PNC Alerts are free to customers. However, third party message and data rates may apply. These include fees your wireless carrier may charge you for data usage and text messaging services. Check with your wireless carrier for details regarding your specific wireless plan and any data usage or text messaging charges that may apply.

Frequently Asked Questions

Start here! You may find answers to your questions and concerns in our Frequently Asked Questions.

My Account

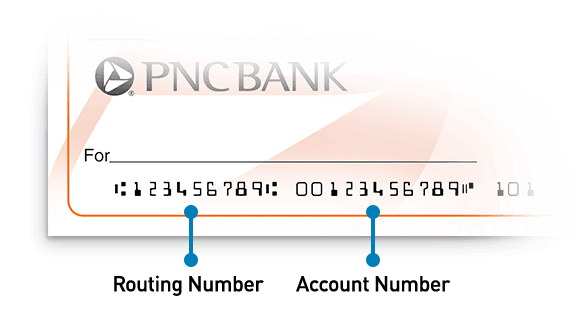

Routing numbers are nine digit numbers that can also be referred to as banking routing numbers, routing transit numbers, RTNs, and ABA numbers. This code identifies your financial institution and it can differ depending on where you opened your account and the type of transaction you make.

There's a number of ways you can find your Account and Routing numbers:

PNC Mobile App

For all Deposit Accounts (Checking and Savings)

- Sign in to the PNC Mobile app.

- Select your account, then select Account and Routing Numbers.

- Verify your identity by entering a one-time passcode to view your full account number and routing number.

Online Banking

For Deposit Accounts (Checking and Savings)

- Sign on to Online Banking.

- Select your checking or savings account.

- At the top, below the account name, select View Account/Routing Number.

- Verify your identity by following the steps to view your full Account Number and Routing Number.

On Your Paper Checks:

Your Account Number and Bank (ABA) Routing Number can be found at the bottom of your checks:

If you don’t have your checkbook handy, don’t worry. If you have recently written a check that has posted to your account you can:

- Sign on to Online Banking.

- Select your account.

- Within the Posted Transactions section of the Account page, locate a recently posted check and click on the blue link.

- View an image of the check to obtain the routing and account number.

Incoming Wire Transfers

Incoming wire transfers have a different routing number than the one displayed on your account. To set up an incoming wire transfer, you’ll need to provide your account number and the following PNC Bank Routing Number: 043000096.

You can reset your password or recover your user ID, click on "Forgot Your User ID or Password?" located in Online Banking Sign On or in the PNC Mobile app.

It's easy to change the address you have on file with PNC for your accounts:

- Sign on to Online Banking.

- Click the Profile and Settings icon in the upper right corner.

- Select Profile. Your personal information appears.

- Find what you’d like to change (address, email, phone number) and select Edit next to it.

- You can also select Add Address, Add Email or Add Phone if you’d like to add a new one instead.

For a non-U.S. address or phone number change, use Message PNC in the PNC Mobile app or Online Banking. For an address change, include your new physical, international address or a military box address and contact number.

For Business Accounts: To ensure your protection and security, please change your address by visiting your local PNC branch.

Your deposit is typically available on the first business day after your deposit is received. Your funds may be delayed, however, depending on the type of deposit and the amount of that deposit.

See when funds deposited to your Consumer Accounts will be available:

| Type of Deposit | Funds will be available… |

|---|---|

| Cash with teller or at certain PNC ATMs, Direct Deposit or wire transfer | Same business day |

| Check from an account at PNC |

Same business day to cover items in nightly processing Remainder – next business day |

| Check from an account at another financial institution | $100 - Same business day Remainder – next business day |

| Large deposit ($50,000 or more in one day) New account holders (30 days or less) |

$100 - Same business day $400 - Next business day Remainder – on the second business day |

| All cash deposits made at a Non-PNC ATM equipped with currency validation technology | Same business day |

In some situations, you may be notified that your funds may not be available for up to 5 business days after you make your deposit.

For more information on the circumstances under which a delay may occur, refer to the applicable Funds Availability Document:

Consumer Accounts

PNC Bank Consumer Funds Availability Policy

Business Accounts

Funds Availability Policy for Business Accounts

It’s easy to order checks with Online Banking:

- Sign on to Online Banking.

- Select Help, then Manage Accounts.

- Select Order Checks and Supplies.

- Find the account you’re ordering for and select Order Checks and Supplies.

- You’ll be taken to our partner site, Harland Clarke, to choose your checks and complete your order.

- Allow 7 – 10 business days for your order to process and ship.

Sign up for Automatic Check Reorder so you don’t have to remember about reordering checks.

Automatic Check Reorder is a free service offered by PNC that notifies you when 70% of your checks are gone. At that time, you can make changes to your check style or address. Your new checks will be mailed to you automatically

Not sure if you’re already enrolled in Automatic Check Reorder?

You’ll need to place at least one check order before the option appears in your Online Banking. Once you’ve placed your first order:

- Sign on to Online Banking.

- Select Help.

- Select Manage Accounts.

- In the Checking & Savings section, select Order Checks and Supplies.

- Select Enroll under Automatic Check Reorder for eligible accounts.

- Review the information and confirm your enrollment by selecting Enroll again.

You were charged a fee because your account was overdrawn.

There were not enough funds in your account to pay for all of the transactions that were posted to your account. Fees may be charged for each Overdraft Item (OD) or Returned Item (NSF).

If you sign on to Online Banking, you can view the transactions that led to your overdraft by clicking on the Overdraft Item Fee or Returned Item (NSF) Fee.

PNC customers with a Virtual Wallet Spend account and all other consumer checking/savings account types: You won’t be charged a Returned Item fee (also known as Non-Sufficient Funds or NSF) for an item that is returned unpaid. You may see a maximum of one Overdraft fee per business day. If there are additional overdrafts on the same business day, those items will be paid or returned with no additional fees.

PNC customers with business checking/savings account types: You may see a maximum of four Overdraft or Returned Item (NSF) fees per business day.

Please refer to the appropriate Consumer and Business Schedule of Services and Fees for additional information.

A "Stop Payment" allows you to stop payment on a check, range of checks or pre-authorized payment (excluding cashier's checks, money orders or other cash equivalent items).

To place a Stop Payment:

- Select Help.

- Select Manage Accounts.

- Select Stop Payment from the Checking and Savings section.

- Select Stop Check Payments.

- Complete the remaining steps to place the stop payment.

For pre-authorized recurring ACH debit and Visa debit card payments, we must receive your request at least three business days before the payment is scheduled to be made. Once placed, your stop is effective for two years for Visa debit card recurring payments and indefinitely for ACH debit recurring payments. After two years, you can place another stop payment for two more years on Visa debit card recurring payments.

For pre-authorized one-time ACH debit payments, be sure your information is completely correct – we can assume no responsibility for information provided incorrectly or incompletely. Stop payment requests on pre-authorized one-time ACH debit payments are not effective if, either before or within 24 hours from the time when you place the stop payment, the payment is scheduled to process. Once placed, your stop is effective for six months. After six months, you can place another stop payment for six more months.

For checks, be sure your information is completely correct – we can assume no responsibility for information provided incorrectly or incompletely. Stop payment requests on checks are not effective if, either before or within 24 hours from the time when you place the stop payment, PNC Bank cashes the check or has become otherwise legally obligated for it’s payment. Once placed, your stop is effective for six months. After six months, you can place another stop payment for six more months.

Please note that additional fees may apply. For more information, refer to the applicable schedule of service charges and fees:

Our toll-free Customer Service number will get you fast, easy and secure account information from our automated banking system - there's no waiting and it's available anytime, whenever you need it. Use it to check balances, hear account activity, transfer funds and much more.

To access the Automated Telephone Banking Service, you will need the following:

- Your User ID you associated with your account, as well as

- Your Telephone PIN Number you registered with your account (in many cases, this is the same as your PNC Debit Card PIN).

Once you enter the information required to access your account, just follow the instructions given to you through the automated system

- Sign in to the PNC Mobile app.

- Select one the menu icon in top-left corner.

- Select View Profile & Settings.

- Scroll down and select Alerts & Notifications.

- Select an account, then an alert.

- Select Push Notifications*, Email and/or Text for alert delivery and select Save.

- If prompted, allow notifications when your phone asks for permissions.

- Sign on to Online Banking.

- Select the profile icon in the upper right corner.

- Choose Alerts and Communication.

- From the Alert Management tab, Alerts appear sorted by Security, then by each account type.

- Expand the row for the desired account, locate the alert that you would like to set up and select the toggle to turn the alert on or off. Or, click on Edit Delivery and Alert options to customize your alert settings and how you would like the alert delivered.

Note: Security alerts are automatically turned on to your primary email.

- Security Alerts

- Deposit Account Alerts

- Credit Card Alerts (provide balance & payment information)

- Debit/Credit Card Transaction Alerts

- Loan and Line of Credit Alerts

You can receive alerts via push notifications, email and/or text message.[1] To update your contact methods in Online Banking, go to the Profile icon, select Profile and update your email addresses or mobile phone numbers as desired.

To receive alerts as push notifications, you can enable them in the PNC Mobile app.

Please refer to your applicable account agreement for more detailed information on how to file a dispute, including the timeframe in which you must file a dispute for a debit card or credit card transaction.

You may dispute most debit or credit card transactions via your Online Banking by going to the Help Tab.

To dispute a debit or credit card transaction:

- Sign on to Online Banking.

- Select Help.

- For Credit transactions, select Account Actions, then Dispute a Transaction from the Manage Your Account section.

- For Debit transactions, select Help, then Manage Accounts, then Dispute a Transaction from the Checking and Savings section.

- Complete the request with your information. The dispute tool will tell you what to expect and any next steps.

You can also dispute a card transaction by notifying us in writing at PNC Bank, P.O. Box 3429, Pittsburgh, PA 15230. Include your name and account number, the dollar amount of the error, and a description of what you believe is wrong and why you believe it is a mistake.

You may also call us. Credit Card customers can call 1-800-282-7541 and Debit Card Customers can call 888-762-2265.

If you have a question regarding a fee, finance charge, payment or other question not related to purchase dispute, please contact Card Customer Service at 1-800-282-7541. For Debit Card Customer Service call 888-762-2265.

To dispute a PNC Online Bill Pay transaction, if you have a question about a payment or would like to dispute it, call 1-800-762-2035.

To dispute a Personal Check or Pre-authorized Payment, call 1-888-762-2265 or visit a branch. Find a PNC location

If you have banking questions, we encourage you to take advantage of this helpful resource:

Connect with our Customer Care Center using Message PNC, now available in both Online Banking and the PNC Mobile app[2]. Connect on your time and reply when convenient. You can even switch between devices during a conversation. To begin a conversation in Online Banking, click the “Message PNC” link at the top of the right-hand navigation column. In the PNC Mobile app, tap “Help.”

Effective October 8, 2021, BBVA Bank Visa Reward Card service was transferred to PNC Bank.

As of June 14, 2021, the Reward Card sales were discontinued.

- As of December 13, 2024 this service has been discontinued. For more information call 877-491-0754.

Credit Cards

If you think someone has used your card without your permission, call PNC immediately at 1-800-558-8472. Business Credit Card customers can call 1-800-474-2101.

You can report your card as lost or stolen either through the PNC Mobile App, Online Banking, by calling PNC, or by visiting a local PNC branch.

To report your card as Lost or Stolen in the PNC Mobile App:

- Sign in to the PNC Mobile app.

- Tap the menu icon (three lines), then tap Cards.

- Tap Card Actions.

- Tap Report a Card Lost or Stolen and begin filing your report.

To report your card as Lost or Stolen in Online Banking:

- Sign on to Online Banking.

- Select Cards.

- Find your card and select Card Actions.

- Select Report Card Lost or Stolen to start filing the report.

The easiest way to request a replacement card is either through the PNC Mobile app or Online Banking.

To request a replacement card in the PNC Mobile app:

- Sign in to the PNC Mobile app.

- Tap the menu icon (three lines), then tap Cards.

- Tap Card Actions.

- Tap Request a Replacement Card and begin your request.

To request a replacement card in Online Banking:

- Sign on to Online Banking.

- Select Cards.

- Find your card and select Card Actions.

- Select Request Replacement Card to start your request.

You can also request a replacement card by calling PNC at 1-800-558-8472. Business Credit Card customers can call 1-800-474-2101.

| Payment Methods | Main Details | How Does It Work? |

|---|---|---|

| PNC Online Banking | Make a payment to your account using PNC Online Banking. You can schedule one time or recurring payments. | Sign on to Online Banking and click the green Make a Payment button. You can also click Pay and Transfer from any screen, then click PNC Payments. |

| PNC Mobile App | Make a payment to your account using PNC's Mobile App. You can schedule one time, same day payments from a PNC deposit account. | Download the PNC Mobile app from your phone's app store and log in. Select your account and choose Make a Payment to schedule a payment. |

| Automated Payments | Enroll in the Automated Payment Program and have your monthly payment automatically deducted from your deposit account. | Download, complete, and return the Automated Payment Authorization form to the address or fax number listed on the form, or to your local PNC branch. |

| Pay by Phone | Make a payment over the phone through Voice Banking or with a PNC Agent. | Consumer Credit Card: Pay over the phone with Voice Banking by calling 1-800-282-7541.* If paying from a non-PNC deposit account, have your account number and routing number available. Business Credit Card: Authorized payers can make a payment with a PNC Agent by calling 1-800-474-2101. If paying from a non-PNC deposit account, have your account number and routing number available. |

| In-Branch Payment | Make a payment at any PNC Branch. | Visit a PNC Branch during normal branch hours to make a payment. The payment is effective as of the date the payment is made, although it may take up to 2 business days for the payment to be reflected on your account. |

| Mail Your Payment | Make a payment to your account by mail. | Send a check in the mail along with the payment slip provided at the bottom of your monthly billing statement. If you do not have a statement, please make sure to write your PNC account number on your check. Address for regular mail payments: PNC Bank P.O. Box 71335 Philadelphia, PA 19176-1335 Address for overnight mail payments: PNC Bank Consumer Loan Center BR-YB58-01-5 6750 Miller Rd. Brecksville, OH 44141 |

*Your use of the Voice Banking service, with the entry of your PIN, is your authorization for PNC Bank to initiate a payment via an ACH debit or other electronic entry to the designated account. Your payment cannot be canceled after you have submitted it.

If you suspect a charge on your account to be fraudulent, please call PNC immediately at 1-800-558-8472. Business Credit Card customers can call 1-800-474-2101.

If you have concerns about an authorized merchant charge on your credit card account, you can dispute the charge either through Online Banking (steps provided below) or by calling PNC.

Note: Please consider contacting the merchant before disputing a merchant charge. Reaching out to the merchant can often result in a quicker resolution and greater clarity into the nature of the transaction.

To dispute an authorized merchant transaction in Online Banking:

- Sign on to Online Banking.

- Select Help.

- For Credit transactions, select Account Actions, then Dispute a Transaction from the Manage Your Account section.

- For Debit transactions, select Help, then Manage Accounts, then Dispute a Transaction from the Checking and Savings section.

- Complete the request with your information. The dispute tool will tell you what to expect and any next steps.

- Sign in to the PNC Mobile app.

- Tap the menu icon (three lines), and then tap Cards.

- Tap Activate This Card.

- Tap Begin Activation.

Activate your card in Online Banking:

- Sign on to Online Banking.

- Select Cards.

- Find your card. If it hasn't been activated, a Card activation required banner will appear.

- Select Activate Card and complete the activation.

Credit cards expire at the end of the month indicated by the expiration date on your credit card. PNC will automatically send you your replacement card approximately 2 weeks in advance of expiration. If you have not received your new credit card before your current credit card expires, please contact PNC at 1-800-558-8472. Business Credit Card customers can call 1-800-474-2101. You may not receive a new credit card if your account is not in good standing or is inactive.

A balance transfer, as it pertains to your account, is a transaction where all or part of a balance existing with a non-PNC financial institution is transferred to your PNC credit card account. For example, you may want to move a balance from a credit card that has a higher interest rate to your PNC credit card account to take advantage of a lower or introductory interest rate and save money.

Existing PNC credit card customers can transfer a balance to their PNC credit card either through the PNC Mobile App, Online Banking, by calling PNC, or by visiting a local PNC branch. Follow the instructions below to view your eligibility for a balance transfer and to begin transferring a balance. If you decide to transfer a balance, please be prepared to present the account number for the other lender, payment mailing address, and amount to be transferred.

Note: A one-time balance transfer fee is charged for every balance transfer that is processed. The fee is a percentage of the amount transferred or a fixed minimum amount, whichever is greater.

Transfer a balance in the PNC Mobile App:

- Sign in to the PNC Mobile app.

- Tap the menu icon (three lines), then tap Cards.

- Tap Card Actions.

- Tap Transfer a Balance and begin your transfer.

Transfer a balance in Online Banking:

- Sign on to Online Banking.

- Go to Cards.

- Choose the card you'll be transferring the balance to, then select View Account Actions.

- Select Transfer a Balance in the Manage Your Account tile.

You can also call PNC at 1-800-558-8472 to inquire about transferring a balance.

Existing PNC credit card customers can request a credit line increase using the PNC Mobile app or Online Banking.

Request a credit line increase in the PNC Mobile App:

- Sign in to the PNC Mobile app.

- Tap the menu icon (three lines), then tap Cards.

- Tap Card Actions.

- Tap Manage Credit Limit and begin making your request.

Request a credit line increase in Online Banking:

- Sign on to Online Banking.

- Select Cards.

- Find your card and select View Account Actions.

- Select Request Credit Limit Change from the Manage Your Account section.

- Complete and submit the request.

You can also request a credit limit increase by visiting a local PNC branch or calling PNC at 1-800-558-8472.

To go paperless and sign up for online-only statements, visit paperless.pnc.com/creditcard or log in to Online Banking and follow the steps below.

To enroll in paperless statements via Online Banking:

- Sign on to Online Banking.

- Select the Profile and Settings icon in the upper right corner. It looks like an outline of a person’s head and shoulders.

- Select Alerts and Communication.

- Select Statements and Documents.

- Select Paperless.

- Any accounts you have that are eligible for paperless delivery will appear.

- Select Online under Delivery Method for the account(s) for which you’d like to receive paperless statements.

- Select Save at the bottom of the page.

You can use your card(s) when traveling internationally. However, before you do, we recommend you notify us before you leave to have a travel notice placed on your account(s).

There are three ways to place a travel notification:

In Online Banking:

- Sign on to Online Banking.

- Select Cards.

- For any card, select Card Actions. It doesn’t matter which you choose, you’ll be able to include multiple cards with the request.

- Select the cards you’d like to include, then complete the request with your trip information.

In the PNC Mobile Banking app:

- Sign on to the PNC Mobile app.

- Select the menu icon (three lines), then tap Cards.

- Select Card Actions in the bottom of the Cards screen.

- Select Set a Travel Notification.

Call the phone number found on the back of your card

Be prepared to provide the date(s) you will be traveling, as well as your destination(s).

Note: when using your card(s) internationally, foreign transaction fees may apply.

Assistance while you are traveling

For assistance while traveling internationally:

Debit cardholders: call us collect[3] at 412-803-7711

Credit cardholders: call us collect[3] at 412-803-7787

For assistance while traveling within the U.S.:

Debit cardholders: call us toll-free at 1-888-762-2265

Credit cardholders: call us toll-free using the following numbers:

PNC Premier Traveler Visa Signature credit card: 1-877-588-3602

PNC Premier Traveler Reserve Visa Signature credit card: 1-877-631-8996

All other credit cards:

1-800-282-7541

Business Cards:

1-800-474-2101

View Details of Service Charges and Fees:

Before you apply, you’ll need to unfreeze or unlock your credit report with Experian, so we can access your credit bureau information and make a decision on your application.

Follow these steps:

- Visit Experian's Website to see how you can unfreeze or unlock your credit online, by phone, or in writing.

- Unfreeze or unlock your credit report.

- Come back to PNC.com to apply.

Enrollment for points is automatic. If your account is not enrolled please call the number on the back of your credit card.

To establish, modify, or reset your credit card cash advance PIN:

- Please call 1-855-893-0460 and have your credit card available.

- Remember - Cash advances, including ATM withdrawals, are subject to the cash advance APR and cash advance fee that apply to your account.

Please refer to your credit card agreement for details.

To learn more about this benefit or to file a claim, go to

or call 1-866-894-8569. If you are outside the U.S., you can call collect at 1-303-967-1096. Certain terms, conditions, and exclusions apply.

For coverage to apply, you must charge your eligible cellular wireless bill to your covered PNC Bank credit card. Please refer to your Guide to Benefits for further details.

To view your business credit card(s) online you can either view your account through Online Banking or through Account View.

When a business credit card is opened, a control account number is established for the business.

The control account is designed to link together all cards issued to authorized users of the company and provide a number where all card transactions are billed. While there is no card issued for the control account, each card issued to authorized users of the company will have its own number.

Unexpected events may impact your ability to make your monthly payments.

Understanding the range of available options is one of the first steps toward getting back on track. Let's explore what assistance may be available to you - whether you're facing short-term challenges or long-term circumstances. Reaching out to us could make a meaningful difference in your situation.

For hardships, please use our Lending Hardship Service & Support

Home Lending

Yes, we offer options for making your mortgage payment online; simply, go to Online Banking.

Sign on to Online Banking and click the green Make a Payment button.

You can also click Pay and Transfer from any screen, then click PNC Payments.

To sign up for our free Automated Payments Program and have your loan payments automatically deducted from your checking or savings account, including accounts at other banks, download the Automated Payment Authorization form.

Automated Payment Authorization Form (Mortgage and Home Equity) – Complete, sign and return this form via mail, fax, or to a branch using the instructions provided on the form.

If you would prefer to have the Automated Payment Authorization form emailed to you so that you may complete and submit the form electronically, please contract our Customer Care Center at 1-888-762-2265.

Automated Payment set up may take up to ten (10) business days from the date we receive your completed authorization form to process your request. Please continue to make your payments until you receive a confirmation letter with the date that your automated payments will begin.

The PNC Mortgage Bi-Weekly Automated Payment Program automatically withdraws one half (1/2) of your monthly payment amount from the designated deposit account every 2 weeks, for a total of 26 half-payments each year. The first half-payment each month will be held in a non-interest-bearing account and will be applied to your next payment due once a full monthly payment has been received. Twice a year an additional half-payment will be applied directly to your principal balance.

Please note that two full payments may be made within your first month of enrollment. You must pay your mortgage payment that is due for the month in which the bi-weekly payments will begin. The first two bi-weekly payments will then be drafted and applied to your next mortgage payment due the following month.

To learn more about our Bi-Weekly Automated Payment Program, access the Bi-Weekly Automated Payment Authorization form for more details, including FAQs and how to sign up.

An increase or decrease in your payment may be a result of an increase or decrease in your property taxes and/or insurance premiums and may result in an escrow shortage or surplus. An increase or decrease in your taxes may be due to a property reassessment, a change in the tax rate, a change in an exemption or a special assessment.

Rather than making a partial payment, please call 1-800-523-8654 to speak to a Customer Service Representative about your options. We may have a program available to you that permits a period of forbearance.

If your payment is automatically deducted from your checking or savings account each month, and you have enrolled in PNC's Automated Payment Program, or PNC's Bi-Weekly Automated Payment Program, the new payment amount will be deducted from your account. There is nothing that you need to do.

If you scheduled your monthly payment to be paid using your bank's online bill payment system, you will need to modify the monthly payment amount with your bank.

PNC has different grace periods, but the majority of loans are assessed a late charge on the night of the 16th. Late fees vary in accordance with the mortgage note.

More than likely, this bill is an assessment or supplemental bill. Some taxing authorities will send this type of bill because an additional amount is due that was not assessed at the beginning of the current tax cycle. You may wish to contact your local taxing authority for clarification.

If you have an escrow account for taxes and the regular property tax bill is for the current taxes due, we will obtain the tax bills from the tax collector. You may retain the bill for your records.

If the tax bill is for delinquent taxes due, please call us via 1-800-822-5626.

Please note, for customers in the states of PA, CA, VA, MD, NJ, ID, IA, ME, and CT: Supplemental, interim and/or special/additional assessment tax is not escrowed. You are responsible for paying these bills. In addition, if you do not have a tax escrow account, you will need to pay the bill prior to the due date.

Please write your loan number on the bill and mail to our Tax Department.

The mailing address is:

PA Customers:

Tax Department-0046586

PO Box 9220

Coppell, TX 75019

NON-PA Customers:

PNC Financial Services

PO Box 9042

Coppell, TX 75019

You may pay the shortage from your escrow analysis statement through Online Banking, by calling our customer care team, or visiting your local branch. Upon receipt of the escrow payment shortage, we will adjust your payment to reflect the lower payment amount. If you choose not to pay the shortage, the shortage will be divided by 12 and spread over the next 12 months payments, interest free. In either case, your mortgage payment will be adjusted to reflect the new amount.

PNC can assist you with information pertaining to your mortgage. However, we do not have access to information regarding why your taxes, insurance or special assessments have changed. Please contact your local tax office or your insurance agent for further assistance.

Single family dwelling mortgage loans secured by a primary residence and closed after July 29, 1999 are covered under the Homeowner’s Protection Act of 1998 (HOPA). The Act gives customers the right to request PMI deletion once the Loan to Value (LTV) ratio reaches 80%. This will automatically take effect once it’s scheduled to reach 78%.

If you feel your loan qualifies for PMI deletion, please send a written request to the PNC Bank ISAOA ATIMA address listed below so your request can be reviewed accordingly. PMI deletion requires a good pay history: no payment may be 30 or more days late in the past 12 months, and no payment may be more than 60 or more days late in the past 24 months. You may be responsible for the costs of an appraisal.

PNC Bank

Attention: PMI Department B6-YM13-01-5

PO Box 8736

Dayton, OH 45401-8736

The Servicemembers Civil Relief Act (SCRA) provides financial relief and protections to eligible servicemembers and their dependents. PNC is grateful for your service and we would like to help you understand your benefits and protections under SCRA as well as other similar benefits that PNC may be able to provide to you.

To find out more, please contact us at:

- Phone: 844-PNC-SCRA (844-762-7272)

- Email: Servicemembers@pnc.com

- Fax: 855-568-4532

- Mail:

PNC Bank

Servicemembers Operations Center, BR-YB58-01-U

PO Box 5570

Cleveland, OH 44101-0570

For your convenience, PNC offers a variety of methods for submitting your monthly mortgage payments. Visit our Payment Options page to learn more about your payment options.

To find out if your loan is eligible, call us at 1-800-822-5626 and ask for our Special Loans Department. Please note, your loan must be at least 6 months old to be considered for a Modification.

If your property lies within a FEMA defined Special Flood Hazard Area ( SFHA),and in a community participating in the National Flood Insurance Program (NFIP) Flood Zone "A" or "V", federal law requires you to maintain and provide proof of flood insurance coverage. If there are any changes in your flood zone, PNC Mortgage will notify you by mail.

You can find the terms of your repayment in your original note listed under the repayment terms section. If you have additional questions, please contact us at 1-888-762-2265. For information about refinancing, please contact us at 1-877-487-3420.

Your IRS 1098 Form for any interest paid the prior year is postmarked and mailed to you by January 31st. It is also available to view via Online Banking. Should you require a copy, you can download one through online banking.

Call 1-888-762-2265 or visit a branch after February 10th to request a copy from the prior year.

Other Loans

You can review your payoff information for your loan through Online Banking. Once you have signed onto Online Banking:

- Sign on to Online Banking.

- Select your loan account.

- Select Loan Payoff Information in the Account Actions section. There are some circumstances where payoff information will not be displayed. For those types of accounts, you will be directed to call us at 1-888-762-2265.

If you see an unfamiliar charge on your statement or within Online Banking, please call us at 1-888-762-2265.

| Payment Methods | Product | Description | How To Use |

|---|---|---|---|

| PNC Online Banking |

Personal Installment Loans and Lines of Credit | Make a payment to your account using PNC Online Banking. You can schedule one-time or recurring payments. | Sign on to Online Banking and click the green Make a Payment button. You can also click Pay and Transfer from any screen, then click PNC Payments. Click here to learn more. |

| PNC Mobile App[2] |

Personal Installment Loan | Make a payment to your account using PNC's Mobile App. You can schedule one-time, same-day payments from a PNC deposit account. | Download the PNC Mobile app from your phone's app store and log in. Select your account and choose Make a Payment to schedule a payment. |

| Automated Payments | Personal Installment Loans and Lines of Credit | Enroll in the Automated Payment Program and have your monthly payment automatically deducted from your deposit account. | Download, complete, and return the Automated Payment Authorization form using the instructions on the form OR call 1-888-762-2265 to have the form emailed to you to be submitted electronically. |

| Pay by Phone - Voice Banking[4] | Personal Installment Loans | Make a one-time, same-day payment using our Voice Banking service. | Pay over the phone with Voice Banking by calling 1-888-PNC-BANK (1-888-762-2265). If paying from a non-PNC deposit account, have your account number and routing number available. |

| Pay by Phone - Agent Assisted | Personal Lines of Credit | Make a payment with a PNC Agent over the phone. | Call a PNC Agent at 1-888-PNC-BANK (1-888-762-2265). If paying from a non-PNC deposit account, have your account number and routing number available. |

| In-Branch Payment | Personal Installment Loans and Lines of Credit | Make a payment at any PNC Branch. Find a PNC Branch |

Visit a PNC Branch during normal branch hours to make a payment. The payment is effective as of the date the payment is made, although it may take up to 2 business days for the payment to be reflected on your account. |

| Mail Your Payment | Personal Installment Loans and Lines of Credit | Make a payment to your account by mail. Send a check in the mail along with the payment slip provided at the bottom of your monthly billing statement. If you do not have a statement, please make sure to write your PNC account number on your check. |

Personal Installment Loans Address for regular mail payments: PNC Bank PO Box 747066 Pittsburgh, PA 15274-7066 Personal Installment Loans Address for overnight mail payments: c/o PNC Bank Lockbox 747066 500 First Ave Pittsburgh, PA 15219 Personal Lines of Credit Address for regular mail payments: PNC Bank PO Box 747032 Pittsburgh, PA 15274-7032 Personal Lines of Credit Overnight Payment: PNC Bank Lockbox 645993 500 First Ave Pittsburgh, PA 15219 Signature Lines of Credit Address for regular mail: Eastern States[5] PNC Bank PO Box 71335 Philadelphia, PA 19176-1335 Western States[5] PNC Bank PO Box 7422 Pasadena, CA 91109-7422 Signature Lines of Credit Address for overnight payments: Eastern States[5] PNC Bank Consumer Loan Center 6750 Miller Rd. Brecksville, OH 44141 Western States[5] Pasadena Tech Center 465 N Halstead St Ste 160 Pasadena, CA 91107 |

*Your use of the Voice Banking service, with the entry of your PIN, is your authorization for PNC Bank to initiate a payment via an ACH debit or other electronic entry to the designated account. Your payment cannot be canceled after you have submitted it.

To sign up for our free Automated Payments Program and have your loan payments automatically deducted from your checking or savings account, including accounts at other banks, download the Automated Payment Authorization form.

Automated Payment Authorization form - Complete, sign and return this form via mail, fax, or to a branch using the instructions provided on the form.

If you would prefer to have the Automated Payment Authorization form emailed to you so that you may complete and submit the form electronically, please contract our Customer Care Center at 1-888-762-2265.Automated Payment set up may take up to ten (10) business days from the date we receive your completed authorization form to process your request.

Please continue to make your payments until you receive a confirmation letter with the date that your automated payments will begin.

You can request to suspend or cancel your automated payment as long as your contact us at least three (3) business days before your next payment due date. Please call us at 1-888-PNC-BANK (1-888-762-2265) or visit the nearest PNC Branch.

Suspending your automated payment is a temporary option which will allow you to stop your automated payment for one month. You are still responsible for making your payment on time to avoid late fees. When you suspend your automated payment, you must make your monthly payment manually to keep your account current and allow automated payments to resume the next month.

If you chose to cancel your automated payment service, you will be responsible for making on-time payments once the automated payment has been removed from your account. Any applicable interest rate discount for automated payments will be lost, which means that your monthly payment may increase since additional interest would be charged.

Look on the detachable portion of your statement or coupon that you would return with a payment by mail. Your account number will be displayed there.

Yes. If you opt in, your Personal Line of Credit will provide you with overdraft protection when linked with your PNC Checking account.

The available line balance must be sufficient to cover the overdraft amount. The minimum amount that can be transferred is $50. Other restrictions and conditions may apply. Contact us for more details.

Your funds can be accessed by check, by transferring funds via Online Banking or in branch.

You can draw from your line of credit as many times as needed until you reach your line limit. Once you've made payments on your account, you can then borrow until you reach your limit again.