PNC has successfully implemented its FX Multilateral Netting solution with numerous companies across the pharmaceutical and life sciences industry (“PLS”), including pharmaceutical, medical device, CROs, diagnostics & tools, and instrumentation, to help simplify and streamline their cross-border settlements and payments

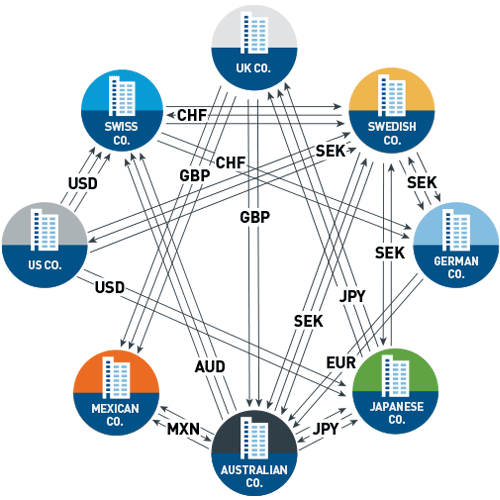

PLS companies often have (i) operations in multiple countries, (ii) complex global manufacturing and supply chains, (iii) and a geographic mismatch of expenses and revenues cash receipts. These factors often result in a complex web of intercompany transactions and payments.

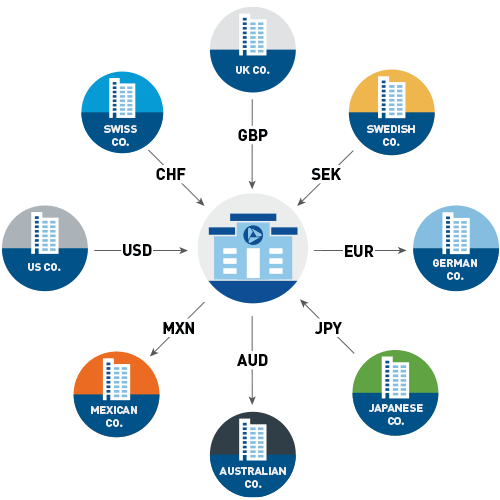

| Without Netting | PNC FX Multilateral Netting |

|

|

View accessible version of this charts.

FX multilateral netting is a financial strategy that focuses on reducing the volume of cross-border transactions. By streamlining global payment processes and reducing financial risk, multilateral netting offers benefits that can enhance operational efficiency, improve financial management and increase transparency. Here's a closer look at how Pharma & Life Sciences companies can benefit from this approach.

Improved Cash Flow

PLS companies often engage in transactions across multiple countries, leading to complex cash flows. Multilateral netting allows companies to consolidate and net these transactions, enabling them to pay or receive the net amount rather than tracking numerous individual payments. This consolidation improves cash flow management by helping reduce the time and resources spent on multiple transactions and freeing up capital for other uses. On average, companies that leverage PNC’s netting technology reduce their total number of intercompany transactions by 74%1.

Funding of Operating Entities

PLS companies often struggle with the funding of operating and testing entities. The requests for funding tend to be communicated and tracked in a haphazard fashion. By putting a structure around intercompany funding and thoroughly tracking the payments, PLS companies can ensure timely funding, more effective use of cash, and adhere to stringent industry reporting standards.

Reduced Foreign Exchange Risk

Operating globally means dealing with multiple currencies, which exposes PLS companies to foreign exchange rate fluctuations. Multilateral netting minimizes this exposure by reducing the number of currency conversions needed. By settling transactions in one currency wherever possible, PLS companies can achieve more predictable financial outcomes and protect themselves against adverse currency movements.

Types of Transactions

- Trade payments

- Interest payments

- Royalties

- Dividends

- Hedge contracts

- Service fees

- Management fees

- Loan repayments

- Investments

- Third-party supplier payments

- Surplus cash

Cost Efficiency

The conventional method of handling payments often involves processing each individual transaction, leading to unnecessary payments and fees. Multilateral netting reduces these transaction costs by enabling companies to make a single, netted payment instead of multiple individual payments. This streamlined process results in substantial cost savings, allowing PLS companies to invest more in research and development, innovation and other core business areas. In a recent client survey, 86% of our clients indicated that the system significantly reduced transaction costs1.

Enhanced Financial Transparency and Accuracy

PLS companies are subject to stringent regulatory requirements and reporting standards. Multilateral netting offers increased transparency by providing a clearer view of financial flows. The consolidated process leads to more accurate and timely financial reporting and ensures compliance with international and domestic financial regulations.

PINACLE FX Netting

PNC FX is a global leader in multilateral netting technology. The netting solution is bank agnostic, and the account “overlay” structure accommodates existing banking relationships. The cloud-based solution has minimal IT requirements and can be implemented quickly. Our global network of correspondent banks allows for direct settlement, without the need for specific currency clearing accounts.

In an industry as global, complex and demanding as pharma and life sciences, financial strategies and tools/solutions that help optimize cash flow, reduce risk and enhance efficiency are vital. Multilateral netting offers PLS companies the tools to manage their intricate financial dealings effectively, which can help with cost savings, improved accuracy and strengthened global operations. By embracing this approach, PLS companies can focus more on innovation and advancing their mission to improve global health.

Let's build your brilliant

For more information on how our corporate banking experience in the Pharmaceuticals and Life Sciences industry can help move your business forward, visit pnc.com/pharmalifesciences or contact your PNC Relationship Manager.

Accessible Version of Charts

Chart 1: PINACLE FX Netting Capabilities

- Enable the netting of cash flows between subsidiaries and/or parent via the platform.

- Establish the dates and frequency of the netting schedule.

- Run the netting program as A/P driven, A/R driven or both A/P and A/R matched.

- Facilitate communication using dispute module and automated email notifications.

- View all reports and statements online or via multiple file formats.

- Configure currency netting calculations: full, currency, gross and home currency.

- Import and export to ERP systems such as SAP, Oracle, or other providers.

- Implement role-based system access for each user with dual approval authorization.

- Include vendor payments with your intercompany activity.

Chart 2: PINACLE FX Netting Benefits

- Potentially reduce the number of international payments.

- Can increase cash availability through float reductions.

- Reduce FX notional required for conversion.

- Reduce time spent on internal payment process.

- Efficiency gained though automated reconciliation.

- Leverage netting center to reduce foreign account requirements.

- Validate program effectiveness via system reporting.