It is important for employers to regularly evaluate and determine whether their benefits offerings are effective in helping their employees plan for and achieve their retirement savings goals. One option to consider is a nonqualified deferred compensation (NQDC) plan.

What is a NQDC Plan?

A NQDC plan is a type of tax-deferred, employer sponsored retirement plan that is not subject to many ERISA requirements. NQDC plans are designed to meet specialized retirement needs for executives and other select management or highly compensated employees.

Why consider a NQDC Plan?

NQDC plans can be used for recruitment and/or employee retention needs by employers. NQDC plans are different than qualified plans (e.g., 401(k) plans) because they are exempt from discrimination rules and top-heavy testing. They are usually created and offered to provide company executives an additional retirement savings option outside of the restrictions of a typical 401(k) plan.

How do you start a NQDC Plan?

The first step is deciding the key features, plan design, and employees that you would like to cover with the plan. A nonqualified plan specialist can help with this process. Once you've defined the parameters of the plan, the consultant can help you to determine the appropriate funding structure, taking into account tax and other financial implications. Finally, an attorney can guide you through the legal/tax requirements and help you draft the plan document.

|

Advantages |

Disadvantages |

Employers |

Helps employers recruit and retain top talent.

Employers can tailor NQDC plans to align specifically to business goals to reward executives for meeting those goals.

Provides employers cash flow flexibility. The NQDC plan can entice executives to accept a lower salary in the present and tax-deferred compensation in the future when the company is in a better position cash-wise. |

The contributions that the employer makes to a NQDC plan usually are not tax deductible by the employer until the employee receives the compensation. This could affect tax planning for the employer.

Employers need to pay close attention to the structure of their plan payments including payment timing, how many payments will take place, and payment amounts. This could affect cash flow planning for the employer. |

Employees |

Provides employees with an additional retirement savings vehicle that allows them to save on a tax-deferred basis beyond the limits of qualified plans.

Employers can tailor NQDC plans for the individual employee’s needs and/or desires that differentiate the compensation structure from that of competitors. |

The employer is not required to set aside assets to fund a NQDC plan. If the employer chooses to set aside assets, these amounts must remain subject to the claims of the company's general creditors. If the employer goes into bankruptcy or has claims from creditors, the employees may not receive their money. |

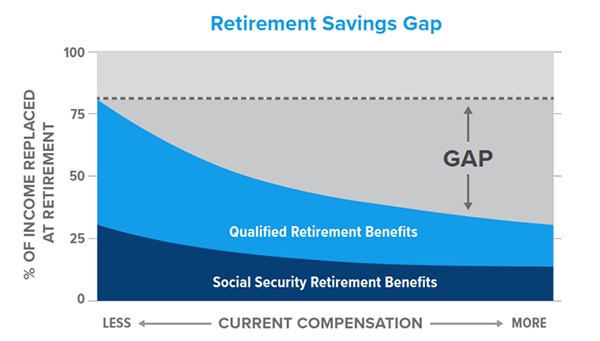

Most commonly, NQDC plans allow employees that meet their allowable annual contributions quickly in their qualified plan to save more for retirement in an additional plan. For higher earners, replacing the target 80% of income in retirement requires saving more than the qualified plan threshold. NQDC plans can help to close this gap and can even provide favorable tax treatment on the deferred income relative to receiving the income now.

Retirement Savings Gap chart

Source: M Financial Group

View accessible version of this chart.

Would your key employees benefit from a NQDC Plan?

- Do you have employees that max out their contributions in their traditional retirement plans every year? If yes, do they desire to save more?

- Do you have employees that need to save for a life event at a certain date in the future? Like a child’s college tuition?

- Do you have employees that would like to defer taxes to a later date?

- Do you have employees that are able to afford losing current income? That are willing to accept the risk of losing deferred income if the company goes into bankruptcy?

- Do you have employees that trust the financial stability of the company?

Would your organization benefit from offering a NQDC Plan?

- Do you have issues attracting and retaining highly compensated employees?

- What is your business structure? Owners and shareholders of Sole Proprietorships, Partnerships and S Corporations would not benefit from the tax deferral features of a NQDC plan.

- Do you need or want to have more flexibility when it comes to plan design? If yes, a NQDC plan might be a good option because they can be designed to be exempt from most of ERISA's provisions.

- Do you need to increase cash flow right now? Compensation can be paid out at a later date, but compensation is not usually deductible until payment.

- Concerned about costs? They are normally minimal to start and administer a NQDC plan with less annual legal filing requirements than ERISA plans.

Accessible Version of Chart

Retirement Savings Gap chart (view image)

| Income | Qualified Plan Distributions | Social Security Distributions | Total Income Replacement |

Income Gap from Qualified Plans and Social Security to 80% Replacement Ratio |

| $100,000.00 | 50% | 30% | 80% | $ - |

| $200,000.00 | 47% | 27% | 74% | $24,384.20 |

| $300,000.00 | 40% | 26% | 66% | $104,384.20 |

| $400,000.00 | 34% | 25% | 59% | $184,384.20 |

| $500,000.00 | 27% | 23% | 50% | $264,384.20 |

| $600,000.00 | 23% | 21% | 44% | $ 344,384.20 |

| $700,000.00 | 19% | 19% | 38% | $424,384.20 |

| $800,000.00 | 17% | 17% | 34% | $504,384.20 |

| $900,000.00 | 15% | 15% | 30% | $584,384.20 |

| $1,000,000.00 | 14% | 13% | 27% | $664,384.20 |

| $1,100,000.00 | 12% | 11% | 23% | $744,384.20 |

| $1,200,000.00 | 11% | 9% | 20% | $824,384.20 |

| $1,300,000.00 | 10% | 8% | 18% | $904,384.20 |

| $1,400,000.00 | 10% | 7% | 17% | $984,384.20 |

| $1,500,000.00 | 9% | 6% | 15% | $1,064,384.20 |

| $1,600,000.00 | 8% | 5% | 13% | $1,144,384.20 |

| $1,700,000.00 | 8% | 4% | 12% | $1,224,384.20 |

| $1,800,000.00 | 8% | 3% | 11% | $1,304,384.20 |

| $1,900,000.00 | 7% | 2% | 9% | $1,384,384.20 |

| $2,000,000.00 | 7% | 1% | 8% | $1,464,384.20 |

Source: M Financial Group