Banca de bienes raíces

Real Estate finance solutions

As part of one of the nation's largest and most diversified financial services companies, PNC Real Estate can connect you to a wealth of solutions that go beyond real estate lending.

Soluciones integrales

Bienes raíces PNC ofrece un conjunto integral de soluciones de financiamiento de bienes raíces comerciales que abarcan toda la duración de un proyecto, desde la adquisición y la construcción hasta el financiamiento permanente. We provide financing to regional owners and operators, large national developers, real estate funds and REITs — throughout the country and across the spectrum of property types including multifamily, office, industrial, retail, lodging and self-storage.

Your PNC Real Estate Relationship Manager can connect you with teams to help you maximize cash flow, raise capital, mitigate risk and manage your company’s assets.

Programas que se ajustan a sus necesidades

Project Financing

We are committed to creating the right solution for your needs, whether it's straightforward or more complex. Explore our range of project financing strategies.

Real Estate Investment Trust (REIT), Fund & Entity Financing

PNC maintains a significant portfolio in the REIT segment and offers a range of debt and equity financing solutions.

Para obtener más información

About real estate banking, contact your

PNC Real Estate Relationship Manager.

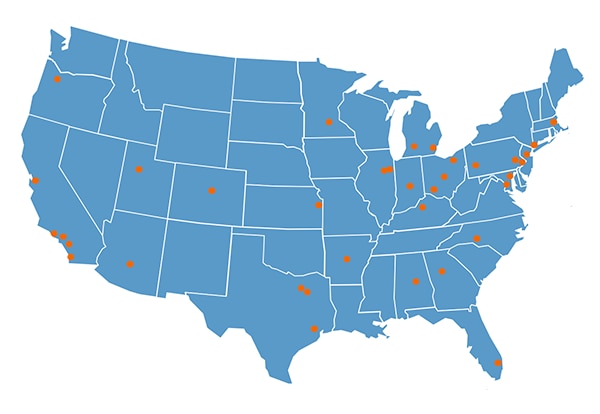

We have more than 1,000 experienced real estate professionals in over 36 office locations across the country to serve you.*

Birmingham, AL

Little Rock, AR

Phoenix, AZ

Calabasas, CA

Irvine, CA

Los Angeles, CA

San Diego, CA

San Francisco, CA

Denver, CO

Washington, DC

Boca Raton, FL

Atlanta, GA

Chicago, IL

Downers Grove, IL

Indianapolis, IN

Overland Park, KS

Louisville, KY

Boston, MA

Baltimore, MD

Grand Rapids, MI

Troy, MI

Minneapolis, MN

Charlotte, NC

East Brunswick, NJ

New York City, NY

Cincinnati, OH

Cleveland, OH

Columbus, OH

Portland, OR

Blue Bell, PA

Pittsburgh, PA

Filadelfia, PA

Dallas, TX

Farmers Branch, TX

Houston, TX

Salt Lake City, UT

* Al 4 de septiembre de 2025