The routing number is used to identify a financial institution. You may be asked to supply this number (along with your account number) when requesting an electronic money transfer, making an online payment, or setting up direct deposit with a checking or savings account.

What Is A Bank Routing Number and What Is It Used For?

A routing number is a nine-digit code identifying a financial institution such as a bank or credit union. You may also see it referred to as a routing transit number (RTN) or an ABA (American Bankers Association) routing number[1].

Combined with your account number, the routing number creates a unique string of digits that informs financial institutions exactly where to withdraw or deposit funds.

While some small banks may have only one routing number, larger institutions may have dozens. At these big banks, your account's routing number will likely depend on where you first opened the account.

For example, if you opened an account at a PNC bank branch in Maryland, your routing number will be different than a PNC customer who opened an account in Massachusetts.

It may be helpful to think of your bank's routing number like a zip code — it ensures that your money comes from or arrives in the right place.

When Will You Need To Know Your Bank's Routing Number?

Typically, you'll need to supply your bank's routing number when setting up any electronic transfers to and from a checking or savings account. That means you'll probably need to know this number when setting up transactions such as a direct deposit for a paycheck at work or to receive a tax refund directly in your account.

You'll likely also need to know your bank's routing number to make any payment directly from a checking or savings account online or over the phone.

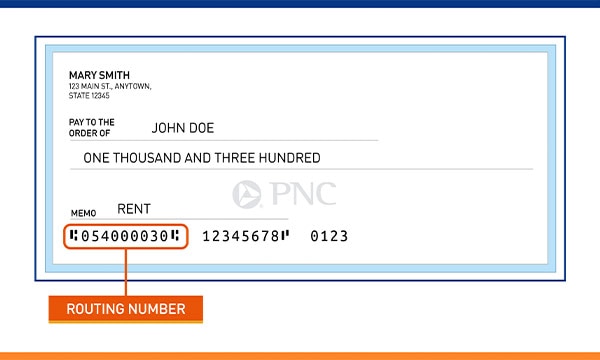

Where To Find A Routing Number On A Check

If you have a checkbook, the easiest way to find your bank's routing number is by looking at a paper personal check.

No matter which bank you use, you'll find the routing number on the bottom left-hand side of the front of the check. It's the first nine digits in a long string of numbers.

Image 1: Routing Number on Check

The numbers following the routing number are your account number and the number for that particular personal check. Together, these numbers are referred to as the magnetic ink character recognition line[2].

If you're setting up a direct deposit for your paycheck, your employer might require you to submit a voided check. This makes it easy for the company's payroll department to determine the bank's routing number and your account number.

Ways To Find A Routing Number Other Than A Check

If you don't have a paper check at hand, there are other ways to find your bank's routing number.

Find A Routing Number Using Your Bank's Online Banking or Mobile App

Finding your bank's routing number using its online banking or mobile app is relatively quick and easy. Simply log in and find your account information. If you’re a PNC customer here’s how to locate your routing number.

Find A Routing Number Through The ABA

The American Bankers Association (ABA) allows users to find routing numbers via an online lookup tool[3]. However, note that there are limits to using the tool.

Users can use it to look up routing numbers no more than two times per day or ten times per month. You must also agree to the ABA's terms of service to search routing numbers this way.

Are you considering opening a checking account? Explore PNC's Virtual Wallet Checking accounts. These combine the benefits of a traditional checking account while adding innovative digital tools to help you plan, save, and protect your finances.

Learn more about PNC's Virtual Wallet Checking Accounts.