Corporate Overview

PNC offers a wide range of services for all our customers, from individuals and small businesses, to corporations and government entities. No matter how simple or complicated your needs, we're sure to have the products, knowledge and resources necessary for financial success.

Retail Banking

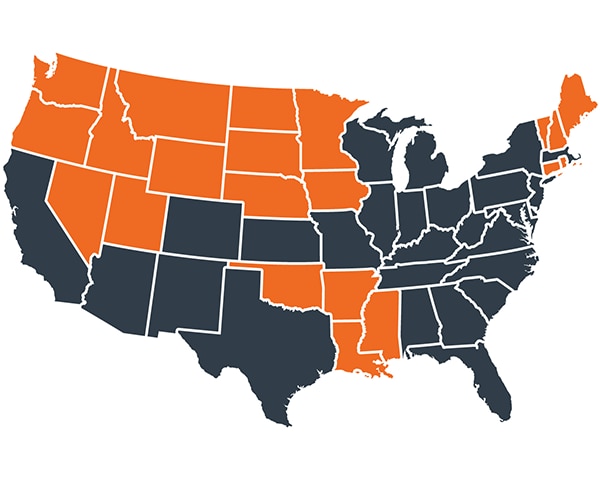

The PNC Retail Bank supports the financial needs of millions of individuals, families and small businesses, and fosters lifelong banking relationships built on expert advice and financial solutions across deposits, payments, personal lending, credit card, wealth advisory and brokerage. Through our coast-to-coast branch network, which includes approximately 2,200 branches, 60,000 PNC and partner ATMs, thousands of highly skilled and knowledgeable bankers, and telephonic, online, and mobile banking channels, we empower our clients with the solutions they need to move forward financially.

We pride ourselves on our ability to create positive outcomes in the communities where we live and work. That’s why, to help make banking more accessible and promote economic empowerment, we deploy a fleet of mobile branches across the country to address specific needs. These branches on wheels — equipped with bankers already ingrained in the local communities — provide assistance during times of natural disaster or other unavoidable disruptions, offer crucial banking products and services to low- and moderate-income individuals and deliver free financial education and workshops to help support and improve financial literacy.

In addition, to better extend access to banking services and financial expertise to clients and communities across the country, we’re investing nearly $1 billion to open more than 100 new branch locations and renovate more than 1,200 existing locations through 2028.

We also strive to create a clear and transparent environment for our personal lending customers. As one of the largest diversified financial services institutions in the United States, our focus is to be a trustworthy resource with innovative offerings and digital solutions that allow us to provide a borrowing experience that’s simple and easy to navigate.

Another key to our model is the ability to serve small businesses — which are the engine for local economic growth and job creation. We consistently invest in the latest product and technology enhancements for our small business clients because when they succeed, we all benefit. We’re particularly passionate about advancing minority-owned small businesses and entrepreneurs, which is why we have established a dedicated Minority Business Development Group comprised of dedicated bankers and advocacy partners that help accelerate the growth and success of these business owners across the country.

Whether someone is just beginning their financial journey, or they are further along the path, PNC is well-positioned to help all meet their financial goals – one relationship at a time.

Asset Management Group

We deliver a wide variety of asset management insights and solutions to affluent and ultra-affluent individuals and families, as well as corporations, unions, municipalities, non-profits, foundations and endowments, through our Investment and National Practice Groups.

Asset Management Group consists of the following:

- PNC Private Bank® provides tailored investments, wealth planning, trust and estate administration, and credit and cash management services to high-net-worth families and individuals.

- PNC Private Bank Hawthorn® is one of the country’s largest multi-family offices, providing integrated wealth management solutions to ultra-affluent families and individuals.

- PNC Institutional Asset Management® serves as investment manager and trustee for companies, not-for-profit organizations and retirement plans nationally. PNC Capital Advisors, LLC, a multi-strategy registered investment advisor, focuses on supporting clients' long-term investment objectives.

As of September 30, 2025, we had $440 billion of assets under administration.

Corporate & Institutional Banking

PNC competes to win in the middle market, where we are proud to be one of the leading credit providers to middle market companies across the country. PNC is in the top five syndicators of middle market loan transactions for each of the last five years.

But credit is only part of the story. Underpinning our success at building deep and lasting relationships with middle market clients is our breadth of capabilities–including extensive treasury management, capital markets and international banking services–many of which have been tailored specifically for the middle market audience.

PNC is an industry leader in many other target markets as well. Our client list includes more than two-thirds of the Fortune® 500 as well as thousands of real estate, utilities, healthcare, government, higher education and not-for-profit entities. All of these clients, including many of the nation's largest competitors in their respective specialties, benefit from PNC's deep industry knowledge and our sophisticated capital raising, treasury management and capital markets capabilities.

Whether your strategy involves growing your company with access to the right capital, transitioning ownership to your employees or enabling a strategic direction, PNC can help. Through Harris Williams, a global investment bank specializing in M&A and private capital advisory services; Solebury, a premier Equity Capital Markets and Investor Relations Advisory firm; and PNC ESOP Solutions, we offer a family of capabilities and specialized advisors to provide sophisticated advice and hands-on transaction support.