According to the U.S. Census Bureau, there are nearly 28 million small businesses in the country — and together they all have a major impact on the health of our economy. In fact, there are more small businesses than medium and large ones. That’s a big deal!

Even the smallest businesses need to borrow money. So where do you start? There are several options:

- Dipping into personal savings

- Utilizing personal credit

- Getting a loan from a family member

- Crowdfunding

- Borrowing against a 401(k)

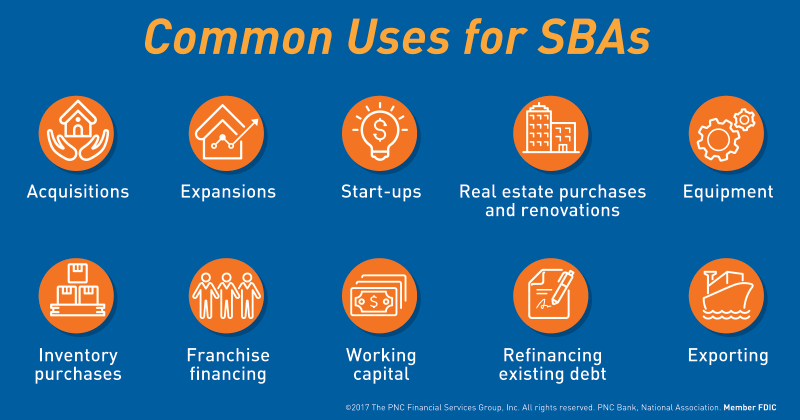

- Securing a Small Business Administration (SBA) loan

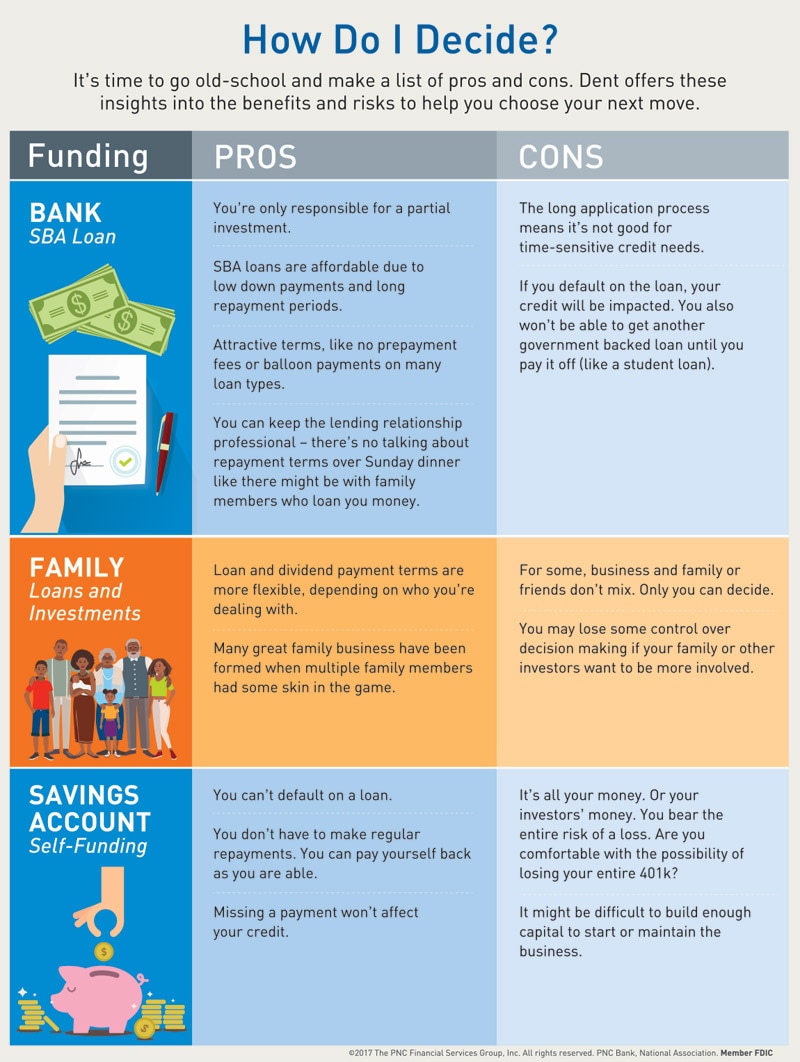

So, which one is right for you? Tom Dent, Senior Vice President and SBA Manager at PNC Bank, gets real about the benefits of an SBA loan — and when self-funding might be a better option.

Banks Really Do Want to Talk to You

If you’re like a lot of start-up entrepreneurs, you may be focused more on “not failing” than on succeeding, and you’re worried that a bank won’t understand your mindset. You might prefer self-financing options because you’re "too small for a bank" or you don’t want to take on "official" debt as you start a business. It’s time to abandon these myths.

“There are many benefits to an SBA loan,” says Dent. “They are generally easier to qualify for than more traditional business loans, and there are lower down payment requirements and early payoff options. Beyond that, bankers have experience helping entrepreneurs of all types turn their passionate ideas into viable businesses. In that way, a bank often becomes a great resource for business ideas and networking.”

More mature small businesses needing loans are also attractive to banks because they are more likely to have a proven track record. For example, if you’re a machinist with 20 years of industry experience and you are ready to open your own machine shop, banks will want to talk to you.

Whatever the stage of your business, the bank will ask you for a strategic business plan that outlines the roadmap of your business — and projects how much money you think you’ll make from investing in the business. If you don’t have a plan, or you can’t show projected cash flow over the next 12 to 24 months, then it’s time to seriously think about other options.

Family and Investors (Might) Want to Talk to You

This is more of a hybrid approach. If you get family members or other investors to help bankroll your business, you’re still going to be accountable to others. How much so is between you and your investors. A venture capitalist will want to see a business plan, just like a bank. Your parents may be willing to invest in you without that level of detail — but think long and hard about how the ups and downs of owning a business together will impact your relationships.

When Self-Funding Is the Best Option

Dent notes that in addition to businesses with no real plan, banks also tend to avoid issuing loans to what they consider “high risk” businesses. These include start-ups in industries with high turnover rates, like non-franchise restaurants and retail, or businesses where the owner has little to no experience in their industry.

Take Sarah, for example. She works a corporate gig, but dabbles in jewelry design. She wants to open a side business making earring sets. Since it’s more of a hobby, the bank will consider her business idea a greater risk. And from Sarah’s viewpoint, she’s better off self-funding anyway, because her new business isn’t yet profitable enough to manage the overhead of an SBA loan.

For more information on managing your business finances and what banking solutions are available to help, stop in your nearest PNC branch, or call PNC 1-877-287-2654 to schedule time with a Business Banker.