Expand Access to Capital

with a Syndicated Solution

Descripción general

Whether you are a private or a public real estate owner or developer or a Real Estate Investment Trust (REIT), you need flexible access to capital to finance large, complex projects and take advantage of emerging opportunities in the commercial real estate market. A syndicated loan is often the answer. Our in-house expertise delivers comprehensive solutions so you can get the financing you need, when you need it, without managing multiple lending relationships.

Transacciones recientes

As a leading financial institution, top agency lender and tax credit equity provider, PNC Real Estate structures capital for all property types and financing needs.

PNC Capital Markets LLC:

Joint Lead Arranger

PNC Bank, NA acted as Administrative Agent

PNC Capital Markets LLC:

Joint Lead Arranger

PNC Bank, NA acted as Administrative Agent

PNC Capital Markets LLC:

Joint Lead Arranger

PNC Bank, NA acted as Administrative Agent

Para obtener más información

About syndication solutions, contact your

PNC Real Estate Relationship Manager.

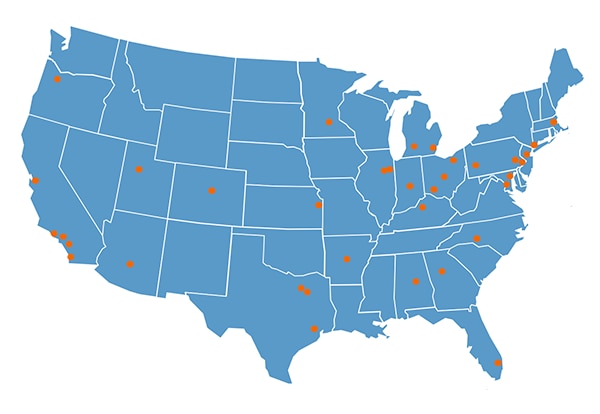

We have more than 1,000 experienced real estate professionals in over 36 office locations across the country to serve you.*

Birmingham, AL

Little Rock, AR

Phoenix, AZ

Calabasas, CA

Irvine, CA

Los Angeles, CA

San Diego, CA

San Francisco, CA

Denver, CO

Washington, DC

Boca Raton, FL

Atlanta, GA

Chicago, IL

Downers Grove, IL

Indianapolis, IN

Overland Park, KS

Louisville, KY

Boston, MA

Baltimore, MD

Grand Rapids, MI

Troy, MI

Minneapolis, MN

Charlotte, NC

East Brunswick, NJ

New York City, NY

Cincinnati, OH

Cleveland, OH

Columbus, OH

Portland, OR

Blue Bell, PA

Pittsburgh, PA

Filadelfia, PA

Dallas, TX

Farmers Branch, TX

Houston, TX

Salt Lake City, UT

* Al 4 de septiembre de 2025