Raising Additional Capital: Recent Trends

A rapid rise in market volatility, a renewed push for social reform, and other recent events have acted as catalysts for change. In response, nonprofit organizations have been financially challenged in responding to the needs created by these events while also supporting existing strategic plans for deployment of capital. In this flash update, we discuss recent trends we’ve seen in nonprofit organizations looking to raise additional capital.

Survey Says…

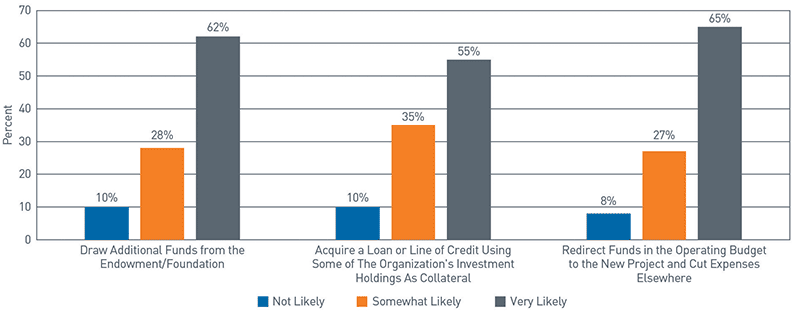

A 2020 PNC survey of nonprofit organizations[1] asked a question regarding where decision-makers would look to raise money to fund a new project: taking a special distribution from long-term asset pools, borrowing the money, or redirecting funds from the operating budget. Based on the responses, these three options are key capital sources for nonprofit organizations, with a majority suggesting that they would “highly likely” consider each of them as a source of liquidity.

View accessible version of this chart.

Evaluating Different Funding Sources

- One of the most important concepts in finance is the cost of capital, referring to how much it costs to have money available. Part of this cost can be measured in a tangible way. As an example, if the money is borrowed, what is the rate of interest on the debt? Conversely, other contributors to the cost of capital can be less tangible. For example, staying with the example of debt, there can be things like the potential for financial distress associated with owing money (and needing the ongoing cash flow to support debt payments) that are harder to measure.

- At the core of the concept is the idea that a dollar is not free to obtain. There are costs associated with fundraising, interest owed on debt borrowed, or even lost investment return potential the dollar might have had if it had remained invested (i.e., as part of an endowed asset pool). These considerations are important when deciding what the most appropriate source of capital is for a given need or project.

Best Practices and Important Considerations

- A possible funding source to consider is a capital campaign or other large fundraising effort. Donors might be willing to make donations using appreciated (or re-appreciated) securities. Being mindful of how donors might find it most advantageous to give (i.e., cash versus stock gifts), and especially how that might be different than in prior years, can help fundraisers be successful. It is important to remember that cash isn’t the only way to fund a gift and that there can be material advantages to donors using appreciated assets.

- There is a lot of pressure being put on institutions with large, long-term asset pools to make special distributions to support operations. For institutions considering taking a special distribution from a long-term asset pool, or explaining to stakeholders why it might not always be a prudent idea, we recommend first reading our report Understanding Special Distributions from Long-Term Asset Pools. In our opinion, the decision hinges on balancing the need to maintain solvency in the present with being financially viable in the future, especially given a special distribution could permanently impair future distributions. For organizations considering borrowing from or against their endowment or other long-term asset pools, we suggest our report Nonprofit Borrowing.

- We highly recommend that decision-makers consider implementing an investment strategy designed to balance investment goals and objectives with considerations for both short-term volatility and long-term shortfall risk. We are seeing institutions shift to a more holistic, enterprise-focused investment management model. Specifically, we see this occurring in two ways: first by analyzing the role of balance sheet investment assets in contributing to their financial wellbeing and second, by using the relationship between investment assets and financial results to help determine the best asset allocation for addressing liquidity and cash flow concerns.

Accessible Version of Chart

| Not Likely | Somewhat Likely | Very Likely | |

| Draw Additional Funds from the Endowment / Foundation | 10% | 28% | 62% |

| Acquire a Loan Or Line of Credit Using Some Of The Organization's Investment Holdings As Collateral | 10% | 35% | 55% |

| Redirect Funds In The Operating Budget To The New Project And Cut Expenses Elsewhere | 8% | 27% | 65% |