PNC Organizational Financial Wellness

Tailored solutions to help turn financial worry into wellness for your employees

2025 Financial Wellness in the Workplace Report:

What today's workers value most, across generations

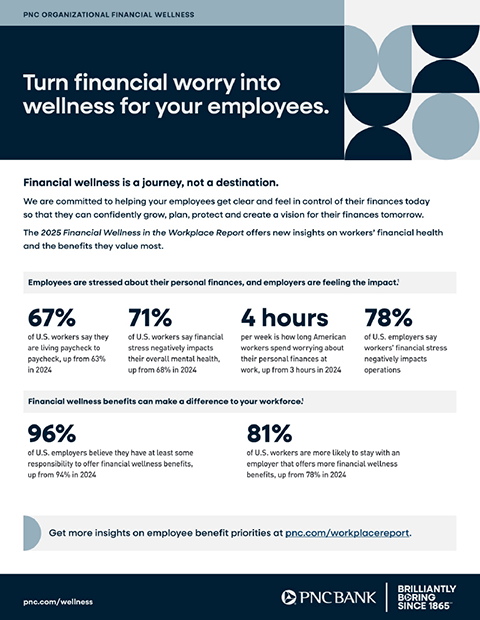

Employers are enhancing benefits to help their workforces secure their financial futures and lower stress. It’s a trend that drives success in hiring and retaining great people across generations — but it presents challenges for organizations already feeling financially squeezed.

Organizational Financial Wellness: An Overview

86% of employees worry about personal finances on the job [1]

Your employees are unique and diverse.

PNC’s customizable suite of solutions meet them at every stage of their life and career.

We’re staffed with dedicated bankers, in physical locations and virtually, to help with the planning, personalized products and financial education your employees need.

Financial Wellness Tailored for Your Employees

See an overview of PNC Organizational Financial Wellness, including important statistics and relevant information about the impact of financial wellness on your employees and your business.

Our Solutions

PNC Organizational Financial Wellness balances a holistic approach with options customized to the needs of your organization. We recognize every organization’s needs are different, and every employee’s financial wellness journey is unique. These options include:

Focus Industries

Every industry is different, with unique needs.

Ideas & Insights

Get news and analysis related to organizational financial wellness

Client Success Stories

LKQ Corporation Boosts Recruitment & Satisfaction with On-Demand Pay

Learn how LKQ Corporation boosted employee satisfaction and recruitment by offering On-Demand Pay with PNC EarnedIt. Read their client success story.

2 min read

Gain Market Insight

Financial Pressures Persist Across Generational Workforce Divides

PNC’s 2025 Financial Wellness in the Workplace report surveyed American employers and workers about the impact of financial stress in the workplace.

3 min read

Gain Market Insight

Feeling the Strain: Four Ways Financial Stress Is Affecting Gen Z Workers

PNC’s 2024 Financial Wellness in the Workplace survey asked American employers and workers about the impact of financial stress in the workplace.

3 min read

Ready to Get Started? Let's Talk.

Let's Start a Conversation

To learn more about implementing a customized financial wellness program into your organization, contact a PNC Organizational Financial Wellness representative in your area or fill out the form below and a Financial Wellness Consultant will contact you.