assets acknowledge they have reviewed and acknowledge the clients most recent IPS. In this piece, we focus on nonprofit organizations, particularly foundations and endowments.

The Components of an Investment Policy Statement

To help organizations develop a robust IPS, below we have outlined the sections commonly included. In this paper, we will try to explain the “what” and “why” of each section, as well as noting any special considerations.

- Governance

- Purpose & Scope

- Definition of Duties

- Investment Philosophy

- Objectives & Constraints

- Statement of Goals

- Spending Rule

- Return Objectives

- Risk Tolerance

- Time Horizon

- Liquidity Requirements

- Unique Circumstances

- Portfolio Parameters

- Asset Allocation

- Benchmarks

- Selection and Retention

- Types of Securities

- Portfolio Rebalancing

- Risk Management

- Control Procedures

- Performance Objectives

- Client Services

- Communications

- Reporting

- Acknowledgement of IPS

I: Governance

Governance largely defines three elements: a) the purpose and scope of the IPS, b) the definition of duties for parties outlined in the IPS, and c) the investment philosophy. The purpose and scope often serves as a table of contents or summary of what the IPS will include and will also identify the specific assets governed by the IPS. The definition of duties identifies possible key stakeholders, those individuals or groups with fiduciary responsibilities, and may outline how they are accountable toward the assets governed by the IPS. Finally, the investment philosophy outlines the board’s preferences and expectations for the investment process, the investment advisors, and other general considerations.

Purpose and Scope – This section should clearly state the general goals and objectives of the organization and of the investment policy statement. Providing a clear understanding of the purpose of the funds can help the Investment Advisor to meet your organization’s investing objectives.

This section may further detail what assets are covered by the Investment Policy Statement, specifically, which assets should comply with the strategic asset allocation set forth within the document.

Definition of Duties – The definition of duties outlines the roles and responsibilities of boards and staff. Some of the more important responsibilities to identify individuals or groups accountable for include:

- Developing and executing investment policy

- Development and affirmation of capital market assumptions inputs

- Preparation and review of Investment performance & risk management reports

- Annual review and updates to IPS

- Selecting and removing consultants and investment advisors.

It is necessary for the IPS to enumerate clearly the responsibilities and expectations of all parties involved.

Some of the main parties and responsibilities may include:

1. Board of Directors/Trustees – This section lists what responsibilities come under the Board of Directors. Typically, such responsibilities include fiduciary responsibility for the investment portfolio and general responsibility for maintaining and reviewing the IPS for accuracy and relevancy. Ultimately, the Board is accountable to care for and protect the assets as established by the guidelines of the IPS.

2. Investment Committee – This section identifies the Investment Committee’s responsibilities, which typically include hiring and firing Consultants and/or Investment advisors, reviewing fund performance, providing oversight and coordination of assets while in the Investment advisor(s)’ care, and implementing the Investment Policy Statement in a timely and accurate manner. If there is no Investment Committee, these responsibilities fall to the Board of Directors.

3. Asset Management Firm – An asset management provider is responsible for guiding the Board of Directors and/or Investment Committee in all areas of investing that relate to the assets being managed. These include, but are not limited to, recommendations for and review of the Investment Policy Statement, asset allocation, ongoing investment manager selection (internal or external), portfolio review, and performance assessment. In addition, it is important to determine whether fiduciary responsibility is shared.

4. Investment Advisor – The investment advisor executes the IPS. The Investment Committee should specify exactly what the Investment Advisor is being hired to do in addition to the level of discretion and authority the Investment Advisor has over the portfolio. Whether tasked with maintaining a diversified portfolio or a implementing a single strategy, the Investment Advisor is responsible for investing within the confines of the IPS. In some cases, a Consultant may also serve as an Investment Advisor.

5. Custodian – The custodian is in charge of safeguarding specific financial assets. Toward this end, responsibilities might include, controlling access, settling trades efficiently, collecting investment income and principal, and/or collecting and disseminating investment portfolio performance.

Investment Philosophy – It is important to establish expectations at the onset of any endeavor. Without expectations, it is impossible to measure success or the attainment of goals. This section should outline the expectations of the board for both the parts and the whole of the investment assets, covering the process, expected behavior, and the definition of success. A few topics we recommend to discuss include:

- The need for and benefits of diversification across asset classes

- Expectations of active managers and passive managers

- How risk management is defined, executed, and reviewed

- The inclusion or exclusion of alternative investments

These expectations and beliefs may be specific to your organization. By defining them, your organization will be properly able to measure success.

II: Objectives and Constraints

An investor’s long-term strategic asset allocation (SAA) is the culmination of two work sets: a) capital market expectations, and b) objectives and constraints. An investment advisor may work with an investment strategist to produce the former, but the latter requires input from your organization.

When defining objectives and constraints, we recommend certain categories be addressed: statement of goals, return objective, risk tolerance, time horizon, liquidity requirements, and unique circumstances. In this part, we will address what we believe may be appropriate to consider when defining these factors.

Statement of Goals – For institutional investors, especially endowments and foundations, investment objectives are generally to provide a permanent asset base of funding specific activities or at a minimum meeting required spending rules. There is also a necessity to preserve real purchasing power and cover investment expenses.

Furthermore, the investment objectives should be sufficiently specific to be meaningful, but adequately flexible to be practicable. These objectives are designed to establish an attitude and philosophy that will guide the investment advisors toward the desired policies and performance.

Spending Rule – This section is applicable to investment programs that are intended to fund a distribution. We recommend that the Board and the Investment Committee adopt a spending rule, by defining the amount of Fund distributions, to instill discipline into the budgeting and financial management process. A spending rule will assist the Board and Investment Committee in determining the Fund’s required rate of return and risk tolerance objectives, which in turn may lead to less volatile distributions from year-to-year and improve the visibility of distributions. When it comes to determining the target distribution, there are generally three main spending rules to consider:

- Simple spending rule: Spending is equal to the specified spending rate multiplied by the beginning period market value.

- Rolling 3-year average spending rule: Spending is equal to the spending rate multiplied by an average of the three previous years’ market values. This method reduces the volatility of required distributions from year to year.

- Geometric spending rule: Spending in the current period is equal to a) Previous year’s distribution adjusted for inflation times a smoothing rate (used to further reduce volatility, i.e., 0.7); plus b) the beginning market value of the portfolio times the spending rate and the residual of the smoothing rate (i.e., 0.3 = 1 – 0.7).

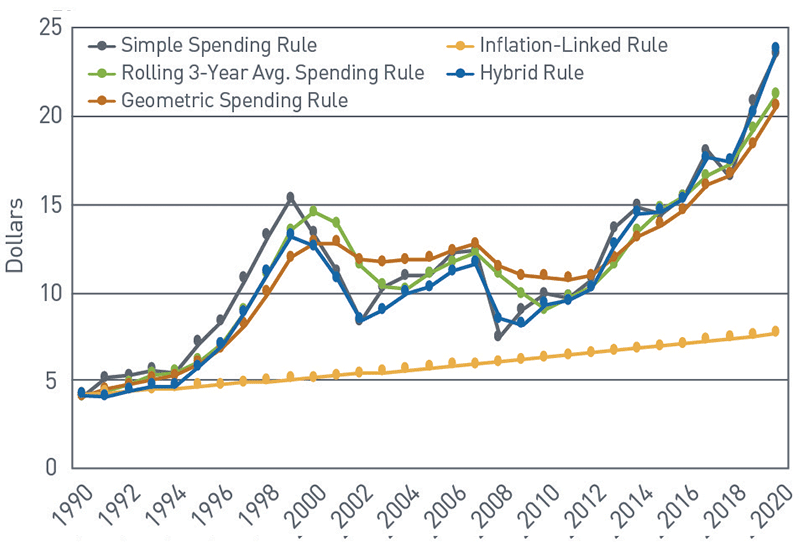

The charts below[1] are to illustrate how the rolling 3-year average and geometric average spending rules smooth out the payments from year to year. An important point is that in years of consecutive market declines, the annual spending of an institution may be higher than the simple spending rule because of the weight placed on higher portfolio values.

Chart 1: Portfolio Value – Millions of Dollars

Source: FactSet®. FactSet® is a registered trademark of FactSet Research Systems, Inc., and its affiliates. As of 12/31/20

View accessible version of this chart.

Chart 2: S&P 500® Annual Return

Source: FactSet®. As of 12/31/20

View accessible version of this chart.

Chart 3: Annual Spending – Millions of Dollars

Source: FactSet®. As of 12/31/20

View accessible version of this chart.

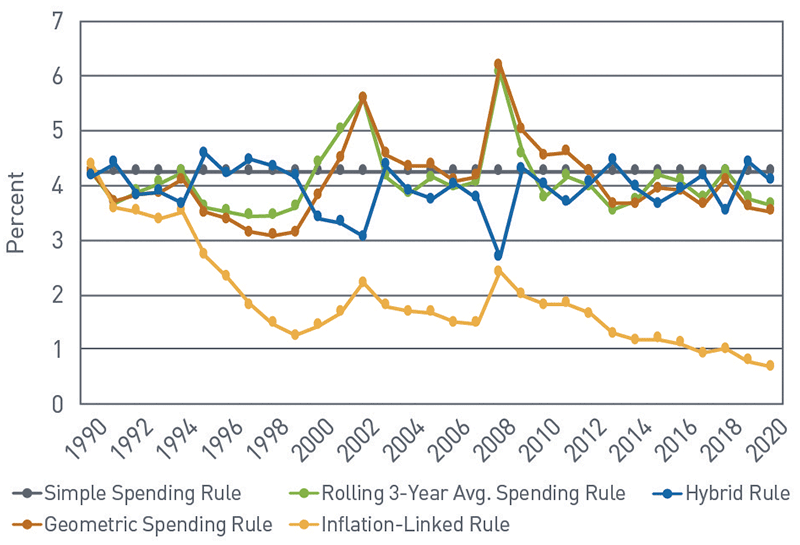

Chart 4: Spending as a Percentage of Beginning Portfolio Value

Source: FactSet®. As of 12/31/20

View accessible version of this chart.

There are pros and cons to all three methods.

The simple spending rule is easy to understand, but can lead to volatile distributions. The rolling 3-year average spending rule can reduce the volatility of distributions, but might lead to an outsized distribution in years where the market value has declined significantly. The geometric spending rule can be complicated to calculate, but reduces the volatility of distributions even further and, with a smoothing rule, can reduce the impact of a significant market decline on the annual distribution. The differences between these three rules is especially apparent in 2003 and 2009, on both the annual spending and spending as a percentage of beginning portfolio value (as seen in the charts above).

Return Objectives – The investment objective and return requirements should clearly define what the organization is hoping to accomplish over a full market cycle and/or multiple market cycles. It is also sometimes important for the spending policy to be considered when setting a return target. Precisely outlining the organization’s needs for growth and liquidity helps the investment advisor determine and execute a strategy to achieve the objective(s).

Chart 5: Illustration of Return Objective Calculation

Thus, for the example, the return objective would be [rounded to] 6.87%. By solving for the return objective this way, the organization will have an absolute benchmark for measuring the success of the investment program at meeting its distributions while preserving real purchasing power.

Risk Tolerance – Endowments and foundations can generally tolerate more risk relative to other institutions such as pension funds, insurance companies, and hospitals. This is because the investment management can focus solely on the assets of the endowment or foundation and the spending needs, while pension plans, insurance companies, and hospitals have liabilities that must be taken into consideration.

Unlike required return, which an organization can solve for quantitatively, evaluating risk tolerance is one area that may be difficult to assess. This difficulty is exacerbated by the need to aggregate the risk preferences of many board members.

A key principle of determining the risk tolerance for an organization involves assessing “willingness vs. ability.”

Even if every member of the board is willing to reach out as far as possible on the risk scale, the appropriate level of risk may not exceed the ability of the fund given a proper assessment of the funds constraints. With this in mind, the risk tolerance section should speak clearly to the acceptable level of risk in as granular a level of detail as necessary, while remaining within prudent levels of practicality.

An example of a risk tolerance statement is as follows:

“It is understood that an endowment or foundation must generally be more aggressive on the risk tolerance scale in order to meet return requirements; however, the Investment Advisor(s) are expected to seek to minimize risk against the return objective.”

Time Horizon – Your organization should state in this document whether or not the time horizon is perpetual. A perpetual time horizon that provides a permanent source of funding is likely to be the case for most endowments and foundations. This indefinite time horizon is one of the reasons risk tolerance can be higher for endowments and foundations than for institutions that are more liability centric.

Liquidity Requirements – With endowments and foundations, liquidity requirements are normally low, but will ultimately vary by institution. Generally, the risk tolerance of a portfolio decreases as the uncertainty around spending and liquidity requirements increase.

Unique Circumstances – In this section, an organization can list any special objectives, constraints, rules around abnormal distributions (i.e., for emergency purposes), or any other policies that could affect the investment program. An example of this is socially responsible investing (SRI): here the organization would list any preferences, such as following the US Conference of Catholic Bishops (USCCB), they expect the investment advisor and/or investment manager(s) to follow. This section can also include whether or not the investment program is allowed to invest in alternative assets, in addition to any policies around the approval process (i.e., if the board needs to approve each alternative investment).

III: Portfolio Parameters

This section of the Investment Policy Statement (IPS) should lay out the investment process: the strategic asset allocation and benchmarks, rules for manager selection and retention, the types of securities allowed, and rules for portfolio rebalancing.

Asset Allocation and Benchmarks – We recommend that the target asset allocation reflect both the organization’s long-term strategic view and the stated goals for the designated funds. How specific the asset allocation guidelines are will vary by organization. Some organizations may prefer broad parameters, setting targets for equities, fixed income and cash. Other organizations may be more precise, segmenting the major asset classes into smaller categories such as large cap, mid cap, and small cap equity. This section of the IPS may also set restrictions on how much or how little an investment advisor may deviate from the allocation target for a given asset class or category; with that said, restrictions should be considered carefully given that there are potential benefits to allowing investment advisors to tactically allocate assets on the basis of prevailing market opportunities and conditions. While narrow ranges may overly restrict asset managers, too much latitude may allow asset allocation to deviate from the overall investment objective.

We also recommend using this section to establish the benchmarks for measuring the relative performance of each asset and sub-asset class. Further, we recommend establishing an absolute benchmark, or hurdle rate, which serves as a measure of success in meeting the overall goals of the investment program. Investment returns below the absolute benchmark would imply the program is failing to meet its objective, above this number would imply that it is meeting its objective.

Selection and Retention Criteria — Managers should be given discretion to manage the funds entrusted in accordance with the style for which they are employed, provided that they comply with the restrictions and limitations set forth in the IPS. Important criteria for selection may include:

- the investment style and discipline of the proposed manager;

- past performance, considered relative to other benchmarks and other strategies having the same investment objective;

- historical volatility and down-side risk management;

- the size of the organization as measured by the amount of assets under management with respect to the investment style under consideration;

- length of the manager’s track record; and the experience of the organization as measured by the tenure of the professionals with respect to the investment style under consideration.

Types of Securities – While risk and volatility are present with all types of investments, it should be stated that high levels of relative risk are to be avoided in every asset class. Diversification by asset class, sector, industry and issuer limits, maturity limits and, to the extent possible, management style can be used to reduce risk. We recommend that this section also clearly outline investments that are prohibited, as well as any other restrictions such as types of securities, weighting limits, quality standards, or liquidity requirements. Further, if mutual funds are utilized, their investment objectives should be consistent with the investment guidelines set forth in the IPS.

Exclusions and limitations can help reduce risk, but they also reduce the investment opportunities available to managers.

With that said, a list of prohibited investments can proactively prevent the inclusion of security types that the board/investment committee is not familiar with and/or does not desire, as an example for Socially Responsible Investing purposes, to include in the portfolio.

Portfolio Rebalancing – The purpose of rebalancing is to maintain the asset allocation within the ranges set around the strategic baseline. This section may specify how often the portfolio is rebalanced, in addition to how much discretion the investment advisor(s) have in managing asset class weight drift from the targets established in the strategic asset allocation. We recommend outlining the procedure that the investment advisor should follow for remedying weight drift outside of the ranges.

In certain circumstances it may make sense for the weights to remain outside of the targeted ranges for a period of time. In these cases, the IPS should provide a procedure by which the Board/ Committee would approve these temporary deviations from the policy.

IV: Risk Management

This part may cover both the operating and investment risks of the investment program. We recommend that the control procedures section discuss the schedule of reviewing the portfolio for both performance and compliance.

Performance objectives should define how “success” for the investment program will be measured.

Control Procedures – In this section, the Investment Committee may reiterate its performance expectations in addition to establishing a schedule to review the portfolio and performance with the investment advisor(s). This section can also make clear what performance periods are important to the organization: while performance may be best measured over full market cycles, as it may more accurately reflect progress toward the organization’s stated goals, analysis of shorter time periods may help explain the impact that certain investments are having on the portfolio.

Furthermore, it is important to herein state the focus of the reviews, including topics such as: investment advisor(s)’ adherence to the policy guidelines; comparison of results to the benchmark(s); material changes in the Investment Advisor(s)’ organizations, such as philosophical or personnel changes. Along the same lines, it may be stated here the circumstances for which termination of an investment advisor will be considered, such as: deviation from the IPS guidelines; deviation [substantially] from investment disciplines and process; or when the client’s representatives have any material problem or concern regarding the investment advisor(s).

Performance Objectives – The fund’s investment performance should be reviewed regularly, such as on an annual basis; however, the emphasis with regard to performance should be focused on results achieved over a full market cycle (typically a three-to-five year period). Furthermore, overall policy and investment objectives should be reviewed on at least an annual basis and adjusted, if necessary, after consultation with the appropriate parties.

We recommend that advisor and manager performance be measured against policy objectives and for consistency with the total return objectives, evaluated on a net-of-fees basis. With regard to benchmarking, the overall portfolio should be measured against an appropriate, often blended, index that measures both the return and risk profile of the portfolio. This blend should be based on the strategic allocation, incorporating the target levels of equity, fixed income, and/or alternative assets comprising the portfolio.

V: Client Service

This section may include what your organization expects from the investment advisor(s) and/ or consultant with respect to communications and reporting. This section may also address the frequency of in-person meetings and the method(s) of communication. Clearly establishing these expectations at the onset can help a board to better manage the investment program and lead to better interactions between the organization and those assigned to manage the organization’s assets.

Communications – As earlier discussed, it is important that the investment advisor(s) provide performance evaluations on a regular basis. This section may require that the managers provide regular accounting of transactions, portfolio holdings, yields, current market values, summary of cash flows, and calculations of the portfolio’s total rate of return.

It is additionally important that a reasonable, baseline frequency of communication be established, such as on the basis of “as market conditions and the portfolio warrant,” to ensure full transparency. Along these lines, it may be stated that significant changes within the investment advisor(s)’ operations or personnel, and the anticipated impact on the portfolio(s), should be brought to the attention of the committee.

Reporting – Setting out the expectations for reporting can facilitate transparency and access between the client, investment advisor(s), and all other relevant parties. With this in mind, a schedule for reports containing portfolio activity and asset holdings, in addition to tactical and strategic updates, may be established at the onset of the relationship. The language may also further specify that the investment advisor(s) are responsible for frequent and open communication with regard to all significant matters pertaining to the investment of assets.

With regard to the schedule of reporting and account reviews, it is important that the schedule is framed around reasonable and appropriate timing. End of quarter and end of year reports take time to produce: reviews and reports scheduled soon after a period’s end will necessarily lack some of the details and clarity that reports scheduled later on can provide. We recommend balancing the need for urgency with the level of detail desired, accounting for the fact the two are sometimes mutually exclusive.

VI: Acknowledgment

The last part of the IPS should document the organization’s recognition of the importance of following the guidelines, rules, and best practices incorporated within the document. A sample acknowledgment would be as follows:

We, the undersigned, recognize the importance of adhering to the mission and strategies detailed in this policy and agree to work to fulfill the objectives stated herein, within the guidelines and restrictions, to the best of our ability.

Thus the acknowledgment signifies all parties as having read the investment policy statement and states the mutual intention to follow both the letter and the spirit of the document.

Conclusion

In summary, the points to address include naming those with fiduciary responsibilities, documenting objectives and constraints, outlining a strategic asset allocation, defining how success is measured, and setting standards and a schedule around performance reviews.

Every IPS should address the preceding points in some detail.

When addressing each point, the organization should be certain to set forth not only “what,” but also “why.” Once a draft of the statement is complete, the entire document should be carefully reviewed to identify and resolve inconsistencies. When all points are consistent and the organization’s leadership is in agreement, they should adopt the final document. Thus, the IPS may serve as the blueprint for institutional investment programs. In addition, it may serve as a foundation for the organization’s overall governance structure and ensure that all fiduciaries are fulfilling their responsibilities and obligations. At PNC, we believe that a document created with such a level of care will result in an investment experience that is fully integrated and aligned with the needs and objectives of the overall organization, thus increasing the likelihood and probability of success over the long term.

Accessible Version of Charts

Chart 1: Portfolio Value – Millions of Dollars

| SIMPLE | ROLLING 3-YEAR AVG. | GEOMETRIC | INFLATION LINKED | HYBRID | |

| 12/31/1990 | 100 | 100 | 100 | 100 | 100 |

| 12/31/1992 | 115.9 | 116.59 | 116.56 | 116.54 | 116.89 |

| 12/31/1994 | 125.88 | 127.38 | 127.68 | 128.68 | 128.83 |

| 12/31/1996 | 160.87 | 163.9 | 164.71 | 168.35 | 167.33 |

| 12/31/1998 | 241.86 | 250.37 | 252.77 | 264.8 | 256.09 |

| 12/31/2000 | 345.09 | 362.68 | 369.27 | 401.02 | 371.82 |

| 12/31/2002 | 253.4 | 263.71 | 271.63 | 311.33 | 275.84 |

| 12/31/2004 | 232.88 | 239.16 | 245.32 | 299.65 | 256.62 |

| 12/31/2006 | 248.37 | 256.43 | 261.02 | 336.98 | 277.71 |

| 12/31/2008 | 278.16 | 288.58 | 293.06 | 399.54 | 315.73 |

| 12/31/2010 | 203.19 | 206.07 | 208.06 | 304.47 | 232.63 |

| 12/31/2012 | 218.87 | 223.21 | 222.6 | 344.84 | 254.28 |

| 12/31/2014 | 308.16 | 317.49 | 315.33 | 514.18 | 364.24 |

| 12/31/2016 | 325.65 | 337.55 | 336.29 | 578.75 | 390.5 |

| 12/31/2018 | 407.24 | 425 | 424.71 | 773.52 | 496.29 |

| 12/31/2020 | 469.39 | 492.22 | 493.58 | 955.2 | 580.73 |

Chart 2: S&P 500 Annual Return

| 12/31/1990 | -3% |

| 12/31/1992 | 8% |

| 12/31/1994 | 1% |

| 12/31/1996 | 23% |

| 12/31/1998 | 29% |

| 12/31/2000 | -9% |

| 12/31/2002 | -22% |

| 12/31/2004 | 11% |

| 12/31/2006 | 16% |

| 12/31/2008 | -37% |

| 12/31/2010 | 15% |

| 12/31/2012 | 16% |

| 12/31/2014 | 14% |

| 12/31/2016 | 12% |

| 12/31/2018 | -4% |

| 12/31/2020 | 18% |

Chart 3: Annual Spending – Millions of Dollars

| SIMPLE | ROLLING 3-YEAR AVG. | GEOMETRIC | INFLATION LINKED | HYBRID | |

| 12/31/1990 | 4.12 | 4.12 | 4.12 | 4.25 | 4.17 |

| 12/31/1992 | 5.3 | 4.87 | 4.8 | 4.42 | 4.47 |

| 12/31/1994 | 5.42 | 5.49 | 5.31 | 4.6 | 4.72 |

| 12/31/1996 | 8.41 | 7.09 | 6.84 | 4.79 | 7.05 |

| 12/31/1998 | 13.22 | 11.09 | 10.01 | 4.98 | 11.15 |

| 12/31/2000 | 13.33 | 14.56 | 12.85 | 5.18 | 12.62 |

| 12/31/2002 | 8.39 | 11.51 | 11.84 | 5.39 | 8.46 |

| 12/31/2004 | 10.97 | 10.2 | 11.84 | 5.61 | 10.02 |

| 12/31/2006 | 12.22 | 11.75 | 12.38 | 5.83 | 11.2 |

| 12/31/2008 | 7.45 | 11.04 | 11.45 | 6.07 | 8.48 |

| 12/31/2010 | 9.94 | 8.99 | 10.88 | 6.32 | 9.33 |

| 12/31/2012 | 10.79 | 10.33 | 10.96 | 6.57 | 10.27 |

| 12/31/2014 | 14.89 | 13.44 | 13.14 | 6.84 | 14.48 |

| 12/31/2016 | 15.5 | 15.46 | 14.69 | 7.11 | 15.36 |

| 12/31/2018 | 16.55 | 17.37 | 16.68 | 7.4 | 17.45 |

| 12/31/2020 | 23.62 | 21.26 | 20.61 | 7.7 | 23.79 |

Chart 4: Spending as a Percentage of Beginning Portfolio Value

| SIMPLE | ROLLING 3-YEAR AVG. | GEOMETRIC | INFLATION LINKED | HYBRID | |

| 12/31/1990 | 4.30% | 4.30% | 4.30% | 4.40% | 4.20% |

| 12/31/1992 | 4.30% | 3.90% | 3.80% | 3.50% | 3.80% |

| 12/31/1994 | 4.30% | 4.30% | 4.10% | 3.50% | 3.70% |

| 12/31/1996 | 4.30% | 3.50% | 3.40% | 2.30% | 4.20% |

| 12/31/1998 | 4.30% | 3.40% | 3.10% | 1.50% | 4.40% |

| 12/31/2000 | 4.30% | 4.40% | 3.80% | 1.40% | 3.40% |

| 12/31/2002 | 4.30% | 5.60% | 5.60% | 2.20% | 3.10% |

| 12/31/2004 | 4.30% | 3.80% | 4.40% | 1.70% | 3.90% |

| 12/31/2006 | 4.30% | 4.00% | 4.10% | 1.50% | 4.00% |

| 12/31/2008 | 4.30% | 6.10% | 6.20% | 2.40% | 2.70% |

| 12/31/2010 | 4.30% | 3.80% | 4.50% | 1.80% | 4.00% |

| 12/31/2012 | 4.30% | 4.00% | 4.20% | 1.60% | 4.00% |

| 12/31/2014 | 4.30% | 3.70% | 3.70% | 1.20% | 4.00% |

| 12/31/2016 | 4.30% | 4.10% | 3.90% | 1.10% | 3.90% |

| 12/31/2018 | 4.30% | 4.30% | 4.10% | 1.00% | 3.50% |

| 12/31/2020 | 4.30% | 3.60% | 3.50% | 0.70% | 4.10% |

Chart 5: Illustration of Return Objective Calculation

| Spending Policy | 4.25% of Market Value – 1.0425 |

| Inflation | 2% over the Long Term – 1.0200 |

| Fees | 0.50% of Market Value – 1.0050 |

| Return Objective | [(1.0425)*(1.02)*(1.005)] -1 = 6.87% |