FINRA BrokerCheck

Check the background of PNC Capital Markets LLC on FINRA's BrokerCheck.

Learn More »

THIS WEBSITE PAGE IS NOT INTENDED FOR RETAIL INVESTORS/CLIENTS AND IS ONLY INTENDED FOR INSTITUTIONAL INVESTORS/CLIENTS.

We focus on relationships, not transactions. We take pride in relating to and serving our communities, as these relationships are at the heart of our business model as a main street bank.

With impactful programs like Grow Up Great® and PartnerUp® and our longtime alliance with DonorsChoose, we’re also committed to helping prepare students for success in school and life.

As a leader in charter school financing, we also know that owning a facility is crucial to providing long-term stability and growth for your school and community.

Learn more about what we offer, including a detailed breakdown of our integrated platform and information about utilizing tax-exempt revenue bonds.

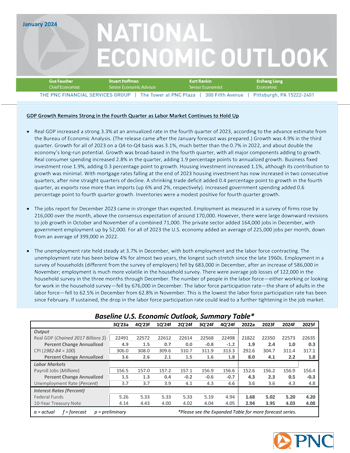

Our economists provide analyses and forecasts of national, regional and global economic & financial trends.

Review the latest report

Charter school tax-exempt revenue bonds are bonds issued by a state or local government agency on behalf of a charter school to refinance existing debt, or finance the acquisition, renovation or expansion of a school. Tax-exempt bonds can be issued on a fixed-rate basis for a term of up to 40 years to finance your building costs.

Most states, cities, counties and school districts use tax-exempt municipal bonds as their major source of capital. The advantages of a tax-exempt bond issue are:

You could develop a 5-year business plan that outlines projected operations once you have acquired your building. The following factors should be considered when developing your plan:

While more complex than typical bank financing, PNC’s experience in this type of transaction can facilitate the process. Once you have identified your project — refinancing of existing debt-acquisition, renovation or construction, and its financial scope — the tax-exempt bond process typically takes 3 to 6 months. During that time, the following will take place: