PNC does not charge a fee for Mobile Banking. However, third party message and data rates may apply. These include fees your wireless carrier may charge you for data usage and text messaging services. Check with your wireless carrier for details regarding your specific wireless plan and any data usage or text messaging charges that may apply. Also, a supported mobile device is needed to use the Mobile Banking App. Mobile Deposit is a feature of PNC Mobile Banking. Use of the Mobile Deposit feature requires a supported camera-equipped device and you must download a PNC mobile banking app. Eligible PNC Bank account and PNC Bank Online Banking required. Certain other restrictions apply. See the mobile banking terms and conditions in the Digital Services Agreement.

Grow Your Business

Managing cash flow starts with the right foundation - a PNC business checking solution.

Business Products & Services

Explore and apply online.

Starting Your Business

Success is your destination, so let's take the journey together.

Insights

Get the most out of your day and keep your business moving forward.

Growing Your Business

Scaling Confidently: Banking Moves to Make Before You Grow

Scale with confidence: These banking moves give growing businesses visibility, control, and protection before complexity takes over.

3 min read

Manage Business Finances

Give Customers More Ways To Pay: Turning Choice into Higher Sales

Give customers more ways to pay by incorporating cards, wallets, ACH, and pay-by-link to reduce friction, boost sales, and improve cash flow.

3 min read

Manage Business Finances

Migrating Paper Receivables To Electronic Health Payments

Processing paper and checks is time-consuming and error-prone. Electronic payments accelerate collections and posting while simplifying reconciliation.

3 min read

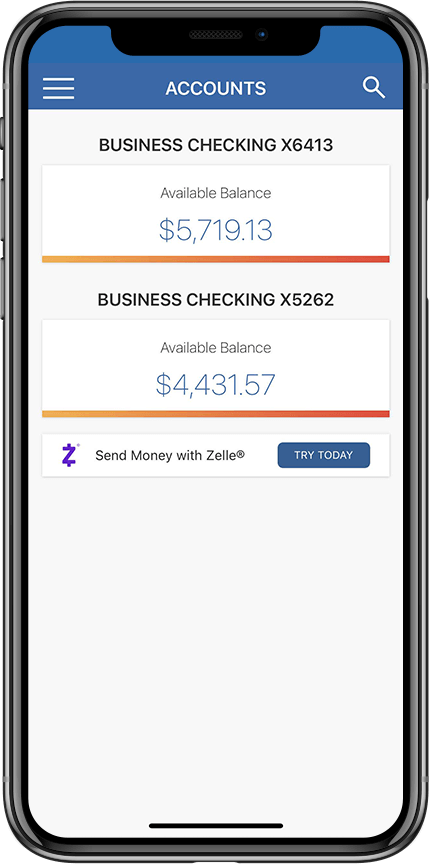

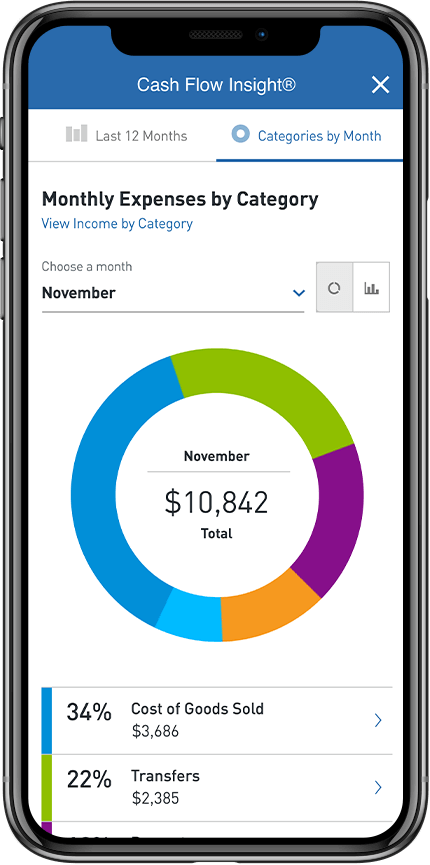

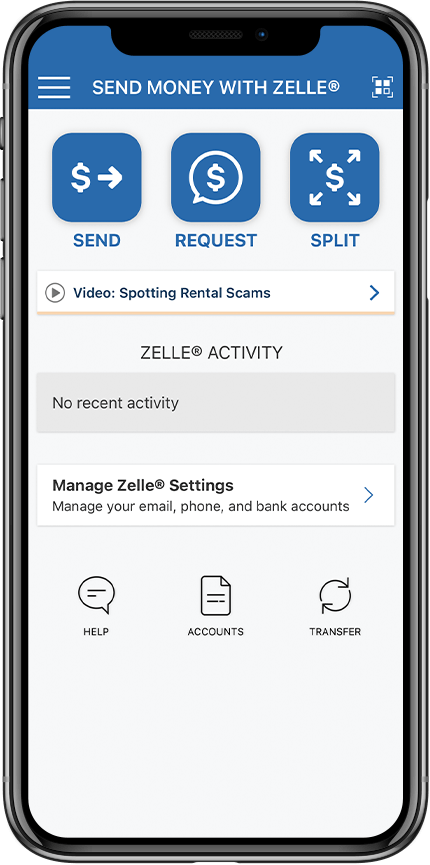

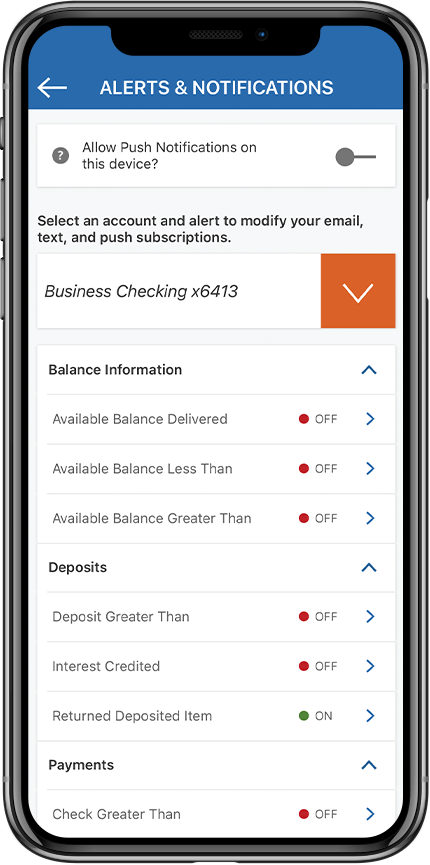

Mobile App

Bank anytime, anywhere. Get started with the PNC Mobile App. [1]

Image for illustrative purposes only.

Image for illustrative purposes only.

Image for illustrative purposes only.

Image for illustrative purposes only.

Image for illustrative purposes only.

Image for illustrative purposes only.

Image for illustrative purposes only.

Image for illustrative purposes only.

- 1

- 2

- 3

- 4

Download our app

Find the PNC Mobile app in the App Store or Google Play.