The numbers don’t lie when it comes to Nevada’s status as one of the nation’s fastest growing states. In fact, since 2010, the Silver State’s population has increased by nearly 20%. Unsurprisingly, growth in construction and new businesses have surged alongside the population expansion.

To get the job done, those companies need the right equipment, and often, that means securing financing. According to Allied Market Research, a U.S.-based marketing research firm, every year businesses from the largest to the smallest finance more than $1 trillion worth of equipment.

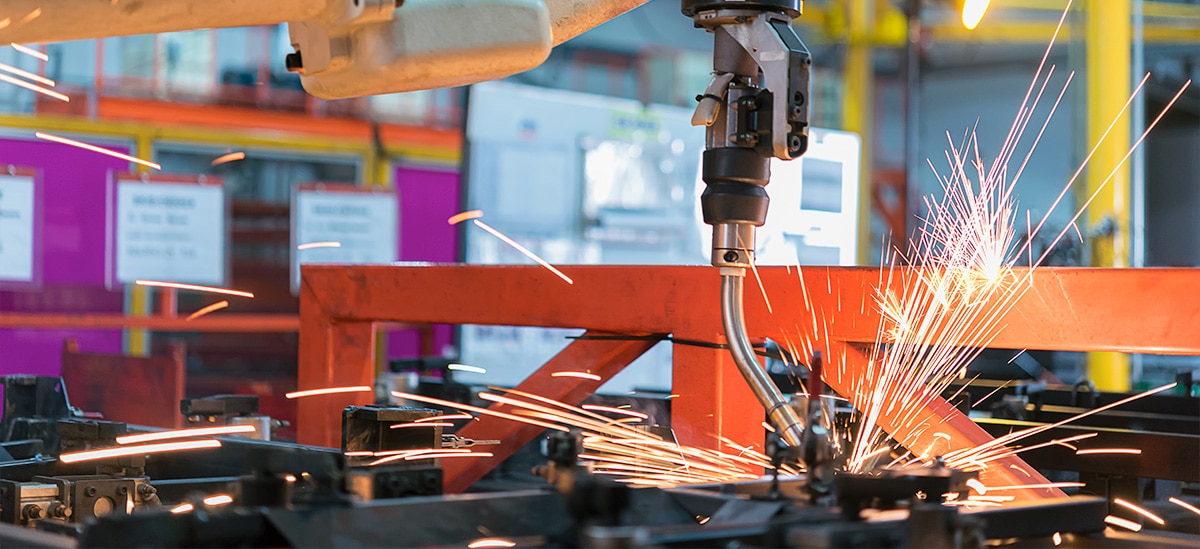

PNC Equipment Finance, the fourth largest bank-owned equipment finance lender in the U.S., has set itself apart from the more than 4,000 equipment finance lenders in the marketplace thanks to its robust capabilities, specializing in manufacturing, production, transportation, healthcare, IT equipment and more.

PNC has more than three decades of experience in equipment finance, and we leverage it to provide the right solutions to our clients.

— Denette Suddeth, PNC Bank regional president for Nevada

“PNC has more than three decades of experience in equipment finance, and we leverage it to provide the right solutions to our clients,” said Denette Suddeth, PNC Bank regional president for Nevada. “We partner with customers as a strategic advisor by providing the right solution, at the right time to help them grow and thrive.”

Suddeth said that technological advances in productivity coupled with regulatory compliance has led to commercial equipment needs rapidly evolving. Having an experienced partner such as PNC, that not only understands financing, but also has the asset-level expertise to analyze the best possible solutions in the face of a rapidly changing industry, is critical.

“Recent trends have pushed the industry toward sustainability and environmental initiatives,” said Suddeth. “Equipment finance lenders, who are proactively building financial solutions with renewable energy sources and artificial intelligence in mind, are best poised to win over the next decade and beyond.”

PNC has operated in Nevada since 2021, offering national bank services like equipment financing, with a localized approach and delivery. PNC’s Equipment Finance team focuses on designing the right solutions for clients, based on their needs, and leveraging an array of lending products.

Ready to Help

PNC Equipment Finance provides comprehensive equipment financing that is designed around the customer's equipment, cash flow, tax, financial statement and end-of-term needs. Learn more about PNC Equipment Finance’s capabilities by visiting pnc.com/ef