Recent Transactions

Delivered for our Customers

PNC Real Estate provides comprehensive financing options that meet

your specific needs spanning the life of a transaction, including construction, permanent and term debt, syndicated loans and tax credit investments.

Transaction Overview

As a leading financial institution, top agency lender and tax credit equity provider, PNC Real Estate structures capital for all property types and financing needs.

Property Types

Fannie Mae

$28,743,000

Construction Loan

$30,000,000

Fannie Mae

$30,225,000

Term Loan

$37,125,000

Construction Loan

$46,100,000

Fannie Mae

$22,035,000

Freddie Mac

$13,200,000

Construction Loan

$43,038,495

Freddie Mac

$18,288,000

Construction Loan

$36,337,000

HTC Equity

$14,276,699

Fannie Mae

$11,250,000

FHA 223(a)(7)

$48,861,200

Fannie Mae

$38,187,000

Construction Loan

$33,000,000

Freddie Mac

$6,315,000

Fannie Mae

$11,505,000

LIHTC Equity

$10,118,562

FHA 221(d)(4)

$12,335,300

Freddie Mac

$7,313,000

Preservation Equity

$8,205,981

Debt

$14,322,750

FHA 221(d)(4) LIHTC

$60,404,300

Freddie Mac

$8,500,000

FHA 223(a)(7) - Section 8

$5,189,400

LIHTC Equity

$15,600,046

Freddie Mac

$7,900,000

Preservation Equity

$11,062,659

Balance Sheet Loan

$19,064,500

FHA 221(d)(4)

$34,999,900

Fannie Mae

$34,182,000

Freddie Mac

$5,407,000

FHA 223(a)(7)

$10,055,000

LIHTC Equity

$10,242,847

Construction Loan

$126,000,000

PNC Share

$63,000,000

Permanent Loan

$19,200,000

Term Loan

$40,850,000

Permanent Loan

$35,000,000

Term Loan

$43,000,000

Construction Loan

$525,000,000

PNC Underwrite

$200,000,000

PNC Hold

$87,500,000

Term Loan

$53,000,000

Construction Loan

$160,000,000

Permanent Loan

$41,000,000

Construction Loan

$60,000,000

Term Loan

$21,515,000

Permanent Loan

$45,000,000

Construction Loan

$50,000,000

HTC Equity

$11,081,370

Term Loan

$36,360,000

Construction Loan

$68,235,499

Permanent Loan

$35,000,000

Construction Loan

$34,357,000

Term Loan

$21,500,000

Permanent Loan

$79,585,000

REIT

Revolver

Revolver & Term Loan

Revolver & Term Loan

Term Loan

Term Loan

Term Loan

Revolver & Term Loan

Term Loan

Revolver

PNC Real Estate Loan Referral Consultants

CMBS

$8,137,500

CMBS

$74,600,000

Ginnie Mae

$3,151,496

Ginnie Mae

$2,929,496

Ginnie Mae

$1,797,392

Ginnie Mae

$1,466,031

Ginnie Mae

$1,023,602

CMBS

$7,000,000

Ginnie Mae

$1,445,424

Bank

$3,500,000

Ginnie Mae

$2,396,498

CMBS

$5,250,000

Other Product Solutions

PNC has served as:

- Administrative Agent and Lead Arranger on a $225 million secured term loan backed by a retail center.

- Administrative Agent and Lead Arranger on a $1.2 billion unsecured revolver for a multi-family REIT.

- Administrative Agent and Lead Arranger on a $83.5 million secured construction loan backed by a multi-family property.

- Administrative Agent and Lead Arranger on a $130 million secured construction loan backed by senior housing property.

- Administrative Agent and Lead Arranger on a $900 million unsecured revolver and term loan facility for an open-ended real estate fund.

- Administrative Agent and Lead Arranger on a $298.3 million secured term loan backed by a portfolio of multi-family properties.

PNC has tailored these solutions and more:

- A residential and commercial brokerage firm typically accepted fees from buyers at the closing table. In the new virtual closing world created by COVID-19, it became imperative to offer an online solution. The firm opted for PNC’s online payment portal to allow buyers to pay brokerage fees online via ACH or credit card.

- When COVID-19 closed offices everywhere, a residential property manager in Philadelphia needed a quick way to manage payroll remotely. By quickly moving to ACH origination, the A/P team could process payroll from home while offering employees direct deposit. Fewer trips to the office and fewer checks in the mail allowed for both safety and efficiency in processing weekly payroll.

- Facing the COVID-19 pandemic, a client determined that they wanted to eliminate the need for any employee to come into the office. They switched from remote deposit scanners to PNC Real Estate’s lockbox solution to deposit rent checks for all their properties without employee intervention. The client also eliminated physical checks and began processing all of their payments through ACH Credit Origination along with some wire transfers.

- A large retail REIT issued a request for proposal for a $120 million card program which would comprise payables, travel and entertainment as well as Canadian capabilities. With a strong current relationship, proven customer service and card technology that incorporated both USD and CAD programs, PNC Real Estate won the deal.

- Upon experiencing a fraudulent incident that spanned several months, a commercial real estate developer used PNC’s ACH fraud protection services. ACH Debit Block and Positive Pay helped them automatically reject unauthorized payment attempts.

- A residential property manager frequently issued prepaid debit cards as rewards to staff and tenants. By switching to PNC’s prepaid card solution, they can now fund cards in real time and issue them on-the-spot, which they could not do through their previous supplier.

- When a real estate investment trust embarked on an internal systems upgrade, PNC implemented a payables program to outsource their check writing and electronic payments processes, helping improve efficiency for nearly 30,000 payments annually.

- A self-storage client needed to improve management of expenses for each location. PNC’s corporate purchasing card and expense reporting platform helped enable the property managers to submit monthly reports, allowing the client’s accounting staff to free up nearly 10 hours each month.

- PNC helped analyze the rate of return on SWEEP balances for a retail-based REIT. After review, the client decided to add SWEEP automation to 31 accounts in order to achieve an improved rate of return.

PNC has provided the following derivatives solutions:

- An apartment REIT recently closed a $150 million unsecured term loan and worked with PNC to structure a forward starting swap to fully fix the outstandings under the term loan through maturity, beginning at the expiration of an already outstanding interest rate swap

- A sponsor working with PNC Real Estate on $55 million acquisition financing of an apartment complex coordinated with PNC’s Derivative Products Group to execute a swap fixing the outstandings of the term loan at closing through maturity of the facility

- A developer of a mixed-use property working with PNC Real Estate to refinance the project into a new $27.2 million year term loan was concerned about the potential for rates to rise before the refinancing closed. Working with PNC’s Derivative Products Group, the developer executed a forward starting swap prior to the loan closing to mitigate that risk and fix the rate through the planned maturity of the facility

- A multi-family developer with an apartment project requested PNC’s assistance in hedging the expected draws under a $75 million construction loan. After developing a collaborative understanding of the construction plan and sponsor’s goals, PNC’s Derivative Products Group worked with the customer to structure a partial swap of the planned draws, removing some interest rate uncertainty while providing flexibility for construction timelines to change

- A multi-family developer with a $70 million construction project financed by a different lender requested PNC’s assistance in hedging the interest rate on the construction financing. PNC provided the developer with an interest rate cap that protected the developer from rates rising above a determined strike

- A multi-family developer with a construction loan at PNC and a plan to refinance the facility with a permanent mortgage from FNMA or FHMC had concerns that interest rates would rise prior to rate locking/closing with an Agency. PNC proposed a Treasury-lock that hedged the risk of fluctuations in the underlying Treasury yield that would underpin the interest rate of the Agency financing, hedging both the proceeds and interest rate of the Agency loan

For More Information

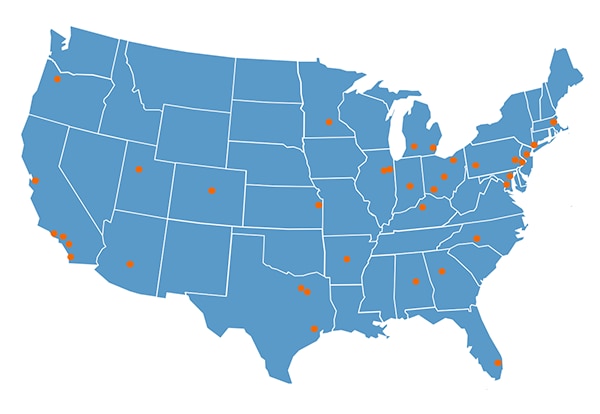

We have more than 1,000 experienced real estate professionals in over 36 office locations across the country to serve you.*

Birmingham, AL

Little Rock, AR

Phoenix, AZ

Calabasas, CA

Irvine, CA

Los Angeles, CA

San Diego, CA

San Francisco, CA

Denver, CO

Washington, DC

Boca Raton, FL

Atlanta, GA

Chicago, IL

Downers Grove, IL

Indianapolis, IN

Overland Park, KS

Louisville, KY

Boston, MA

Baltimore, MD

Grand Rapids, MI

Troy, MI

Minneapolis, MN

Charlotte, NC

East Brunswick, NJ

New York City, NY

Cincinnati, OH

Cleveland, OH

Columbus, OH

Portland, OR

Blue Bell, PA

Pittsburgh, PA

Philadelphia, PA

Dallas, TX

Farmers Branch, TX

Houston, TX

Salt Lake City, UT

* As of September 4, 2025