The conventional view in the nonprofit sector has been that an organization manages its investment portfolio to optimize risk-adjusted financial returns for the purpose of maximizing spending to fulfill its mission. It’s an example of two-pocket thinking: investment returns go in one pocket, and then a portion of that goes into the other pocket for philanthropic purposes.

In this view, the two pockets — income and spending — remain separate and distinct. But for many nonprofit organizations, income not only includes investment returns but also charitable donations. Success is defined by more than just financial gains in the capital markets; it’s really measured by the extent a nonprofit achieves its mission. So when it comes to raising and investing capital for programs and services toward its mission, how an organization pursues its goals also matters.

Increasingly, donors are calling for greater transparency on how and where their money is invested, regardless whether their contributions are included in the broader investment pool (i.e., the organization’s endowment) or as part of a planned giving program. Responsible investing can help address donors’ priorities by integrating their values or an organization’s mission into how their planned giving portfolios are invested. This approach to investing seeks to generate social and environmental outcomes alongside financial returns.

Responsible Investing: An Overview

At PNC, we view responsible investing (RI) as a goals-based investment strategy that aligns your portfolio with investors’ goals, intentions, values or missions. Generally, investors look to:

- avoid harm by excluding or restricting certain exposures in a portfolio because they conflict with their values or mission;

- benefit stakeholders by proactively supporting values or causes by assessing and engaging on environmental, social and governance (ESG) factors; and/or

- contribute to solutions by defining a specific, targeted impact objective and allocating capital toward tackling a social or environmental challenge.

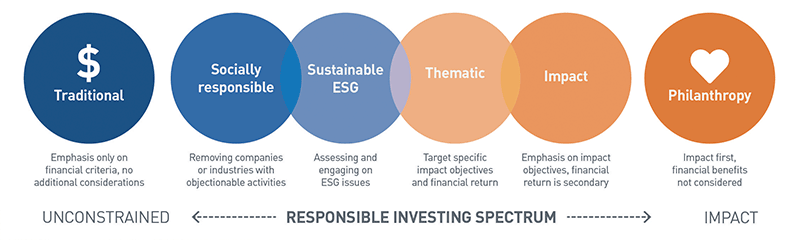

There’s really no one-size-fits-all approach to implementing RI in portfolios. At PNC, we design customized investment solutions tailored to our clients’ unique needs and objectives. The diagram below (Figure 1) illustrates a fresh take on how nonprofits can expand the toolkit for achieving their mission — moving beyond the binary options of “traditional” investing, which has no considerations for mission, and philanthropy, which has no expectation of financial return.

Figure 1: Responsible Investing Spectrum

View accessible version of this chart.

An investment decision divorced from the organization’s mission may actually detract from its pursuit, possibly exacerbating the very problems the organization is trying to solve. With an expanded framework from which to build, nonprofits can move beyond two-pocket thinking by integrating RI in their investment programs and making it a part of their planned giving fundraising initiatives.

The Intersection of Planned Giving and RI

When a nonprofit can demonstrate its commitment to RI, it might find donors amenable to giving when they otherwise wouldn’t have. By providing RI options for donors, nonprofits can highlight how philanthropic dollars are put to work, using all tools at their disposal toward achieving their mission. Below are some examples of mission-related causes nonprofits can implement through an RI lens (Figure 2).

Figure 2: Mission-related Causes to Implement Through RI Lens

Source: PNC

Source: PNC

View accessible version of this chart.

A prospective alumni donor passionate about combatting climate change might refuse to give money to their alma mater until the university divests from fossil fuels. We recognize it might not make sense for the school to make this investment decision. RI, either as part of the endowment investment program or in the university’s planned giving program, could be a way to engage such a donor. Highlight the ways the donor could avoid harm, benefit stakeholders and contribute to climate change solutions. For example, the donor’s gift could be added to a sustainable food and agriculture thematic fund in the endowment. Because planned giving strategies vary in form, there might be special implications for implementing an RI lens. Before diving in, let’s revisit common types of planned giving vehicles:

- Charitable gift annuity: A contract between the donor and the charitable organization in which the donor gifts the charity cash or assets in exchange for a lifetime annuity.

- Charitable remainder trust: An irrevocable charitable trust that provides an income stream to the donor, spouse or family for a period of time. The trust remainder distributes to the charitable organization. Contributions to the trust could be eligible for an income tax deduction.

- Donor advised fund: Donor creates an account with a sponsoring public charitable organization and makes irrevocable contributions of cash or other assets. Donors retain advisory rights on future grants. These contributions could be eligible for income tax deduction.

- Pooled income fund: A charitable trust managed by the charitable organization in which the donor contributes assets to a pooled fund. In return, the donor or beneficiary receives a proportionate share of the pooled fund’s income during their life. Donors could receive an immediate partial income tax deduction.

For Charitable Gift Annuities (CGA) or Charitable Remainder Trusts, there might be unique considerations for implementing responsible investing, depending on the asset allocation. For instance, does the policy require a 70/30 equity-fixed income split, or should it be more conservative, with 40% equity and 60% fixed income? The asset allocation could affect the types of RI strategies available during portfolio construction. For instance, one could easily screen out specific securities with the use of separately managed accounts. State regulation may also dictate asset allocation thresholds. In California, where even some fixed income instruments are classified as equities, there is a 50% maximum on equities for gift annuity that could potentially preclude investing in something like a green bond fund.

Liquidity needs will also likely influence what types of RI strategies can be used in a portfolio. As a rule of thumb, planned giving portfolios tend to avoid investing in securities without daily liquidity. As an example, illiquid impact investments in private markets, which tend to have long time horizons and/or lockup periods where assets are unable to be withdrawn without penalty, could be off limits.

Donor-advised funds (DAFs) have fewer unique considerations relative to CGAs and there are no state regulations. DAFs offer more flexibility regarding asset allocation and investment options. PNC’s DAF RI portfolios are available in the same asset allocation mixes available with traditional investing options, are constructed with the same process and have many similar market exposures. However, they specifically target investment managers who actively consider ESG factors in their investment and stock selection process.

Rubber Meets the Road

Returning to the idea of a prospective donor focused on a specific cause (e.g., climate change and divesting from fossil fuels), there are two key considerations to balance.

- Provide RI options that appeal to a given organization’s donor base.

- You can’t please everyone, and trying to do so usually leads to administrative inefficiencies.

With this in mind, especially in the context of traditional planned giving vehicles and DAFs, it isn’t feasible to offer 100 different investment pool options. However, if an RI category aligns with your mission, founding principles or organizational values, providing it as an investment option can broaden your appeal to donors. In our experience, it’s better to let donors choose between either traditional investment pools or RI pools. Done right, we’ve found that this can help increase donor engagement.

For more information contact Christopher McGurn, Director of Planned Giving Solutions, at christopher.mcgurn@pnc.com or to your PNC Representative.

Accessible Version of Charts

Figure 1: Responsible Investing Spectrum

This figure illustrates the spectrum of responsible investing from traditional investing to philanthropy. Traditional investing relies only on financial criteria without additional considerations. Next, socially responsible investing removes companies or industries with objectionable activities. Then, sustainable ESG investing proactively supports causes by assessing and engaging on ESG factors. Moving closer to the philanthropy end of the spectrum, thematic investing targets specific impact objectives and financial returns. Next, impact investing emphasis impact objectives while financial returns are of secondary importance. Lastly, philanthropy is considered impact first and financial benefits are not considered.

Figure 2: Mission-related Causes to Implement Through RI Lens

This figure provides examples of mission-related causes that nonprofits can implement through an RI lens. Socially responsible investing screens companies with objectional activities such as: tobacco, alcohol, gambling, weapons, pornography, and fossil fuels. Sustainable ESG investing actively engages on issues relating to: CO2 emissions, data privacy, waste reduction, product safety, diversity and inclusion, and executive compensation. Lastly, thematic investing would involve investments that provide solutions for impact objectives such as: climate change, education, healthcare, agriculture, food and nutrition, and financial inclusion.