The average pension plan sponsor entered 2026 with funding levels at or near record highs, continuing the positive momentum seen in recent years. With both asset levels and interest rates shifting over recent periods, sponsors could face new opportunities when considering investment strategy, pension risk transfers and contribution policy. Below are the key considerations for 2026, reflecting the latest market and regulatory trends.

Investment Strategy

Considerations for return driven plans:

With funded ratios trending upward, many pension plans have reached the end of their de-risking glidepaths, increasing focus on hedge ratios and interest rate uncertainty. The modest pullback in discount rates during 2025 underscores the need for proactive risk management. Return-driven plans that have not fully implemented their derisking strategies remain exposed to interest rate volatility and market downturns. To help lock in recent funded status improvements, sponsors should consider right-sizing liability hedge allocations and/or adopting customized fixed income solutions to tighten hedging strategies before conditions shift.

Considerations for overfunded plans:

Overfunded plans have generally de-risked their investment portfolios, and frozen plans in particular have prepared for termination or hibernation. Given the relatively rapid shift in the environment, plan sponsors are encouraged to maintain investment flexibility—for example, by reducing exposure to illiquid assets—and to align strategies with potential regulatory changes or strategic opportunities.

In July 2025, proposed legislation—the Strengthening Benefit Plans Act of 20251 introduced provisions that could allow plan sponsors to utilize surplus while plans remain ongoing. One key provision would permit overfunded pension plans to transfer a portion of their surplus to help fund certain benefits in defined contribution plans, provided specific conditions are met. Although this legislation is still in early stages, sponsors should consider strategies that preserve investment flexibility and position the plan for targeted surplus growth to capitalize on opportunities if the legislation passes.

Pension Risk Transfers

The annuity buyout market remains active, though 2025 and is unlikely to surpass 2024’s record results. According to LIMRA, pension risk transfers totaled $21.6 billion through the third quarter of 2025, down 48% year over year2—largely due to a quieter jumbo market, while smaller contracts remain strong.

Rising PBGC premiums continue to drive activity, having more than doubled over the past decade. In 2026, premiums reach their highest levels: $111 per participant and 5.2% of unfunded liability, subject to a cap.

Future pension risk transfer activity is hard to predict, but regulatory changes may shift the landscape. Lawsuit activity persisted in 2025 but does not appear to be a major factor in reduced buyouts. Proposed legislation allowing pension surplus transfers to defined contribution plans could encourage sponsors to keep defined benefit plans ongoing, as termination was historically required to access surplus. Another consideration is participants’ growing desire for lifetime income options, which defined benefit plans inherently provide. Finally, in 2025, legislation was introduced permitting U.S. sponsors to use captive insurers to reinsure pension liabilities3—a niche solution, but one that signals innovation and new options beyond traditional plan termination.

Contributions

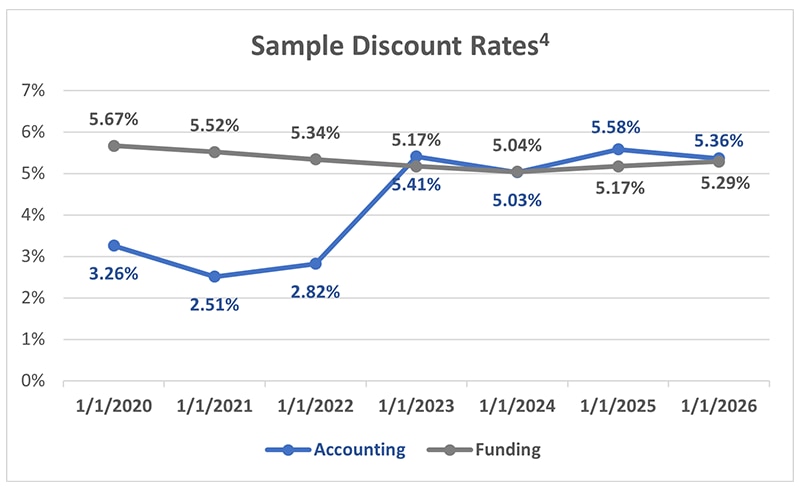

In the last few years, as market interest rates have increased and remained elevated, the impact of funding relief allowing smoothing interest rates on liabilities for contribution calculations has diminished. As shown in the chart below where accounting discount rates are marked-to-market and generally used to measure balance sheet liabilities, the funding interest rates used for contributions are now expected to continue to be lower than or near market rates. Depending on asset levels, this could mean lower funded levels on a contribution basis than the marked-to-market funded levels used for accounting purposes. Some plan sponsors started to see this impact contribution requirements starting in 2024 and 2025. Those that have may begin to see smaller quarterly installment payments rather than a single annual contribution.

View accessible version of this chart.

Considerations for underfunded pension plans:

Lastly, glidepath strategies—which determine the allocation between return-seeking and liability-hedging assets—should be actively managed. Once a glidepath is established, it is considered best practice to monitor trigger points daily, enabling plans to respond quickly to favorable market shifts before conditions change. Relying on monthly or quarterly reviews can result in missed opportunities and increased volatility in plan financials, including the balance sheet and contribution requirements. Timely execution of de-risking moves enhances alignment with funding objectives and improves the overall effectiveness of the glidepath strategy.

Sources

1 Strengthening Benefit Plans Act of 2025

2 LIMRA: U.S. Pension Risk Transfer Buy-in Sales Triple

3 Exemption From Certain Prohibited Transaction Restrictions

Accessible Version of Chart

Chart 1: Sample Discount Rates4

| 1/1/2020 | 1/1/2021 | 1/1/2022 | 1/1/2023 | 1/1/2024 | 1/1/2025 | 1/1/2026 | |

| Accounting | 3.26% | 2.51% | 2.82% | 5.41% | 5.03% | 5.58% | 5.36% |

| Funding | 5.67% | 5.52% | 5.34% | 5.17% | 5.04% | 5.17% | 5.29% |