Read a summary of privacy rights for California residents which outlines the types of information we collect, and how and why we use that information.

Corporate History

PNC is the product of a merger of two distinguished Pennsylvania banks in 1983: Pittsburgh National Corporation and Provident National Corporation based in Philadelphia. Each of these institutions had served diverse markets so that merger creating PNC also became the largest bank in Pennsylvania.

1922

In 1922, the Provident Life and Trust Company split into two independent entities: Provident Mutual Life Insurance Company and Provident Trust Company. The latter company combined with Provident Tradesmens Bank and Trust Company to create Provident National Bank in 1957. By the time of its merger with PNC, Provident operated branches throughout the Greater Philadelphia region.

1930s

During the 1930s, the First National Bank of Pittsburgh, one of the strongest commercial banks in the city, partnered with Peoples-Pittsburgh Trust Company. Together, these banks financed many of the municipal improvements undertaken during the Great Depression.

Because of their partnership, the leaders of First National of Pittsburgh and Peoples-Pittsburgh became national leaders in banking during the 1930s. Both of these banks established branches outside Pittsburgh in the smaller manufacturing towns of western Pennsylvania. They also began to offer loans to consumers for houses and cars with a relatively simple approval process. After the war, other banks followed the example of these PNC predecessors and expanded branch banking and consumer lending.

1946

In 1946, First National of Pittsburgh and Peoples-Pittsburgh banks joined to form Peoples First National Bank and Trust Co. At the time of this merger, this bank had 275,000 customers and $28 million in capital.

1957

Provident Trust Company combined with Provident Tradesmens Bank and Trust Company to create Provident National Bank in 1957. By the time of its merger with PNC, Provident operated branches throughout the Greater Philadelphia region.

1959

In 1959, Fidelity Trust Company merged with Peoples First which created Pittsburgh National Bank. This new bank had 52 offices throughout Greater Pittsburgh and $81 million in assets. It also adopted a new triangular symbol that represented the industrial and commercial strength of Pittsburgh's Golden Triangle.

1983

In 1982, Pennsylvania changed its laws to allow statewide banking. Pittsburgh National and Provident National were the first two banks to act on the new legislation, and came together in 1983 in what was at the time the largest bank merger in U.S. history. Taking the shared initials of their holding companies, they created a new entity called PNC Financial Corp.

1986

A series of mergers with local banks followed and, in 1986, PNC took the major step of merging with an out-of-state bank, Citizens Fidelity Corporation of Louisville, Kentucky. Shortly after, PNC acquired The Central Bancorporation of Cincinnati and the Bank of Delaware Corporation, which traces its roots back to 1795.

1990

In 1990, PNC made the strategic decision to move from separate technology platforms, operated by each individual bank, to a single common platform. That allowed the bank to offer customers a common set of products and services, wherever they were located. And we shifted our organizational focus from geography to lines of business.

1991

Another series of acquisitions began in 1991, when PNC purchased First Federal Savings and Loan Association of Pittsburgh. The addition of First Federal made PNC both the largest bank and the largest bank holding company in Pittsburgh. Between 1991 and 1996, PNC acquired nine financial institutions.

1993 and 1995

PNC's growing wealth management business was bolstered by two bank acquisitions in the '90s: The Massachusetts Company, Boston, which was the oldest trust company in the country, dating from 1818, and which counted John Quincy Adams, Daniel Webster and Henry Wadsworth Longfellow among its clients and Indian River Federal Savings Bank of Vero Beach, Fla., which added private banking capabilities to PNC's existing Florida trust business

1993

In 1993, PNC acquired Sears Mortgage Company. PNC added the capabilities of Sears Mortgage to its existing PNC Mortgage operation to create one of the nation's largest mortgage originators and service providers at the time. Due to heavy consolidation in the industry, PNC made a strategic decision to exit the consumer mortgage business in 2000, selling PNC Mortgage to Washington Mutual Home Loans, Inc.

1995

In 1995, PNC achieved its longtime goal of entering New Jersey by merging with Midlantic Corporation in a $3 billion transaction that instantly gave it a major presence in the southern New Jersey/Philadelphia market.

1999

In 1999, PNC's steady transformation into a diversified company with national reach was further strengthened with the acquisition of First Data Investor Services Group (ISG), a leading provider of services to mutual funds and other investment vehicles. The addition of ISG solidified PNC's Global Investment Servicing (formerly known as PFPC Worldwide) entity as a premier provider of processing, technology and business solutions to the global investment industry.

2003

In 2003, PNC acquired United National Bancorp. This acquisition strategically expanded our banking business in the growing and appealing markets of central New Jersey and the Lehigh Valley of Eastern Pennsylvania.

2005

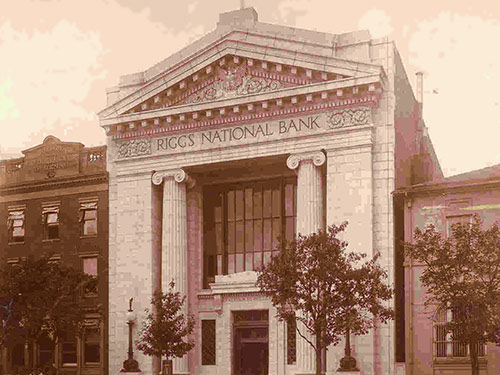

In 2005, PNC made a number of strategic acquisitions in growth areas, which included:

- PNC acquired Riggs National Corporation. PNC gained entry into the Greater Washington area that includes Washington, D.C., Maryland and Virginia - one the nation's most appealing financial services markets and the fifth-most affluent metropolitan region in the U.S. When PNC acquired Riggs Bank, traditionally known as "The Bank of Presidents," it became the owner of an incredibly rich collection of documents and artifacts which lead to the creation of The PNC Legacy Project.

- Harris Williams, a global investment bank specializing in M&A and private capital advisory services, became part of the PNC Corporate & Institutional Banking business.

- BlackRock acquired SSRM Holdings Inc., the holding company of State Street Research Management Company & SSR Realty Advisors Inc., from MetLife. This transaction expanded the scale and scope of BlackRock's mutual fund products and distribution capabilities as well as strengthened them as a global leader in fixed income assets.

2006

In 2006, BlackRock Financial Management acquired Merrill Lynch's investment management business creating one of the top 10 investment management companies in the world with assets under management more than $1 trillion. At the time, PNC owned 44.5 million shares representing an ownership interest of approximately 35 percent and Merrill Lynch had a 49 percent ownership interest. The transaction closed on Oct. 2, 2006.

2007

PNC continues its expansion into growth areas through strategic business acquisitions, at the same time; the company is focused on a disciplined capital management strategy that included:

- Completing the acquisition of Mercantile Bankshares Corporation on March 2, 2007. This transaction significantly expanded PNC's presence in the Mid-Atlantic region, adding an additional 240 offices in the District of Columbia, Maryland, Delaware, Virginia and Southeastern Pennsylvania.

- Acquiring ARCS Commercial Mortgage, the largest independent multifamily lender in the country and the leading Fannie Mae DUS lender. This transaction closed on July 2, 2007.

- On June 7, 2007, PNC announced it signed a definitive agreement to acquire Hamilton, N.J.-based Yardville National Bancorp, a commercial and consumer bank with $3 billion in assets, $2 billion in deposits and 33 branches in central New Jersey and eastern Pennsylvania. This transaction closed on March 11, 2008.

- On July 19, 2007, PNC announced it signed a definitive agreement to acquire Lancaster, Pa.-based Sterling Financial Corporation, a diversified financial services company with $3.3 billion in assets and 67 branches in Pennsylvania, Maryland and Delaware. This transaction closed on April 4, 2008.

- Continuing the transformation of PNC's Global Investment Servicing (formerly known as PFPC Worldwide) business model, in addition to its processing capabilities, Global Investment Servicing increased its information services to the global investment industry through its acquisitions of Albridge Solutions Inc. (transaction closed on Dec. 7, 2007), a provider of portfolio accounting and enterprise wealth management services, and Coates Analytics Group LP (transaction closed on Dec. 10, 2007), a provider of Web-based analytics tools. On Feb. 2, 2010, PNC announced a definitive agreement to sell its PNC Global Investment Servicing subsidiary to BNY Mellon. The sale, which closed on July 1, 2010, further focuses PNC on its core banking business while offering PNC GIS the scale and scope to compete more effectively throughout the world.

2008

- On March 31, 2008, PNC completed the definitive agreement to sell J.J.B. Hilliard, W.L. Lyons, Inc., a full-service brokerage and financial services provider headquartered in Louisville, Ky., to Bowling Green, Ky.-based Houchens Industries, Inc.

- On Oct. 24, 2008, PNC announced it signed a definitive agreement to acquire National City Corporation. This was the largest acquisition in PNC's history placing it among the nation's five largest banks, doubling its assets to $291 billion and expanding it market reach from the Midwest to the Mid-Atlantic, providing access to almost one-third of the total U.S. population and a strong presence in 33 of the most populated metropolitan areas. The transaction closed on Dec. 31, 2008.

2011

- On Jan. 31, 2011, PNC Bank entered into an agreement to purchase 19 branches and 2 related facilities in the Tampa/St. Petersburg area and the associated deposits from BankAtlantic Bancorp, Inc., the parent company of BankAtlantic. This transaction was completed on June 6, 2011.

- On June 20, 2011, PNC announced it signed a definitive agreement to acquire RBC Bank (USA), the U.S. subsidiary of Royal Bank of Canada for $3.45 billion in cash and stock. Through this agreement PNC entered a number of highly attractive regions with deep roots in the Southeast. RBC Bank (USA) serves approximately 900,000 customers through 426 branches in North Carolina, South Carolina, Georgia, Florida, Alabama and Virginia. The acquisition closed on March 2, 2012.

- On July 26, 2011, PNC announced that it has signed a definitive agreement to acquire 27 branches in metropolitan Atlanta, Georgia from Flagstar Bank, FSB, a subsidiary of Flagstar Bancorp, Inc. This transaction closed on Dec. 9, 2011.

2014 – 2019

Between 2014 and 2019, PNC continued to acquire strategic specialized businesses that included:

- On Sept. 16, 2014, acquired the primary operating entities of Solebury Capital Group LLC, a highly regarded equity capital markets advisory firm and investor relations consultant. This transaction closed Oct. 2014.

- On Dec. 20, 2017, acquired Fortis Advisors, a leading provider of private merger and acquisition post-closing shareholder representative services. This transaction closed in Feb. 2018, and Fortis become a subsidiary of PNC Bank within its Corporate & Institutional Banking business.

- On Nov. 27, 2017, acquired The Trout Group, LLC, a premier investor relations and strategic advisory firm servicing the healthcare industry. This transaction closed in December 2017 and Trout was combined with Solebury Communications (a wholly-owned subsidiary of PNC), where they provide industry leading investor relations and strategic communications services to clients across multiple industry sectors. The combined firm was renamed Solebury Trout Communications.

- On May 13, 2019, acquired Sixpoint Partners LLC, a specialty advisory boutique that offers a diversified set of services and solutions for the middle-market private equity industry. Founded in 2007, Sixpoint Partners is headquartered in New York City with offices in Chicago, San Francisco and Austin. This transaction closed in July 2019 and Sixpoint Partners became a standalone subsidiary of PNC Bank. In April 2023, Sixpoint was merged into Harris Williams bringing best-in-class advice and service to our private equity clients throughout their firms’ life cycle—from fundraising to generating returns.

- On Jan. 14, 2019, acquired Ambassador Financial Group, Inc., a provider of balance sheet management, investment banking and capital markets services to banks, insurance companies, and other financial institutions. This transactions closed in April 2019 and AFG became a subsidiary of PNC Bank within the Capital Markets Financial Institutions Group in the Corporate & Institutional Banking business.

2020

- On May 11, 2020, PNC announced its intent to sell its investment in BlackRock, Inc. through a registered offering and related buyback by BlackRock. PNC held 34.8 million common and Series B preferred shares of BlackRock, representing 22.4% ownership.

- On Nov. 16, 2020, PNC and the Spanish financial group, Banco Bilbao Vizcaya Argentaria, S.A. announced that they signed a definitive agreement for PNC to acquire BBVA USA Bancshares, Inc., including its U.S. banking subsidiary, BBVA USA, for a purchase price of $11.6 billion funded with cash on hand in a fixed price structure. BBVA USA Bancshares, had $104 billion in assets and was headquartered in Houston, Texas; and provided commercial and retail banking services through its banking subsidiary BBVA USA and operated 637 branches in Texas, Alabama, Arizona, California, Florida, Colorado and New Mexico. When it was combined with PNC's existing footprint in Oct. 2021, PNC had a coast-to-coast franchise with a presence in 29 of the 30 largest markets in the U.S.

2021 – 2022

PNC again acquired and expanded its strategic specialized businesses that included:

- On Jan. 27, 2021, acquired Tempus Technologies, Inc., a leading payment gateway provider that delivers secure and innovative payment-processing solutions for businesses of all sizes. The acquisition of Tempus Technologies, expanded PNC Treasury Management's robust payments platform, enabling corporate clients to manage payables and receivables through a single channel, spanning all payment rails. The transaction closed Feb. 2021.

- On Sept. 26, 2022, acquired Linga, a point of sale (POS) and payments solutions firm providing an industry-leading, cloud-based restaurant operating system. The acquisition of Linga and its technology further expanded PNC's digital resources and enhanced the bank's capabilities to better serve its hospitality and restaurant industry clients. This transaction closed in Sept. 2022.