Important Investor Information: Brokerage and insurance products are:

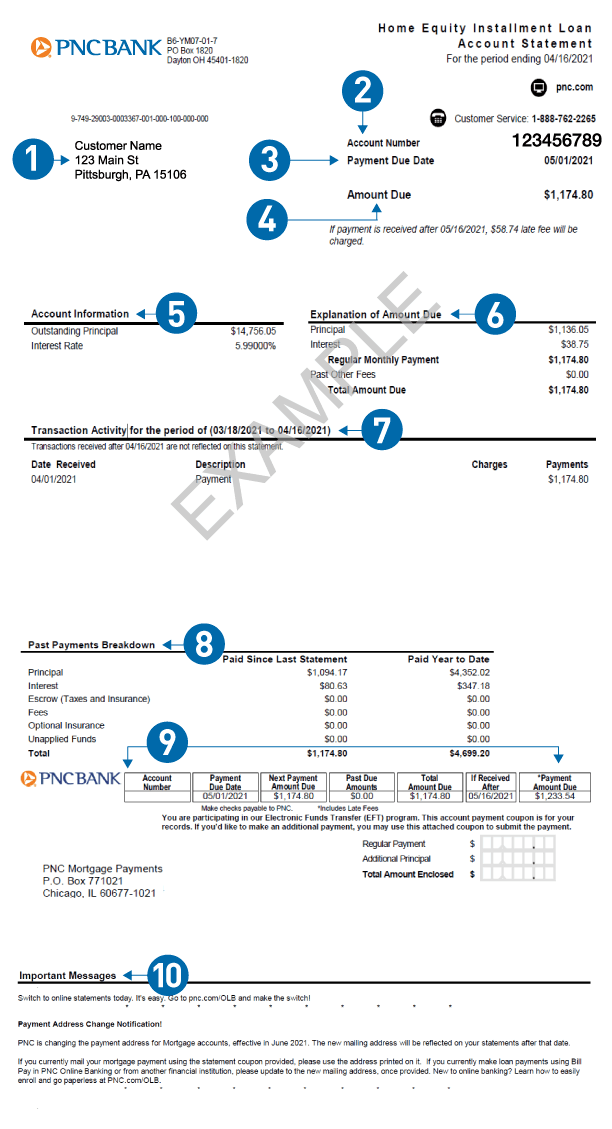

Reviewing Your Home Equity Loan Statement

Customer Name:

Customer name and mailing address.

Account Number:

Account number identifies your Home Equity Loan with PNC.

Payment Due Date:

The date your Home Equity Loan payment is due.

Amount Due:

The total amount due as of this billing period.

Account Information:

This section is used to show the outstanding principal balance and the

current interest rate, as well as any deferred balances that may exist.

Explanation of Amount Due:

A detailed explanation of the items that compose the amount due as of this billing cycle.

Transaction Activity:

A list of the transactions that have taken place since the last billing statement

Past Payments Breakdown:

This section shows how previous payments have been applied to your Home Equity Loan.

Billing Statement Payment Information: This section identifies what you must pay and by what date to avoid late fees. When paying with a check, this section should be removed and used as a payment coupon returned with your check. The account used for payment via Electronic Funds Transfer (EFT) will not be identified.

Important Messages:

This section is used to communicate with you about additional important information from PNC.

Customer Name:

Customer name and mailing address.

Account Number:

Account number identifies your Home Equity Loan with PNC.

Payment Due Date:

The date your Home Equity Loan payment is due.

Amount Due:

The total amount due as of this billing period.

Account Information:

This section is used to show the outstanding principal balance and the

current interest rate, as well as any deferred balances that may exist.

Explanation of Amount Due:

A detailed explanation of the items that compose the amount due as of this billing cycle.

Transaction Activity:

A list of the transactions that have taken place since the last billing statement

Past Payments Breakdown:

This section shows how previous payments have been applied to your Home Equity Loan.

Billing Statement Payment Information: This section identifies what you must pay and by what date to avoid late fees. When paying with a check, this section should be removed and used as a payment coupon returned with your check. The account used for payment via Electronic Funds Transfer (EFT) will not be identified.

Important Messages:

This section is used to communicate with you about additional important information from PNC.