Being a student is getting more expensive. Here are six easy steps to creating a budget to help you monitor, manage, and make the most of your money.

Tuition, room and board, textbooks, class supplies — college costs can really add up. On top of that, you have personal expenses and savings goals to think about. Don’t let money management overwhelm you. It can actually be easy when you have the right foundation in place. That foundation is a budget.

A budget is a plan that enables you to see how much money you have coming in and how much is going out to pay for various expenses. It empowers you to control your finances and make smart decisions about saving and spending.

Here are six easy steps to help you get your college budget off the ground:

Step 1: Determine Your Total Income

Think about all of your income sources — any regular paychecks, cash from dog walking or babysitting, financial aid, scholarships or grants, birthday or holiday money, financial assistance from family, and college savings (like from a 529 Plan). Write down the dollar amount of each as a monthly sum that’s available to you. Then add these figures together to determine your total monthly income.

Step 2: Create a List of Your Expenses

Next, turn your attention to your monthly expenses. Being able to anticipate your monthly financial obligations is critical to successful budgeting, so take some time to really think this through. Referring to your recent bank statements can help you see where your money typically goes.

Common costs for college students include:

- Tuition payments

- Textbooks and other class supplies

- Room and board or rent

- Groceries

- Utilities

- Phone

- Transportation

- Dining out

- Clothing

- Entertainment

Of course, expenses vary based on where students live and other factors. For example, if you’re living off campus, you may need to factor in gas, parking, and car loan and insurance payments, whereas someone living on campus may not.

Step 3: Categorize Your Expenses

Look over your list of monthly expenses and categorize each of them as a need, a want, savings or debt.

- Needs are necessities — expenses you can’t avoid: housing, food, transportation, etc.

- Wants are extras or nice-to-haves: dining out, going to the movies, buying clothes, etc.

- Savings should include three categories: emergency savings for unexpected expenses, short-term savings (for that spring break trip or a new phone) and long-term savings for your financial future (like a house or retirement).

- Debt includes any financial obligations you have committed to, like a car loan or credit card payments.

Step 4: Create Your Budget

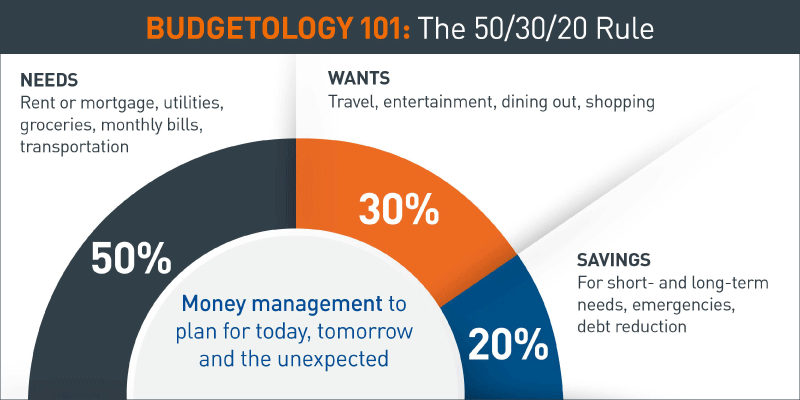

Figure 1: 50/30/20 Financial Guideline

Accessible version of this graphic is below.

Now that you know the components of your college budget, pull them all together in a form that makes it easy for you to refer to your budget throughout the month and make needed updates. Create a simple spreadsheet or find a template online to help keep your budget organized and current.

Enter all of your expenses, putting numbers to each. For some line items — those that are the same from month to month — this will be easy. For others, you may have to estimate. Once again, your bank statements may be helpful as a starting point. Look at several months to calculate an average.

As you work toward your ideal budget, you can also refer to the 50/30/20 rule, a guideline many financial experts recommend for budgeting costs. They suggest allocating income this way:

- 50% to needs

- 30% to wants

- 20% to savings and repaying debt

This guideline can help you keep your budget on track, as you look back to evaluate where you spent money in any given month. Keeping these percentages in mind may help you identify areas where you can cut back or where you have wiggle room to spend a little more.

PNC’s Student Budget Calculator can also help you get your budget where you want it to be. Check it out!

Step 5: Track Your Spending

Having a budget only works if you stick to it! Track your spending and subtract anything you pay out from your total monthly funds. This will help you stay current on your financial situation, so you know exactly how much money you have to work with at any given time.

Be as exact as possible with your tracking. Hang onto receipts until you’re able to record them, and refrain from rounding up or down. While rounding may seem easier to do in the short term, those dollars and cents add up. If you’re not recording your expenditures precisely, you may find yourself accidentally overspending.

Step 6: Revisit and Adjust Your Budget

One of the great things about having a budget is that you can look for opportunities to put yourself in a better financial position. For example, maybe you’ll find that you can save money at the grocery store by making a list and shopping for sales. You have the power, then, through your budget, to move that extra money from the grocery column into the savings column. By revisiting and adjusting your budget regularly, you can move yourself closer and closer to your financial goals.

Remember: Practice makes perfect! Don’t get down on yourself if you make some budgeting mistakes as you start out. Just like every other aspect of your college journey, budgeting is a learning experience. Once you get the hang of it, you’ll be managing your money like a pro!

Smart Ways to Save Money in College

Sticking to a budget is a lot easier when you’re not constantly stressing about money. The good news is that you can cut costs in college without making major sacrifices. Here are some easy ways to save while still enjoying the college experience:

- Take advantage of student discounts: Many retailers, restaurants, and services offer discounts for students. Always ask if there’s a student rate available.

- Buy used textbooks or rent them: New textbooks are often expensive. To save money, look for secondhand options, rental programs, or digital versions. You can also consider reselling your books after you're done with them.

- Limit dining out: Meal plans and home-cooked meals can save you a lot compared to eating out or ordering in.

- Use public transportation: If your campus offers free or discounted transportation, take advantage of this perk instead of paying for gas and parking.

- Look for free campus events: Many colleges host free entertainment, workshops, and activities for students, helping you stick to your budget without skimping on fun.

Remember, even small changes can add up over time. Finding simple ways to cut costs gives you more flexibility in your budget, making it easier to cover expenses, build savings, and set yourself up for future success.

TEXT VERSION OF GRAPHIC

Figure 1: 50/30/20 Financial Guideline

50% Needs: rent/mortgage, utilities, groceries, transportation, etc.

30% Wants: dining out, entertainment, shopping, travel, etc.

20% Savings & Debt Repayment: emergency savings, long-/short-term savings, retirement, student loans, credit card debt, etc.