PNC Organizational

Financial Wellness

Tailored solutions to help turn financial worry into wellness for your employees

2024 Financial Wellness in the Workplace Report:

The Evolving Needs of the Multigenerational American Workforce

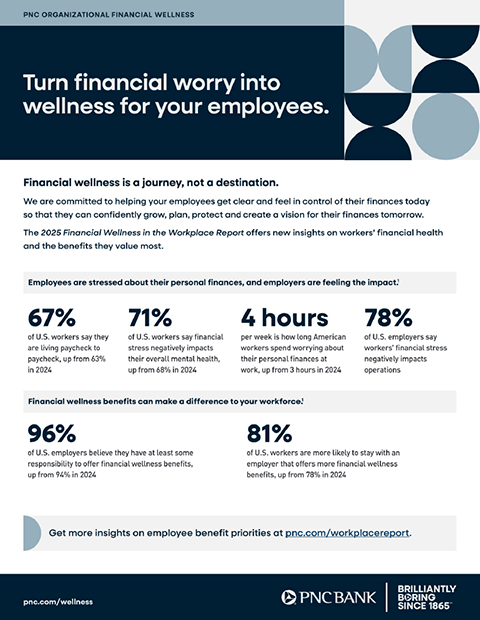

Employers are enhancing benefits to help their workforces secure their financial futures and lower stress. It’s a trend that drives success in hiring and retaining great people across generations — but it presents challenges for organizations already feeling financially squeezed.

Organizational Financial Wellness: An Overview

85% of employees worry about personal finances on the job [1]

Your employees are unique and diverse. PNC’s customizable suite of solutions meet them at every stage of their life and career.

We’re staffed with dedicated bankers, in physical locations and virtually, to help with the planning, personalized products and financial education your employees need.

Financial Wellness Tailored for Your Employees

See an overview of PNC Organizational Financial Wellness, including important statistics and relevant information about the impact of financial wellness on your employees and your business.

Our Solutions

PNC Organizational Financial Wellness balances a holistic approach with options customized to the needs or your organization. We recognize every organization’s needs are different, and every employee’s financial wellness journey is unique. These options include:

Focus Industries

Every industry is different, with unique needs.

Insights

Gain Market Insight

Addressing the Evolving Needs of a Multigenerational Workforce

PNC’s 2024 Financial Wellness in the Workplace report surveyed American employers and workers about the impact of financial stress in the workplace.

4 min read

Client Success Stories

Client Success Story – Wisconsin Aluminum Foundry

Specialist in alloy casting, molding and engineering partners with PNC to deliver meaningful financial wellness benefit options for its diverse team.

2 min read

Client Success Stories

Client Success Story – Hershey Entertainment & Resorts Company (HE&R)

Resort and entertainment company relies on PNC to help simplify banking for seasonal workers participating in the J-1 Visa Summer Work Travel Program.

2 min read

Get Started

Let's Start a Conversation

To learn more about implementing a customized financial wellness program into your organization, contact a PNC Organizational Financial Wellness representative in your area or fill out the form below and a Financial Wellness Consultant will contact you.