Business Risk Management Solutions

Find out how your business can reduce 5 kinds of risk.

What Kinds of Risks Does Your Business Face?

Every day you discover more about the risks affecting your business – attracting and retaining the right talent, fighting cyber payments fraud, managing cash transactions securely and reducing interest rate and currency exposure. Some risks are obvious. Others are not. We can help you identify the primary risks your business faces and deliver new ways to mitigate them. Contact a PNC Commercial Relationship Manager to learn more.

Employee Programs to Attract & Retain Talent

Attracting and retaining the right talent may be one of your greatest challenges. One way to reduce turnover risk and keep your workforce engaged is by offering robust and compelling benefits. PNC can work with you to design and implement programs specifically focused on your needs:

- 401(k) plans.

- Health savings accounts.

- Financial wellness programs.

- PNC Workplace Banking.

Tools to Manage International Transaction Risks

- PINACLE®, PNC’s top-rated mobile and online banking portal, can help you efficiently transfer funds internationally and reduce F/X risk.

- PNC's Import, Export and Standby Letters of Credit can help you more securely and conveniently transact business internationally.

Ways to Mitigate Payments Fraud

Eighty two percent[1] of companies were targets of payments fraud in 2018. PNC’s tools can help you:

- Reduce check disbursement risk.

- Maintain tighter control over check issuance and payment.

- Define debit controls and block ACH debits and checks from posting.

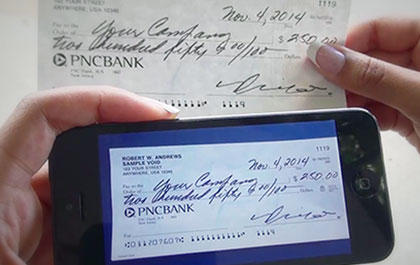

Cash & Check Handling Tools

- Cash Logistics services designed to help you handle daily operating cash efficiently and securely.

- Deposit On-Site® and Deposit On-Site Mobile to help prevent checks from being transmitted twice and provide additional security controls.

Interest Rate Risk Mitigation

Who knows where interest rates will head next? PNC offers financial products that can help protect against fluctuations in interest rates such as:

- Interest rate swap to lock-in a fixed rate for a floating rate loan.

- Interest rate cap to cap the interest rate on a floating rate loan.

- Treasury lock or forward starting swap to hedge the interest rate on a debt issuance.

Ideas, Insights & Solutions

Make informed decisions and maximize your business with perspectives

on leading financial issues from PNC professionals.

Gain Market Insight

PNC 2026 Business Outlook: Unlocking Stability in the Year Ahead

As uncertainty clears, M&A activity, AI and agility are all likely to play a big role in the landscape for 2026.

2 min read

Gain Market Insight

CFOs Reveal How Uncertainty Boosts Agility and Efficiency

Discover how CFOs are using economic uncertainty to drive innovation, streamline operations, and boost growth.

2 min read

Maximize Cash Flow

Sky's the Limit — How Next Level Aviation Found a Solid Lending Framework

Discover how listening and learning helped PNC Business Credit build a reciprocal financing relationship with Next Level Aviation.

2 min read

Ready to learn more?

Let's talk about ways PNC can help build your business.

* Required fields