Introduction

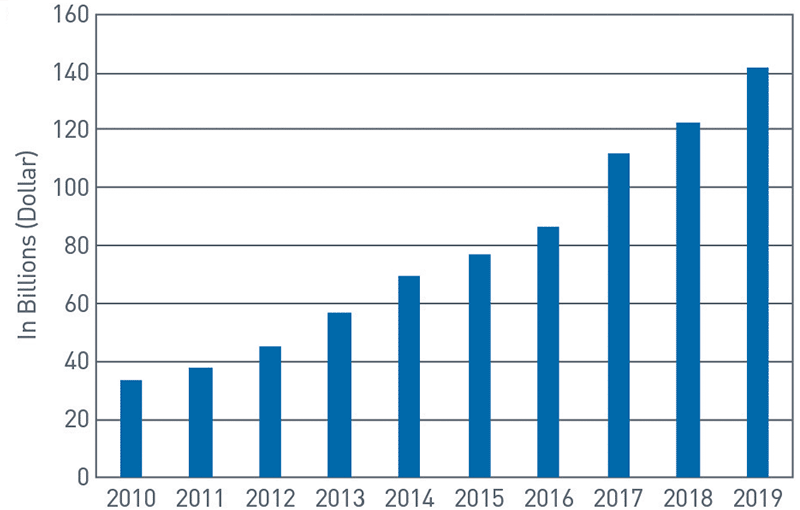

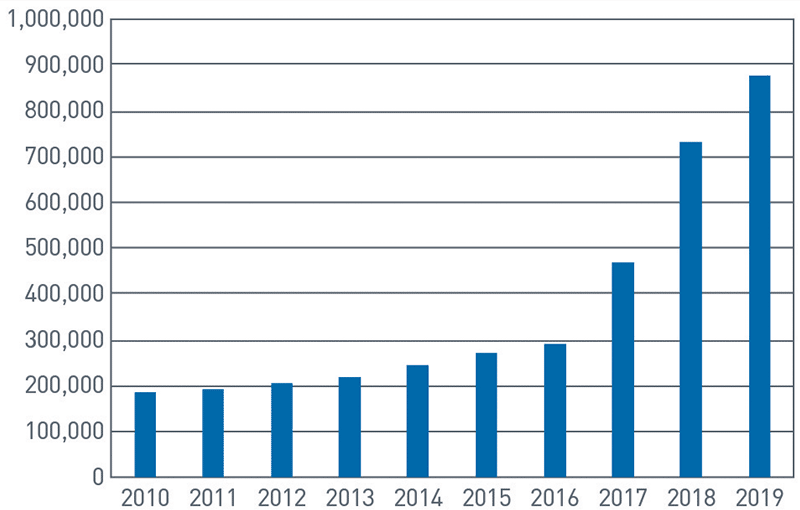

Donor-advised funds (DAFs) as a charitable giving vehicle have increased in popularity over the last decade, as seen in Charts 1 and 2, creating new opportunities for charitable giving fundraisers. Unfortunately for many nonprofit organizations, often these funds have flowed into a few large, commercial DAF programs rather than community foundations, single-issue charities, or other singular nonprofit entities.

For a nonprofit organization to compete for these charitable dollars against the established titans (by market share), they need to provide a comprehensive solution that includes a platform that allows access in real time, prudent investment management, and efficient administrative processing. To help nonprofit organizations manage their DAFs to overcome these challenges to time and resources, PNC Institutional Asset Management® (IAM) has cultivated a service platform to enable sponsoring organizations to outsource back-office functions related to DAFs. The result provides the sponsoring organization with the ability to focus on the stewardship rather than investment and administrative tasks.

Specifically, PNC IAM has invested in a digital platform meant to address the distinct infrastructure needs of nonprofit organizations that sponsor DAFs.

Total DAF Charitable Assets

View accessible version of this chart.

Number of DAFs

View accessible version of this chart.

Reasons to Outsource DAFs

Donors continue to look for more opportunities to make their impact on the charitable missions that are important to them. Recently, this has driven the popularity of DAFs to unprecedented levels. To meet the expectations of these donors, we believe the sponsoring organization should focus energy on creating and maintaining strong donor relationships while demonstrating effective stewardship of the gifts entrusted to them. Because of this, we believe there are three components of DAFs that support outsourcing: investment, administration, and technology.

Investment

| Common Problem Areas | Our Solution |

| The sponsoring organization has to provide investment options that are appropriate and keep up with ongoing due diligence. | PNC offers experience of investment strategists combined with investment advisors who have strong backgrounds in charitable giving assets. |

| Investment committees, even with experience in investments, do not always have familiarity with investing specialized charitable gift vehicles, such as a DAF. | Designated investment professionals will meet regularly with your organization to discuss strategy, performance, and customized investment policy statement structure. |

| Development officers on the front line need to feel comfortable discussing investment options with donors and potential donors. | Investment advisors at PNC will work with development officers to help make them more comfortable having those discussions. |

Administration

| Common Problem Areas | Our Solution |

| Back-office support that manually records data is labor intensive and could result in human error. | Our platform automates accounting to track fund flows and donors’ individual interests within the pooled accounts. |

| Keeping track of important records, such as gift substantiation letters, can be a very time consuming task for staff. | Our platform includes the ability to upload and maintain important records such as welcome and gift substantiation letters. |

| Grant administration can be labor intensive, especially regarding grantee charitable status verification. | Our platform automates the verification of a grantee’s charitable status through embedded access to IRS Publication 78 (Pub 78) and the IRS Business Master File (BMF). |

Technology

| Common Problem Areas | Our Solution |

| By creating your own platform to manage donor advised funds, you are committing to the cost associated with maintaining and periodically updating a complex technology platform. | PNC IAM has invested in a digital platform meant to address the distinct infrastructure needs of nonprofit organizations that sponsor a DAF. |

| Donors want access to their account and the ability to initiate common transactions (such as making a grant request) at their discretion and without having to pick up the phone and call someone. | We offer a customized platform that is tailored specifically to the needs of your donors, allowing for real-time access, processing, and status updates. It also provides donor access to important account documents and statements. |

| Sponsoring charities need to be able to see their fund balances, respond to donor-initiated requests, and generate/store account statements, in real time. | PNC’s platform provides transaction processing for contributions, grants, and investment activity with real-time visibility to sponsors, with key reports including grant history and consolidated reporting for the fund available to the sponsoring charity at their discretion. |

Outsourced DAF Solutions

Our DAF philosophy is that superior investment, administration, and technology services are simply not enough in the challenging donor environment. This type of platform has to be enhanced with value-add, consultative services that help your organization build effective philanthropic relationships with your donors.

As an example of this commitment, we offer assistance to our clients with education, training, and gift planning consultation. We will work with board members and/or development officers to better articulate the philanthropic value proposition of your DAF. Our DAF solution can offer your organization:

- Back-office solutions that enable your organization to refocus its skilled professionals on more donor-focused activities, including the cultivation of multigenerational donor relationships.

- A level of confidence that the essential service and compliance components are supported by experienced professionals. Distributions, recordkeeping/reporting, and the other crucial but time consuming duties are facilitated in an effective, timely fashion.

- Working with us can be very cost effective, demonstrating an emphasis on good stewardship of gifts and contributions to donors.

- We provide experienced professionals who keep current with regulatory and compliance issues that affect the nonprofit community. Because of this, we can help your organization learn and adapt to the various rules and regulations specific to the industry.

- Our team members are nationally recognized speakers who present on pertinent topics and are available to do internal and external training, as well as a more educational program designed to help your organization stimulate donor activity.

Conclusion

DAFs can begin as a reasonable in-house operation, but with the current growing popularity, management of these funds can become a burden and, ultimately, a liability. Outsourcing the labor-intensive, costly operational and technological components to PNC IAM and our Planned Giving team can help to reduce these challenges, allowing your organization to focus its efforts on the donors that made it possible. Contact your PNC representative if you have any questions, and they would be happy to engage the Planned Giving team to assess your DAF.

Accessible Version of Charts

Total DAF Charitable Assets

| Year | Billions of Dollars |

| 2010 | 33.6 |

| 2011 | 38.16 |

| 2012 | 44.71 |

| 2014 | 57.05 |

| 2015 | 77.18 |

| 2016 | 86.35 |

| 2017 | 112.1 |

| 2018 | 121.42 |

| 2019 | 142 |

Number of DAFs

| Year | Number of DAFs |

| 2010 | 184,364 |

| 2011 | 192,378 |

| 2012 | 204,704 |

| 2013 | 218,429 |

| 2014 | 241,507 |

| 2015 | 272,845 |

| 2016 | 289,614 |

| 2017 | 469,331 |

| 2018 | 728,563 |

| 2019 | 873,228 |