It arrives every month: Your monthly credit card statement. And, chances are, looking at your balance and making a payment are just part of your financial routine.

However, when receiving your statement, it could really pay to invest an extra minute and take a closer look. Because your credit card statement tells you about more than just your transactions.

"We’re all guilty of scanning the basic information, making the payment, and moving on,” offers Lakhbir Lamba, PNC Bank’s Head of Retail Lending. “But a credit card statement contains a variety of other indicators about your current financial status. That makes it important to give the information a closer look. And the closer you examine it, the more your credit card statement tells you."

So, what buried treasure is found in your credit card statement? Here’s the rundown.

First, The Basics.

If you hold a credit card, then you already know about your Payment Due Date, the Amount Due, and the Balance. These three items are the nuts and bolts of owning a credit card.

Further, your statement will contain a Late Payment Warning. This details how much in additional fees you’ll be charged if you’re late—and how much your interest rates and payments could climb as a result.[1]

“It’s always important to realize that a credit card is a loan,” comments Lamba. “And remaining current is necessary to not incur additional, unnecessary costs. That’s why you should always be aware of your payment due dates, even if it means setting a reminder on your calendar.”

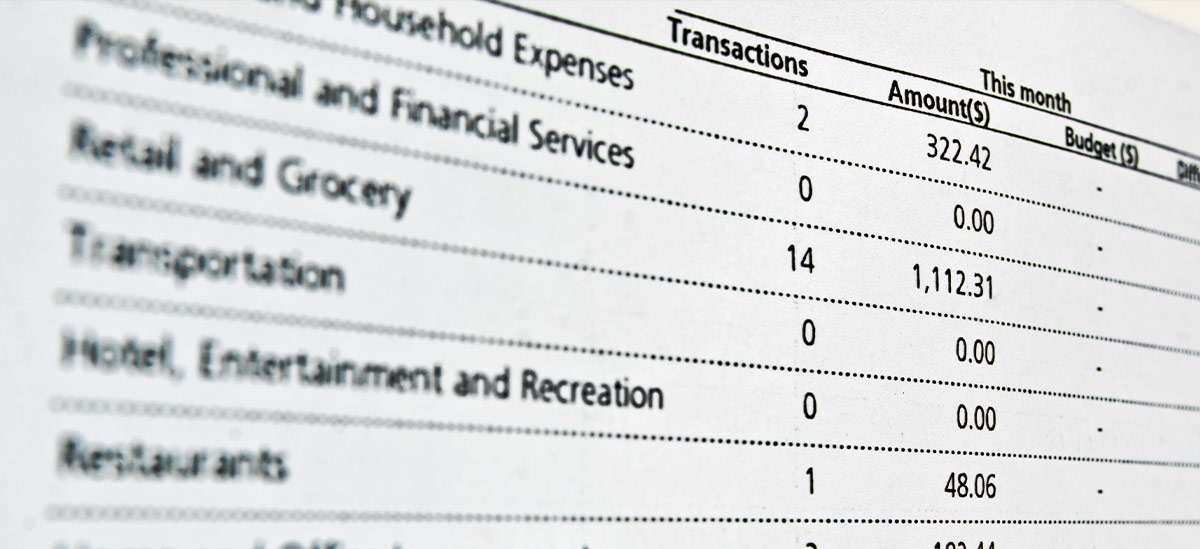

At the same time, you’ll also find your Account Summary, which recaps your activity over the previous month. In it you’ll find information such as your Previous Balance, any Payment Received or Credits to your account, the total of your new Purchases or Cash Advances, Fees levied to your account, and Interest Charged.

Second, Look Over Your Activity.

While reviewing your previous month’s card transactions may seem tedious, a minute or two of your time could save you a lot of money. This is your opportunity to double check the details of your credit card activity for accuracy and, even more importantly, instances of fraud.[2]

In accordance with the Fair Billing Act of 1974, you have recourse when it comes to protecting yourself against inaccurate or fraudulent credit card charges. If you notice something out of place on your credit card, it’s vital to contact the issuer's credit card support immediately to help resolve any issues.[3]

Keep in mind that if you don’t report questionable charges, you could be liable for those fraudulent or mistaken charges. “We always do our best to investigate cardholder problems,” explains Lamba. “But the longer someone delays reporting the issue, the harder it becomes.” By law, you have 60 days from the receipt of your statement to dispute charges.

Your Credit Usage and Interest.

If you’re a credit card holder, you have a credit score, too. The more responsible your credit card use is, the more positive the effect will be on your credit score.

As Lamba points out, “Lenders typically want to see credit use of 30% or below of the credit limit. The closer you get to your credit limit, the more it could adversely affect your ability to secure additional credit on the card or your future applications for additional types of credit.”[4]

Your statement will also detail both the amount of Interest Charged as well as the Annual Percentage Rate you’re paying.

Finally, The Extras

There are several different types of cards[5] that produce different statement types. For example, if you have a Rewards Card, your statement will detail all the benefits you’ve accrued in the previous month. Depending on the rewards card you hold, this might take the form of cash back, airline miles, points toward hotel rooms, or some other benefit. In addition, your statement should contain information on how to redeem rewards, if applicable.

So, there you have it. Now you can read your monthly statement like a financial pro—as well as take any necessary steps to address issues or begin building your credit. And the very first step is making your credit card statement work for you.