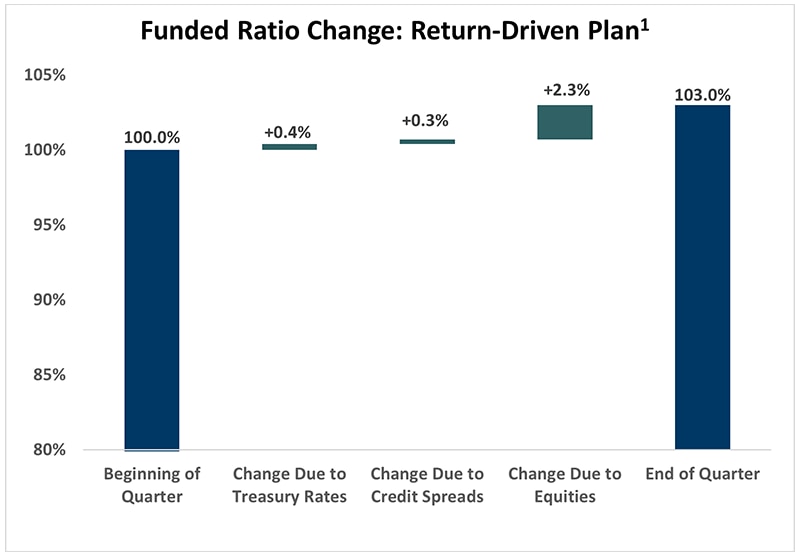

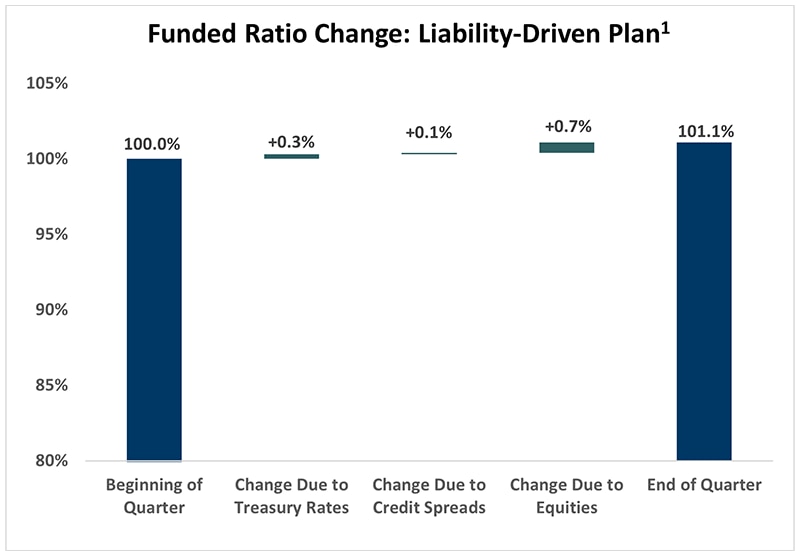

Corporate defined benefit plan funded levels increased during the fourth quarter of 2025. The primary drivers were positive returns in return-seeking asset classes. A typical return-driven plan had a 3.0% increase in its funded ratio, while a typical liability-driven plan experienced a 1.0% increase. Return-driven plans with higher equity allocations saw a larger increase in funded status due to the larger impact of positive equity returns on the assets. Year to date, the sample return-driven plan funded ratio has increased approximately 9.7%, while the sample liability-driven plan funded ratio has increased approximately 3.2%.

Chart 1: Funded Ratio Change: Return-Driven Plan1

View accessible version of this chart.

Chart 2: Funded Ratio Change: Liability-Driven Plan1

View accessible version of this chart.

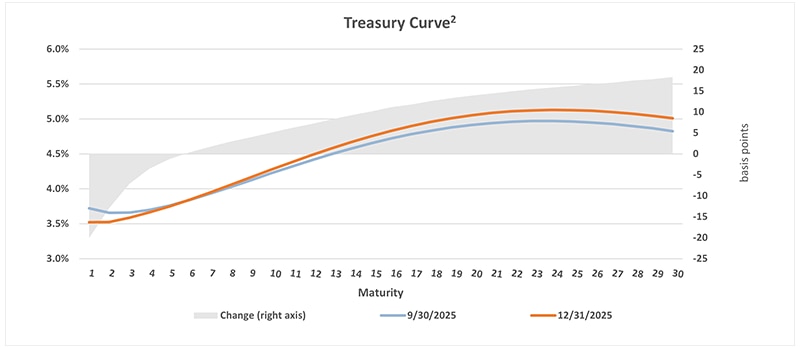

Treasury Rates

Treasury rates increased and had a positive impact on funded status.

During the quarter, the Treasury curve continued to steepen with rates decreasing along the short end and increasing on the long end of the yield curve. The short end of the curve decreased approximately 4-22 basis points (bps), while the long end of the curve increased by approximately 5-18 bps. The Federal Reserve reduced the federal funds rate by 25 bps in December which directly impacted the short end of the curve. In isolation, the change in long-term Treasury yields decreased the liability and caused an increase in funded ratios for return driven pension plans and liability driven plans.

Chart 3: Treasury Curve2

View accessible version of this chart.

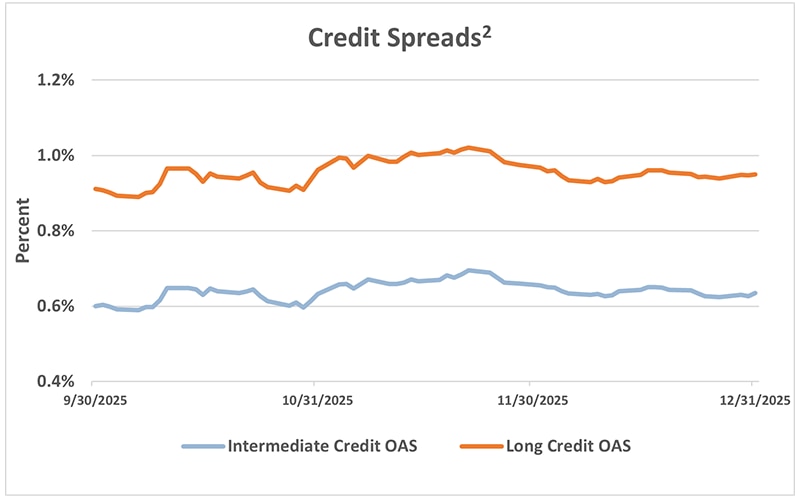

Credit Spreads

Credit spreads remained tight with slightly positive impact on funded status.

Credit spreads remained tight with some slight widening in November, causing a slight increase in discount rates and decreased liabilities. Intermediate duration credit spreads widened by 3 bps while long duration credit spreads widened by 4 bps. The overall persistence in tight spreads was driven by stable corporate fundamentals, and demand for yield. The slight widening in November was driven by equity market volatility. On a net basis, the total corporate bond discount rate for pensions increased approximately 5 bps and decreased plan liabilities. Due to the steepening of the yield curve, plans would have had varied experiences based on their unique duration profiles.

Chart 4: Credit Spreads2

View accessible version of this chart.

Equities

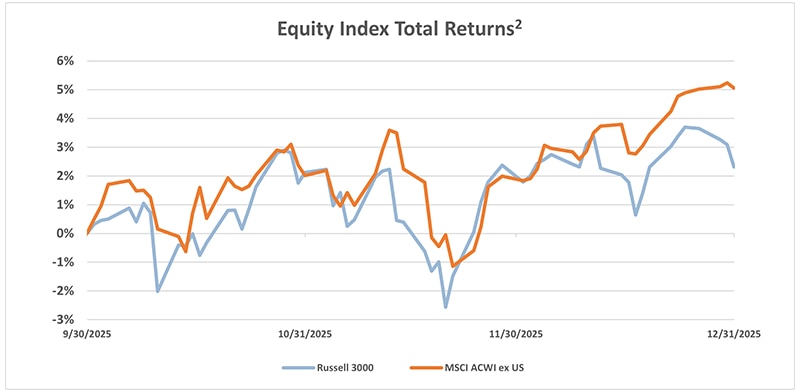

Equity market performance had a positive impact on funded status.

Overall positive performance in global equity markets helped funded statuses this quarter, driven by a continued tech-led rally along with other sectors such as financials and energy. Anticipated further Federal Reserve rate cuts and easing concerns over tariffs also contributed to the improvement. U.S. large cap stocks underperformed U.S. small cap stocks with returns of approximately 2.7% and 2.2%, respectively. International equities outperformed domestic equities and returned around 5.1% due to weakening of the U.S. dollar, local interest rate cuts and attractive valuations.

Chart 5: Equity Index Total Returns2

View accessible version of this chart.

1Assumptions

- Data as of 12/31/2025, Source: PNC.

- The funded ratio changes are for generic plans with allocation and liability profiles specified below. Results are market driven and do not incorporate any plan-specific effects, such as benefit payments, expenses, benefit accruals, or plan contributions. Funded ratio changes are sensitive to the beginning of the period funded ratio.

- A return-driven plan is a pension plan with an asset allocation commonly associated with an absolute return-objective and has a high allocation to return-seeking assets (public equity in this case) and typically has high funded status volatility. Assumed asset allocation is 70% MSCI All Country World, 30% Bloomberg Aggregate.

- A liability driven plan is one that is well along its path in a liability-centric approach to investing and has a large allocation to long-duration bonds to help reduce funded status volatility. Assumed asset allocation is 20% MSCI All Country World, 64% Bloomberg Long Credit, 16% Bloomberg Long Government.

- Liability profile is based on BAML Mature/Average U.S. Pension Plan AAA-A Corp Indexes with average duration of 13.0 years.

2Data as of 12/31/2025, Source FactSet®. FactSet® is a registered trademark of FactSet Research Systems Inc. and its affiliates.

Contact Us »

Accessible Version of Charts

Chart 1: Funded Ratio Change: Return-Driven Plan1

| Return-Driven Plan | Funded Ratio Change |

| Beginning of Quarter | 100.0% |

| Change due to Treasury Rates | 0.4% |

| Change Due to Credit Spreads | 0.3% |

| Change Due to Equities | 2.3% |

| End of Quarter | 103.0% |

Chart 2: Funded Ratio Change: Liability-Driven Plan1

| Liability-Driven Plan | Funded Ratio Change |

| Beginning of Quarter | 100% |

| Change due to Treasury Rates | 0.3% |

| Change Due to Credit Spreads | 0.1% |

| Change Due to Equities | 0.7% |

| End of Quarter | 101.1% |

Maturity |

9/30/25 |

12/31/25 |

Change (right axis) |

1 |

3.66% |

3.52% |

-0.14 |

3 |

3.66% |

3.66% |

0.00 |

5 |

3.75% |

3.59% |

-0.16 |

7 |

3.95% |

3.95% |

0.00 |

9 |

4.12% |

4.16% |

0.04 |

11 |

4.31% |

4.37% |

0.06 |

13 |

4.49% |

4.58% |

0.09 |

15 |

4.65% |

4.75% |

0.10 |

17 |

4.78% |

4.90% |

0.12 |

19 |

4.88% |

5.01% |

0.13 |

21 |

4.94% |

5.09% |

0.15 |

23 |

4.97% |

5.12% |

0.15 |

25 |

4.96% |

5.13% |

0.17 |

27 |

4.93% |

5.10% |

0.17 |

29 |

4.87% |

5.04% |

0.17 |

Date |

Intermediate Credit Option-Adjusted (OAS) |

Long Credit Option-Adjusted Spread (OAS) |

9/30/25 |

0.60 |

0.91 |

10/31/25 |

0.63 |

0.96 |

11/30/25 |

0.66 |

0.97 |

12/31/25 |

0.63 |

0.95 |

Chart 5: Equity Index Total Returns2

| Index | Date | Percent |

| Russell 3000 | 9/30/2025 | 0.00% |

| 10/31/2025 | 2.02% | |

| 11/30/2025 | 2.37% | |

| 12/31/2025 | 2.31% | |

| MSCI ACWI ex USA | 9/30/2025 | 0.00% |

| 10/31/2025 | 2.02% | |

| 11/30/2025 | 2.00% | |

| 12/31/2025 | 5.05% |