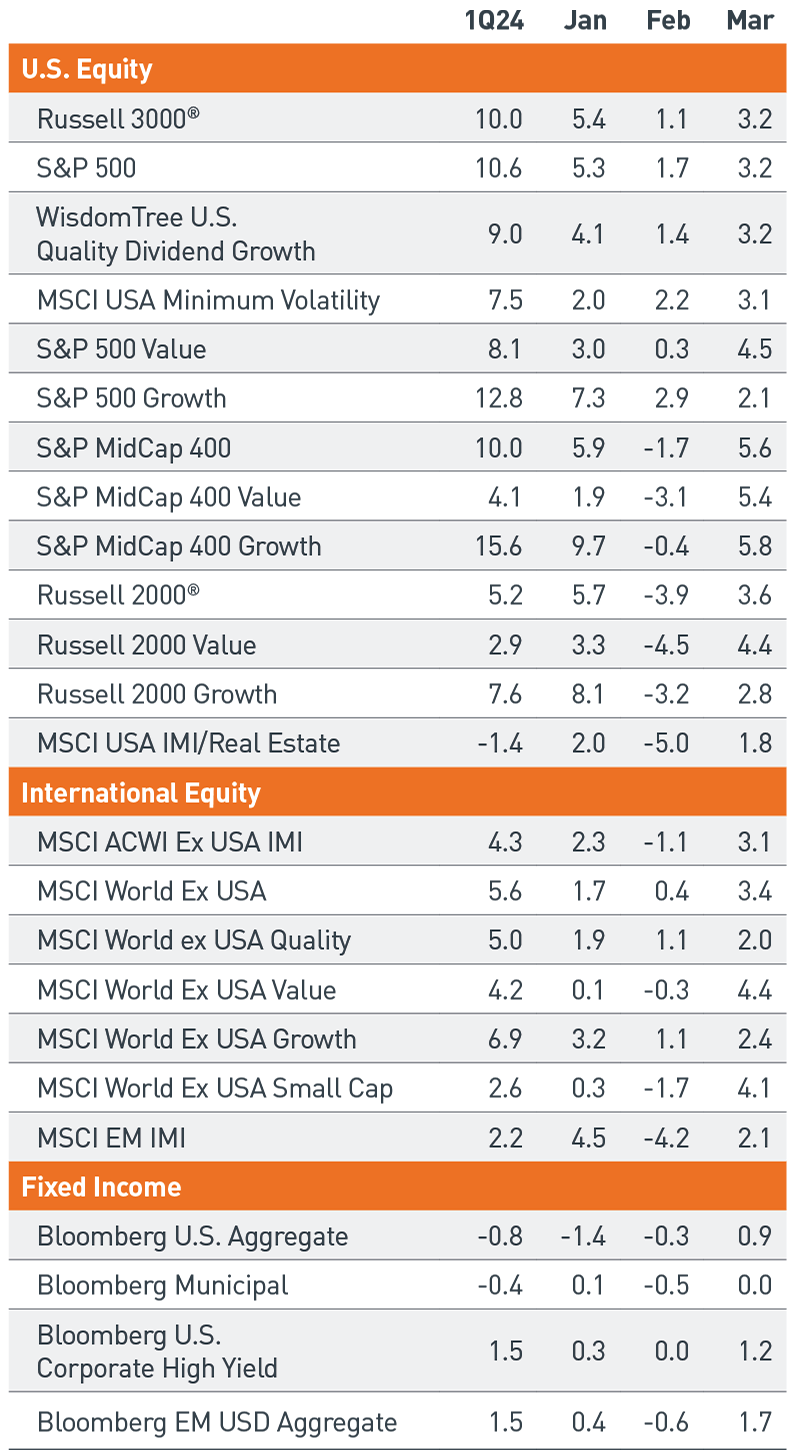

Last year’s fourth quarter rally continued in 2024, with the S&P 500, Dow Jones Industrial Average and Nasdaq-100 reaching all-time highs. In fact, the S&P 500 notched its best start to the year since 2019, this time climbing 10.6% (Figure 1). Investors were able to put aside fears of a U.S. recession and embrace a soft-landing scenario, with the hopeful expectation that the Federal Reserve (Fed) could finally embark on rate cuts.

Figure 1: Global market rally continued on investor optimism for a soft landing

Source: Morningstar Inc.; Data as of 3/31/24

View accessible version of this chart.

Despite the positive sentiment and strong returns, we cannot ignore some important potential downside risks. First, valuations remain elevated, with the S&P 500 valued at 20.8 times next-12-month earnings as of March 31. We also have yet to see the earnings story broaden out to a wider swath of the market beyond a handful of mega-cap technology companies. Finally, the path of monetary policy and inflation remains uncertain. For these reasons, much like the rally, the themes from last quarter carried through into the first quarter of 2024.

Key Theme Recap

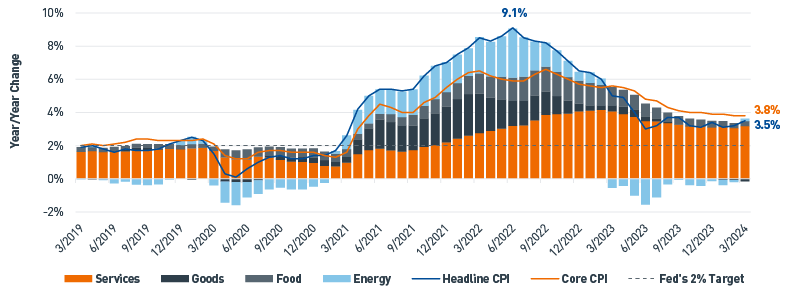

Inflation: Each month this quarter, month-over-month inflation accelerated, leading to 3.2% year-over-year growth in February. Just after quarter end, the March inflation report showed inflation ticked even higher, to 3.5% year over year — still well above the Fed’s 2% target (Figure 2). Investors appear to continue to expect disinflation through 2024, as evidenced by the recent global equity rally, despite the recent reacceleration in inflation data.

Figure 2: Components of the U.S. Consumer Price Index

Inflation remains above the Fed’s 2% target

Source: Bloomberg L.P.; Data as of 3/31/24

View accessible version of this chart.

Monetary policy: At the start of the year, consensus expectations indicated six rate cuts in 2024, beginning in March, which we thought was far too aggressive. Needless to say, consensus was incorrect. Not only was there an absence of rate cuts during the first quarter, consensus expectations have also since come down. Current market observations indicate expectations for two rate cuts in 2024. However, if there is risk to this estimate, we believe it is for fewer rate cuts as opposed to more. Throughout the quarter, the market sought to determine the correct number of cuts as Fed officials reiterated their patient approach to monetary policy, to be assured inflation was indeed under control. As a result, Treasury yields increased once again. The 10-year U.S. Treasury (UST) yield finished the quarter at 4.2%, up 26 basis points (bps) from where it started the year, while the yield curve remained inverted.

The Everything Rally: 2023 was capped off by an impressive equity rally across global markets, which continued into the first quarter of 2024 while hardly missing a beat. The S&P 500 hit 24 new all-time highs and ended the quarter at 5,254. Mid-cap, small-cap, developed international and emerging market (EM) equities all followed higher as well. Performance broadened, as more parts of the globe moved higher; however, equity market leadership remained similar to the recent past. The “Magnificent 7” accounted for more than 35% of the S&P 500’s return for the quarter, and U.S. large cap outperformed mid- and small-cap equities. Also, the U.S. outperformed developed international, which outperformed EM.

The continued optimism leading markets higher in the first quarter was welcomed by investors — us included. However, to achieve a sustainable path higher across markets, we believe it is paramount to maintain a focus on fundamentals. Given the strong move higher since the end of October 2023, we would not be surprised to see a pullback alongside increased volatility. We will continue navigating through 2024 with our investment process as our guide, focusing on the business cycle, valuations and technical indicators.

Which Asset Classes Led in Q1?

U.S. Large Cap

Our thesis: We believe large-cap equity is the long-term growth and innovation engine of the public equity asset class universe given its sustainable, high-quality fundamental characteristics.

What worked in the quarter: Out of the 61 trading days in the first quarter of 2024, the S&P 500 Total Return Index reached new all-time highs on 24 days, or approximately 39% of the time. This volume of new all-time highs was last witnessed in the first quarter of 2013, when the S&P 500 had 27 new all-time highs out of 60 total trading days. All sectors except Real Estate were positive for the quarter. Communication Services and Energy were the top contributors to overall index returns. We believe the first quarter rally can be attributed to investor optimism about impending rate cuts and an overall positive earnings growth rate.

Looking ahead: We believe the forward path of interest rates will directly impact corporate earnings over the next few years. Consensus anticipates a positive earnings growth rate for large-cap equities in the first quarter of 2024, as well as for the full year. Despite current levels of restrictive policy, which are expected to ease as the year progresses, macro factors, such as consumer spending, income growth and the labor market, remain robust. As such, we maintain broad exposure to large-cap equities across several sectors and industries.

U.S. Mid-cap

Our thesis: We believe in the long-term benefit of the mid-cap premium and associated growth prospects. As such, we maintain a small overweight asset allocation in mid-cap, as it combines growth and stability.

What worked in the quarter: Positive momentum continued for U.S. equities as earnings and economic data came in better than expected. Additionally, the improved inflation outlook brought expectations for monetary policy softening. This rally broadened to mid-cap, driven by relative valuation and diversification considerations, leading the asset class to all-time highs as well. Mid-cap performance was also aided by its greater exposure to Industrials, as well as its favorable, U.S.-centric revenue base.

Looking ahead: If the odds of the U.S. economy achieving a soft landing continue to improve, mid-cap valuations may have room to expand as they are currently in line with their longer-term average, based on price-to-earnings (P/E) and price-to-free-cash-flow. However, this would require an improvement in net earnings revisions and operating profit margins.

U.S. Quality Dividend Growth

Our thesis: High-quality, dividend-paying companies tend to have consistent earnings growth and cash flows that support and grow their dividends. We believe these companies may be better positioned to withstand a slowdown of the business cycle.

What worked in the quarter: Like the rest of the U.S. equity market, the asset class benefited from continued positive momentum, led by the Information Technology and Health Care sectors.

Looking ahead: The P/E for the asset class is sitting just below its all-time high, potentially diminishing its upside potential. However, profitability metrics have been improving, which may indicate the higher valuations are warranted.

Which Asset Classes Lagged in Q1?

U.S. REITs

Our thesis: Real Estate Investment Trusts (REITs) include a broad representation of the U.S. economy across styles and factors. Historically, the asset class has provided a diversification benefit due to lower correlations with traditional equities. However, structural changes within the index we use to track REITs, the MSCI USA IMI Real Estate Index, are fundamentally impacting its characteristics and return outlook.

What happened in the quarter: After strong performance during the prior quarter due to falling interest rates, REITs broadly trailed equity markets this quarter as interest rates rose. Telecom tower REITs, in particular, have been pressured by a global slowdown in 5G capital spending by U.S. carriers, which impacted their earnings outlook and dividend payouts. Higher interest rates may limit capital expenditure plans and cause some REITs to focus on preserving cash for operations and deleveraging debt.

Looking ahead: Given the evolution of the REIT index, its fundamental characteristics and risk profile have dramatically shifted. As a result, we do not expect REITs to provide the same diversification benefit or downside protection they once did. Additionally, the REIT index dividend yield of 3.84% as of March 31 remains well below the 2-year UST yield of 4.62%.

Core Fixed Income

Our thesis: Core fixed income tends to be the primary ballast in multi-asset portfolios given its broad diversification across Treasury, Corporate and Securitized markets. We expect the slowing growth phase of the business cycle will continue to weaken, which supports our increased exposure to the most conservative areas of fixed income.

What happened in the quarter: The Bloomberg U.S. Aggregate Index declined for the third time in the past four quarters, amid rising interest rates. Investment grade credit declined modestly, as option-adjusted spreads narrowed to the lowest level since 2021.

Looking ahead: Over the long term, we remain confident that core fixed income can still provide stability in portfolios and generate positive real total returns. In the near term, increased clarity on the path of interest rates will provide direction for returns. Additionally, we believe duration characteristics and spreads for core fixed income have dramatically improved since last year.

High Yield Fixed Income

Our thesis: Over the course of a business cycle, we expect high yield (HY) to outperform core fixed income. The asset class also traditionally has a stronger correlation with equity markets than the direction of interest rates. Thus, we believe the diversification benefit of HY is an important consideration for fixed income investors.

What happened in the quarter: HY outperformed core fixed income for the sixth consecutive quarter, as credit spreads narrowed 20 bps, falling to the lowest level since Q1 2022. As financial conditions eased in the quarter, the lowest-rated issuers saw the strongest performance, with CCC-rated bonds rallying more than 10% for the quarter.

Looking ahead: We remain cautious on HY. Earnings growth for lower-quality issuers is expected to weaken as the business cycle continues to slow through 2024. Despite the modest improvement in fundamentals, we expect headwinds to emerge in 2024 as issuers are forced to roll over maturing debt at higher interest rates. Given the weighted average maturity of the HY index is approximately 4.9 years, bonds issued during the historic lows of 2020 and 2021 are already beginning to roll over and will accelerate in 2024 and beyond.

Accessible Version of Charts

Figure 1: Global market rally continued on investor optimism for a soft landing

|

1Q24 |

Jan |

Feb |

Mar |

U.S. Equity |

|

|

|

|

Russell 3000® |

10.0 |

5.4 |

1.1 |

3.2 |

S&P 500® |

10.6 |

5.3 |

1.7 |

3.2 |

WisdomTree U.S. Quality Dividend Growth |

9.0 |

4.1 |

1.4 |

3.2 |

MSCI USA Minimum Volatility |

7.5 |

2.0 |

2.2 |

3.1 |

S&P 500 Value |

8.1 |

3.0 |

0.3 |

4.5 |

S&P 500 Growth |

12.8 |

7.3 |

2.9 |

2.1 |

S&P MidCap 400® |

10.0 |

5.9 |

-1.7 |

5.6 |

S&P MidCap 400 Value |

4.1 |

1.9 |

-3.1 |

5.4 |

S&P MidCap 400 Growth |

15.6 |

9.7 |

-0.4 |

5.8 |

Russell 2000® |

5.2 |

5.7 |

-3.9 |

3.6 |

Russell 2000 Value |

2.9 |

3.3 |

-4.5 |

4.4 |

Russell 2000 Growth |

7.6 |

8.1 |

-3.2 |

2.8 |

MSCI USA IMI/Real Estate |

-1.4 |

2.0 |

-5.0 |

1.8 |

International Equity |

|

|

|

|

MSCI ACWI Ex USA IMI |

4.3 |

2.3 |

-1.1 |

3.1 |

MSCI World Ex USA |

5.6 |

1.7 |

0.4 |

3.4 |

MSCI World ex USA Quality |

5.0 |

1.9 |

1.1 |

2.0 |

MSCI World Ex USA Value |

4.2 |

0.1 |

-0.3 |

4.4 |

MSCI World Ex USA Growth |

6.9 |

3.2 |

1.1 |

2.4 |

MSCI World Ex USA Small Cap |

2.6 |

0.3 |

-1.7 |

4.1 |

MSCI EM IMI |

2.2 |

4.5 |

-4.2 |

2.1 |

Fixed Income |

|

|

|

|

Bloomberg U.S. Aggregate |

-0.8 |

-1.4 |

-0.3 |

0.9 |

Bloomberg Municipal |

-0.4 |

0.1 |

-0.5 |

0.0 |

Bloomberg U.S. Corporate High Yield |

1.5 |

0.3 |

0.0 |

1.2 |

Bloomberg EM USD Aggregate |

1.5 |

0.4 |

-0.6 |

1.7 |

Source: Morningstar Inc.; Data as of 3/31/24

Figure 2: Components of the U.S. Consumer Price Index

Inflation remains above the Fed's 2% target

Date |

Headline CPI |

Core CPI |

Services |

Goods |

Food |

Energy |

Fed's Target |

3/31/2024 |

3.5% |

3.8% |

3.2% |

-0.2% |

0.3% |

0.2% |

2.0% |

3/31/2023 |

5.0% |

5.6% |

4.1% |

0.3% |

1.1% |

-0.5% |

2.0% |

3/31/2022 |

8.5% |

6.5% |

2.8% |

2.4% |

1.2% |

2.2% |

2.0% |

3/31/2021 |

2.6% |

1.6% |

1.0% |

0.3% |

0.5% |

0.8% |

2.0% |

3/31/2020 |

1.5% |

2.1% |

1.7% |

0.0% |

0.3% |

-0.4% |

2.0% |

3/31/2019 |

1.9% |

2.0% |

1.6% |

0.0% |

0.3% |

0.0% |

2.0% |

Source: Bloomberg L.P.; Data as of 3/31/24