Standard message and data rates may apply.

PNC BeneFit Plus Health Savings & Other Benefit Spending Account Solutions for Employers

Promote health and financial wellness, drive engagement and help manage costs

Why BeneFit Plus?

PNC has been a leader in benefit spending accounts since 2004, offering experience and innovation.

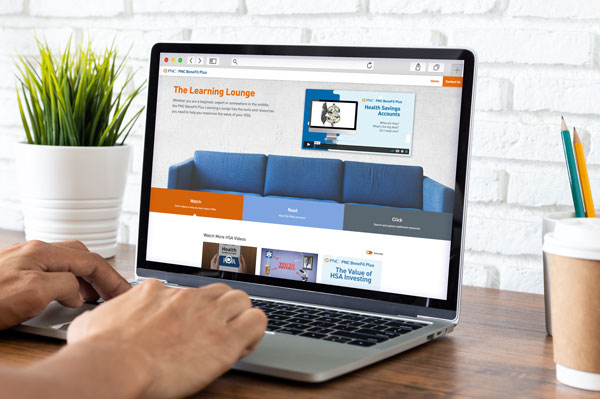

With advanced technology and detailed focus on employee engagement and education, we are committed to helping our clients manage healthcare costs while delivering an HSA and benefits spending account experience for their employees.

Video: PNC Hero Benefit Plus

What We Offer

PNC BeneFit Plus can help you manage costs while promoting engagement, health and financial wellness for your employees.

PNC BeneFit Plus Webinars

PNC BeneFit Plus Webinars

Health Savings & Benefit Spending Account Solutions for Employers

Health Savings Account

Flexible Spending Account

Lifestyle Spending Account

Qualified Transportation Accounts

Health Reimbursement Arrangement

Explore all the employee financial wellness solutions PNC has to offer.

Ready to Enroll?

Employer Frequently Asked Questions

Health Savings Account (HSA)

PNC, as one of the nation’s largest banking institutions, has been an industry leader and innovator in HSAs since their inception in 2004. We bring a wealth of knowledge, experience and leadership in providing robust solutions that can help add value to the benefit programs you offer your employees. The fully integrated PNC BeneFit Plus solution can help bring education and administrative efficiencies and fosters employee engagement for our employer relationships.

The PNC BeneFit Plus Employer Portal is your gateway for complete management of your HSA program. Once you sign up, a dedicated, knowledgeable Implementation Specialist will guide you through getting your program started and helping you feel comfortable with managing your HSA program. The portal provides you easy-to-use options for enrolling your employees and making payroll and/or employer contributions right from your desktop:

- Use the Automated Employee Enrollment Tool in the PNC BeneFit Plus Employer Portal to upload Demographic/Enrollment Files containing employee enrollment information.

- Upload employer and/or payroll files to the PNC BeneFit Plus Employer Portal.

- Add a single employee or a series of employees to your program using a simple, intuitive web page within the PNC BeneFit Plus Employer Portal.

The PNC BeneFit Plus Consumer Portal is a website designed specifically for managing healthcare spending. Benefits include:

- Complete, intuitive account management functionality, including robust account notification options.

- The easy-to-use self-service access provides convenient distribution options, including Online Bill Pay and the ability to electronically reimburse oneself to a personal bank account.

- The Expense Tracker enables employees to consolidate, track and categorize expenses online and budget for annual healthcare expenses.

- The integrated PNC BeneFit Plus Mobile App[1] allows employees to manage their expenses on the go.

- The PNC BeneFit Plus debit card provides convenient access to HSA funds that can be used to pay for qualified medical expenses.[2]

- A dedicated and experienced service team is available toll-free from 8:00 a.m. to 8:00 p.m. ET to answer any questions or assist in maximizing your employees’ HSA experience.

Yes.

Employees have the option to direct the investment of account balances over a specific threshold into a selection of no-load or load waived mutual funds.[3]

Yes.

Your employees can download the PNC BeneFit Plus Mobile App[1] to manage their qualified medical expenses[2] while on the go. They can upload and store receipts for record keeping, view transaction details and account balance information (including their investment account balance), and request distributions. The mobile app is compatible with Apple® devices (iPhone®, iPod touch®, iPad® ) version 6.0 or higher and Android™ devices version 2.2 and higher.

Yes.

PNC has substantial experience in working with employer relationships that have existing HSA programs. We can help minimize the impact to your employees and provide the necessary Direct Rollover/Transfer Request Form and instructions for your employees.

Yes.

PNC offers the full suite of employee benefit spending accounts, including Health FSAs, Dependent Care FSAs, Health Reimbursement Arrangements (HRAs) and other benefit spending programs such as Transit accounts, all through the PNC BeneFit Plus Employer Portal. Your employees can benefit from viewing and managing their accounts in one location and accessing available account funds on a single debit card.

Contributions may begin on the first day of the month in which the Eligible Individual is enrolled in the HDHP.

An Eligible Individual is anyone who:

- is covered under a High Deductible Health Plan (HDHP)

- is not covered by any other health plan that is not an HDHP

- is not currently enrolled in Medicare or TRICARE

- has not received medical benefits through the Department of Veterans Affairs (VA) during the preceding three months

- may not be claimed as a dependent on another person’s tax return

No.

An employer and/or an employee may contribute any amount into an HSA, up to the maximum annual contribution limit, during the applicable tax year.

Yes, you can contribute to your employees’ HSAs. Plus, you save on payroll and FICA taxes through tax deductible contributions. Keep in mind, total combined employer and employee contributions to an employee’s HSA cannot exceed the annual limit set by the Internal Revenue Service (IRS).

No.

If an employer elects to contribute to their employee’s HSA, they must make “comparable” contributions to all participating employees’ HSAs in the same dollar amount or same percentage of the employee’s deductible — for all employees in the same “class.” Employers may vary the contribution level for full-time versus part-time employees, and employees with individual coverage versus family coverage.

There are unique circumstances for these specific ownership/employment situations. Please consult your tax advisor or the IRS.[4]

No.

HSAs are individually owned, and employees have full ownership and control of contributions to their account as soon as the funds are deposited (in the same manner that their wages are deposited to a personal checking or savings account). Employees are responsible for managing their HSA according to IRS guidelines.

The employee is responsible for paying any fees that may be incurred on the HSA. The fees may be debited directly from their HSA. Once the average daily balance exceeds $5,000, the HSA accountholder monthly administrative fee is waived.

Employers have the option to pay any monthly administrative fee on behalf of their employees.

HSAs are portable; therefore, former employees keep their account, and any funds in the HSA can be used to pay for qualified medical expenses.[2] If employees are no longer covered by an HSA-qualified HDHP, they cannot contribute to their HSA.

Employers can manage an employee’s employment status within the PNC BeneFit Plus Employer Portal. This confirms that the employee is removed from your active roster (and your invoice if you are paying service fees on behalf of your employees).

Let's Talk.

For questions about your existing PNC BeneFit Plus Program, please contact your Financial Wellness Consultant. If you are new to PNC, get in touch with our team by completing this short form

By completing this form, you are authorizing us to contact you (via email and/or phone) to answer your questions and provide information about PNC products and services.