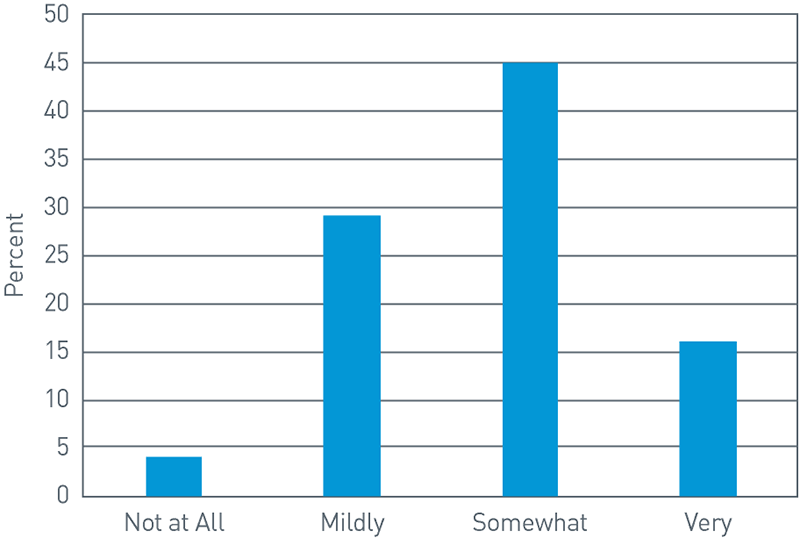

"How do you think the economy is doing?"

If you asked a randomly selected group of individuals, you would likely get a range of responses, from “not good” to “the strongest it has ever been.” In our November 2019 State of Nonprofits Webinar, we asked 489 nonprofit professionals to fill in the prompt, “I am ___ concerned about the next recession.” Of the 239 people who answered, the majority indicated “somewhat” or “very.”

Chart 1: How Concerned Are You About the Next Recession?

View accessible version of this chart.

Source: PNC

The irony is not lost on us as we begin a discussion of preparing for the future with commentary about how predicting the future is hard. But we think this perspective helps us avoid overconfidence in our ability to predict both the outcome of future events and how those outcomes could be reflected in financial markets.

Our primary goal is helping clients meet their long-term financial objectives — not harvesting every single basis point of a bull market, or participating in the latest investing fad, or timing every market movement.

We believe investing is for the long term. It is crucial to identify your biases, be comfortable with the risks you take, and have a thorough understanding of what you own and why. This is the best chance, in our view, for investors to maintain a well-thought-out plan that will help maximize the likelihood of achieving long-term goals. That said, patience is key. The long term comprises a series of short terms, and we live in those short-term periods. Even the best investment strategy may struggle in certain market environments.

Here we focus on six best practices for preparing nonprofit organizations for the next recession:

- Prioritize your efforts based on efficacy.

- Exercise caution around major capital investments.

- Increase fundraising efforts.

- Reduce spending/distribution policy.

- Stress test your operating budget sources.

- Investment portfolio positioning: Take a defensive stance.

We believe a few best practices can go a long way toward helping your organization be better positioned to weather the next recession.

Prioritize Efforts Based on Efficacy

It happens to most organizations, whether for-profit or nonprofit – programs, operations, buildings, and more start with the best of intentions and carefully laid strategic plans, only to struggle over time or even fail to achieve initial liftoff. Whether it is a reluctance to admit defeat or the often-misplaced optimism that “just around the next corner is success,” these types of time- and resource-draining initiatives can take away from the overall success of your mission.

From a best practice standpoint, we recommend periodic evaluation of all operations and activities. Create a scorecard for each area of operation and determine if your organization is effective in that area. How is each activity contributing to the success of your mission? If there are areas with low success rates or are struggling to achieve mission success, consider redeploying the time and resources to other areas where your organization is having success.

Exercise Caution around Major Capital Investments

It could be fairly easy to fall into the mindset of “success means continually expanding,” only looking at the bottom line or new locations. However, growth is not always appropriate or warranted. Sometimes the organization is “just the right size” for the given market or objectives at a particular point in time. The mindset of expansion has its place and is important, especially for nonprofit organizations trying to better our communities.

For example, perhaps your nonprofit wants to open more shelters to help the homeless community. However, much like certain banks that grew too big and failed prior to the great recession of 2008, growing too big and too quickly can lead to overextension and financial failure. In our view, it is better to serve the market you can well than serve every market at once, poorly, and end up facing insolvency.

We recommend caution at this point in the business cycle. Think through major capital investments – what does your five-year budget projection look like? What would happen if you stress tested it for a market crash or a major fundraising drought?

If the answers to these questions do not paint a positive picture, now might be the time to solidify around existing operations and be thoughtful with any expansion plans.

Increase Fundraising Efforts Now

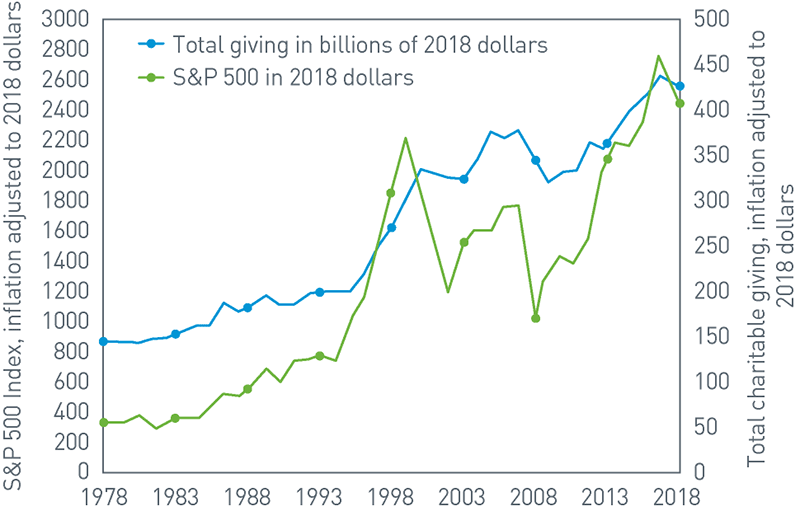

We understand there is a highly positive correlation between the performance of the stock market and the overall level of charitable giving. The hypothesis is that the stock market serves as an indicator of financial and economic health to both households and corporations: When the stock market is “good,” charitable giving is up; when the stock market is “bad,” charitable giving tempers lower. In a similar vein, private foundation giving, which is based on a minimum required distribution of equal to approximately 5% of investment assets, is also tied to the performance of the investment markets by default.

Chart 2: Link between Stock Market Performance and Charitable Giving As of 1/1/19

View accessible version of this chart.

Source: Giving USA 2019

The stock markets have done well since the last recession; barring a few periods of volatility and short downturns, the markets have generally been in a positive trend over the last 10 years. With sentiment high as a result, and bearing in mind that it is easier to raise money when the stock markets are up than when they are down, we believe now is the time to fundraise and campaign on the idea that “we (the charitable organization) need money now to prepare for future rough times.”

Toward this end, we recommend taking what is going well for your organization, specifically what is driving a high impact toward your mission, and developing more talking points around it. Be honest and sidestep any sob stories. Donors want honesty about the difference their contributions could make. Avoid “guilting” donors into giving because of a problem. Instead, focus on your solution and how the donation is going to enable that solution.

For more information on driving donor engagement, please see our white papers Philanthropy Outlook in 2019–20 and Ten Questions Donors Should Ask a Nonprofit Organization before Giving.

Reduce Spending/Distribution Policy

One of the biggest challenges facing investors today is the possibility of low economic growth and below-average investment returns for most asset classes over the next 10 years.

The reality of what we believe to be a lower-return environment has been consistently reflected in our Capital Market Assumptions. To this end, we believe this future return environment should factor into discussions around return expectations, asset allocation, and distribution policies.

We encourage nonprofit organizations to meet more frequently with their investment advisors and boards of directors to help confirm their investment programs remain oriented to achieve objectives while weathering potential turbulence. At the end of the day, what other levers can an organization pull so it is not relying solely on investment performance to achieve long-run financial goals and objectives? The more money that remains in the investment program, the greater the potential effect of compound interest.

Stress Test Your Operating Budget Sources

In our opinion, stress testing is a universal best practice for any organization’s budget forecasting. Whether for a for-profit or a nonprofit organization, the potential for external or internal circumstances to affect budget sources is a very real and potentially harmful concern. Consider the simple hypothetical example, with the following assumptions:

- There is an investment portfolio with $10 million.

- Each year, the investment portfolio distributes 5% of its ending market value to the budget in the following year.

- The organization’s total budget is $1 million, of which the investment portfolio provides a target of 50% of the budget ($500,000).

- $500,000 in budget funding comes from sources (for example, government funding, grants, fee for service) other than the investment portfolio.

Table 1: Example of How Budgets Can Be Affected

| Investment Performance Scenario | Starting Value | Return | Ending Value | Distribution | + | Other Funding | = | Budget |

| Major Downturn | $10,000,000 | -20% | $8,000,000 | $400,000 | $500,000 | $900,000 | ||

| Downturn | $10,000,000 | -10% | $9,000,000 | $450,000 | $500,000 | $950,000 | ||

| Weak Negative | $10,000,000 | -5% | $9,500,000 | $475,000 | $500,000 | $975,000 | ||

| Zero | $10,000,000 | 0% | $10,000,000 | $500,000 | $500,000 | $1,000,000 |

Source: PNC

While this is a very simple stress test, it is easy to see the effect a market downturn could have on the budget. In the major downturn scenario, a 20% drop in market value of the investment portfolio resulted in the budget being $100,000 short of the target $1 million. How could the organization in that scenario make up the budget shortfall to pay its bills and funds its operations?

Even in the case of a zero return year, we would note the distribution will impair the principal of the investment portfolio to $9.5 million to start the next year. This means it would need to earn an even greater return for the math to work out to a 5% distribution equaling the $500,000 required to fund the budget in full in future years. The point of scenario testing is not to scare the board of directors but rather to determine what to do in these scenarios. Having a written plan in place could help reduce the likelihood that a bad market scenario could result in mission impediment for your organization. That plan could involve a line of credit, a hierarchy of programs, operations, and expenses that are the first/last to be cut in a budget shortfall situation, or a strategy for emergency fundraising appeals.

Investment Portfolio Positioning: Defensive Stance

The US economy started 2020 in its longest expansion in history, with the stock market charting new all-time highs. But have we reached a market peak? We don’t believe so.

To be clear, we are not blindly bullish — a core belief of our investment process is that financial markets are complex, dynamic systems.

Rather, in our First Quarter 2020 Strategy Insights, 20/20 Vision, we made the analogy that investors need bifocals to be able to focus on both the near and far term (nearsighted and farsighted). Our nearsighted view is one focused on still-positive fundamentals and a short-term cyclical reacceleration, but our farsighted view is focused on the potential impacts from the 2020 US presidential election.

As mentioned earlier, we encourage nonprofits to meet more frequently with their investment advisor and board of directors to help confirm their investment programs remain oriented to achieve objectives while weathering potential turbulence. With this in mind, there are a few factors we believe are worth keeping in mind:

- Portfolio performance has been robust, but future expectations are likely to be lower. That needs to play into spending policy and distribution discussions.

- With 2019 equity returns near the best of this business cycle, valuations have also ticked higher, suggesting moderating returns ahead.

- With the Federal Reserve (Fed) back in easing mode, 2019 enjoyed strong double-digit returns across multiple fixed income asset classes. Now that the Fed is back “on pause,” fixed income returns should likely be much more muted.

- We continue to see a better return environment for alternative strategies (private equity/debt/real estate), though projected returns for private equity have started to come down marginally alongside public markets. In a subdued return environment, the illiquidity premium becomes that much more valuable.

Toward this end, we think there are certain measures a nonprofit investment program can take to position portfolios to weather periods of heightened volatility.

Table 2: Positioning Portfolios

Key Themes

|

Equities

|

Fixed Income

|

Alternatives

|

Source: PNC

For more of our thought leadership on the markets, reach out to your investment advisor.

Conclusion

Nonprofit organizations are increasingly important in the role they play in our communities, our country, and the world.

Whether a religious institution serving our faiths, a higher education institution teaching the next generation, a nonprofit healthcare system keeping the community healthy, or any of the other nonprofit institutions serving as pillars of our society, financial planning plays a major role in helping to confirm that resources are available to fund mission objectives and operations.

While this paper focuses on a tough topic, recession, we do not want to give the impression that we believe the sky is falling or will be falling soon. Rather, we encourage the leadership of nonprofit organizations to plan now for the next rainy day. Focus on proactive steps that can help create readiness for the next recession, a time when nonprofit organizations will likely be needed the most. To the extent these best practices can help stabilize your organization’s finances and operational readiness, we hope it prepares your mission for uninterrupted progress regardless of market environment.

About The Endowment & Foundation National Practice Group

The Endowment & Foundation National Practice Group builds on PNC Bank’s long-standing commitment to philanthropy and is focused on endowments, private and public foundations, and nonprofit organizations. Our group is structured to help these organizations address their distinct investment, distribution and capital preservation challenges.

TEXT VERSION OF CHARTS

How Concerned Are You About the Next Recession?

| Answer | Percent |

| Not at all | 4% |

| Mildly | 31% |

| Somewhat | 48% |

| Very | 17% |

Link between Stock Market Performance and Charitable Giving As of 1/1/19

| Year | Total Charitable Giving (in Billions $) | S&P 500 Price Return Index Inflation Adjusted to 2018 Dollars using CPI Core |

| 1978 | 38.57 | 367.59 |

| 1979 | 43.11 | 370.84 |

| 1980 | 48.63 | 415.88 |

| 1981 | 55.28 | 342.72 |

| 1982 | 59.11 | 376.31 |

| 1983 | 63.21 | 421.36 |

| 1984 | 68.58 | 407.26 |

| 1985 | 71.69 | 493.26 |

| 1986 | 83.25 | 544.84 |

| 1987 | 82.2 | 533.72 |

| 1988 | 88.04 | 573.24 |

| 1989 | 98.3 | 698.42 |

| 1990 | 98.48 | 619.65 |

| 1991 | 102.58 | 749.66 |

| 1992 | 111.29 | 757.48 |

| 1993 | 116.58 | 786.22 |

| 1994 | 120.05 | 754.55 |

| 1995 | 123.1 | 982.16 |

| 1996 | 138.89 | 1,150.84 |

| 1997 | 162.46 | 1,474.23 |

| 1998 | 176.56 | 1,822.67 |

| 1999 | 203.19 | 2,138.33 |

| 2000 | 229.66 | 1,873.30 |

| 2001 | 232.09 | 1,584.87 |

| 2002 | 232.72 | 1,191.16 |

| 2003 | 237.45 | 1,489.10 |

| 2004 | 260.26 | 1,587.07 |

| 2005 | 292.43 | 1,600.85 |

| 2006 | 296.09 | 1,772.55 |

| 2007 | 311.06 | 1,791.48 |

| 2008 | 299.61 | 1,082.94 |

| 2009 | 274.78 | 1,312.98 |

| 2010 | 288.16 | 1,471.07 |

| 2011 | 298.5 | 1,438.29 |

| 2012 | 332.61 | 1,600.68 |

| 2013 | 332.52 | 2,039.01 |

| 2014 | 357.6 | 2,235.02 |

| 2015 | 375.90 | 2,173.18 |

| 2016 | 396.52 | 2,328.80 |

| 2017 | 424.74 | 2,732.80 |

| 2018 | 427.71 | 2,506.84 |