Read a summary of privacy rights for California residents which outlines the types of information we collect, and how and why we use that information.

Predecessor Banks

Building a Sense of Community & Trust

PNC recognizes the contributions of predecessor banks and honors the role these institutions have played in local economic development. As stewards of community history, PNC is committed to upholding the enduring trust that has been placed in these banks by their communities.

A tight-knit group of merchants and manufacturers founded the Bank of Delaware in 1795 to promote “the Interest of the community.” The bank functioned as a partner of the state by issuing currency, taking deposits from smaller banks and investing in infrastructure.

In the midst of the Great Depression, the Bank of Delaware merged with and took the name of Security Trust Company. It helped fuel the postwar boom after World War II by providing consumer loans. After a merger in 1952 with Equitable Guarantee and Trust, the Equitable Security Trust bolstered its position within the state and, six years later, it took the name of its oldest predecessor, the Bank of Delaware.

For the better part of three decades, the Bank of Delaware was the largest supplier of credit in the state and brought automation to banking and other businesses in Delaware.

PNC and Bank of Delaware Merge in 1989

PNC carries forth a banking culture focused on economic growth, innovation and community investment. The bank has become a vital part of the Delaware community and continues to support the administration of the Common Wealth Awards, which has awarded more than $6 million to 192 honorees throughout its 37-year history. In addition, PNC continues its 27-year-old holiday arts series tradition that has produced original artwork depicting the best of Delaware.

During its 145-year existence, Bank of Lancaster County has provided outstanding service to its customers in central Pennsylvania. In the 1970s, the bank affirmed this longstanding tradition by adopting the moniker "The Friendly First," to convey a friendly, community atmosphere.

Bank of Lancaster County held the oldest federal banking charter in the county. In May 1863, the citizens of southern Lancaster County applied for a national bank charter a few months after Congress established the national banking system to stabilize the currency. Initially known as the First National Bank of Strasburg, the bank held charter number 42.

Like other banks, the First National Bank of Strasburg expanded its services during the 1950s. It offered drive-through tellers, auto and other consumer loans, banking by mail and established branches throughout the county. By 1980, the bank changed its name to the First National Bank of Lancaster County to reflect its service to the county as a whole.

In 1987, Sterling Financial Corporation was formed as a holding company. This move initiated two decades of expansion, yet enabled Bank of Lancaster County to retain its commitment to the Lancaster community.

CCNB originated in 1904 with the establishment of the New Cumberland National Bank. It emerged from the Great Depression in a strong position and merged with the New Cumberland Trust Company in 1938. The resulting bank, the Cumberland County National Bank and Trust Company, aggressively expanded to cover the central Pennsylvania region.

CCNB always adhered to the highest professional standards. In the 1950s, well before most banks, CCNB automated its banking services and offered evening and weekend hours. Little wonder that, in 1981, CCNB introduced automated teller machines on the MAC network, enabling customers to withdraw money at ATMs throughout the region.

As it grew, CCNB never lost sight of the special needs of its customers. CCNB established branches at the naval and army depots when they opened in 1945 and 1952 respectively. CCNB signaled its commitment to agriculture by establishing CCNB Agribusiness in 1970, its first subsidiary. As important, CCNB employees engaged in a wide range of community activities, including its Dress-a-Doll contest, economic forums, and the sponsorship of a Savers' Club.

Formed as a holding company in 1970, CCNB Corporation extended its holdings with several key acquisitions, including The Gettysburg National Bank. When PNC acquired CCNB in 1991, it was the most trusted bank in the region.

Centura Banks was formed on November 4, 1990, by the merger of longstanding rivals of equal size, Peoples Bancorporation and The Planters Corporation, two regional bankholding companies based in Rocky Mount, NC. The name Centura, a Latin-based term from the words "century" and "future," suggested the banks' historic stability and its strong position in the competitive North Carolina banking market.

Centura emphasized the importance of customer service, as it aggressively expanded its reach into North Carolina through other acquisitions and organic growth. By 1995, it provided its customers access to their accounts through a network of 250 full-service financial offices, telephone banking, an extensive ATM network, and online bill payment. It was the first bank in North Carolina – and one of the first banks in the nation – to introduce PC-based home banking. By February 2000, the year that it acquired Raleigh-based Triangle Bancorp Inc., Centura Banks Inc. was the sixth largest bank in deposit share in North Carolina with $7 million in deposits.

The merger of equals to form Centura did not diminish the bank's commitment to the community. Instead, Centura was more effective in its philanthropic efforts. It forged community partnerships to augment the impact of its dollars. Most notably, Centura honored two of its retired Chairman, J. Richard Futrell and Robert Mauldin by establishing the Futrell-Mauldin Foundation with a $500,000 matching grant. During the 1990s, their gifts included a planning grant for the expansion of the Braswell Memorial Public Library, capital funding for North Carolina Wesleyan College, and ongoing support of the Rocky Mount YMCA.

Centura Bank developed creative partnerships with local businesses, municipal leaders, and non-profits to provide the Twin Counties a firm economic and community base. Centura was the chief sponsor of the Carolinas Gateway Partnership, formed in 1995 as the only economic planning agency in the Twin Counties. Immediately after Hurricane Floyd, Centura and its employees played a leading role in relief efforts that ameliorated suffering and the economic planning that rebuilt the region.

In 2001, the Royal Bank of Canada (RBC) acquired Centura Bank, Inc.

Founded as the first nationally chartered bank in Prince George's County, Citizens National Bank has emerged as a strong community bank serving the area surrounding Laurel. It has endured, even as the economic base of the city has shifted from a mill town to an early commuter town and then postwar suburb.

When Citizens National Bank opened in 1890, it was the first commercial bank in Laurel. From its start, the bank took advantage of its geographical position between Washington and Baltimore, offering loans to residents of both cities. These relationships enabled the bank to weather financial panics and depressions that closed other community banks.

As other banks, Citizens National Bank diversified its services following World War II. When constructing new branches, the bank added night depositories and drive-in windows to provide customers the conveniences they demanded. It opened new branches and, in 1965, acquired the Central Bank of Howard County to extend its reach into that county.

In 1972, Mercantile Bankshares Corporation acquired Citizens National Bank. Five years later, Belair National Bank was consolidated into The Citizens National Bank, which acquired four more branches with the transaction. By 2005, Citizens maintained more than twenty branches.

After its acquisition by Mercantile Bankshares in 2003, Farmers & Mechanics Bank solidified its position as the largest bank in Frederick, as it merged with Fredericktown Bank & Trust which had been operating as a Mercantile affiliate for more than twenty years. With longstanding histories dating back to the early nineteenth century, both banks withstood economic crises, provided basic banking services, and invested in the prosperity of Frederick.

Both banks were founded at a time when Frederick stood at the crossroads between east and west. Founded as the Office of Pay and Receipt, a branch of the Bank of Westminster, in 1817, Farmers & Mechanics offered basic cash services to migrants leaving Maryland for Ohio. The Fredericktown Savings Institution, chartered in 1827, concentrated instead on encouraging savings among the farmers living in the area.

Both banks weathered economic crises well. In 1864, the Confederate army threatened to destroy the city if it did not receive $200,000. Farmers & Mechanics and Fredericktown Savings were among the five local banks that provided the cash to save the city. Each bank also emerged from economic panics, particularly the Great Depression, in a stronger position than before.

After World War II, Farmers & Mechanics grew steadily through a series of community bank mergers that extended the bank's reach beyond Frederick County and into Carroll County. The most significant of these – the acquisition of Citizens National Bank in 1953 – included this location.

In 1814, the leading citizens of Adams County formed The Bank of Gettysburg with a state charter to serve Gettysburg, Littlestown, Hanover, and surrounding areas. Throughout its history, this bank provided capital to promising businesses and earned a reputation for sound investment.

Like other banks before the Civil War, The Bank of Gettysburg depended upon the judgment of its officers, who controlled the distribution of loans. Its early directors included men of high regard throughout the state: Colonel Alexander Cobean, a hero during the War of 1812; James Gettys, founder of Gettysburg; and Thaddeus Stevens, elected to the U.S. House of Representatives between 1849 and 1868.

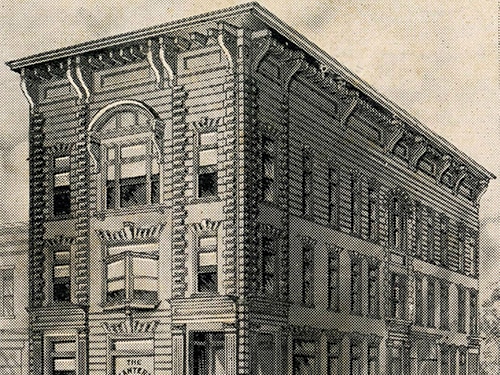

Despite the perils posed by the Civil War, The Bank of Gettysburg emerged in a strong position. As the battle approached in early July 1863, the bank closed its doors, removed all valuables for safekeeping, and re-opened at the end of the month. Soon thereafter, the bank converted to a national charter and changed its name to The Gettysburg National Bank.

GNB fulfilled the intent of the original state charter. It provided sound and convenient services farmers and manufacturers throughout the county. When CCNB acquired GNB in July 1986, GNB had seven branches throughout the region. It retained its name until 1991, when PNC acquired CCNB.

Photo courtesy of the the Adams County Historical Society.

As soon as the Hershey chocolate factory opened in 1905, Milton S. Hershey began to turn his dreams of a harmonious model industrial town into reality. He considered a bank integral to the fulfillment of that mission. He wasted little time and established Hershey Trust Company to accept deposits and make loans to factory workers and farmers.

As envisioned, Hershey Trust Company quickly became a large presence in the town. Ten years after its founding, the Trust moved to its new headquarters on West Chocolate Avenue. In 1925, the Trust Company began to direct more of its efforts towards managing the assets of the Hershey Industrial School Trust, which had been established seven years earlier. Therefore, the Trust separated its savings and loans departments from other Trust functions by creating the Hershey National Bank.

The bank helped realize the ideals of its founder, Milton S. Hershey. It provided opportunities to students at the Hershey Industrial School, as many worked at the bank and assumed executive level positions. Between 1955 and 1975, the bank also helped construct the suburban residences of Hershey, as it made $39 million available in residential mortgages.

In 1980, Hershey National Bank converted to a state charter and re-named itself as The Hershey Bank. PNC acquired it six years later.

Photo courtesy of the Hershey Community Archives, Hershey, PA.

With a sense of apprehension common to all new business ventures, the leading residents of Marshall established the Bank of Marshall in 1905. Its deposits grew quickly, and their success prompted them to re-charter as the Marshall National Bank in 1912. The early stockholders could not have imagined the longevity of their bank. It weathered the Great Depression, recessions in the real estate market, and deregulation that closed other local banks.

Farmers have always been the most important patrons of Marshall National Bank. Prior to its founding, farmers depended upon local merchants or banks in Baltimore, Alexandria, and Richmond to provide financial services. With the establishment of Marshall Bank, the farmers found a bank that would deal with their special needs.

By the 1950s, the bank emphasized the convenience of its services, as it continued to serve local farmers. It installed a night depository in 1953 and, three years later, the first drive-in window in Fauquier County. In 1970, it opened its first branch in Warrenton and eventually opened another branch in Middleburg.

For a century, this bank with modest beginnings has served the financial needs and community interests of Marshall. After opening a new trust department in 1928, the Board of Directors changed the bank's name to Marshall National Bank and Trust Company. In 1998, Mercantile Bankshares acquired the bank, a move that provided additional capital backing and enabled Marshall National Bank and Trust to retain its local identity.

In 2004, Mercantile Bankshares Corporation consolidated three of its affiliates – the Chestertown Bank of Maryland, St. Michaels Bank, and Peoples Bank of Maryland – into a single company, Mercantile Eastern Shore Bank headquartered in Chestertown. This reorganization combined three community banks that originated at the turn-of-the-century to serve the agricultural population of their respective towns, Chestertown, St. Michaels, and Denton.

Each of these banks was founded to meet the needs of farmers, watermen, and other workers, people who usually did not use banks. When the Board of Directors of St. Michaels Bank adopted its by-laws in February 1890, it stated its purpose as "receiving such small sums of money as are the profits of its industry and economy or legacies, or donations to widows' children and others who may need its aid" that could, in turn be invested in "public stocks or other such safe securities." When the Peoples Bank of Denton formed in 1898 and the Chestertown Bank of Maryland followed suit in 1904, their purposes were similar to St. Michaels.

Of these banks, only the Chestertown Bank of Maryland expanded significantly before World War II. Six years after its organization in 1910, the bank established an office in Galena and, by 1930, had added offices in Kennedyville and Betterton. Its officers had constructed this branch in 1929, a couple of years after a fire had destroyed its first office.

Even with the changes in banking that followed World War II, these banks tailored service to meet their agricultural base. Like other banks, they added conveniences such as night depositories and teller windows and diversified their services by offering installment loans.

The push to computerize prompted Chestertown Bank of Maryland in 1971, St. Michaels Bank in 1981, and Peoples Bank of Maryland in 1982 to sell their stock to Mercantile Bankshares. As affiliates, each bank retained its own Board of Directors and identity and maintained the high level of community service which the people of the Eastern Shore expected.

The officers of two longstanding banks – the Safe Deposit and Trust Company and Mercantile Trust & Deposit Company – merged forces to create Mercantile-Safe Deposit and Trust Company in 1953. At the time, the new bank pledged to uphold the traditions of its predecessors.

Business leaders established the Safe Deposit and Trust Company and Mercantile Trust & Deposit Company in the years following the Civil War. Bank failures were common, so that the rapid emergence of these institutions as trusted repositories for people's valuables, dependable sources of credit, and managers of trusts was a boon to the city. Each bank lent money to local businesses, invested in industry, and helped build transportation networks in the South.

For fifty-four years, Mercantile has updated its banking services to meet its customers' needs and advance the commercial interests of Baltimore. Even with outside competition, Mercantile retained its position as a leader in customer service and community involvement.

In 1969, with two other local banks, Mercantile-Safe Deposit and Trust Company formed Mercantile Bankshares Corporation as Maryland's first multi-bank holding company. The flagship subsidiary was Mercantile-Safe Deposit and Trust Company, doing business as Mercantile Bank & Trust. During the next thirty-eight years, Bankshares grew to become a network of nearly two dozen locally managed and directed community banks throughout Maryland, Virginia and Delaware.

Since 1820, this building has housed the most trusted banks in the city: the Farmers' Bank and The National Bank of Fredericksburg. Both banks attracted the investments and patronage of the city's leaders and earned the confidence of the population as a whole. Yet, each bank conducted its business within distinctive economic settings that, in turn, affected its fortunes.

Founded as a branch of the state bank in 1812, the Farmers' Bank prospered at a time when there was no central currency. In addition to performing bank functions such as taking deposits and promoting commerce through its investments, the Farmers' Bank needed to distinguish between sound and unsound bank notes and succeeded in doing so until the Civil War. By the end of that conflict, however, its assets consisted largely of worthless Confederate notes, and the bank failed.

By October 1865, six months after the end of the war, leading citizens of Fredericksburg secured a new charter to form The National Bank of Fredericksburg. During the war, the United States government established national banks to stabilize the currency. By joining this system, The National Bank agreed to meet its standards and circulate a new medium of exchange, national notes.

In 1994, Mercantile Bankshares Corporation acquired The National Bank of Fredericksburg. As one of its affiliates, The National Bank retained its name until PNC Financial Services purchased Mercantile Bankshares in 2007.

Throughout its 163-year history, National City Bank (NCB) fostered commerce in greater Cleveland. This commercial leadership increased its standing within the broader community. Known for its resilience, NCB offered friendly, innovative services to households throughout northern Ohio.

Cleveland became an industrial center, thanks in part to the financial support of NCB. Founded as the City Bank of Cleveland in 1845, its officers invested in a town of 10,000 residents engaged in a modest local trade. During the Civil War, the city grew by leaps and bounds, while the bank took on a new charter as the National City Bank of Cleveland. NCB steadily grew, by cultivating Cleveland's industrial elite as its customer base.

Through the Depression, NCB engendered trust among business leaders and the general public and, as a result, quadrupled in size. The growth continued in the postwar years. NCB honed its services to businessmen without forgetting ordinary consumers, particularly new suburban residents. Its efficient and automated banking services established NCB as one of the leading banks in Cuyahoga County.

The formation of a bank holding company, National City Corporation, in 1973 enabled the bank to extend its services. By 1984, NCC became the state's largest holding company. Four years later, NCC became an interstate bank with acquisitions in Kentucky, followed by Pennsylvania, Indiana, Michigan, Missouri, Florida and Illinois. PNC Financial Services acquired National City Corporation in October 2008.

The founding president of Peoples Bank & Trust Frank Spruill once said that it must have taken a fool to start a bank on April 1, 1931. Peoples defied expectations that day and into the future. For nearly sixty years, Peoples strengthened commerce and community in Rocky Mount and the surrounding areas of Eastern North Carolina.

Spruill not only recognized that a bank needed to "get to know and understand the people," but he also built an institution that effectively responded to their financial needs. Peoples specialized in setting up trusts and other services for farmers in the rural towns surrounding Rocky Mount. As early as 1935, Peoples established three branches – in Nashville, Zebulon, and Whitakers – that brought its business to farmers instead of expecting them to come to Rocky Mount for their banking.

Like other banks, Peoples expanded its customer services following World War II, but it never lost focus on the special needs of farmers. By establishing the Farm Relations and Services Division in 1945, it became the first bank in North Carolina with an agricultural department. It also led the way providing consumer credit, drive-up windows, and automated banking.

As agribusiness transformed farming throughout the region, Peoples retained the loyalties of the people of Eastern North Carolina. In 1983, the year of its fiftieth anniversary, Peoples served more than twenty-eight communities in fifteen counties of Eastern and Piedmont North Carolina and established Peoples Bancorp as the holding company for its subsidiaries. It acquired several more banks, including the Mid-South Bank & Trust Company as an independent and wholly-owned subsidiary. By a "merger of equals" with The Planters Corporation. in 1990, it formed Centura Banks, Inc.

Planters Bank was founded in 1899, just as Rocky Mount emerged as the leading market and mill town of Eastern North Carolina. Planters anchored its business in that city and thrived because it created commercial opportunities for local farmers and businesses. Throughout its ninety-year history, Planters stimulated the wealth that became the foundation of the Rocky Mount community.

Leading planters and merchants incorporated Planters to meet the need for a reliable commercial bank in Rocky Mount. Prior to its founding, farmers needed to travel to Richmond to secure the loans needed to finance their planting operations. The Braswell family, led by Thomas Permenter Braswell, a large planter and merchant from Battleboro, organized the subscribers necessary to secure a state charter. It was the first bank in the region to pay dividends to its stockholders.

By 1915, Planters became a national bank which enabled them to print national currency and enhanced their position as the leading investor in local business. It was in such a strong position that it weathered the banking crises following the Crash of 1929 with relative ease. By the mid-1950s, Planters National Bank sought to diversify by expanding its operations outside of the Twin Counties. In 1954, it opened its first two branches outside of Rocky Mount, in Plymouth and Ahoskie. Two years later, it purchased the stock of Roanoke Bank and Trust Company of Roanoke Rapids in Pitt County to gain a stronger presence among textile manufacturers. Planters continued its strategy of purchasing within communities that represented strongholds of industry so that, by 1979, Planters had thirty-nine offices in twenty-three communities as far east as Manteo on the Outer Banks and as far west as Mount Airy in the Blue Ridge Mountains. With Rocky Mount as its headquarters, Planters also had offices in Raleigh and Greenville.

Throughout its history, Planters was a bank of influence throughout the state. Its officers distinguished themselves with their service to the North Carolina Bankers Association and on the Boards of numerous corporations throughout the state. In 1983, Planters enhanced its organizational structure with the establishment of The Planters Corporation, with Planters Bank as its chief subsidiary. In 1990, its Board voted to merge with its chief competitor within Rocky Mount, Peoples Bank & Trust. This "merger of equals" became Centura Bank.

Provident National Bank originated in 1865 when a group of merchants established Provident Life and Trust to encourage people to plan for their futures and protect their estates. In 1922, new regulations impacting trusts led Provident to separate its life insurance and trust businesses to form Provident Trust. The company adopted its trademark – the Sower – to symbolize the abundant wealth that could stem from small but steady savings.

In 1958, Provident Trust and Tradesmens National Bank merged to form a company known for its conservative business philosophy, wealth management services and commercial lending.

Trademens National Bank

When Provident Trust was looking to expand its wealth management services to include commercial and consumer banking, it found its perfect complement in Tradesmens National Bank to form Provident Tradesmens National Bank and Trust in 1957 (later re-named Provident National Bank).

Founded as a bank for people of modest means in 1846, Tradesmens Bank had national impact. Its president, Charles H. Rogers, became a trusted advisor to Secretary of Treasury Salmon P. Chase and helped organize Philadelphia bankers to provide loans to the federal government during the Civil War.

Tradesmens’ political and social influence did not end there. George H. Earle, one of its presidents, was popularly known as the “financial doctor” because of his ability to save businesses in crisis. He resigned from this position in 1910 to run for mayor. Subsequently, noted Jewish philanthropist August Loeb took over as president at a time when most Jews were shut out of commercial banking. His son Howard Loeb succeeded him.

After mergers with Market Street National Bank and Real Estate Land Title & Trust, Tradesmens National Bank became a leader in commercial and consumer lending with a large network of branches throughout greater Philadelphia.

Largest Bank Merger in U.S. History to Date

When Provident National Corporation merged with Pittsburgh National Corporation to form PNC Financial Services Group in 1983, it brought together two highly capitalized and profitable banks in the largest bank merger in U.S history at that time. Provident and Pittsburgh National were the first two banks to have taken advantage of legislation passed in 1982 that enabled commercial banks to expand operations statewide. Prior to passage, bank operations were localized and were confined to home office and adjacent counties.

Chemical Bank and Midlantic Corporation

In 1995, PNC made two bold moves to establish its presence in southern New Jersey. In March, it announced the purchase of 81 branches of Chemical Bank, nearly all located in southern New Jersey. Four months later, PNC announced the acquisition of Midlantic Corporation, a holding company with $13.7 billion in assets and more than 300 offices in Pennsylvania and New Jersey.

Midlantic Corporation had pursued an aggressive acquisition strategy, including a merger with Philadelphia-based Continental Bancorp in 1987.

In 1836, William Wilson Corcoran opened a note brokerage house in Washington, D.C. Within four years, he took on a new partner, George Washington Riggs, to form Corcoran & Riggs as a private bank. Together, they hoped to serve local investors, most especially the elected and appointed officials of the federal government. They achieved immediate success which enabled Corcoran to leave the firm and pursue philanthropic pursuits in 1854. With G.W. Riggs at its head, Riggs & Co. planted the seeds for the bank's future. Riggs became the city's largest bank serving ordinary citizens and prominent politicians alike.

Corcoran & Riggs took advantage of the opportunities provided by the closure of the Second Bank of the United States. The newfound banking house purchased the Washington branch of the federal bank which then became a symbol of Corcoran & Riggs' relationship to the federal government. Between 1847 and 1848, Corcoran & Riggs financed the Mexican War, by raising $5 million from European merchants and financiers ($12.25 billion in 2006 dollars) and in turn lending that amount to the federal government. Twenty years later, at the end of the Civil War, the federal government requested another major transaction from Riggs & Co. Lacking the confidence in the U.S. money supply in 1867, the Russian minister required $7.2 million in gold bullion ($10.12 billion in 2006 dollars) for payment of Alaska.

These transactions conferred prestige upon Riggs & Co. Congressmen, presidents and military officers accordingly entrusted their accounts with Riggs & Co. Most presidents of the mid-nineteenth century – including John Tyler, James Polk, and Abraham Lincoln – deposited their paychecks at Riggs & Co. Senators who ultimately fought the Civil War on opposite sides – Jefferson Davis of Mississippi and Salmon P. Chase of Pennsylvania, for instance – agreed upon Riggs & Co. as their bankers. Military officers, such as General John J. Pershing and General Douglas MacArthur, relied upon Riggs to handle their financial needs when they were commanding on the field and then upon their return.

The turn of the twentieth century marked a watershed for Riggs. It received a charter as a national bank, began to sell its stock publicly, and took on new leadership. Its chairman Charles Glover initiated the construction of new headquarters on Pennsylvania Avenue, directly adjacent to the old one and across from the U.S. Treasury. As Riggs National Bank expanded its services and customer base, it maintained its influence in fiscal and monetary affairs. Glover influenced the passage of a series of reforms that ultimately led to the creation of the Federal Reserve. His successor Robert V. Fleming enjoyed the confidence of several U.S. Presidents, including Franklin D. Roosevelt, Harry S. Truman, and Dwight D. Eisenhower.

Like other banks, Riggs substantially expanded its services to the growing middle-class after World War II. It opened new branches and offered mortgages, car loans, and other forms of credit to serve metropolitan Washington. It financed businesses such as Marriott, Woodward & Lothrop, and the Pennsylvania Avenue Development Corporation. Riggs continued its special relationship with the government, as it provided basic services to the International Monetary Fund, the Veteran's Administration, and the U.S. Treasury. In May 2005, PNC Financial Services acquired Riggs Bank.

Formed in 2000, Westminster Union Bank combined two highly regarded community banks, Westminster Bank and Trust Company of Carroll County and Union National Bank of Westminster. As Mercantile Bankshares had acquired Westminster Bank and Trust in 1972, two banks with deep roots in the community became Mercantile affiliates with this merger.

Union National Bank opened in 1816 as the Bank of Westminster. This was one of several repositories of gold and other valuables established in the countryside by Baltimore banks and merchants during and immediately after the War of 1812. As other antebellum banks, the Bank of Westminster issued its own notes. After the Civil War, the bank took on a charter as a national bank and took a new name, the Union National Bank of Westminster. With federal backing, the bank continued to issue currency.

Established in 1898, Westminster Deposit and Trust Company was among the first to offer trust services to the residents of Carroll County. As other trust companies, it managed investments for individuals and corporations. In so doing, the bank enriched not just its customers but the local businesses chosen for investment.

World War II represented a turning point. Both banks expanded their customer base and diversified their services, offering more home mortgages and installment loans. In 1951, Westminster Deposit and Trust Company extended its reach into Carroll County with its acquisition of Union Mills Savings Bank to form Westminster Trust Company.

As a Mercantile affiliate, Westminster Trust Company continued to grow. In 1979, Mercantile Bankshares acquired Woodbine National Bank and merged its operations into Westminster Trust. Two years later, the bank changed its name to Westminster Bank and Trust Company of Carroll County.