Fulfilling your mission, keeping risk in check, maintaining healthy financials, and using your assets to help achieve these outcomes—is completing all these tasks possible against a backdrop of change, uncertainty, and volatility? In our view, the answer is yes, with an analytical and enterprise approach. We increasingly see institutional investors implement a financial modeling analytical framework for managing their assets and liabilities en route to achieving their organizations’ objectives. In this paper, we discuss this trend and its potential benefits.

A Challenging Landscape

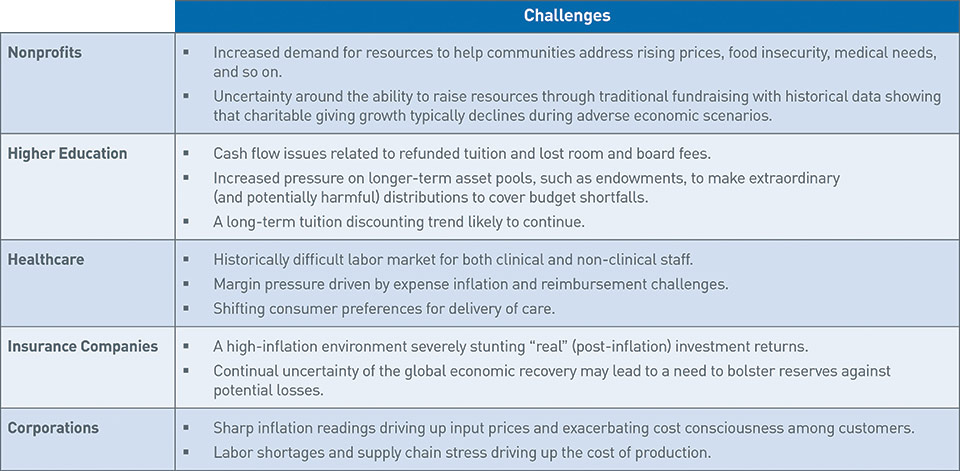

Institutional investors are facing numerous and unique challenges, including the return of inflation, a rising interest rate environment, and supply chain and labor market stressors, all of which introduce uncertainty regarding the economic recovery. While some of these challenges might be novel, the presence of unforeseen hurdles is not. In the table below, we attempt to summarize specific challenges facing institutions today.

View accessible version of this chart.

We see institutions shift to a more holistic, enterprise-focused investment management model in response. Specifically, we see this occurring in two ways:

- Analyzing the role of balance sheet investment assets in contributing to their financial wellbeing.

- Using the relationship between investment assets and financial results to help determine the best asset allocation for addressing liquidity and cash flow concerns.

Together, these two strategies form what we call a financial modeling investment framework. In this framework the institution’s enterprise goals serve as a key component of the investment strategy for the asset pool(s).

Enterprise Financial Modeling Framework

While there is no single formula that will work for all institutions, most financial modeling investment frameworks are based around four key steps:

View accessible version of this chart.

While the implementation of these four steps can vary, the objective is to attempt to determine how investment assets impact key financial metrics and overall financial wellbeing. This type of analysis can range from an organization reviewing the impact of its pension on its cash flows to a university determining appropriate liquidity to avoid inopportune asset sales. A financial modeling framework can link both sides of the balance sheet, such as a healthcare system that seeks to terminate its pension using either a borrow-to-fund approach or funds from long-term operating assets. The optimal endowment asset allocation for a charitable foundation that needs to disburse resources while facing fundraising challenges and uncertain prospects for financial asset returns is another example. Finally, an insurance company seeking an improved carrier rating might leverage a financial modeling approach to improve its liquidity and capital adequacy ratios.

Based on the nature of this analysis, a financial modeling investment framework that is flexible and tailored specifically to a given institution will tend to outperform one that is rigid or “one-size-fits-all,” in our opinion. Additionally, organizations need not devise and administer such a framework on their own. Working with financial services firms with experience helping like institutions, deep analytical capabilities, and an understanding of both sides of the balance sheet can provide a path to successful execution.

Conclusion

As is the case with any period of uncertainty or instability, institutional investors will need to continue to implement tactical and strategic plans for managing their finances. Institutions must balance maintaining solvency in the present with being financially viable in the future. Implementing a financial modeling investment framework can aid with navigating these challenges.

Accessible Version of Charts

Chart 1

| Challenges | |

Nonprofits |

|

Higher Education |

|

Healthcare |

|

Insurance Companies |

|

Corporations |

|

Chart 2

Step 1. Organizational Goals & Projections: Establish organization’s financial goals and review financial projections

Step 2. Enterprise Financial Analysis: Measure and calibrate relationship between changes in investment strategy and impact to key financial metrics

Step 3. Customized Investment Strategy: Create custom asset allocation for each pool that maximizes probability of achieving organizational objectives within risk constraints

Step 4. Implementation & Oversight: Implement, monitor performance and key financial metrics, and update strategy as needed

Let's Talk

Our solutions can be tailored to meet your unique needs