At PNC, we define responsible investing (RI) as a goals-based strategy that aligns our clients’ portfolios with their missions and values. It is a process that identifies specific RI issues in order to:

- Avoid harm by excluding or restricting portfolio exposures that conflict with a set of values and/ or an organization’s mission

- Benefit stakeholders by supporting certain values related to environmental, social, and governance (ESG) factors, and/or

- Contribute to solutions by defining a targeted impact and allocating capital toward that objective

The rapid adoption of RI across the financial services industry, estimated to represent $2.7 trillion1 assets under management globally, has also ushered in a healthy dose of skepticism and concerns of “greenwashing.” Greenwashing is a term used to describe products and investments that may mislead customers on their environmental or “responsible” attributes. In response, the Securities and Exchange Commission (SEC) issued a Risk Alert in April 2021 highlighting certain RI-related deficiencies and internal control weaknesses from examinations of ESG investment advisors and funds. The SEC indicated it would continue to examine investment advisors and funds engaging in ESG investing in the future, focusing on several key areas, which could include:2

- Portfolio management practices inconsistent with disclosures about RI approaches

- Controls inadequate to maintain, monitor, and update clients’ RI-related investing guidelines, mandates, and restrictions

- Proxy voting inconsistent with advisers’ stated approaches

- Unsubstantiated or potentially misleading claims regarding RI approaches

- Inadequate controls to confirm that RI-related disclosures and marketing are consistent with the firm’s disclosures and practices

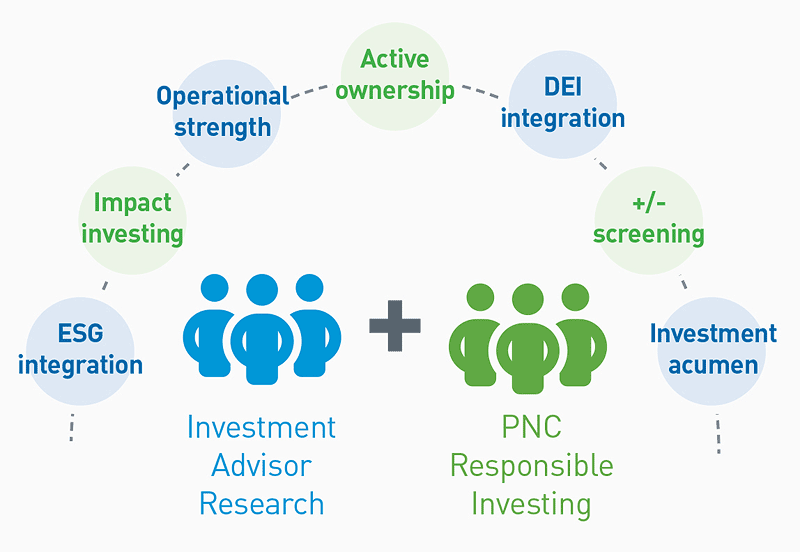

At PNC, responsible investing is a process — not a product or distinct investment philosophy. Therefore, it is important that we understand how managers integrate RI into their investment and portfolio management practices. Two teams within the PNC Asset Management Group Investment Office (AMG IO) collaborate during the due diligence process for RI investment managers: Investment Advisor Research (IAR) and Responsible Investing.

Responsible investing is a process—not a product or distinct investment philosophy

A Team Approach to Evaluating Responsible Investing Strategies

IAR’s 30+ investment and operational due diligence professionals oversee PNC Asset Management Group's third-party investment platform and provide specialized expertise across asset classes, styles and geographies. For dedicated RI searches, IAR works with the RI team to leverage its robust research and expertise on ESG and impact issues to implement a data-forward framework for selecting managers.

IAR’s manager search and due diligence processes reflect our duty as fiduciaries, and that remains true for our RI-related searches. We assess the investment acumen and operational strength of a firm, as well as evaluate them against RI best practices across exclusionary and positive screening, ESG integration, impact investing and active ownership.

With every search, IAR implements a peer review process, where strategies under consideration are scrutinized by both the investment and operational due diligence analysts (IDD and ODD, respectively). This means that even if there is high conviction in the investment thesis supported by a strong track record of the investment team, if the ODD analysts have concerns about the firm’s ability to execute on the strategy, it would not be approved for use on the platform.

View accessible version of this chart.

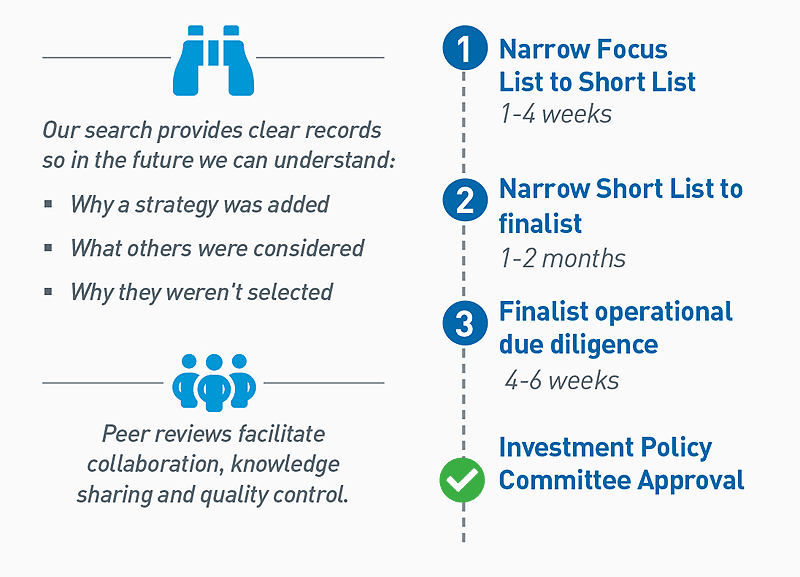

RI Assessment Process

For RI searches, there is an additional assessment of the manager's RI claims. Only when investment solutions meet both the IAR and RI teams' standards are they recognized as a responsible investing strategy.

Our process begins with an assessment of the current PNC investment manager platform offerings within the style of the asset class of the investment manager platform we seek to identify. We also assess the need within the context of our Investment Strategy team's long-term views.

An analyst reviews the search rationale with the IAR and RI teams. Then the team provides feedback, and the analyst develops a list of prospects by screening various industry databases and PNC's extensive networks. At this stage, managers that simply claim RI integration could still enter the pipeline of viable options.

Next, the IAR analyst narrows the prospects through assessments aligned with the search rationale. For instance, this could include concerns for liquidity risk, or specific ESG exposures, such as Scope 1 and 2 carbon emissions, in the manager's portfolio. Engaging in peer review with IAR colleagues and the RI team, the analyst uncovers insights, including previous experiences with firms and managers, and creates a list of prospective managers called the Focus List.

IAR and RI conduct a due diligence process of the managers on the Focus List to assess the prospective managers among multiple criteria: firm, people, philosophy, process, portfolio, performance, and RI integration. In addition to direct conversations with the manager, the RI team will use a mix of third-party data providers and internal research methodologies to assess the credibility of the ESG claims of a manager.

After an initial round of conversations, the RI and IAR teams debrief and seek peer review to create a Short List. Once we identify Short List candidates, we conduct further interviews, diving into outstanding questions and requesting additional documentation to confirm their claims. Before the COVID-19 pandemic, these conversations often took place in person but have since migrated to a virtual or hybrid model.

Once the search team provides a final recommendation, the prospective manager is reviewed for operational risk by our ODD team. They review an investment firm’s procedures, controls and infrastructure to determine whether it can support its strategies for future return generation. Performing operational due diligence minimizes the chance that selected strategies will suffer from significant capital loss, mispricing or fraud due to operational issues. Upon review and sign-off from our operational team, the recommended investment managers are presented to our Investment Policy Committee (IPC). The IPC is comprised of senior members of PNC Asset Management Group, including others from the AMG IO, our Private Bank and Institutional Asset Management groups.

Only when this extensive process is complete and approved by the IPC is the investment strategy identified as a responsible investing strategy on the PNC investment platform and made available to our clients.

View accessible version of this chart.

Assessing ESG characteristics of Non-RI-focused Investment Strategies

We set a high bar for inclusion on our platform for both RI-focused and traditional strategies. In addition to RI specific solutions, we assess all strategies on our platform through a broader ESG and diversity, equity, and inclusion (DEI) lens as part of the IDD and ODD processes. All managers, as part of the search and in on-going monitoring and evaluation, receive our ESG and DEI due diligence questionnaires on a regular basis.

We do not expect all managers to integrate ESG factors into their investment or portfolio management practices, but through our work, we find that some active managers merge ESG into their own processes, even if they do not characterize themselves as a responsible investing strategy. Additionally, managers could have exposures to specific ESG issues, such as renewable energy generation, that clients implementing RI may seek in their portfolios. For this reason, we also analyze on-platform strategies for a variety of ESG issues to assess their fit within client portfolios. We explore whether the exposure is accidental or intentional, and if the holdings are expected to change significantly that it could alter the manager's ESG profile. We have seen a notable uptick in ESG-related product offerings, as well as strategies that historically did not claim ESG considerations, now doing so. We believe active strategies should intentionally and systematically integrate ESG into the investment process and optimize for specific ESG factors. For equities, this may also include actively engaging management at portfolio companies. There is no one-size-fits-all approach to implementing RI. Instead, we align the right investment tools and solutions to help our clients meet their goals.

We don’t score active managers on ESG integration. In our view, clients who want to invest with RI values shouldn’t have to make decisions on how a strategy scores as it relates to RI evaluation. We identify the best-in-class active strategies that integrate RI into the investment process and those that pursue engagement activities with companies in which they invest. Only this caliber of RI active strategies will receive a RI label on the PNC investment platform.

Benefits of the PNC Approach

For more information, please contact your PNC advisor.

1. Morningstar 2021 Global Sustainable Fund Flows (As of 12/2021)

2. SEC 2021 Risk Alert: The Division of Examinations’ Review of ESG Investing

Accessible Version of Charts

Chart 1: Considerations for Responsible Investing

This figure illustrates PNC’s collaborative approach to evaluating RI strategies. The Investment Advisor Research team and Responsible Investing team work together to evaluate and assess ESG and DEI for all managers on the PNC platform. Assessment criteria include: ESG Integration, impact investing, operational strength, active ownership, DEI integration, positive and negative screening, and investment acumen.

Chart 2: Considerations for Responsible Investing

This figure illustrates PNC’s comprehensive search process. The first step is narrowing the Focus List to the Short List (1-4 weeks), step two is narrowing the Short List to the finalist (1-2 months), the third step is submitting the finalist for operational due diligence (4-6 weeks). At that point the finalist is submitted to the Investment Policy Committee for approval. This process provides clear records so we may understand why the strategy was added, what others were considered, and why they weren’t selected. Peer reviews throughout the process facilitate collaboration, knowledge and quality control.