PINACLE®

Commercial Online Banking built for the way you work

PINACLE®, PNC’s top-rated online commercial banking solution

Confidently manage your banking activity on your PC, Mac, tablet, or phone. Built for the way you work, PINACLE® helps you spend more time on what is important to you - nurturing your business.

The Simple, Integrated Solution You've Asked For

Pay Suppliers & Individuals

From Anywhere

- Send real-time and same day payments in PINACLE

- Initiate via freeform entry, templates, file upload, or elect to initiate directly out of your accounting system via PINACLE Connect® and PNC’s API channels

- Leverage PINACLE Payment’s intelligent routing capabilities

- Save payee payment information create payee groups and track progress of your payments through comprehensive reporting

- Create teams and permissions to manage user access within your company

Video: Explore PINACLE®

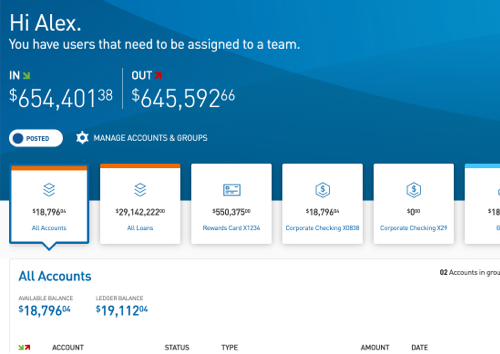

See Your Accounts and Balances

in a Single Dashboard View

- View daily pending and posted transaction information for accounts, loans and cards

- Customize reporting with robust filtering and search capabilities

- Synchronize with your accounting software to streamline your account reconciliation

- Transfer funds easily between accounts

- Manage fraud-related risk and respond quickly to suspicious transactions with our optional fraud mitigation services

Accelerate Daily Receivables and Cash Application

- Gain better control over your cash position and accelerate incoming payments with PNC’s comprehensive receivables solutions

- Deposit your checks without going to the branch via your mobile phone or remote deposit desktop scanner

- View robust receivables reporting across multiple channels including deposited images for easy reconciliation

- Securely deposit or order cash by utilizing an armored courier to deliver to and from PNC’s national cash vault network

Your Fraud Risk By The Numbers

PNC Protect – Fraud

Protection, It’s What We Do

- Choose the PINACLE package with the capabilities and built-in fraud protections that you require

- Build additional layers of protection around online money movement with Dual and Self-Approval options, company and user level initiation and approval limits, and security tokens

- Respond quickly to suspicious transactions with optional Positive Pay services

- Gain insight and monitor user actions through robust audit reports

- Set up PINACLE activity and security alerts via text, email or online delivery

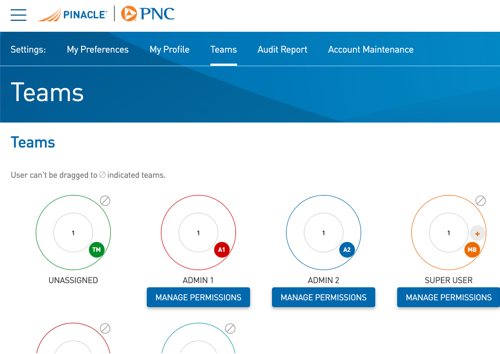

Provide Secure Access to Employees Through Teams

and Permissions

- Identify trusted Security Contacts and Administrators who will have authority over your PINACLE services at set up

- Manage user access to your accounts and services with our easy-to-use Teams feature

- Set up a user in less than 5 minutes with predefined or customized permissions

Easy Access to a Variety of Support Resources

- Get started quickly! The New User Checklist will guide you through your first log in with access to welcome guides and onscreen walkthroughs

- Find the help you need in PINACLE’s online help center with access to FAQs and user resources

- Take advantage of robust training options for both administrators and users, including live training

- Leverage built-in support through live messaging and self-guided tours

Ready to Get Started? We'll Call You

Fill out the form and a PNC Representative will reach out to you shortly.

Thank you for your time.

PINACLE® FAQs & Product Details

Provide secure access to employees through teams and permissions

- Establish company administrators who can set up additional users and delegate access.

- Provide appropriate user access to accounts and services using customizable permissions or our predefined default permissions.

- Predefined default permissions include:

- Admin 1 & 2– Has access to all functions for all accounts including managing user permissions, initiating, approving and viewing (established during set up of service).

- Super User – Has equivalent permissions as the company’s delegated Admin 1 & 2 users.

- Initiator – Can view reporting and initiate payments and account transfers for all accounts.

- Approver – Can view reporting and approve payments for all accounts.

- Viewer – Can view reporting for all accounts.

Strengthen your internal controls through a combination of standard

and optional features:

Dual Approval / Self-Approval

- Provide an added layer of security with our standard dual approval feature when sending payments.

- Utilize the self-approval option to initiate and approve your own payments with step-up authentication.

Token Passcodes

- Token passcodes are required for users accessing services with external money movement capabilities.

- Use PINACLE Pass™ to easily generate a token passcode on your mobile phone.

- Go to the App Store® or Google Play™

- Search for “PINACLE Pass”

- Download the PINACLE Pass™ App

- Work on your PC, Mac, tablet or mobile device. PINACLE is ready to work wherever you are.

- PINACLE is mobile ready and can be accessed directly through your mobile browser or via the PINACLE Mobile app.

Pay vendors and suppliers from the office or on the go with any of the below payment types:

PINACLE Payments Service

PINACLE Payments harnesses the collective power of the Real Time Payment (RTP) network, Bill Payment service, and the Automated Clearing House (ACH) network to process your payments. Simply initiate your payment and decide who, when and how much to pay.

- Quickly and easily pay your bills with just a few clicks.

- Real-time and same day payment options available.

- Maintain and organize saved payees for easy future payment.

- Track your payment through the lifecycle of the payment.

- View historical payment details and audit reports.

Wire

- Securely send funds online (Domestic, International USD, International FX)

- Initiate payments via freeform entry or with easy-to-use templates.

- View wire transaction reporting including detail and summary information, audit reports, items pending approval, and future-dated transfers.

PINACLE Connect via Connected Payments

- With its award-winning platform connectors, PINACLE Connect integrates PNC's banking services directly with your accounting software.

- Streamline and reduce manual effort in your reconciliation process by synching your account balances and transactions.

- Manage payment methods and make payments directly within your own system — select and submit bills, approve and release payments, and track payments.

- Implement with ease without technical resources, reducing onboarding costs and time.

Accelerate Daily Receivables and help eliminate multiple trips to the bank:

Deposit On-Site® — Remote Deposit Service

- Create a new deposit by easily capturing images of consumer and business checks via a remote deposit scanner or on your mobile device.

- Submit your deposits several times a day or at the end of the business day.

- View the status of open and submitted deposit details and access deposit reporting.

- To find PNC's Deposit On-Site® app:

- Go to the App Store® or Google Play™

- Search for “PNC Deposit On-Site Mobile”

- Download the PNC Deposit On-Site® Mobile App

Cash Logistics

- PNC’s Cash Logistics services are designed to provide a depository channel and/or to provide the daily operating cash for businesses handling or requiring large quantities of cash.

- Transport prepared cash and check deposits via an armored courier to one of PNC’s vaults within its national cash vault network.

- Order cash via phone or web to obtain daily currency and coin requirements.

- View a comprehensive summary of your cash activity with PINACLE’s Cash Logistics Information Portal (CLIP).

Merchant Gateway

- Merchant Gateway’s Virtual Terminal allows users to process payment-related credit card transactions.

- Take payments online and perform payment actions within PINACLE.

- View transactions and create reports of your activity.

ACH Positive Pay

- Establish rules for authorized vendors who are allowed to debit your account electronically.

- ACH debits matching established rules will automatically post for payment. ACH debits that do not match will be presented for your review.

- Enroll in notifications to be alerted when exception items are available for review.

- Decision exception items within PINACLE to be “paid” or “returned”, or create new rules as needed.

Check Positive Pay

- Provide PNC with the details of the checks you have issued, and PNC will match them against the checks presented for payment.

- Items that match will automatically clear your account. Any exception items are presented for your decision to pay, or return.

- Choose a default decision setting to be applied to all exception items if you do not decision them each business day.

- Enroll in notifications to be notified when exceptions are available for review.

Reverse Check Positive Pay

- Review prior day’s paid checks within PINACLE so you can match the checks presented for payment against the checks you have issued.

- Validate the list of paid checks, view check images and mark unauthorized checks for return—all through one online tool.

- Enroll in notifications to be notified when checks are available for review.

EDI Report

When vendors send electronic transactions with associated payment information, EDI reports can help you efficiently capture this data via secure online access to apply the payment accurately and efficiently.

- View your electronic (ACH, wire and credit card) receivables online.

- The amount of remittance information reported is based on the type of transaction delivered to the bank by your vendors and may include ACH, wire and/or credit card transactions. For ACH transactions, you can also receive reporting based on Standard Entry Class (SEC) codes, as well as ACH credits and/or debits.

View your business accounts, loans and cards and view balances in a single dashboard view or drill into specific transactions with robust filtering and search capabilities:

Statements

Manage your cash flow by viewing all your account activity on a monthly basis.

- View up to 7 years of your account statements online.

- Gain insight by viewing all of your services on your analysis statements.

Reports

Reconcile accounts faster by viewing account detail online instead of waiting for your statement to arrive in the mail.

- View daily balances, float, returns, and pending and posted transactions with summary and detail level information.

- Create custom reports with robust filtering and search capabilities which can be exported to PDF, XLS, or CSV or synch this information directly with your QuickBooks® desktop or online software.

- Review detailed remittance and/or addenda information received from the Automated Clearing House (ACH) network or see EDI Transactions received directly from your business partners.

Notifications

Stay on top of important account activities, transaction approvals and more.

- Customize which notifications you want to view and when.

- Maintain flexibility with notifications delivered within PINACLE, by email or by text message.

Securely Transfer funds online between your PNC business accounts:

- Manage your time effectively by creating and saving recurring instructions or utilize free-form instructions for one-time transfers.

- View the status of your pending, completed, and future dated transfers.

Make informed decisions and efficiently initiate transactions.

Loan Information, Transactions, and Statements

- Review your balances, availability, and transaction history.

- Download your statement in PDF or CSV format.

Loan Payments

- Pay loan invoices or make additional principal payments.

- Pay today or schedule for a future date.

- Set up recurring principal payments.

Loan Advances

- Request advances and receive your funds immediately (or immediately following a review by a PNC representative when necessary), providing quicker and easier access to funds when you need them most.

Maximize the benefits of your PNC Commercial Rewards Card® program with easily accessible online access that can help you optimize cash flow, control expenses, and reduce time spent on back-office tasks.

Card Information, Transactions, and Statements

- Manage your program in real-time by setting spend limits and restricting cash access on cards.

- Order cards and grant online access to employee cardholders.

- View detailed transaction information for all cards including the ability to download into QuickBooks®.

- View and pay your monthly balance due.

Training

- Utilize the New User Checklist to guide you through your first log on with access to welcome guides and onscreen walkthroughs.

- PINACLE offers online drop-in training classes to help orient you to your new online banking services.

- Daily tasks on the home page will alert you to activities that require your immediate attention.

- Tool Tips are placed strategically throughout the experience to provide additional information about a service.

- Access PINACLE’s online help center to find FAQs and user resources.