Although charitable gift annuities (CGAs) typically represent a small portion of a charity’s assets, they may pose unique investing challenges due to their differences from other types of long-term assets, such as endowments. When determining the appropriate asset allocation, these contrasts become key considerations.

Endowments are permanent funds designed to support a charity in perpetuity, while a CGA is a contract in which a charity, in exchange for a transfer of assets (such as cash and marketable securities), agrees to make fixed payments to one or two individuals for their lifetime. Unlike endowments, the contractual nature of CGAs removes some of the flexibility in terms of spending. With a CGA, the charity is obligated to make the fixed payments at the frequency outlined in the initial contract.

Objetivo de inversión

One of the key differences between CGAs and endowments is the investment objective of the assets. Endowments must balance the need of both current and future beneficiaries, which leads to preserving the purchasing power of the assets at a minimum—this equates to the endowment’s spending rate plus inflation. For example, if the endowment has a 4% spending policy and 2% inflation, the investment objective should be 6% to preserve the purchasing power of the assets.

A CGA is a contractual agreement between a donor and a charity. In exchange for the donor’s irrevocable gift of cash, securities or other assets, the charity must agree to pay an annual fixed sum to one or two annuitants for life. Upon the passing of the annuitants, the remaining funds will go to the charity. Most charities use the American Council on Gift Annuities’ (ACGA) suggested CGA rates, which assume that CGAs have an expected target residuum of 50% of the original gift value.

It is assumed that a CGA’s original gift amount will reduce over time, which typically leads to lower expected investment returns. Currently, the ACGA has a 5.75% gross investment return assumption as of 1ro de enero de 2024. But generally, each gift will have its own experience influenced by its start date, beneficiary’s longevity and investment returns.

Fuente: PG Calc, Aspectos a considerar para los activos de anualidades de donaciones a entidades benéficas; PNC

Vea la versión accesible de esta infografía.

Plazo previsto

Endowments are permanent funds that have a perpetual time horizon, whereas CGAs have a much shorter time horizon based on the donors’ life expectancies—typically 10-12 years. While some of our clients see a tilt toward longer time horizons as they market to younger donors, average life expectancies still remain around 12 years, according to PNC Institutional Asset Management® analyses of Planned Giving clients. Although this is not necessarily a short time period, there is less time for recovery compared to a time horizon without end.

According to the 2021 ACGA survey, the average age of an annuitant at the time of making a gift is 79.

Tasa de desembolso

Another feature of CGAs is their higher fixed payout amount compared to an endowment’s spending policy. Endowments often have a 4-6% fixed payout rate of market value, allowing the payout amount to fluctuate as market value changes. In contrast, CGAs pay a fixed dollar amount, regardless of the current market value.

According to the 2021 ACGA survey, the average age of an annuitant at the time of making a gift is 79. Using the rates effective 1ro de enero de 2024, a 79-year-old donor would receive 7.8% of the initial gift amount annually[1]. For example, if the donor establishes a CGA with a $10,000 gift, the income beneficiary would receive $780 per year (based on the ACGA suggested rates) for life—regardless of whether the market value moves up or down. With that said, it is common for market values to decrease over time since the ACGA targets a 50% residuum, which increases the current or effective payout rate over time. This higher payout rate makes market values more susceptible to marked declines when confronted with volatility. As a result, both timing and volatility matter more for CGAs than other types of assets that provide a lower variable payout amount.

Restricciones reglamentarias

Furthermore, CGAs are often subject to stricter regulatory constraints than endowments, which vary by state. A helpful guide on state-specific regulations can be found on the ACGA website (www.acga-web.org). While some states are silent on the issue and others require only an initial notification on the issuance of CGAs, a small number require additional regulation with an initial registration. In higher-regulated states, it is common to require a dedicated gift annuity reserve account with annual reporting funding requirements. Most states now follow the prudent investor rule for CGA reserve accounts; however, California and Florida have investment restrictions that limit equities to a maximum of 50% in the reserve account. Additionally, while many states will “look through” underlying funds, California does not, requiring the fixed income portion of the reserve to be invested in individual bonds, according to the ACGA.

Resumen

As described generally, CGA assets have considerable differences from endowments, including the following characteristics:

- Higher and fixed payout rates

- Lower expected investment returns and shorter time horizons based on annuitant life expectancies

- State regulatory constraints and funding requirements

Each CGA program has a unique set of these characteristics that require a thorough evaluation during the asset allocation consideration process. This is described in detail in our white paper, The Evaluation Complex: Measuring the Success of Your Charitable Gift Annuity Program. This evaluation, along with each organization’s financial health status, risk tolerance and objectives for the CGA program, will provide a comprehensive and customized basis for how to invest the assets, keeping in mind the need for greater liquidity compared to endowment assets.

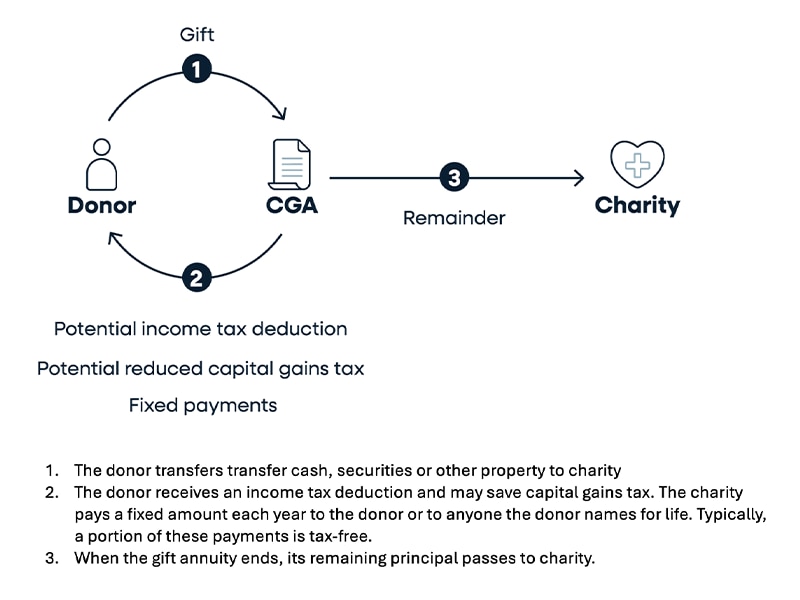

VERSIÓN ACCESIBLE DE LA INFOGRAFÍA

El proceso:

1. Usted transfiere dinero en efectivo, títulos u otros bienes a la organización benéfica.

2. Recibe una deducción de impuesto a la renta y puede ahorrar el impuesto sobre ganancias de capital. La organización benéfica le paga un monto fijo cada año a usted, o a cualquier persona que usted nombre, de por vida. Normalmente, una parte de estos pagos se encuentra libre de impuestos.

3. Cuando termina la anualidad de donación, el capital restante pasa a la organización benéfica.

Fuente: PG Calc, Considerations for Charitable Gift Annuity Assets, PNC