Market Review: Global markets open 2026 with broad-based gains

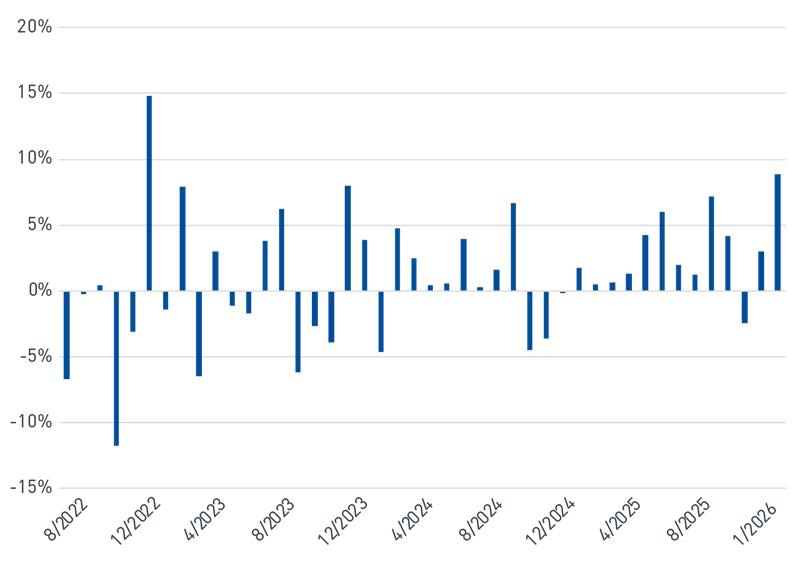

Global markets began 2026 with broad, positive momentum across major asset classes. U.S. equities posted modest gains, led by small-capitalization (cap) equities. International equities outperformed U.S. large cap, aided by a weaker U.S. dollar. Developed markets posted solid gains, while the MSCI Emerging Markets Index posted its best month in more than three years (Figure 1).

Monetary policy remained steady as the Federal Reserve (Fed) held its policy rate at 3.50-3.75% at its January 28 meeting. Commodity prices continued to rise in January; gold prices reached record highs, underpinned by global central bank buying, while broad commodities posted solid gains, with standout performance from energy.

Figure 1. MSCI Emerging Markets Index Monthly Return (%)

Emerging Markets are off to a strong start in 2026

As of 1/31/2026. Source: Bloomberg L.P.

View accessible version of this chart.

Short takes

Level-set with the big picture

- Fiscal and monetary policies both point in positive directions.

- Productivity gains could deliver profit growth and help ease inflation.

- Consumers and businesses, in aggregate, are in healthy positions.

Precious metals shined in January

- Gold and silver prices were gripped by speculation, but both have underlying demand.

- Global central banks have been significant buyers of gold, driven by geopolitical concerns, but high prices and lack of yield are likely to slow upside gains.

- Silver is expected to have a persistent supply deficit for years to come, but high volatility is also likely to persist.

Is artificial intelligence (AI) too costly and too disruptive?

- Even strong earnings from mega-cap technology companies have been met with negative stock price reactions when associated capital expenditure spending was elevated.

- Recent AI advances sent shockwaves through the software and technology sector.

- Some companies will adapt and thrive – while a pullback is healthy, a lasting bout of weakness could present a potential investment opportunity.

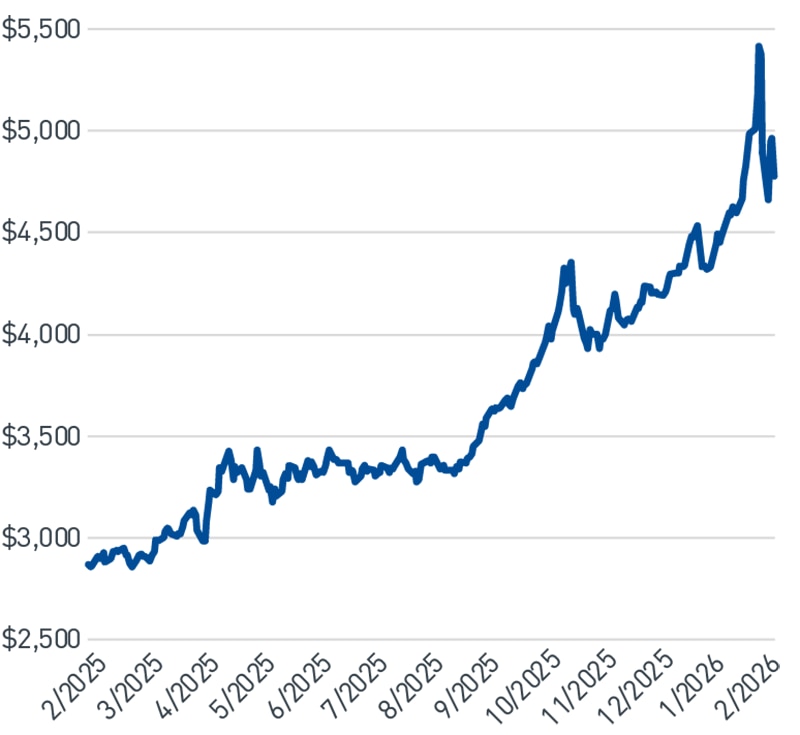

The big picture: Reviewing portfolio diversifiers – gold, bitcoin and hedge funds

Given recent market volatility, it is timely to provide our updated perspective on topical portfolio diversifiers. Gold is a reserve holding of central banks across the globe and many have increased their gold holdings in recent years from a desire to have currency diversification and to help buffer against geopolitical frictions (Figure 2). Notably, in the mid-to-late 1990s, numerous central banks sold down their gold holdings and the metal was eschewed for years due to lack of yield and the costliness of storage. We do not currently recommend gold as an investment allocation. The lack of income generation and recent speculative fervor add to the risk of investing in gold. Gold is sometimes perceived to be an inflation hedge, but that relationship primarily existed in the runaway inflation period of the late 1970s.

Figure 2. Daily Gold Price ($/oz)

Gold prices have become quite volatile after a strong 2025

As of 1/31/2026. Source: Bloomberg L.P.

View accessible version of this chart.

Bitcoin, another potential portfolio diversifier, has experienced extraordinary gains for long-term holders. Recent price action, however, has not kept pace with gold and some market participants point to the stalled cryptocurrency legislation (Digital Asset Market Clarity Act of 2025, or CLARITY Act) as a significant headwind. Despite the dramatic price appreciation since its 2009 launch, one role in which bitcoin has not seen success, is that of protection during times of market pullbacks. For that reason, along with the legislative overhang and difficulty of establishing a range of “fair value,” we continue to view bitcoin as a speculative rather than strategic holding.

Hedge funds exhibited healthy performance in 2025 and experienced the first year of net inflows in four years. Hedge fund strategies come in many varieties including equity hedge, event-driven, systematic, relative value and macro. Certain market dynamics tend to be more favorable for hedge funds overall – those dynamics include dispersion across asset classes, volatility, lower interest rates and economic disruption. We expect these characteristics to remain present throughout 2026 and consider the overall environment one that is favorable for a diversified exposure to hedge funds and “liquid alternatives.” While a diversified basket of hedge funds typically maintains a positive correlation to the equity market, it has also historically provided an element of risk mitigation and portfolio resilience.

Outlook and portfolio positioning

While low double-digit S&P 500® earnings growth in the fourth quarter has thus far been unable to propel the overall index or the Technology sector higher, we believe the overall trajectory remains intact for both continued growth and positive market returns. The stimulative effect of larger tax refunds and higher take-home pay should support spending, and companies are aggressively implementing technology to drive profit growth. Although the Fed is currently on pause from cutting interest rates, we expect a softening labor market and moderating inflation to allow for looser monetary policy later in the year.

Figure 1. MSCI Emerging Markets Index Monthly Return (%) (view image)

Emerging Markets are off to a strong start in 2026

MSCI Emerging Markets Index Monthly Return |

|

8/2022 |

0.42% |

12/2022 |

-1.41% |

4/2023 |

-1.13% |

8/2023 |

-6.16% |

12/2023 |

3.91% |

4/2024 |

0.45% |

8/2024 |

1.61% |

12/2024 |

-0.14% |

4/202 |

1.31% |

8/2025 |

-0.14% |

1/2026 |

8.85% |

As of 1/31/2026. Source: Bloomberg L.P.

Figure 2. Daily Gold Price ($/oz) (view image)

Gold prices have become quite volatile after a strong 2025

Last Price |

|

2/2025 |

2951.73 |

3/2025 |

3123.57 |

4/2025 |

3423.98 |

5/2025 |

3431.77 |

6/2025 |

3432.34 |

7/2025 |

3431.48 |

8/2025 |

3447.95 |

9/2025 |

3858.96 |

10/2025 |

4356.30 |

11/2025 |

4239.43 |

12/2025 |

4533.21 |

1/2026 |

5417.21 |

2/2026 |

4964.93 |

As of 1/31/2026. Source: Bloomberg L.P.