Almost 25 million U.S. households are either unbanked or underbanked according to an FDIC

survey. [1] It’s easy to take the neighborhood bank branch for granted. Unless your neighborhood doesn’t have one.

There are entire communities lacking convenient access to a bank branch. When that happens, everyday transactions—opening an account, making a deposit, or cashing a check—can suddenly prove a significant challenge.

“If someone has either no banking relationship or a limited one, it has a punishing effect on that person’s ability to manage their financial lives,” offers Chris Hill, PNC Bank’s Mobile Branch Manager. “Just getting access to cash, or paying the monthly utilities becomes difficult enough. Now imagine having more complex needs, such as financing the repair of a car needed to drive to work.”

The costs of not having a banking relationship mount over time. While the average face value of a check presented to a check-cashing outlet is $442.30, the average fee to cash that check is $13.77. If that is someone’s weekly paycheck, that means $661 a year are spent on check- cashing fees alone.[2]

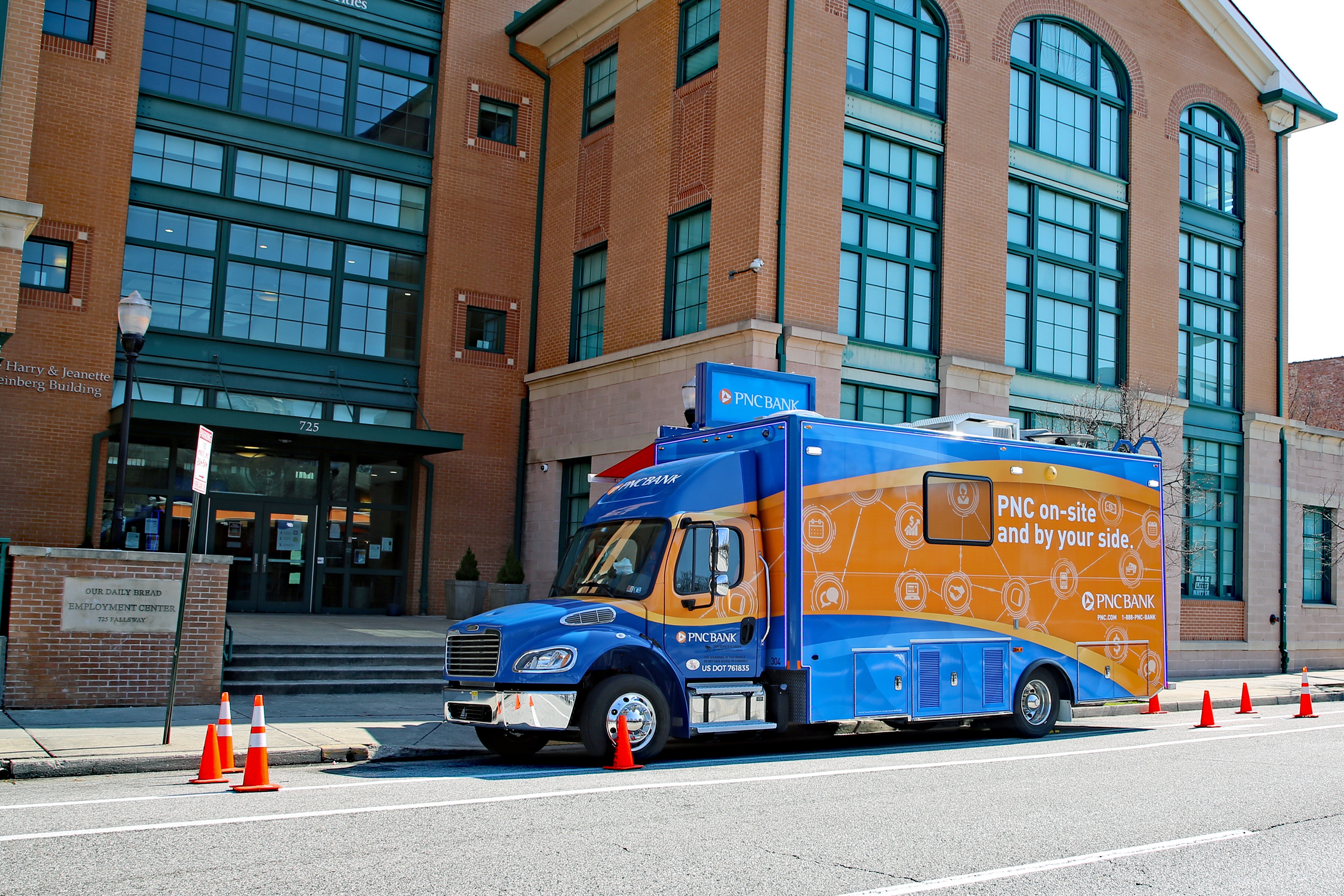

So, what’s the solution when banking is inconvenient to an entire community? PNC Bank now brings Mobile Branches to key neighborhoods across 10 U.S. markets, including Atlanta, Baltimore, Chicago, Cleveland, Dallas-Fort Worth, Detroit, the Greater Philadelphia area, Houston, Phoenix, and South Florida. As a result of this innovative program, underserved communities are now enjoying regular access to financial services—access that simply did not exist before.

“There are communities that simply do not have full-service banking,” adds Hill. “Our mobile branches and dedicated teams offer a fantastic solution.”

Banks on wheels are not new. Most major financial institutions have the capability to serve customers in areas hit by natural disasters. But PNC places equal importance on serving low- to moderate-income communities and their residents. At a time when more than one out of every five Americans has no trusted source for financial advice,[3]knowledge is the most valuable asset PNC has to offer.

“It’s more than providing a branch where none exist,” Hill continues. “In many ways, we’re breaking new ground by helping people in those communities better understand banking, ensuring that they get the right financial advice.”

That means PNC’s mobile branches don’t just help with day-to-day banking services. They also deliver the healthy, supportive relationships that foster long-term financial health.

“We become part of their community over time with our routine visits and respectful conversations meeting consumers where they are financially, mentions Henitte Predelis, Mobile Branch Manager in South Florida. “It takes time. We work hard to build trust and create an environment that allows for conversations grounded in healthy banking habits. Over time, many will eventually bank in some way with PNC but all walk away with a better understanding of their financial journey.”

PNC mobile branches visit designated communities once every two weeks, teaming up with community partners. In Baltimore, My Brother’s Keeper is an example of this partnership. The organization provides meals 365 days a year, behavioral health services, workforce development and employment, and health care services--to mention a few services available at the location--to those community members needing support.

While My Brother’s Keeper serves others, PNC assists by taking the mystery out of banking services, instilling greater confidence when it comes to handling finances. According to Kevin Mason, Program Director, mobile branches give his organization an entirely new dimension.[4]

“Our primary goal is employment. It’s difficult for those in low- to middle-income communities to get advice and employment. My Brother’s Keeper’s employment partnership includes walking through resumes, conducting mock interviews, even following up with bus tokens and clothes for interviews,” says Mason. “PNC’s ability to offer financial and budgeting workshops fits nicely with our mission, teaching people how to manage money.”

Chris Hill agrees. “Employment goes hand in hand with how to manage the resources one earns. Yet many in these communities have never been exposed to the basics of budgeting or how to make good financial decisions. Our teams build rapport and offer financial wellness in small digestible nuggets, in turn setting the consumer up for a better future. By bringing the branch to them, we can offer most banking services on the spot in real time—services which otherwise wouldn’t be possible.”

What’s more, the benefits are often immediate and substantial. As one example, PNC customers who use PNC’s mobile branches have an opportunity to avoid the high fees charged by check cashing services. By offering this benefit, PNC mobile branches have created loyalty in the communities they serve—places where trust has traditionally been lacking.

“Because we’re here onsite working with the team that community members already know, we become familiar faces,” says Theresa Winebrenner, Mobile Branch Team Manager in Baltimore, “We hope that creates a more comfortable environment for them to drop in, ask questions, and eventually open an account with us.”

To PNC, mobile branches represent a commitment to its core values of not just serving customers—but lifting up communities as well. Plus, in the long haul, helping people is just good business. Because someone who seeks guidance about how to best manage money today might be a banking customer tomorrow.

“So many people we encounter want nothing more than to enter the mainstream of American life,” offers Hill. “Yet, through no fault of their own, they have lacked the tools and knowledge to make that possible. Our mobile branches and dedicated team members provide the support they need, and that’s far more rewarding to us than mere dollars and cents. To create this program, to make a concrete difference in the lives of others, is simply one of the most gratifying projects of my banking career.”

PNC’s mobile branches have already become a fixture in the communities they support. The mobile branch fleet has expanded to 22 vehicles and has fulfilled its commitment to deploy dedicated mobile branches across 10 key markets in our retail baking footprint as a part of the bank’s $88 billion Community Benefits Plan.

Learn more about PNC's mobile branches in this article Mobile Branches Provide Better Banking Access, Promote Economic Empowerment.