Article Summary

- Students should build a simple budget and track their spending. They may want to consider using the 50/30/20 rule to split their money between needs, wants, and savings.

- Save consistently — even small amounts — using automations, the 52-week challenge, and “keep the change” habits.

- Add a no-spend week or month and funnel that cash straight into savings.

- Review finances regularly and follow the month-by-month plan; do a quick post-holiday reset if you overspent.

New Year’s resolutions aren’t just for getting more sleep, drinking more water, or finally organizing your closet. They’re also a great chance to hit reset on your money. Just a few small habits can make a big difference.

Budgeting for big expenses like tuition and textbooks, along with a bit of "fun money," may be challenging when you're a student working a part-time job. The good news is, a few small tweaks often make a big difference. This student guide to money resolutions may help you build a strong financial foundation for 2026 and beyond.

Financial Resolution 1: Get into the Budgeting Groove

It's not unusual for students to find themselves short on money with no idea where it went. A budget helps you balance income and expenses, so you know exactly how much you earn, spend, and save. With all the budgeting apps available today, it's easier than ever to enter your part-time income and track all spending —from large expenses like textbooks to streaming services, campus meals, and even vending machine snacks.

Starting with all these details makes it easier to adjust the numbers so they work with your budget.

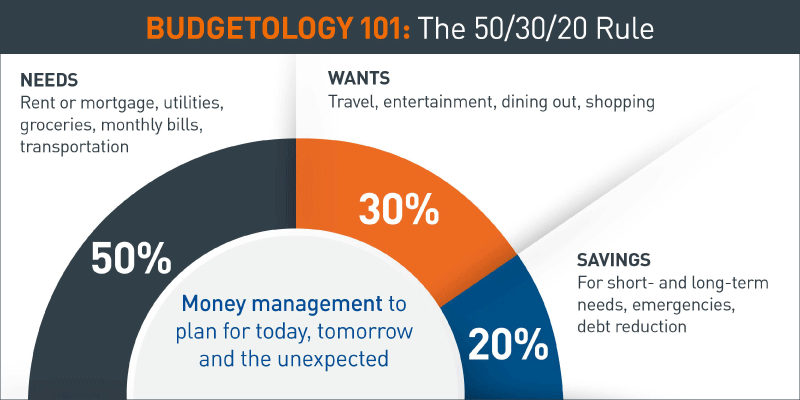

Not sure where those numbers should be? Financial experts often recommend following the 50/30/20 budget guideline: allocate 50% of your monthly income for things you need, 30% for things you want, and 20% for building your savings and paying down debt.

Figure 1: 50/30/20 Financial Guideline

Accessible version of this graphic is below.

Financial Resolution 2: Save Something Every Month

When it comes to saving money, consistency is key. Resolve to stash a little cash away every week or month and watch your money build. These three tips make saving easy, even on a student's budget:

- Try the 52-week savings challenge - Put $1 into your savings the first week, $2 the second week, $3 the third week — you get the idea. By the time you reach week 52, you’ll be depositing $52 and will have saved up $1,378!

- Pay yourself first – Choose an amount and set up automatic payments from your electronic paycheck to your savings account(s). When you don’t see that money in your checking account, you won’t be tempted to spend it.

- Keep the change - Each time you buy something with cash, put the change in a jar and set it aside. When the jar is full, make a deposit into your savings account.

Financial Resolution 3: Take the No-Spend Challenge

One nice thing about campus life is that there are plenty of things to keep you busy without having to spend money. Try adding a no-spend month (or even a week) to your 2026 money plan. During the designated time, resolve to spend absolutely nothing on wants. Nada. Zip. Zilch. Instead, deposit the money you would have spent into your savings account to give your balance an immediate boost. (Bonus: less clutter! Doesn’t that feel good?)

Financial Resolution 4: Review and Reflect

When you're busy with school work and a social life, it’s tempting to skip this step – but it’s important. Schedule time each week or month to check in on your finances and ask yourself:

- Are you on track to meet your savings goals?

- Are you paying your bills on time?

- Did you anticipate any extra financial obligations coming up?

If not, don’t give up. Just like calculus or chemistry, good financial habits sometimes come with a bit of a learning curve, and that's okay. Adjust, try again, and pat yourself on the back for the progress you’ve made managing your money and building your wealth.

Recovering from Holiday Spending: A Quick Money Reset

If you're still reeling from winter break and holiday spending, it's hard to start thinking about the future. Use these tips to give yourself a quick money reset:

- Review your post-holiday bank and credit card statements: Get an understanding of where your money actually went and expenses you might have missed or underestimated.

- Set a mini-budget for January: Prioritize essential expenses, such as rent, groceries, and transportation. Keep extra spending to a minimum while you stabilize your finances.

- Plan a "no spend" week or month: Intentionally avoid spending money on things you don't absolutely need for a set period of time. Use this as a chance to reset spending habits and pad your bank account.

- Create a realistic repayment plan: If you used credit or spent down savings over the holiday season, calculate how much you can allocate each month toward getting back on track.

- Reflect and set boundaries: Think back on what triggered your overspending this year. Was it pressure from family or friends? Lack of planning? Impulse buys? Use this information to set boundaries for next year.

2026 Money Plan for Students

Without a plan, financial resolutions may start to feel overwhelming. This year-long student guide helps turn small steps into a big difference:

January - March: Review current spending to clarify where your money goes. Set up automatic savings (even a little bit helps), and see if there are any student discounts you can use to lower spending. Start looking for and applying to scholarships for the next academic year.

April - June: Sell any used textbooks you no longer need and explore summer jobs or side gigs. Set aside a savings goal for the summer so you start next semester with some breathing room.

July - August: Finalize your fall budget, factoring in tuition, books, housing, food, and some money for social activities. Consider renting or buying any textbooks you need. Review your fall financial aid package and look for any new opportunities.

September - November: Reassess your spending habits and make any necessary adjustments. Consider bumping up your savings to prepare for the upcoming holiday season, and look for earning opportunities you may be able to take advantage of over winter break.

December: Set spending limits for holiday shopping. Make a plan for how much you'll spend on gifts, travel, and other expenses, then commit to sticking to it. Before heading back to school, spend some time reflecting on the progress you made over the year and set new financial goals.

Heading back to campus with focused New Year resolutions may help you take better control of your money. Your 2026 money plan doesn't have to be perfect, and you don't need to make drastic changes. Start by making one good choice at a time and let those small wins help you build strong financial habits over time.

TEXT VERSION OF GRAPHIC

Figure 1: 50/30/20 Financial Guideline

50% Needs: rent/mortgage, utilities, groceries, transportation, etc.

30% Wants: dining out, entertainment, shopping, travel, etc.

20% Savings & Debt Repayment: emergency savings, long-/short-term savings, retirement, student loans, credit card debt, etc.